Let's dive in!

So, what are synthetic assets?

Synthetix allows the creation of 'synthetic' assets or 'synths.' Synths reflect the price of their real-world counterparts. Think of synthetic materials (materials made by people rather than those found in the natural environment).An example is sBTC, which mirrors the price of BTC (Bitcoin). However, Synths can be used for any real-world asset (oil, gold, FTSE 100, and even property).

This concept may sound familiar. That's because synths can also be described as 'derivatives.' Derivatives are contracts based on the value of an underlying asset—its 'derived value.' The two most popular types of derivatives are futures and options.

'Perpetual futures,' better known as 'perps,' are some of the most popular products in the crypto space and receive billions of dollars in daily trading volume. You might be asking, What exactly is a perpetual future? A future is an agreement to purchase an asset (such as Ethereum) at a point in the future. 'Perpetual' refers to the fact that there's no settlement date. They roll on until you close the position.

Synthetic governance

As the oldest DeFi blue chip crypto, SNX has a long history. It also has the best DAO (Decentralised Autonomous Organisation) structure in crypto. Its DAO is made up of "councils" that vote on specific actions. For example, the Grants Council votes on who should receive funding, the Treasury Council sets budgets, and the Spartan Council votes on the higher-level management of the protocol.This system has resulted in very efficient and reactive management of Synthetix.

SNX token and synth minting

Synth minting is extremely complicated, but we'll try to explain it simply:To mint a synth, users must "stake" SNX (Synthetix native token). Once staked, they can "mint" sUSD (synth of USD). Stakers are then rewarded by sharing transaction fees with the ecosystem. This requires a collateralisation ratio of 400%, meaning the SNX staked must be 4x the value of the synth minted. This is referred to as the C-ratio. Once minted, this sUSD can be swapped for any other synth in the Synthetix ecosystem.

Note, by minting sUSD, you're taking a short position against all other Synths. For a more detailed look at this, check out this article.

V3

The V3 upgrade is coming soon and will allow deposits of other assets (not just SNX) to be used as collateral for minting Synths.The cold start liquidity issue is one of DeFi's main problems. Let us explain. New protocols need to put considerable time and resources into incentivising liquidity for their tokens. This problem is made worse by the fact that, right now, liquidity is fragmented across different chains.

Synthetix V3 is an ambitious attempt to solve this problem. First, it will allow SNX stakers to choose which asset pools their SNX will supply collateral for. This will allow stakers to implement their own strategies, based on staking incentives and desired exposure.

Second (and more revolutionary), it will enable protocols to create their own assets on Synthetix, and source and incentivise liquidity for them. This will convert the entire Synthetix collateral pool into a unified source of liquidity.

Change of target market

As part of its V3 upgrade, Synthetix is focusing more on business-to-business transactions. Previously, only whales could benefit from Synthetix (due to the large fees and its complicated nature).It's now focused on making deals with other protocols. Examples include Lyra, a DeFi options exchange, and Kwenta, a perpetual future exchange. If these protocols succeed, SNX stakers and liquidity providers, as well as the Synthetix DAO, will earn fees.

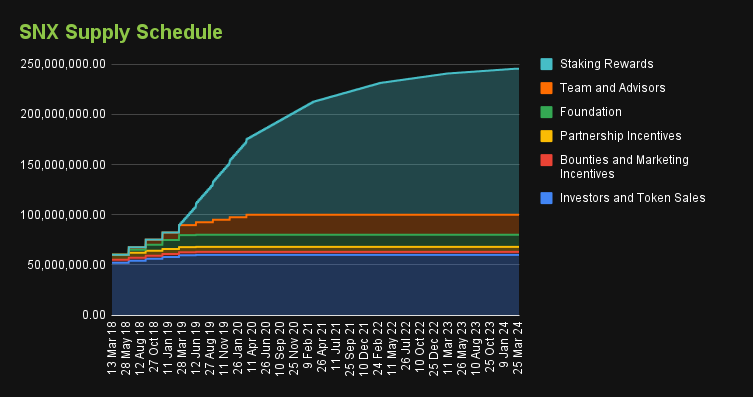

SNX tokenomics

The maximum supply of SNX is 212 million coins. During its seed round and token sale, Synthetix sold more than 60 million tokens, raising $30 million. Of the initial 100 million coins issued during the ICO, the allocations are as follows:- 61% to participants in the ICO

- 20% to the team and advisors

- 12% to the foundation

- 5% to partnerships

- 3% to marketing incentives

The derivatives market is estimated at over $1 quadrillion! Bringing traditional finance on-chain and utilising it in a decentralised manner is hugely promising for DeFi and Synthetix.

Curious about how Cryptonary rates SNX? Browse our Rating Guide to see how it fared against its peers in terms of team, tokenomics, fundamentals, and more.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms