Pump Fun: The Great Extraction

PumpFun is making headlines with its $PUMP token ICO. We break down the details and try to make sense of the platform’s sudden pivot from “launch a meme coin for free” to “we’re going to kill Facebook, TikTok, and Twitch… on Solana.” All announced just 72 hours before their ICO. Sounds sus, so let’s dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What’s going on?

PumpFun is a meme launchpad that’s already extracted over $780 million from the Solana ecosystem, dumped SOL on the open market via centralised exchanges like Kraken. It’s now launching its own token, $PUMP, via an Initial Coin Offering (ICO). 15% of the total supply will be sold to the public at a $4 billion valuation, while 18% has already been snapped up by institutional players at the same price. The sale will take place on PumpFun’s platform, as well as partner exchanges.We now have a clear picture of $PUMP’s token distribution and vesting schedule, and the details have raised major concerns.

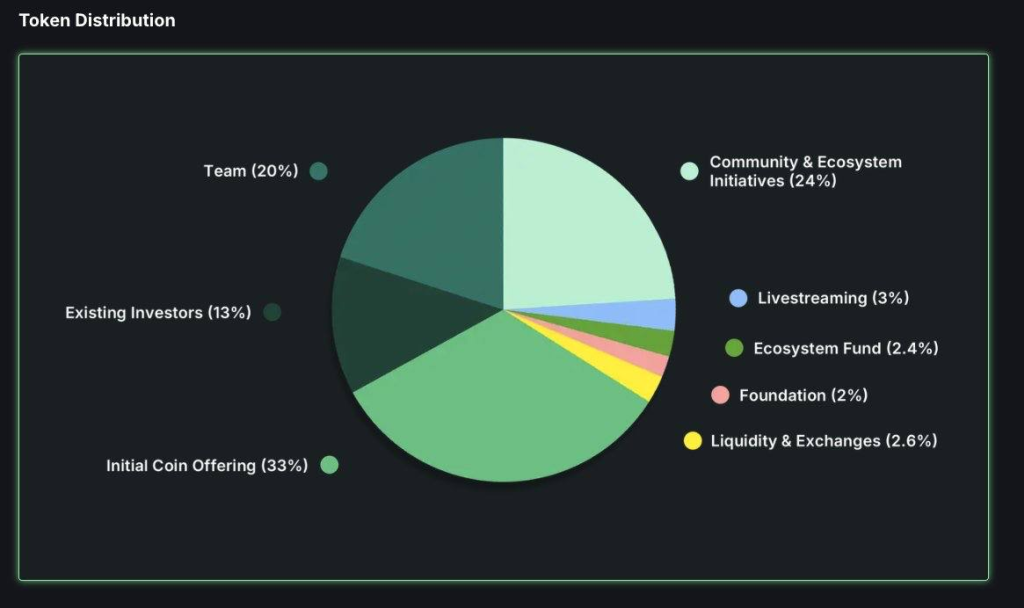

$PUMP Token Distribution

Here’s what the chart shows:- 33% allocated to the Initial Coin Offering

- 24% reserved for community and ecosystem initiatives

- 20% to the team

- 2.4% to the ecosystem fund

- 2% to the foundation

- 13% to existing investors

- 3% for livestreaming

- 2.6% for liquidity and exchanges

- 67% goes to insiders

- 18% to private investors

- Just 15% to the public

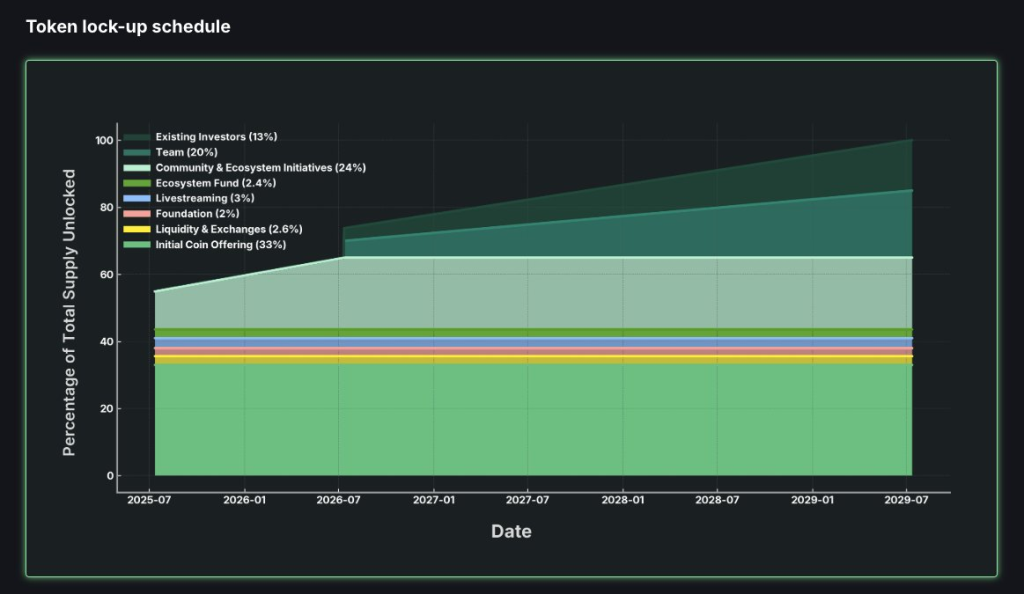

$PUMP Token Unlock Schedule

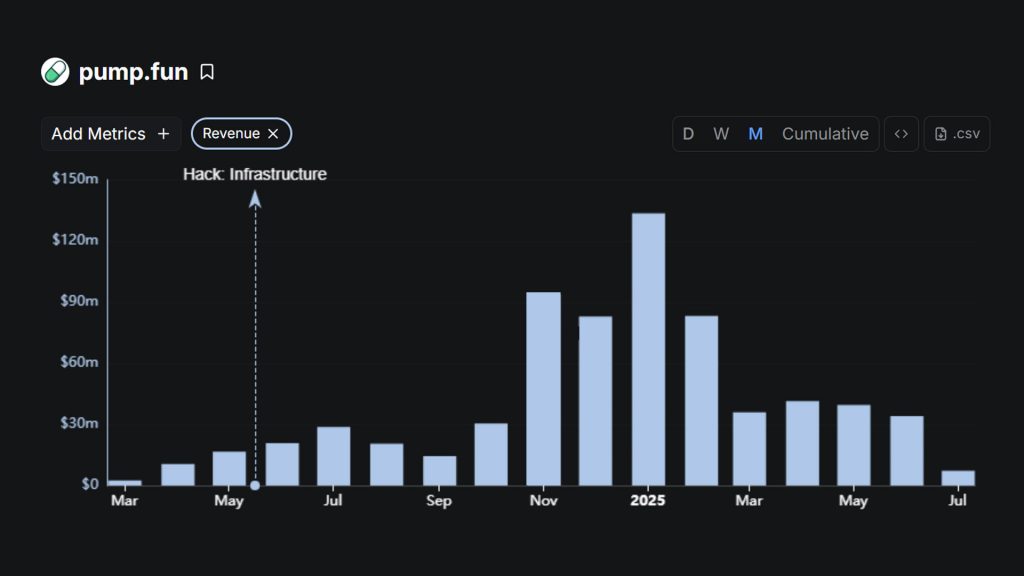

At its peak, the platform earned $134 million in 30 days, making it the third most profitable DeFi protocol, trailing only stablecoin issuers Tether and Circle. But with its history of leaving memecoin traders high and dry, it appears that PumpFun is going for the final act of extraction amidst growing competition.

PumpFun Revenue

Generally, when a Web3 platform rolls out a token, communities are happy because it has become an industry standard to focus on rewarding loyal users with a nice airdrop. But PumpFun is flipping the script. Instead, the team is focused on a token sale. PumpFun is planning to raise a $1.3b cash at $4b valuation.$4 billion for a startup that has generated around $780m in 1.5 years might seem undervalued based on traditional valuation metrics such as Price-to-Earnings (P/E ratio). Messari analysts have even suggested a $7 billion valuation, citing PumpFun’s dominance in memecoin launches and Solana’s ecosystem growth. Delphi Digital also seems to be bullish on the upcoming ICO due to PumpFun's revenue and multipliers that are higher than most of the DeFi platforms.

However, we don’t share Messari and Delphi Digital's optimism. The P/E ratio is a good framework if the business is sustainable and is not losing to competitors. PumpFun’s market share has recently plummeted from 90% in 2024 to below 30%, as competitors like LetsBonk have emerged.

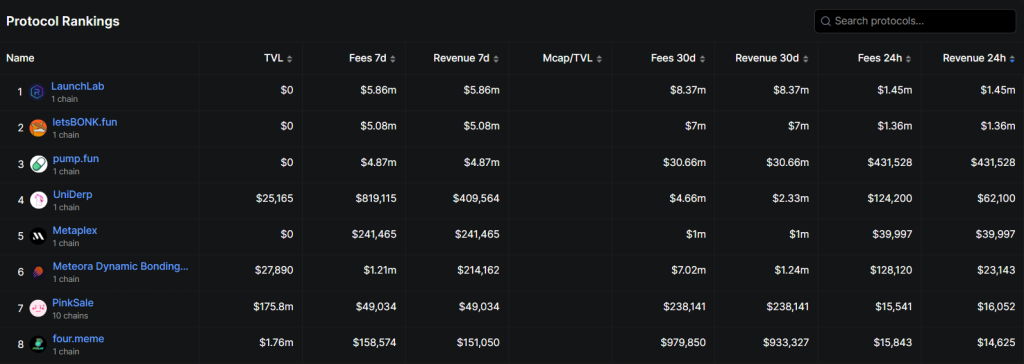

It has recently surpassed PumpFun in daily revenue, generating over $1 million daily through successful meme launches. Furthermore, new platforms like LaunchLab (backed by Raydium) further threaten PumpFun’s dominance and often generate more daily fees.

Launchpad Protocol Ranking

Additionally, over 80% of PumpFun’s top creators have reportedly migrated to competitors, drawn by lower fees, better incentives, or more vibrant communities. PumpFun’s lack of a sustainable competitive moat (its bonding curve model can be replicated) makes it vulnerable to further market share erosion.Furthermore, the top 1000 wallets on PumpFun and PumpSwap are made up almost entirely by bots. This is not organic in our view and it is possible those bots might be run by insiders as well.

Why is PumpFun launching a token?

There could be a few reasons behind it. We think the market is peaking for them, and the TGE is the final attempt to extract money from the industry before PumpFun becomes an OpenSea of this cycle. They are losing market share, and the hype around meme token launches is fading. Seems like the team is intending to create a hype to extract liquidity from the memecoin space by launching a token.Another possibility is that PumpFun investors (e.g Alliance, Daxos Capital and others) might be pushing for TGE, because they are also not comfortable holding an illiquid equity position in a platform losing to competitors. Thus, they need an exit or a hedge. The investors’ tokens will be locked and vested (as we have seen in the distribution chart), but it is still possible for insiders to hedge their allocation and exit via perps before unlocks happen. For example, Hyperliquid has already listed $PUMP on its platform pre-market.

Or, they may indeed need a token to beat the competitors. There are many ways to boost the ecosystem and adoption via a token. For example, they can subsidise creators and activity on the platform using $PUMP as an incentive. However, this practice never ended well for investors as the price trends down with subsidies. Therefore, it can end up being a very costly bet.

$PUMP? No, thank you

Here are some more reasons to be careful with buying $PUMP during a public sale:Limited upside

$4b valuation limits the upside of $PUMP. It is already a big number. Potential 2x - 3x for the risk of being an exit liquidity for insiders, who will sell SOL for USD through Kraken? It is not a good risk-reward plan in our view. Furthermore, it is not clear what role $PUMP will play within the ecosystem. Another governance token? If yes, the token is likely to trend toward zero after the initial hype, especially with current sentiment on socials. Moreover, the way the team communicated the “utility” of the token isn’t the best. The team is still “considering” mechanisms such as fee rebates or buybacks while TGE is less than 24hrs away. Sounds like a B plan in case the demand is weak and the extraction plan fails.Revenue is trending down

Furthermore, as we said, the competition among launchpads is heating up, and PumpFun is losing market share. Revenue is still higher than in 2024; however, it hasn’t recovered fully and is trending down with increased competition.Last year was great for revenue since the meme craze on PumpFun was wild. We believe those days are done. Sure, we will still have launches, and the memecoin sector will continue to grow and innovate. However, the market has learnt its lesson, and the capital will likely concentrate around a few established memecoins and cults instead.

Therefore, buying the TGE of PumpFun is likely buying a token of a losing business. We are not ruling out the initial speculative pump, especially since most of the initial circulating supply will be bought at $4b market cap, though.

Suspicions pivot

However, it is still a losing business with predatory tokenomics. Furthermore, what strikes us the most is PumpFun’s recent pivot to compete with TikTok, Facebook and Twitch. This is very surprising to us because it is currently losing the launchpad market to competitors. Competing with giants like TikTok, Facebook and Twitch on their game is reckless in our opinion.

PumpFun's post on competing with Facebook, TikTok and Twitch

TikTok’s algorithm-driven, short-form video empire has a stranglehold on younger audiences, with over 1 billion monthly active users and a hyper-engaged ecosystem that thrives on viral trends. Facebook, despite its aging demographic, still boasts nearly 3 billion monthly active users and an unmatched ad infrastructure. Twitch dominates live streaming, with 30 million daily active users and a deeply loyal gaming and creator community. These platforms have spent years/decades building network effects, refining algorithms, and securing advertiser dollars.PumpFun has been around for a mere 1.5 years with only around 130k users, and is already losing the launchpad market to competitors. It is a very weird move in our opinion. The timing is equally suspect. With TGE coming in a couple of days, this pivot smells like a marketing gimmick to justify higher valuation.

Even if the pivot is sincere, it’s a strategic disaster. Social media is a winner-takes-all market where new entrants rarely succeed without a radical innovation or niche focus. A smarter move would be to innovate within the memecoin space, in our opinion.

And lastly, there seems to be some more suspicious activity by the team. PumpFun has recently announced that they have acquired a wallet tracker, Kolscan. The token went from around $400k to $20m in around 20 minutes. However, what worries us again that there seem to be several insiders involved in this move. Few wallets could buy-up the token just hours before the announcement. Another extraction?

Cryptonary’s take

The crypto community isn’t blind to this, and the sentiment is mixed at the moment. We think PumpFun’s TGE, or what we’re calling “The Great Extraction”, is against the whole point of memecoins.Memecoins are supposed to be the wild, rebellious movement against low-float, insider-driven tokens that rig the game for the few. They’re meant to give the average trader a shot at 100x dreams, a chance to ride the wave of community-driven hype and narrative.

We think the sole purpose of this token sale is further extraction, because the revenue is likely to trend down further, meaning less money for the team.

Therefore, we're not buying $PUMP. This is a pass for us. We prefer organic cults and platforms that are actually beating competitors in the market (E.g Hyperliquid).

Messari and Delphi Digital seem to be optimistic about the upcoming ICO and subsequent success of PumpFun. There could be an initial pump engineered, especially because some research firms pushing their thesis to their institutional clients; however, we think the way tokenomics and distribution are set, $PUMP will likely slowly bleed after the initial swings.

Therefore, protect your capital.

This is The Great Extraction…

Peace!