Guide: Consumer Price Index (CPI)

Consumer Price Index (CPI) is a key economic indicator closely watched by policymakers, traders and investors alike. Even as a consumer, it’s important to have a clear understanding of what CPI is, how it’s measured and what kind of information it provides.

Before we dive in, here are a few general points to note.

An economic indicator is simply any statistic that is an indicator of the current or future state of the economy. Economic indicators can be classed into three broad categories: leading, lagged and coincident.

Leading: indicators that change before the economy changes (e.g. stock market returns tend to decline before a decline in the economy is seen). These indicators are the most important type for traders and investors.

Lagged: indicators that reflect changes that have already taken place in the economy (e.g. CPI).

Coincident: indicators that change at the same time the economy does (e.g. Gross Domestic Product (GDP)).

Many different institutions publish reports on economic indicators. However, because the United States is the world’s leading economy, the financial data published by the U.S. Bureau of Labour Statistics (BLS; a government agency) is particularly important.

CPI: basic definition

The Consumer Price Index (CPI) is a measure of the monthly, quarterly, or yearly change in prices paid by consumers in a specific country/region.

Because CPI indicates price trends, it is a key marker for inflation/deflation.

In the U.S, the BLS publishes CPI figures on a monthly, quarterly and yearly basis. The schedule for the BLS CPI release dates can be found here.

How to calculate

CPI is calculated using weighted averages of prices for a representative basket of goods and services. Let’s break down what this means.The ‘basket of goods and services’ is made of a sample of goods and services which includes several different categories such as food and beverages, housing, transportation and education. The items that make up the sample are chosen based on information collected by the BLS regarding consumer spending habits. More specifically, data from approximately 48,000 quarterly survey responses and 24,000 weekly diary entries detailing everything purchased by the consumer over the course of a two-week period is used to define the contents of the representative basket.

The prices of each item within the basket are based on approximately 94,000 price quotes collected from retail, service and rental housing units. The averages of these prices are then ‘weighted’ to account for the good’s/service’s varying degrees of importance (which is also determined using the consumer spending data).

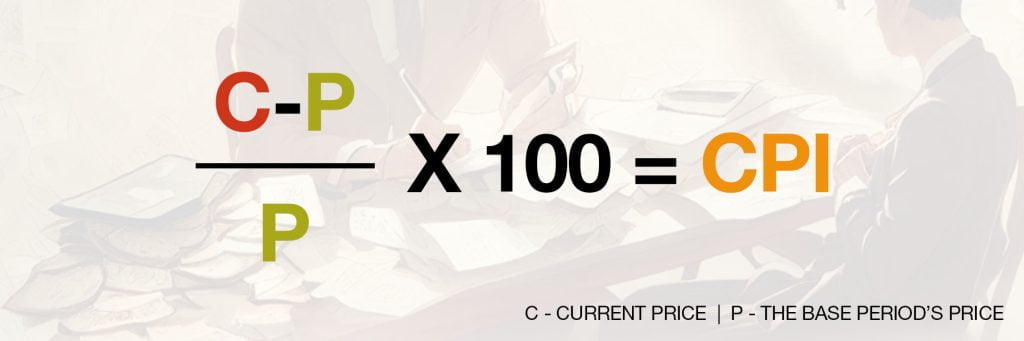

Note: there’s more than one way to calculate CPI; below is an example.

C = current price of a representative basket

P = the base period’s price.

So, for example, let’s say that the basket cost was $2,000 in 2021 (base year), and in 2022, the cost of the basket rose to $2,050.

Therefore:

((2,050 – 2,000) / 2,000) x 100 = 2.5

This means that for the period beginning in 2021 and ending in 2022, the CPI was 2.5, i.e. inflation was at 2.5% (prices rose by 2.5%).

Types of CPI

The BLS publishes two CPI versions every month.The Consumer Price Index for All Urban Consumers (CPI-U)

CPI-U accounts for approximately 93% of the U.S. population but does not include individuals living in remote rural areas, military bases or institutions.

Note: Core CPI (same as CPI-U, except it excludes energy and food) is often used over CPI-U. This is because the prices of energy and food are quite volatile (subject to change), so the Core CPI allows economists to get a better picture of the ‘core’ or underlying rate of inflation/deflation.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)

The CPI-W represents individuals living in the U.S whose income is mainly derived from jobs with an hourly wage or clerical jobs (approx. 29% of the population). This figure informs changes to Social Security payments, pensions and other federal benefits. It’s also used to make adjustments to income tax brackets so that taxpayers aren’t faced with higher marginal rates as a consequence of inflation.

Why it’s important

At the level of the consumer, it’s important to be aware of how inflation is impacting your purchasing power so that financial decisions can be made accordingly.

In simple terms, an increase in CPI indicates inflation, or the decline of a currency’s purchasing power over a period of time. Inflation isn’t necessarily bad when kept at reasonable levels, as it provides an incentive for consumers to spend, which keeps the economy churning. However, at high levels, inflation erodes consumers’ purchasing power, i.e. your money is worth less, so everything becomes more expensive.

On the opposite end, a decrease in CPI signals deflation, or the increase in a currency’s purchasing power and the decrease in consumer prices. While falling prices may sound like a good thing, deflation can signal an impending recession.

CPI is widely used by central banks (e.g. the U.S. Federal Reserve) to guide monetary policies. An in-depth account of the relationship between CPI and monetary policy is beyond the scope of this report. Briefly speaking, banks attempt to control inflation/deflation by altering the availability of money. For example, during periods of inflation (like the one we are currently in), banks try to cool off’ the economy by reducing the availability of money, largely through raising interest rates. If you would like to learn more about this topic, check out our pro macroeconomic series.

The rate of inflation or deflation can have an impact across all markets, so CPI is also very important to crypto traders and investors. When inflation is high, and there’s less money to go around, people are generally less willing to invest in ‘risk-on’ assets (assets considered to be riskier investments) like crypto. This also means that there’s less money for cryptocurrency-related businesses and teams to grow. Again for more detail on this, we highly recommend you check out our macro series.

Comment and share if you found this guide useful! Also, keep an eye out for more economics guides coming soon!

Disclaimer: We do not give any financial advice. Instead, our guides and tutorials are created to provide you with information about the crypto space. The decisions that you make are completely up to you, and remember that your capital is at risk when investing in crypto.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms