The 2024 cycle has shown a significant shift in investor behaviour, where memecoins have gained unexpected traction, challenging the more traditional utility tokens. This shift has sparked a debate about where your capital might be safer and more productive in the long run. One of the most intriguing aspects of this shift is understanding the difference between meme coin and crypto, which continues to drive conversations among investors.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Utility coins vs memecoins

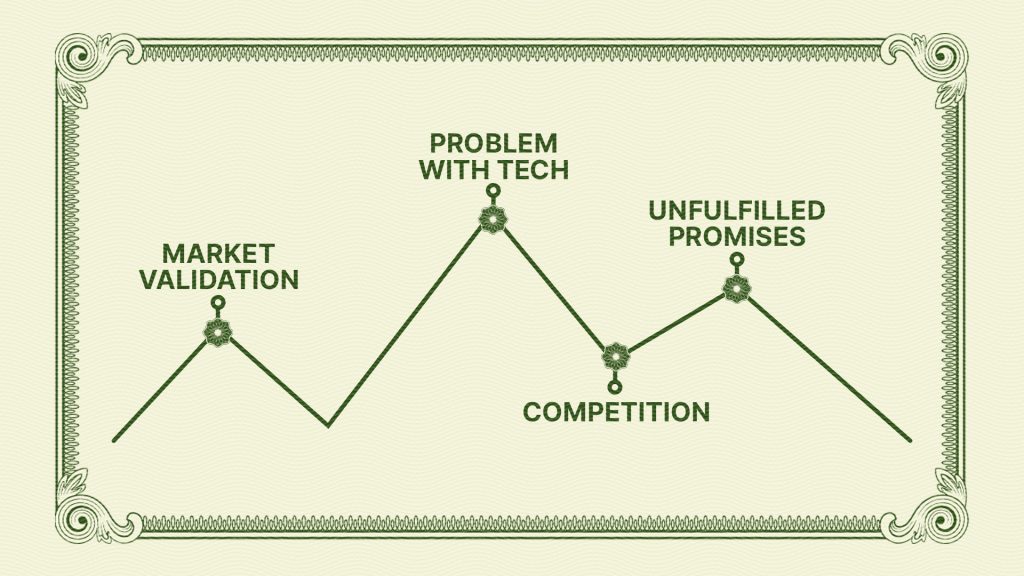

Utility tokens typically enter the market with grand ideas, promising to revolutionise the crypto market. These tokens often gain early market validation due to their exciting prospects and robust teams. However, the real challenge for utility tokens arises later, as they face competition, technological hurdles, and the risk of unfulfilled promises.Memecoins, often seen as a joke in previous cycles, have become a focal point for many investors. To better understand this shift, it's crucial to grasp the difference between meme coin and crypto, especially as the latter often relies on delivering technological innovations and fulfilling complex roadmaps.

In the last cycle, Dogecoin and Shiba Inu demonstrated the exponential potential of memecoins, changing lives and reshaping the cryptocurrency landscape. This cycle, investors are looking for the next big memecoin, spurred by the ease of access provided by platforms like Solana, Phantom, and Jupiter. Understanding the difference between meme coin and crypto is key to navigating this trend and deciding where to allocate your investment.

Utility tokens are akin to businesses. Like businesses, they face competition and must continuously innovate to stay relevant. In the fast-paced world of technology, where AI and other advancements rapidly evolve, utility tokens can struggle to keep up. A utility token's initial success often hinges on its ability to deliver on its promises. Still, over time, the same factors that brought in capital can jeopardise its position in the market. This highlights yet again the difference between meme coin and crypto, as the former thrives on sentiment while the latter depends on technological reliability.

The trajectory of utility tokens vs memecoins

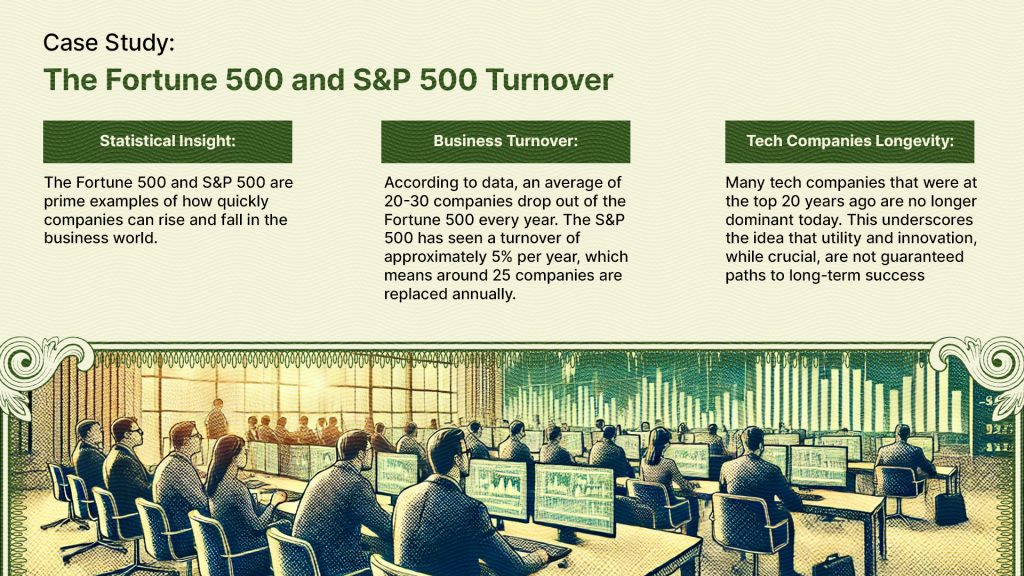

Utility tokens typically experience a surge of interest at their inception, driven by their new and exciting technology.However, as time goes on, these tokens often face challenges. Technological issues, unmet promises, and new competition can cause these tokens to lose momentum. This is similar to how businesses in the Fortune 500 experience turnover, with only the most innovative and adaptable companies remaining on top.

In contrast, memecoins follow a different trajectory. They often start with low expectations but can rapidly gain market validation if they capture the collective imagination of a community. Once a memecoin reaches a certain market cap, it can maintain its position with fewer risks compared to utility tokens. This is because memecoins are not tied to the success of a particular technology or roadmap but are driven by community sentiment and cultural relevance. This stems from the difference between meme coin and crypto, where memecoins rely on community and cultural relevance rather than technological advancements or roadmaps.

Market performance: Utility coins vs memecoins

Memecoins operate in a unique space where their success is not necessarily tied to technology or utility but to their cultural and community-driven appeal. Meme coins like Dogecoin, Shiba Inu, and Pepe have shown bullish structures, often outperforming many utility tokens in the market. This performance is driven by the collective belief of the community, which creates a robust and resilient force behind the token's value. The difference between meme coin and crypto becomes evident when analysing this performance—memecoins are less burdened by roadmaps and innovation demands, thriving instead on pure market sentiment.Unlike utility tokens, meme coins are not burdened by roadmaps, promises, or the need to continuously innovate. Their value is purely speculative and driven by market sentiment. This makes them less susceptible to the same pitfalls that utility tokens face, such as technological obsolescence or competition.

Above is Arbitrum's chart, an asset that performed well in October as investors priced in the ETH ETF in anticipation of capturing a cycle-long bullish surge. That's not to say Arbitrum can't perform—it still might—but compared to Pepe's chart below, it's a fascinating comparison of the visual structural strength of the two assets.

Cryptonary's take

In today's fast-paced technological landscape, where innovation happens rapidly, memecoins offer a simpler and potentially lucrative investment opportunity. While they are undeniably risky, their volatility is part of what makes them attractive to investors seeking high returns.Memecoins don't have to worry about staying technologically relevant or delivering on complex promises, making them more straightforward in some respects. In contrast, utility tokens must continuously innovate and adapt to new technological advancements. This constant need to evolve can be both a strength and a weakness, depending on how well the token's team can keep up with the pace of change.

While utility tokens have the potential to revolutionise industries, they also face significant challenges that can jeopardise their long-term success. Memecoins, on the other hand, are driven by community sentiment and cultural relevance, which can sometimes allow them to weather market storms better than utility tokens.

Missed DOGE? Catch the next big thing with Cryptonary

Did you know we reported WIF at $0.003 (+62,308%), POPCAT at $0.004 (+48,233.33%), and SPX at $0.01 (+6,200%)? Imagine what our research could uncover next.

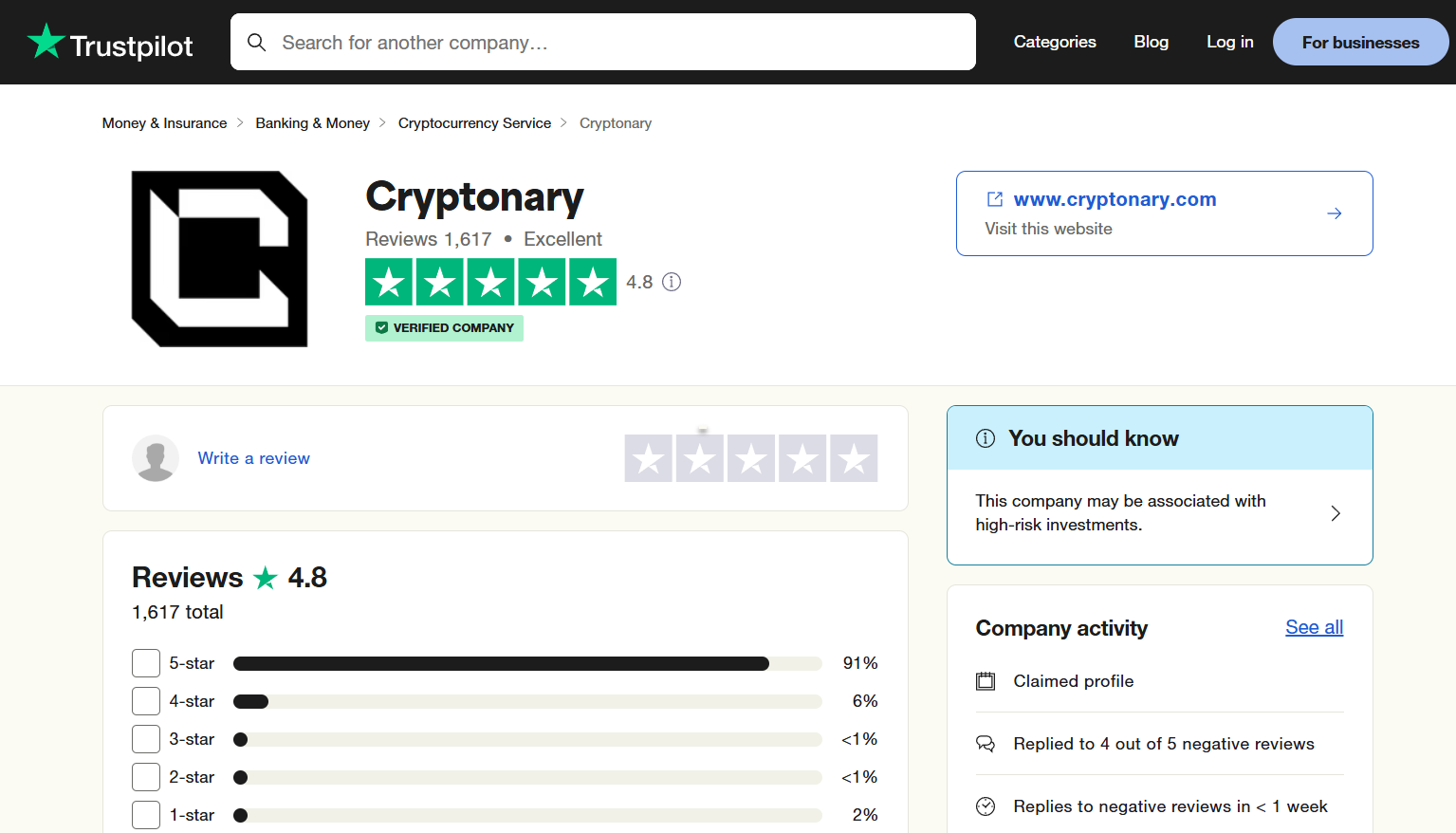

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

FAQs

Here are some related FAQs.1. What is the main difference between meme coins and utility tokens?

Meme coins get their value from community support and popularity, while utility tokens are linked to useful technology and delivering on plans.2. Why are meme coins becoming so popular recently?

Meme coins have gained attention because they are simple, fun, and can grow quickly in value without needing complex technology.3. Are meme coins or utility tokens better for long-term investments?

Meme coins can grow quickly but are very risky. Utility tokens are more stable but face challenges like staying up to date with technology. It depends on how much risk you are willing to take.4. How do meme coins like Dogecoin perform better than utility tokens?

Meme coins often do well because they don’t rely on technology or detailed plans. Instead, they grow through community excitement and market interest.5. What problems do utility tokens face that meme coins avoid?

Utility tokens need to keep improving and delivering on promises, which can be hard. Meme coins avoid these issues by focusing on popularity and community support.6. What is the difference between a meme coin and other cryptocurrencies?

Meme coins are a type of cryptocurrency that gains value mainly from internet culture, community support, and social media trends. They often have little or no practical use compared to other cryptocurrencies, which are usually tied to solving real-world problems or offering specific technology-based services.7. What are some examples of meme coins?

Popular examples of meme coins include Dogecoin (DOGE), known for its Shiba Inu dog logo, and Shiba Inu (SHIB), a coin inspired by Dogecoin. Other examples are Pepe (PEPE) and newer coins that often go viral on social media platforms.Continue reading by joining Cryptonary Pro

$0

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms