Bitcoin shatters past $23,000, carries strong cryptocurrency market sentiment

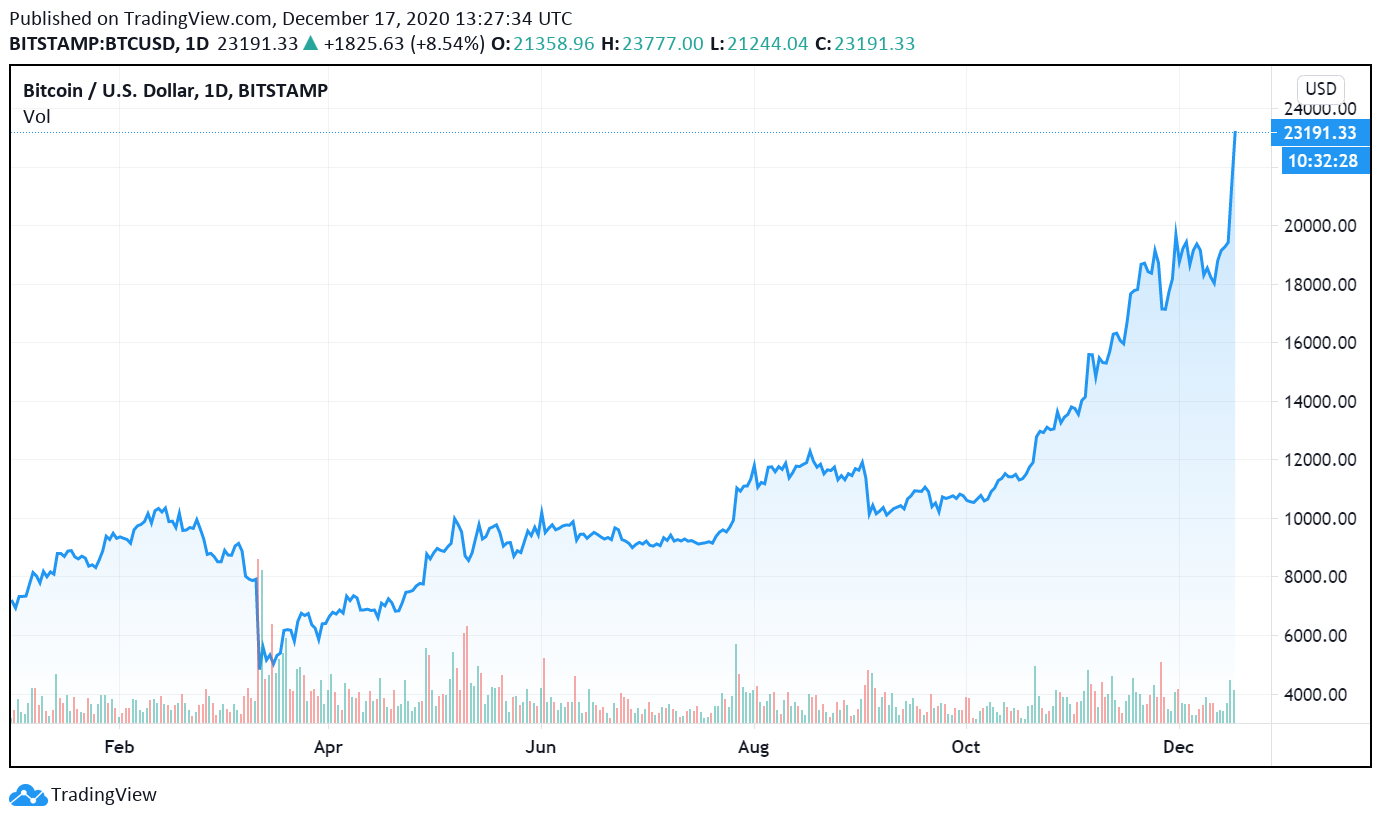

Today marks exactly 3 years after bitcoin hit an all-time-high (ATH) of nearly $20,000 in 2017. While a prolonged bear market followed shortly and saw the leading digital asset tank to less than $4,000 by the end of 2018, bitcoin set new records as its price first broke the $20,000 resistance level a day before surging past the historic $23,000 mark.

The 2017 bitcoin bull run, which many called a bubble, was largely driven by retail investors.

Investor interest surges bitcoin past $23,000

At the time of writing, bitcoin is trading at $23,191on Luxembourg-based exchange Bitstamp. Bitcoin’s run to a record high is buoyed by institutional investors who see the asset as a haven for quick gains and can act as a hedge against inflation and global events.

[caption id="attachment_20156" align="aligncenter" width="1381"] Bitcoin sets new records highs as it shatters the $23,000 mark | Credit / TradingView[/caption]

Bitcoin sets new records highs as it shatters the $23,000 mark | Credit / TradingView[/caption]

Bitcoin has a hard cap of 21 million and its scarcity quality makes it an attractive alternative for investors who are watching central banks and governments turn on the money printer to stimulate the economy that has been pushed into a recession by the ongoing coronavirus pandemic.

Ruffer’s Multi-Strategies Fund which recently exposed its treasury to bitcoin highlighted that they purchased the digital asset as an insurance policy against the devaluation of major currencies.

Bitcoin is pushing itself from being a topic only spoken in alleyways to a financial asset that big investment firms such as MicroStrategy and famed investors that include Paul Tudor Jones and Stanley Druckenmiller have bought or praised.

Strategists at multinational investment firm J.P. Morgan recently claimed that increased interest in bitcoin by institutional interest will see more money flowing into the cryptocurrency market at the expense of gold, which has been traditionally perceived as the ultimate safe-haven asset.

Where bitcoin goes from here is anyone’s guess. Scott Minerd, the Global Chief Investment Officer of investment firm Guggenheim Investments which manages $275 billion in assets, said bitcoin should be valued at around $400,000.

"Our fundamental work shows that Bitcoin should be worth about $400,000," says Guggenheim's Scott Minerd https://t.co/9QyOWyYAVA pic.twitter.com/uojQqaKPia

— Bloomberg TV (@BloombergTV) December 16, 2020

Some analysts and investors have previously made lofty predictions about bitcoin’s price that didn’t come true.

Bitcoin’s momentum carries the market

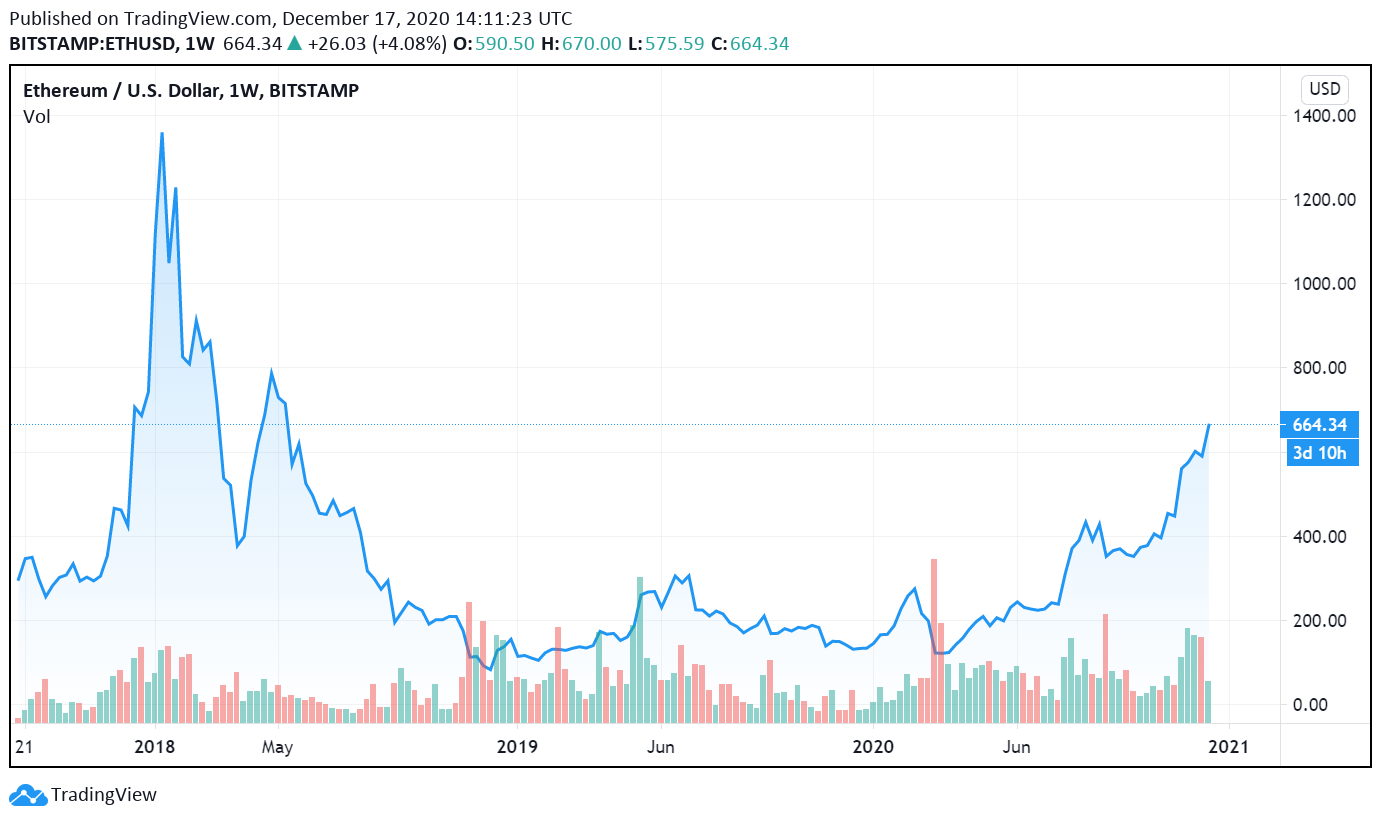

Ethereum, whose price swings move in tandem with bitcoin, has piggybacked on the leading digital asset’s bullish sentiment to trade at over $660. Ethereum last traded in this range in May 2018.

The second-largest digital asset by market capitalization, which is considered to be the silver to bitcoin’s gold, is up more than 11% in the last 24 hours.

In year-to-date (YTD) performance, Ether has outperformed bitcoin with gains of 410% compared to BTC’s 221%.

[caption id="attachment_20157" align="aligncenter" width="1381"] Ethereum is trading above $660, a range last reached in 2018. | Credit / TradingView[/caption]

Ethereum is trading above $660, a range last reached in 2018. | Credit / TradingView[/caption]

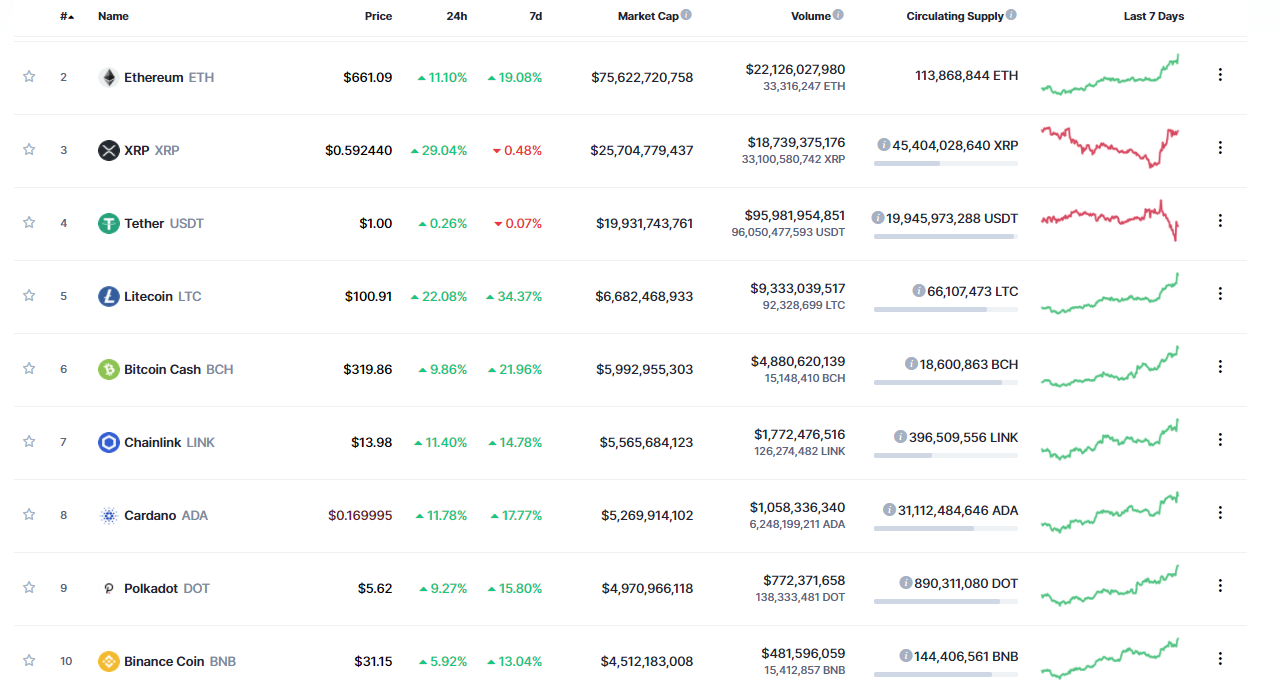

Some of the leading digital assets have also posted impressive gains in the last 24 hours, thanks to bitcoin. Chainlink, Cardano, Polkadot, and Bitcoin Cash are up more than 9%. XRP and Litecoin are respectively trading 29% and 22% higher than they did 24 hours ago.

[caption id="attachment_20158" align="aligncenter" width="1281"] Top 10 digital assets ride on Bitcoin historic bull run | Credit / CoinMarketCap[/caption]

Top 10 digital assets ride on Bitcoin historic bull run | Credit / CoinMarketCap[/caption]

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms