Guide: Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is an important economic indicator closely watched by policymakers, traders and investors alike. Even as a consumer, it’s important to have a clear grasp of what GDP is, how it’s measured and what kind of information it provides.

Before we dive in, here are a few general points to note.

An economic indicator is simply any statistic that reflects the current or future state of the economy. Economic indicators can be classed into three broad categories: leading, lagged and coincident.

Leading: indicators that change before the economy changes (e.g. stock market returns tend to decline before a decline in the economy is seen). These indicators are the most important for investors.

Lagged: indicators that reflect changes that have already taken place in the economy (e.g. CPI).

Coincident: indicators that change at the same time the economy does (e.g. GDP).

Many different institutions publish reports on economic indicators. However, because the United States is the world’s leading economy, the financial data published by the U.S. Bureau of Economic Analysis (BEA; a government agency) is particularly important.

GDP: basic definition

In simple terms, GDP represents the total market value of all finished goods and services produced within a region’s borders in a specified time period. The term ‘finished goods’ refers to those that have gone through all stages of production and are being held for sale. Because GDP gives a broad overview of domestic production, it's seen as a marker of a region’s overall economic health and growth rate.

Because GDP gives a broad overview of domestic production, it's seen as a marker of a region’s overall economic health and growth rate.

Most countries publish GDP data on a monthly, quarterly and yearly basis. In the U.S., the BEA publishes an advance release of quarterly GDP four weeks after the quarter ends and a final release three months after the quarter ends. More information can be found here.

Types of GDP

Nominal GDP

Nominal GDP values goods and services at their current market price, meaning that it does not adjust for inflation/the pace of rising prices. Nominal GDP is generally used when comparing the output of different financial quarters within the same year.Real GDP

Real GDP measures the number of goods and services produced while controlling for price inflation. With Real GDP, the prices of goods and services are adjusted to the price levels of a reference year, known as the base year. This allows economists to get a better idea of whether changes in GDP are a result of economic expansion/contraction or just changes in price. If there is a big difference between the real GDP and nominal GDP, it may be a sign that there is inflation or deflation in the economy.GDP per capita

Gross Domestic Product per capita is a measurement of how much economic production output can be attributed to each individual citizen. It’s often viewed as an indicator of the average productivity levels, living standards and the overall wealth or prosperity of a region. For example, if a country is seen to have a high GDP per capita but a small population, this may reflect a strong and relatively self-sufficient economy.How to Calculate

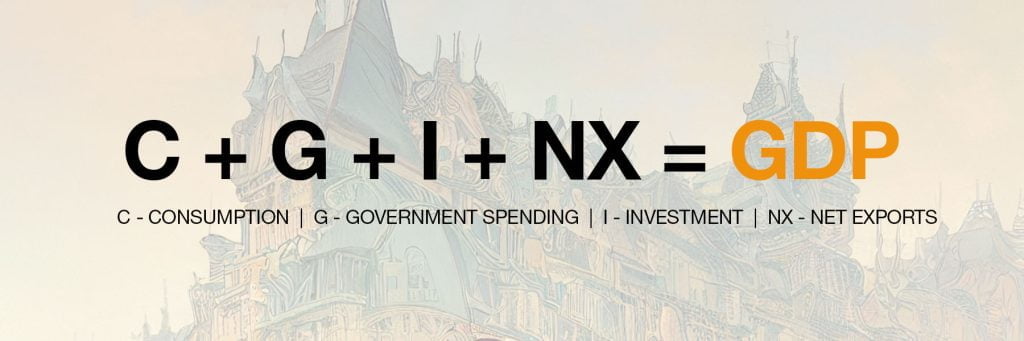

There are three primary methods used to calculate GDP: the expenditure approach, the Output Approach and the Income Approach. The Expenditure Approach is the primary method used to calculate the GDP in the U.S., so let’s go through it briefly.

Consumption is the biggest component of GDP, as it accounts for all consumer spending.

Government spending includes government consumption expenditure and gross investment (e.g. payroll, infrastructure and equipment).

Investment represents all private domestic investment and capital expenditures (e.g. a business buying machinery or software).

Net exports subtracts total exports (exported goods and services that an economy makes) from total imports (imported goods and services purchased by domestic consumers) (i.e. NX = exports - imports). All expenditures by companies located in a given country, even if they are foreign companies, are included in this calculation.

Note: Real GDP is calculated using a ‘price deflator’, which takes into account the difference in prices between the base year and the current year. For example, if prices rose by 7% since the base year, the deflator value would be 1.07. Real GDP is then calculated by dividing the nominal GDP by the deflator. GDP per capita is simply calculated by dividing the real GDP figure by the region’s population.

GDP Growth Rate

The growth rate is a comparison of the year-on-year (or quarterly) change in a region’s economic output. The growth rate is typically expressed as a percentage and is viewed as an indicator of how fast an economy is expanding or contracting.Why it’s important

To recap, Gross Domestic Product provides a snapshot of a region’s economic size and health.

Generally speaking, countries with larger GDPs will have a greater amount of goods and services generated within them (i.e. more value being produced), along with greater market activity and a higher standard of living compared to countries with lower GDPs.

This being said, a criticism of GDP is that it does not account for economic inequality, and so a high GDP isn’t necessarily a sure sign of a healthy economy. For example, two regions could have similar GDPs, but the GDP of one region could be the result of a healthy economy where each individual earns a decent income whereas the other could be a result of an economy fuelled by a handful of extremely wealthy individuals while the rest live in poverty.

As already mentioned, GDP Growth Rate is an indicator of how fast an economy is expanding or contracting. This metric is particularly important for government entities/central banks, as it helps inform changes to monetary policies. For example, a large positive growth rate may signal that the economy is overheating, which may call for the implementation of strategies that will help to cool down or ward off inflation (e.g. raising interest rates). On the other hand, a declining or negative growth rate may require banks to lower interest rates or engage in other expansionary measures to avoid a potential recession.

We’ll go into all of this in more detail in our upcoming guides on monetary and fiscal policies so keep an eye out! In the meantime, check out our pro macroeconomic series here.

As regards crypto trading and investing, the latest GDP figures can have a considerable influence on market sentiment. Stronger economic growth tends to translate into higher profits and investor risk appetite. In other words, there is more money in the economy, and people are more willing to invest in ‘risk-on’ assets (assets considered to be riskier investments), like crypto. The opposite is true during times of economic downturn, where people either conserve their wealth for more immediate consumption or are more willing to invest in assets that are ‘risk-off’ (considered to be a safer bet during times of economic uncertainty, e.g., gold).

Comment and share if you found this guide useful! Also, keep an eye out for more economics guides coming soon!

Disclaimer: We do not give any financial advice. Instead, our guides and tutorials are created to provide you with information about the crypto space. The decisions that you make are completely up to you, and remember that your capital is at risk when investing in crypto.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms