Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

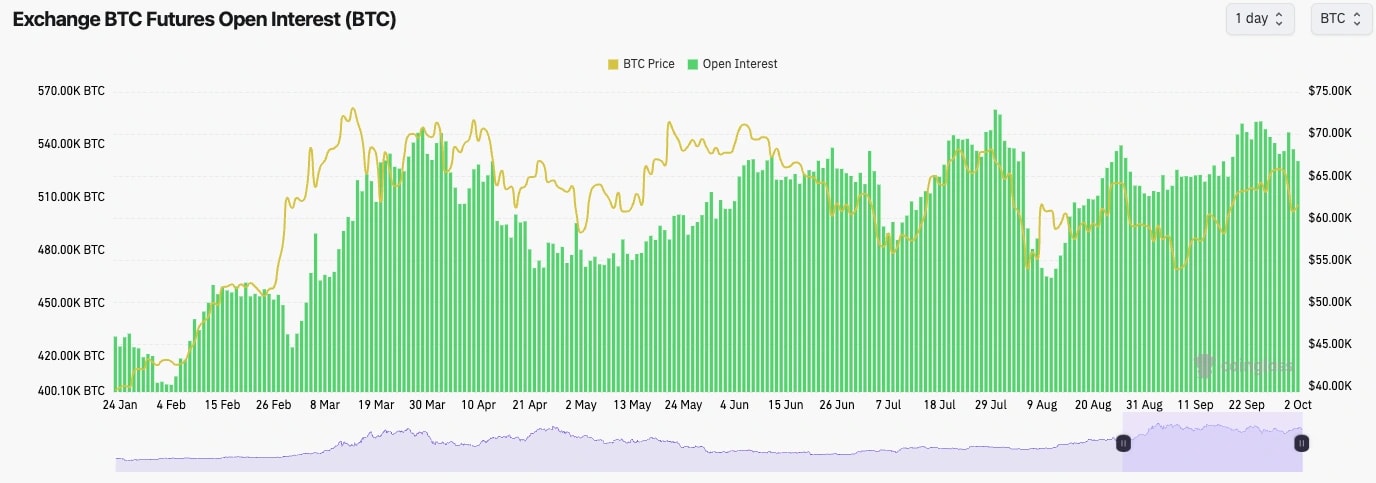

- BTC's Open Interest came down substantially over the past 24 hours, although Funding Rates remained positive.

- We can see that yesterday's price pullback was driven by Spot selling as Iran began bombing Israel.

- This wasn't a leverage flush out; it was more the case that investors de-risked on geopolitical fears.

Technical analysis

- Having rallied throughout almost all of September, the price began to pull back during Monday's session.

- Price pulled back from $66k, and came down to retest the local uptrend line and also the horizontal level of $63,400. But, price broke down and has pulled back to the local Yellow box we identified in Monday's Market Update.

- This pullback has seen the RSI drawdown more drastically, which is good to see, especially when you've had a clean uptrend.

- We now see the next major support area between $58k and $59k, and we would expect this area to be the more major support.

- On the upside, we see $63,400 as the new local resistance, which will require a price reclaim.

Cryptonary's take

Our thinking is that this pullback was necessary and needed. Price rallied throughout September, essentially in a clear uptrend. These can't go on forever, and you expect pullbacks to come, which we're now getting. Over the coming days, we see the price as likely to be range-bound between $59k and $63,400. We think it's possible that the price does dip into the $58k to $59k area, but even the current price seems attractive when you look at the macro setup we have going into the next 1-2 quarters.Over the coming days and week or two, we're expecting the price to remain subdued, to potentially retest the $59k area, and then to bounce from there and retest $63,400.