FREEGAME Friday: Using leverage to your advantage

Welcome back to Freegame Friday, everyone! Today's episode is all about risk management and leverage trading strategies. I know there have been a lot of questions flying around in the Discord about leverage, futures trading, and how to use them effectively. This guide is here to clarify any confusion and answer all your questions.

We'll cover everything you need to know about leverage, from understanding it to placing your trades and managing different market scenarios. I'll also give you a quick tour of Blowfin so you can see how to set up your trades step-by-step.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is leverage?

Leverage is essentially borrowing money from the exchange to gain more exposure to a certain asset. It allows you to control a larger position with a smaller amount of capital.For instance, if you have $100 and you use 2x leverage, you’re effectively controlling $200 worth of an asset.

Leverage can amplify both your potential gains and your potential losses. That’s why it's crucial to understand how to use it correctly.

Using exchanges for leverage trading

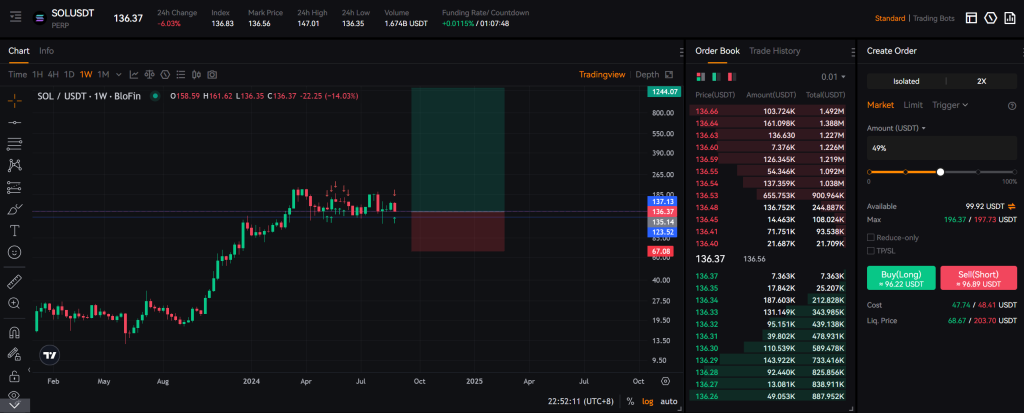

Let's move to Blofin, an exchange that I like to use. I’ve set up a Futures account with $100 to demonstrate how leverage works.Scenario example:

- Account balance: $100

- Asset: Bitcoin

- Leverage level: 1x to 5x

Understanding liquidation

Liquidation occurs when the exchange automatically closes your position to prevent further losses beyond your margin. The more leverage you use, the closer your liquidation price will be to your entry price.For example:

- With 2x leverage, a 50% drop in the asset’s value will lead to liquidation.

- With 3x leverage, a 33% drop would liquidate your position.

Low leverage strategies

Using low leverage with a high margin is a strategy where you put up a larger margin with lower leverage. This gives you broader exposure without needing precise entry points—ideal for traders who have a broad perspective on the market and want to gain exposure without taking on too much risk.Example:

- You have a $100,000 account.

- You want to trade Solana using 2x leverage.

- You put up $20,000 as margin, giving you $40,000 worth of exposure.

High leverage strategies

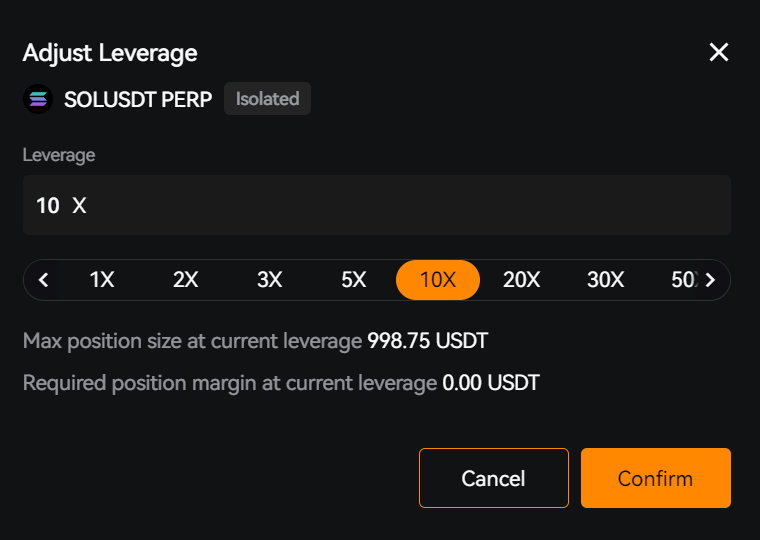

Using high leverage with a lower margin (like 5x or 10x) requires precision. You need to be exact with your entry points and use tight stop losses. This strategy is for traders who are confident in their analysis and can manage risk correctly.Example:

- You put $10 as margin with 10x leverage.

- You’re now controlling $100 worth of Solana.

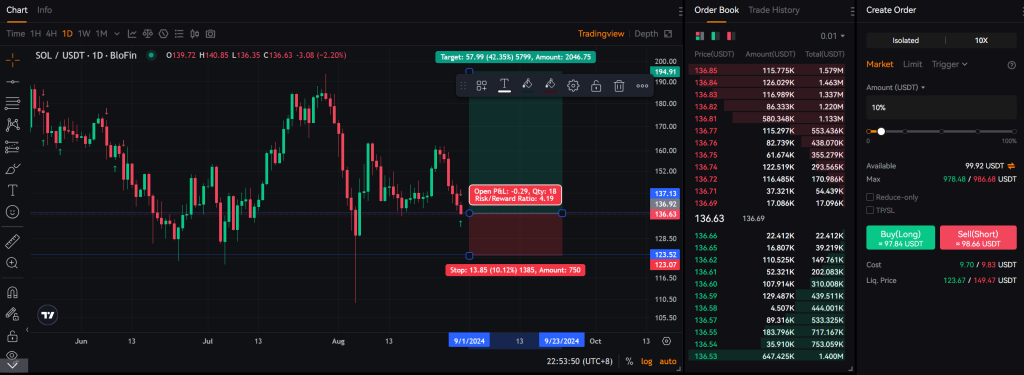

Risk management: the most crucial factor when using leverage

The only thing you can truly control in trading is your risk. Everything else is out of your hands—market movements, asset performance, etc. That’s why risk management is the most critical decision you make in trading.When you use leverage:

- Always calculate your stop-loss based on the total value of the trade, not just the margin you put up.

- Be strict and disciplined with your risk management strategies.

When to use high-conviction trades

High-conviction trades are appropriate when you’re highly confident in the market direction. In these situations, you might use higher leverage to maximize gains, but being strategic and disciplined is vital.For example, if you're certain about the market's direction and willing to set tight stop losses and roll stops if needed, you might want to enter a position with 10x leverage.

Cryptonary's take

Leverage is a powerful tool that can amplify both gains and risks. Understanding how to use it in conjunction with margin and risk management is crucial for successful trading. Remember, liquidation, leverage, and stop losses are fundamental concepts that every trader must grasp.If you have any more questions, drop them in the Discord. Trading is one of the world's most competitive and challenging skill sets, so take your time, practice good habits from the beginning, and you'll be ahead of the curve.

Stay safe out there, and I’ll see you in the next episode!