Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The mixed signals from macro last week left the market relatively flat.

- Crypto Indexes testing 2017 highs as support.

-

An ETH flippening is approaching

-

dYdX and MINA are at all-time low levels - great time to DCA?

Macro

US GDP figures came out better than expected in Q3 (3.2% vs 2.9% expected).

This suggests the FED’s tightening is not impacting the economy as much as anticipated. Not the best thing because it gives room to the FED to delay easing.

The next FOMC meeting is in February however, leaving the markets undisturbed.

Total Market Cap

The Total Market Cap can is still at 2017 all-time high levels, which makes a push to the upside likely in the short term. Only a weekly loss of $761B will invalidate this scenario.

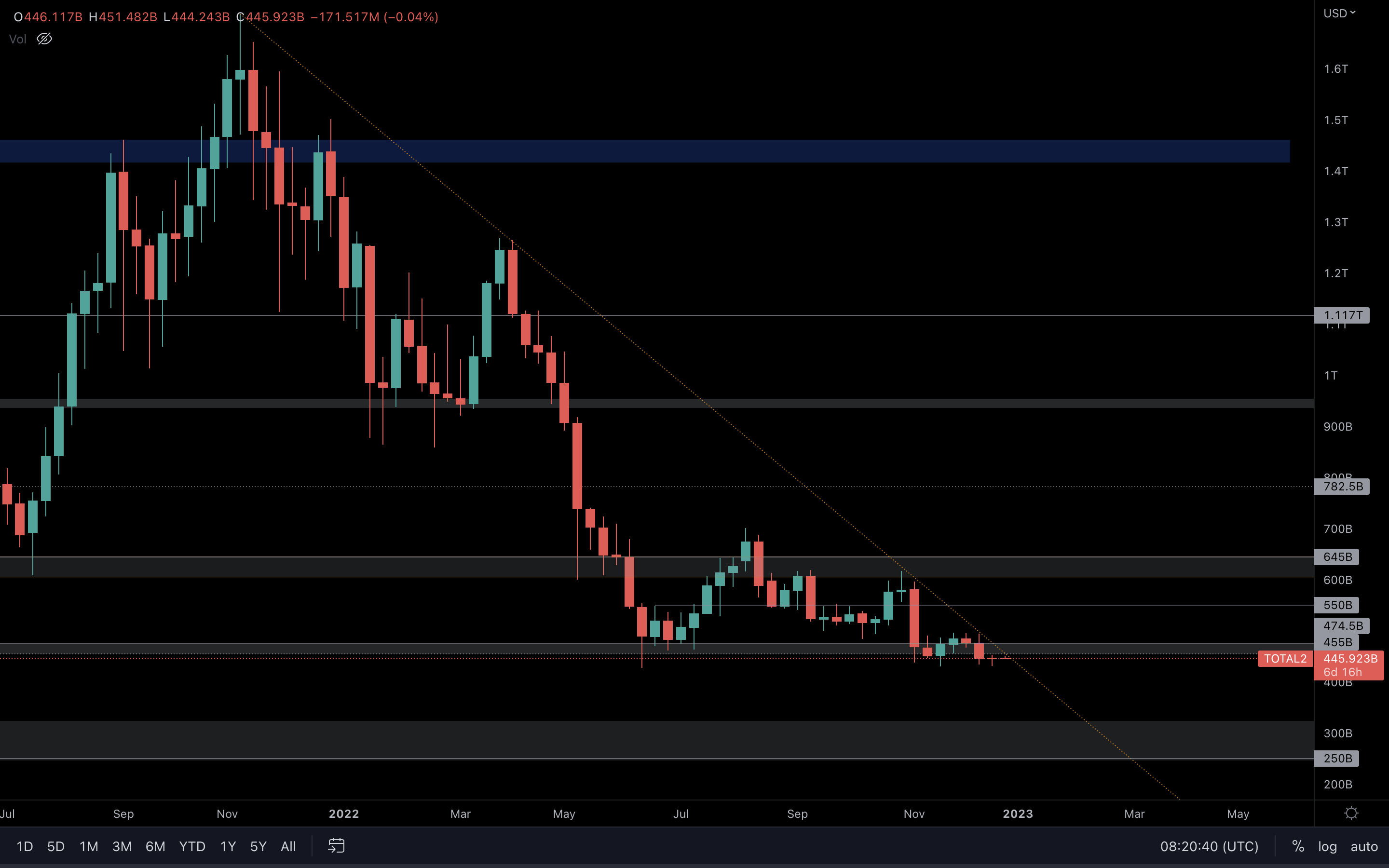

Altcoins Market Cap

A larger look at the Altcoins MCap index shows that we still need to break above this diagonal trend line. On a shorter timeframe, the index closed under $455B last week and is at risk of toward $300B.

A reclaim of $455B is necessary to prevent further downside.

DPI | DeFi Index

This is the first time we've added the DPI (DeFi Pulse Index) into our analysis reports - it measures the overall health and performance of the DeFi market, which should be of interest to all market participants.

We can see that the index has descended throughout 2021 and 2022 and is now reaching a bottom with decreased selling pressure. A push toward the blue line ($125) is definitely on the cards now, which will make the DeFi sector an outperformer in the coming weeks.

The index remains in "ranging territory" until it breaks above $125. If the latter happens, DeFi bull-run follows.

BTC | Bitcoin

ETH | Ethereum

Ether is still in the middle of the $1400 - $1100 range on the weekly timeframe. As we know, where Bitcoin goes, everything follows - and Ether is no different. With the Bitcoin chart showing bullish signs for the coming week(s), we can only assume Ether will be experiencing the same thing.

On a shorter timeframe (daily), $1235 needs to be reclaimed to prevent a risk of rejection toward $1100.

ETH/BTC

We look at the ETH/BTC chart to understand which of the two is outperforming. We can see that a symmetrical triangle is forming on this chart and is approaching a break. As we do not have enough data, just know that a break to the upside means Ether will outperform, whilst a break to the downside means Bitcoin will outperform.

When Ether's outperforming, we need to change our attention to alts.

SOL | Solana

Solana remains bearish and is slowly approaching its November low of $10.90. Unless buyers step in at that level, then SOL losses its last line of defense and $5 is tested. To prevent this bearish scenario, SOL would need to reclaim $14.

RUNE | THORChain

We can see that RUNE closed the week strong with a bullish engulfing candle above the $1.38 resistance level. From a purely technical standpoint, $1.45 - $1.50 is where RUNE is headed next. However, this scenario requires a well-behaved Bitcoin, otherwise, its price action could easily influence RUNE's price action and invalidate its bullish scenario.

For now, holding $1.38 is key.

SNX | Synthetix

Slowly approaching its June low.

Slowly approaching its June low.

SNX continues to set lower lows and lower highs - however the selling pressure is diminishing, meaning we're getting closer to a bottom. The trend will not change until we see the setting of a higher low and a higher high.

Alpha-DAO & Cryptonary's Watchlist

DOT | Polkadot

After last week's candle closure under $4.70, $3.60 is now on the cards.

SYN | Synapse

Quite a surprising turn of events for SYN - after testing its all-time low, buyers stepped in and pushed the asset to $0.70. Based on the buying pressure alone, this week will likely end up closing green and above $0.60. If that were to happen then SYN would be activating a double bottom which can lead it all the way to $3.5.

OP | Optimism

Still ranging between resistance & support. It's either a weekly break of $0.98 or a weekly loss of the orange support trend line. Both are scenarios that we need to wait out for them to occur before picking a direction.

LDO | Lido DAO

Last week's candle closed as a hammer candlestick, typically known as bullish. However, LDO has $1 as resistance, and unless we see a daily & weekly reclaim of this level, the road to $0.75 is still open.

Last week's candle closed as a hammer candlestick, typically known as bullish. However, LDO has $1 as resistance, and unless we see a daily & weekly reclaim of this level, the road to $0.75 is still open.

THOR | THORSwap

THOR closed this week above resistance and is now on a path toward $0.43. Although a weekly retest of $0.28 can occur, $0.43 remains on the cards until the level of $0.28 is lost on the weekly timeframe.

MINA | Mina Protocol

MINA was unable to hold this support channel. Unless it is reclaimed, the asset's downside price discovery will resume with key levels being psychological round numbers.

The selling pressure remains steep meaning a bottom isn't in sight just yet.

DYDX | dYdX

DYDX is ranging between $1 and $2.50. Until we see a breakout from one of them we can assume that the range holds and we see a jump from $1 to $2.50.

A breakout from the range will lead to one of two things:

- Breakdown from $1 leads to downside price discovery and $0.50 is likely.

- Breakout from $2.50 leads to $5.

Summary

We continue to stand our ground - a Dollar-Cost-Averaging approach would be wise now, because the bottom is either near or in. Although there are small opportunities that can make you a few extra dollars, the best one we see is crypto trading at 2017 levels.

Downside is limited, upside isn't.