Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Fundamentals of market mechanics

While you might associate market mechanics with concepts like funding rates, open interest, liquidation heatmaps, and volume, we'll dive deeper into understanding the dynamics of being a buyer or seller in the market. This understanding is crucial for improving decision-making, reducing mistakes, and ultimately lowering your loss rate.Liquidity and market movement

Liquidity refers to the number of participants willing to buy or sell an asset. For a market to move in any direction, there must be sufficient liquidity, meaning enough orders are available. If there's no one willing to buy or sell, the market remains stagnant. Large players, often called "Smart Money," require significant liquidity to move the market, and understanding their influence is key to correctly positioning yourself.Manipulation by big players

The financial market, including cryptocurrencies, is not always fair. Big players have more information, capital, and influence, which allows them to manipulate the market to their advantage. They often target areas where retail traders place orders (e.g., stop-loss levels) to trigger movements that benefit them. Knowing these manipulative tactics helps you avoid common traps and protect your capital.Price action and timeframes

Importance of higher timeframes

Higher timeframes provide more reliable signals and help you avoid the noise present in lower timeframes. It's essential to wait for closures on higher timeframes before making decisions to avoid getting caught in false signals. Lower timeframes often present misleading data, leading to poor trading decisions.Example analysis

Using Bitcoin as an example, we examined how focusing on higher timeframes can prevent you from being caught offside. By observing key price levels and understanding the dynamics of market movements, traders can avoid panic selling during temporary market downturns. The market's behaviour often reflects the actions of larger players who capitalize on retail traders' fear, leading to significant price movements in the opposite direction.

Same price region, Same asset - two very different stories.

Identifying and avoiding an overheated market

What is an overheated market?

An overheated market is characterized by excessive buying or selling pressure, often driven by high leverage. This situation is typically unsustainable, leading to sharp corrections. Understanding the symptoms of an overheated market and knowing when to stay out can protect you from significant losses.Using market mechanics: funding rates and open interest

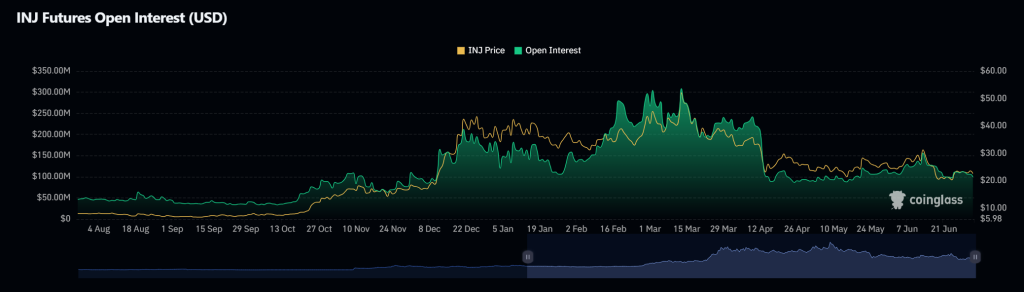

Funding rates and open interest are crucial indicators of market sentiment. Open interest reflects the amount of leverage in the system, while funding rates indicate whether more buyers or sellers are using leverage. When both indicators show high levels, it suggests that the market is overheated and a correction is likely.Example analysis of market corrections

We reviewed instances where high funding rates and open interest led to market corrections. By understanding these indicators, traders can avoid getting caught in bullish traps and protect their positions. For example, in March 2021, as funding rates and open interest ramped up, a significant market correction followed. Traders who were patient and observed these indicators were able to avoid losses.

As you can see by the dates and the charts, when funding, open interest, and price action all ramp up on the same dates, they were shortly followed by significant corrections. Understanding this can prevent you from being caught offside.

Cryptonary's take

The key to successful trading lies in understanding and utilizing market mechanics.By focusing on higher timeframes, being aware of manipulation tactics by larger players, and recognizing signs of an overheated market, you can significantly reduce the risk of losses. Remember, sometimes, the best action is to step back, observe, and wait for the right conditions before entering a trade.

Thank you for engaging with this material. By incorporating these concepts into your trading strategy, you'll be better positioned to navigate the complexities of the market. Stay informed, stay patient, and make strategic decisions to stay on the right side of the market.