‘Upgrading Ethereum to radical new heights…The vision is to bring Ethereum into the mainstream and serve all of humanity, we have to make Ethereum more scalable, secure and sustainable.’

Let's take a closer look.

Why are the upgrades necessary?

Back in 2013, Vitalik Buterin published Ethereum’s whitepaper “A Next-Generation Smart Contract and Decentralized Application Platform.” And in 2015, Ethereum was launched.The network has seen a lot of success since then, but from the start, it’s been expected that a few key upgrades would be necessary for Ethereum to reach its full potential.

Recently, high demand and more uses have driven up transaction fees (gas fees) and caused congestion on Ethereum. This means that right now, ETH transactions are extremely expensive and slow. Also, the proof-of-work consensus mechanism that currently validates ETH transactions and keeps the network secure has a pretty bad environmental impact.

Ethereum’s planned upgrades aim to fix these problems to make the network more scalable, secure, and environmentally sustainable.

The network will see some fundamental changes to its structure and design as part of these upgrades. The two main changes will include a movement to ‘proof of stake’ and the introduction of something known as ‘sharding,’ which we'll discuss in more detail.

The future of Ethereum

Here's a closer look at Ethereum’s future goals.More scalable

In Ethereum's own words, the network ‘needs to support 1000s of transactions per second, to make applications faster and cheaper to use.’As more and more users joined Ethereum, the network’s efficiency declined. This means the network is currently plagued with congestion issues, and some smaller transactions are priced out; it can cost hundreds of dollars in gas fees to complete a single transaction!

Ethereum must become much more scalable to accommodate the increasing number of users and transactions on its network.

More secure

‘As the adoption of Ethereum grows, the protocol needs to become more secure against all forms of attack.’Ethereum needs to be able to increase its scalability while maintaining its core values of privacy, security and decentralisation. To do this, improvements will be rolled out slowly overtime to make sure decentralisation is maintained.

Achieving scalability and security while maintaining decentralisation is known as the ‘scalability trilemma.’

More sustainable- Green Ethereum

‘Ethereum needs to be better for the environment. The technology today requires too much computing power and energy.’

As part of what’s known as ‘The Merge’, Ethereum will switch to a proof of stake consensus mechanism, which is much more energy-efficient than the proof of work mechanism it currently uses.

With proof of work, transactions are processed by a network of computers that compete to solve mathematical puzzles, in return for rewards in ETH. This mechanism is, unfortunately, extremely energy-intensive and involves a lot of unnecessary computational work. In fact, the mathematical problems that the miners compete to solve serve no purpose other than maintaining the network’s security.

Proof of stake is an alternative mechanism that allows blockchains to run in a more energy-efficient way, using less electricity while making sure security and decentralisation are still maintained. The removal of the mining process means less computational energy is used, and less competition occurs. So the speed of transactions also tends to be quicker, and the cost more affordable.

It’s been claimed that the movement to proof of stake could cut Ethereum’s network energy by at least 99.95%!

So, what actually are the upgrades?

Ethereum’s roadmap lays out a set of interconnected upgrades that will help to make the network more scalable, secure and sustainable. Each upgrade has different requirements that will determine when they will be put in place, so they won’t all be released at the same time.Also note that some of these upgrades are separate from the main Ethereum network we use today, but they won’t replace it. Instead, the Ethereum Mainnet will simply ‘merge’ with the new parallel system that’s now being gradually created.

What is the Beacon Chain?

The Beacon Chain is a new chain at the core of the ‘new’ Ethereum. It’s already live and launched back in 2020. This upgrade brought the proof-of-stake consensus mechanism and therefore staking to Ethereum, laying the basis for future upgrades.As we mentioned above, proof of stake is much more secure and environmentally friendly than the proof of work mechanism that the main Ethereum network still uses.

With proof of stake, holders stake their ETH to validate transactions and create new blocks. The network rewards validators for processing transactions, but it also 'slashes' their stake if they try to attack it, ensuring good behaviour. Proof of stake, also makes it easier for more users and not just large miners to participate in the network.

The Beacon Chain will eventually lead Ethereum’s new system and lays the foundation for the rest of Ethereum’s planned upgrades.

Right now, the Beacon Chain exists separately from the main Ethereum network we use today. Holders can already stake their ETH on the Beacon Chain, but can’t currently do anything else on it. But eventually, the two chains will be ‘merged’ or connected so the main Ethereum network moves to the Beacon Chain. Once the ‘Merge’ is complete, Ethereum will no longer use proof of work.

When the main Ethereum network has merged with the Beacon Chain, the next update will introduce what’s known as ‘shard chains’ to the network.

How does staking on The Beacon Chain actually work?

As we mentioned above, the Beacon Chain is already live and runs parallel to the main Ethereum chain. (The main Ethereum network still currently uses the proof-of-work consensus mechanism). Right now, users can’t do anything but stake ETH on the Beacon Chain. However, holders can stake as much ETH as they like to become a validator and secure the Beacon Chain and earn rewards in returns.Note that at the moment, staking on Ethereum is a one-way street. Once you’ve staked your ETH, there’s no option to unstake it until The Merge is complete.

Eventually, when the main Ethereum network merges with the Beacon Chain, stakers will help secure all of Ethereum.

What do validators do?

While both proof of work and proof of stake help to secure the chain, they work in very different ways. Proof-of-work involves miners, while proof of stake involves validators (or “virtual miners”).The Beacon Chain is primarily composed of a list of validators and confirmations made by validators. The Chain’s virtual validators are activated and controlled by ETH stakers (in proof of work, users purchase physical hardware to become miners.) For every 32 ETH staked, one validator is activated.

The Beacon Chain is also divided into what’s known as ‘epochs.’ And each epoch is further divided into 32 ‘slots.’ Validators are evenly spread across these slots. For security, each slot has a ‘committee’ of at least 128 validators. This means an attacker has less than a one in a trillion probability of taking control of two-thirds of a committee.

Staking rewards & penalties

Validators help to secure the network and are incentivised by staking rewards, as well as penalties. They have three main functions: to propose and add blocks to the chain; to certify the validity of the chain, and to report malicious behaviour of other validators.Validators get rewards for good behaviour. But they also receive penalties for bad behaviour such as dropping offline. The amount a staker can earn in rewards closely reflects the amount they may lose. A validator may make 10% in a year on rewards, but if they do a bad job, they may lose 7.5% of that.

Slashing is another type of penalty for bad behaviour. These penalties range from 0.5ETH to a validator’s whole stake!

How to stake on The Beacon Chain

Staking is key to Ethereum’s upgrades. And if you have ETH, you can already stake it on the Beacon Chain to help secure the network, and earn more ETH as a reward!Staking can be done through the Ethereum staking launchpad or by joining a staking pool. To become a full Ethereum validator, you’ll need to stake 32 ETH. But if you don’t want to stake that much, you can join a staking pool where you stake less and earn a percentage of the rewards.

Find out more about how to do so here.

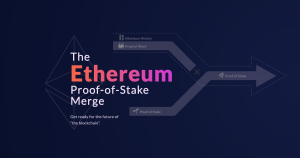

What is the Merge?

The existing main Ethereum chain will need to ‘merge’ with the Beacon Chain. This update will bring staking to the whole Ethereum network. It will also mark the end of energy-intensive Ethereum mining. This upgrade is known as The Merge and is expected in Q3/Q4 2022.Why the Merge? Well, the Merge will preserve the history and functionality of the old Ethereum network, while importantly switching its consensus mechanism from proof of work to proof of stake.

Note that the Merge won’t resolve Ethereum’s scalability issues straight away. This is where the next upgrade comes in: sharding, which we'll discuss below.

Sharding: Solving Ethereum’s scalability issues

‘Shard chains’ are designed to increase Ethereum’s bandwidth, in other words- its ability to process transactions and store data. Shard chains will make more data available to the network. This upgrade is expected to launch in 2023.The main problem that blockchains like Ethereum currently face is that every node on the network has to verify and execute every single transaction. There are two main ways to solve this issue: by scaling vertically or by scaling horizontally.

How does scaling work?

Put simply, scaling vertically involves increasing the power of the network’s nodes. While scaling horizontally basically means adding more nodes to the network. For purposes of decentralisation, blockchains need to scale horizontally.Ethereum’s goal is for nodes to be able to run on consumer hardware- it will do this by what is known as ‘sharding.’ The Ethereum blockchain will be split up into ‘shard chains.’ Each shard chain will have its own subset of nodes which will only validate transactions in that chain. This will make the whole network more efficient as a single validator doesn’t have to handle all of the work alone.

You can think of shards as the blockchain’s “hard drive.”

This update will reduce the delays and congestion that we see on the Ethereum network today. Right now, Ethereum can support 30 transactions per second. The new shard chains will be able to conduct up to 10,000 transactions per second!

The next challenge Ethereum will face is maintaining the security of those shards and preventing malicious validators from taking over single shards. Part of Ethereum’s solution to this involves randomly shuffling validators to avoid manipulation, as well as different fraud and custody proofs.

Many proof of stake networks have relatively small sets of validators, which means network security is decreased. But after its upgrades, Ethereum will have a large set of validators, meaning it will be more decentralised, secure, and less open to manipulation.

How will these shards connect to the Beacon Chain?

‘Crosslinks’ are part of a planned upgrade that will connect the shard chains to the Beacon Chain. Put simply, a ‘crosslink’ is a reference in a Beacon Chain block to a shard chain block. If there are 64 shards, every Beacon block can contain up to 64 crosslinks or references.What about ETH 2.0?

The term ‘Eth2’ or ‘ETH 2.0’ is actually being phased out by Ethereum in preparation for ‘The Merge’.Right now, ETH 1.0 handles transactions and ETH 2.0 handles the new proof of stake consensus mechanism. Once ETH 1.0 and ETH 2.0 are merged into the same chain, there will no longer be two different Ethereum networks- so no need for the reference anymore!

What do the upgrades mean for ETH holders?

ETH holders don’t need to do anything to prepare for the upgrades. There is no ETH 2.0 token and your ETH won’t need changing or upgrading after the Merge. (Note: anything telling you otherwise is likely a scam, so be careful).For Cryptonary's transparent take on Ethereum, go to the Ratings Guide here.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms