Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Options are incredibly versatile instruments, and sophisticated traders can use the wide range of choices to create derivatives that suit a specific purpose. For example, if they hold a range of alt-coins and want to protect against 70% of potential downside, a basket of options can achieve this. The underlying asset, and goal of the basket, can be changed to suit any need!

Put – give the buyer the right, but not obligation, to sell a set amount of an asset at a set price.

Call – give the buyer the right, but not obligation, to buy a set amount of an asset at a set price.

Let’s have a look at a call option example:

Karim buying an ETH call option from Bill:- Karim pays Bill $200 now, for the right to buy 1 ETH for $3,000 in 1 months’ time.

- Karim wouldn’t be forced to buy it (unlike futures), so if the price goes down, he only loses the premium.

- If Karim wants to buy it, Bill must sell it to him at the set price. If ETH goes up to $5,000, Karim has made a $1,800 profit.

Now, if Karim was buying a put option from Bill:

- Karim pays Bill $200 now, for the right to sell Bill 1 ETH for $3,000 in 1 months’ time.

- Karim wouldn’t be forced to sell it (unlike futures), so if the price goes up, he only loses the premium.

- If Karim wants to buy it, Bill must buy it from him at the set price. If ETH goes down to $1,000, Karim has made a $1,800 profit (as he can sell his ETH to bill for $3,000, then buy a replacement ETH on the spot market for £1,000).

Selling Options

In the examples above, Karim is the buyer of a call and put option, Bill is the seller.Selling options is much more complex than buying them, as it requires specialist knowledge to select strike prices, expiration dates, and many more complex instruments that are out of the scope of this report (such as the options Greeks: Delta and Gamma for example).

In DeFi, things that have previously been impossible are routinely being done. One such thing allows users to benefit from the returns of options selling, simply by depositing their assets into a pool. Enter, DeFi Options Vaults.

For more info on options, especially in DeFi, and information on the protocols available, check out our research report, **Don’t Lose The Option.**

DeFi Options Vaults (DOVs)

DOVs make it possible for anyone to benefit from the high, sustainable yield you can get from selling options. Users simply deposit into the pool, which the protocol uses as collateral to sell options, either through auctions or directly on platforms such as PsyOptions.

Katana is an example of a DOV. It advertises projected Annual Percentage Yields (APYs) between 20-60%, with most falling between 20-30%. It is important to note that these returns are not guaranteed, and there is a risk of loss. Read the risks section later in this report.

There are two types of options that most DOVs sell:

Covered Calls

Sells a call option, giving the buyer the right to buy the underlying asset at a set point in the future, for a set price (the strike price); while simultaneously hedging by buying spot to cover the risk of selling the option (hence the name).

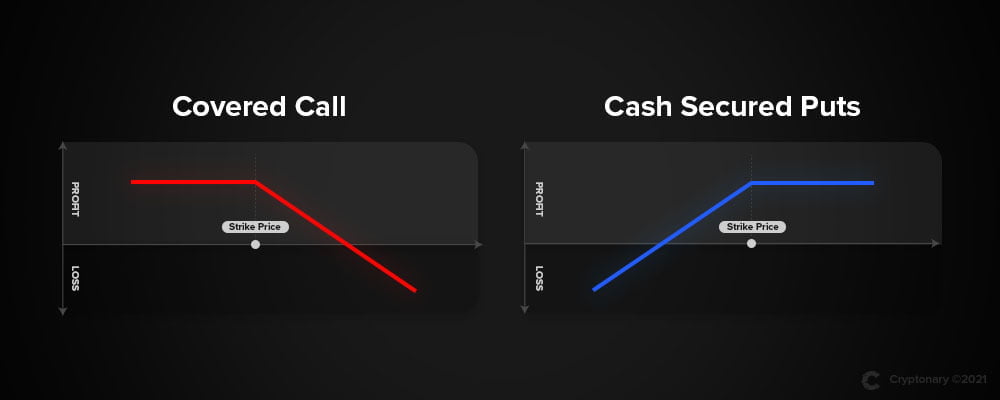

Above is the payoff profile, compared to holding the spot asset, for the seller of a covered call option (which is what you are when you deposit into a DOV).

The seller hopes the price will remain below the strike price. As you can see in the chart above, once the asset goes above the strike price, returns go down.

This would mean the buyer doesn’t use (exercise) the option, and buy the asset off the seller. The seller then keeps the asset, and the premium (the amount the buyer paid for the right).

The optimal situation for the seller: the assert price rises to just below the strike price, as they will benefit from a modest rise in the asset price, and keep the premium.

If the price of the asset falls, the seller will lose USD value, as they are holding the asset as collateral. However, they earn the premium. If they would be holding the asset anyway, then they have turned a profit.

Selling covered calls is a great strategy for times of low volatility, or bear markets if you would be holding the asset anyway.

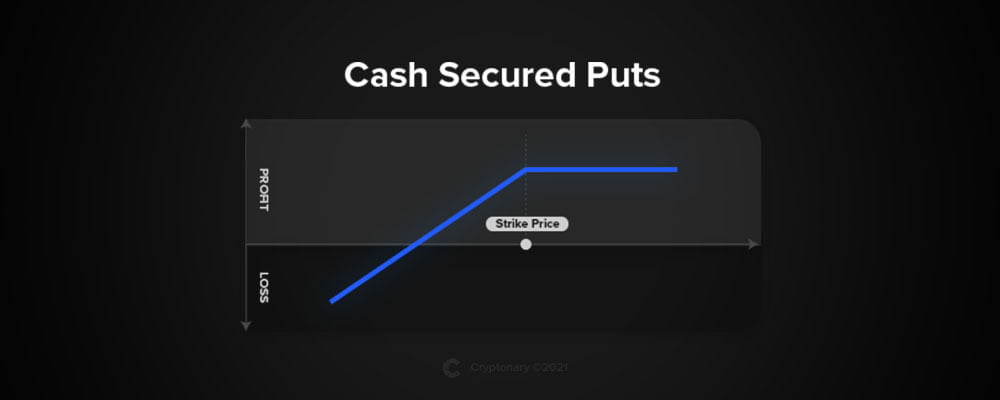

Cash Secured Puts

Sells a put option, while keeping cash ready to buy the underlying at the options strike price (the price you have agreed to buy the underlying from the options buyer).

The profit for a cash secured put is the premium the buyer paid. As long as the strike price is not hit, the seller earns the profit. After the strike price is hit, price rises have no effect on the payoff.

Comparing their payoff side by side, you see how a covered call strategy is profitable when prices remain the same or go down. A cash-secured put strategy is profitable when prices remain the same or go up.

Note, this does come with risks.

Deposits into DOVs can suffer losses.Generally, they sell far out-of-the-money options, for example, a call option with a $110 strike price when the price is $80.

If the price jumps to $120 before expiry, the buyer would exercise the options and buy the asset, which would result in a loss of $10 for the seller (minus the premium earned) when compared to buying and holding the asset.

Using a similar example for a put, the current asset price is $80, and you sell a put option with a strike price of $60. If the price falls to $50 before the expiry, the buyer would exercise the option and sell the asset to you for $50, resulting in a $10 loss (minus the premium).

As puts are cash-secured, the seller locks up the relevant amount of USD, so the loss is a direct USD loss. For covered calls, the loss is when compared to holding the asset, as that is what you are locking up.

For more info on DOVs, check out our report 80% APY!? Is It Sustainable?

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms