Similar to how DOT is the native token of Polkadot, PARA is Parallel’s native token.

For a more detailed overview of the protocol and its token, check out our pro report here.

This tutorial will go through how to lend and borrow on Parallel. Check out our previous tutorial for a guide on how to swap, provide liquidity and stake on the platform.

Tutorial

Getting set up

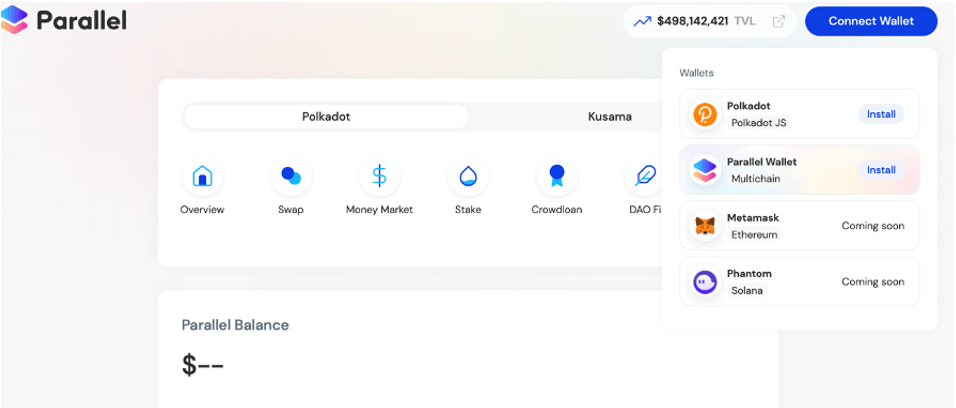

Head to https://parallel.fi and click ‘enter app.’

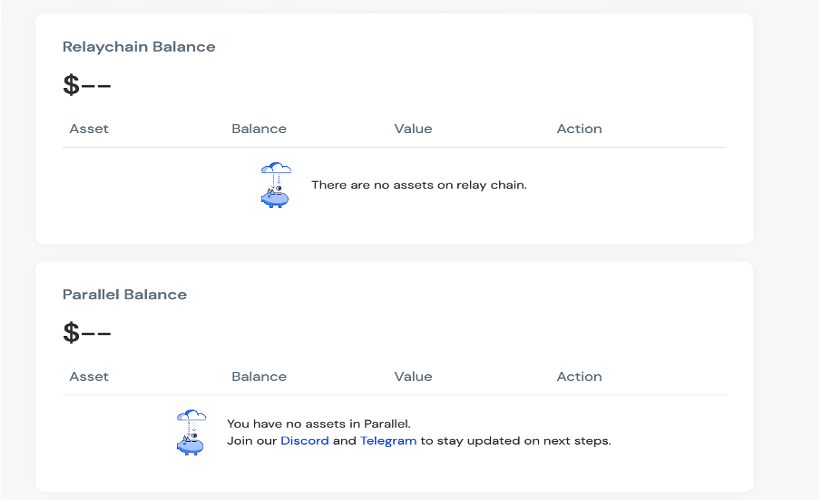

The first thing you’ll need to do is connect a wallet. Polkadot.js and Parallel’s native wallet are the two wallets currently supported by the protocol, but support for other wallets is coming soon.

Click here for a quick guide on how to set up a Polakdot.js wallet and here for more on how to set up and use Parallel Wallet.

Towards the top of the ‘overview page,’ you’ll see that you have the option to choose between ‘Polkadot’ and Kusama. Kusama is a blockchain very similar to Polkadot. It acts as a kind of a test-net that allows developers and projects to test apps, parachains and blockchains before they deploy on Polkadot. If you click on the Kusama tab, you’ll actually be directed to Heiko Finance, Parallel’s sister protocol that operates on Kusama. For this tutorial, we’re going to focus solely on Parallel.

Lending

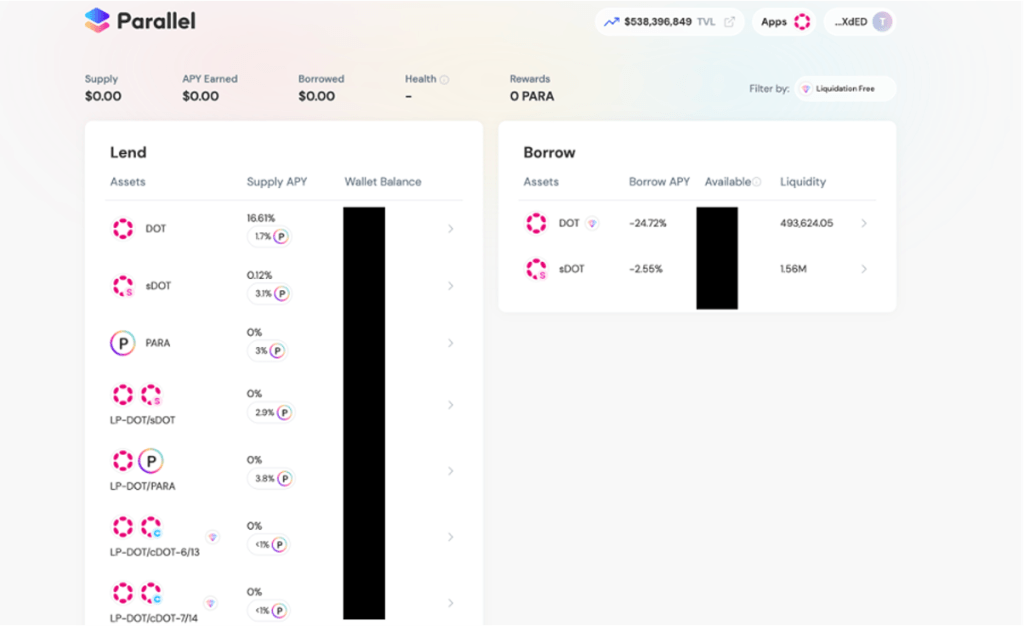

First, head to the ‘lend’ section of the Money Market page.

Here your wallet’s balance, as well as the ‘supply APY’ for each token will be listed. The supply APY rate is a combination of the lending APY (i.e. interest you earn for lending to the Money Market, which is paid in the same asset being lent) and the farming APY (i.e. the amount of PARA tokens you’ll earn).

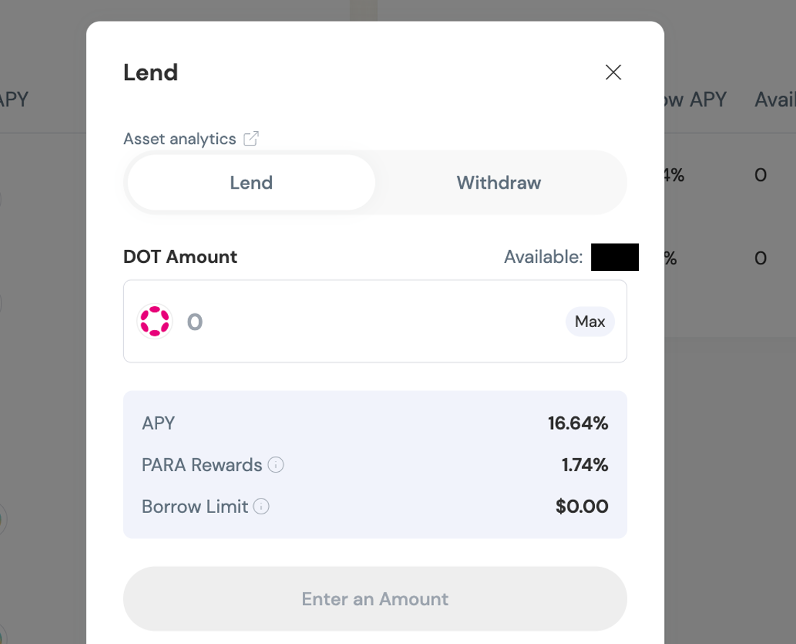

Once you click on the token you want to supply, the following pop-up should appear. You can click on ‘asset analytics’ at the top of this screen to view more details about the asset on Parallel.

Next, enter the amount you want to lend. At the moment, Parallel Finance has no minimum or maximum deposit limits for lending. The ‘borrow limit’ represents the maximum amount you can borrow by using your lent assets as collateral.

Once you click ‘lend,’ you’ll be prompted to confirm the transaction in your wallet.

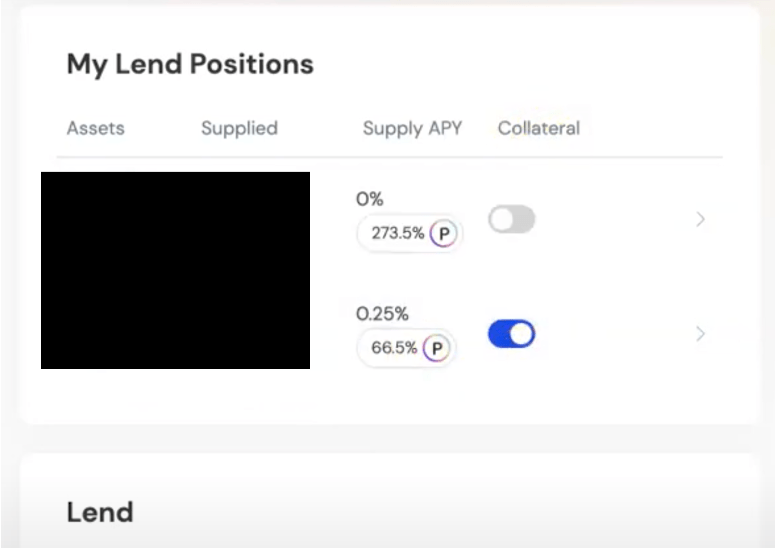

After this, you should now see a ‘my lend positions’ section on the Money Market page.

Your position will shortly begin to accrue interest. You can click the switch button next to your lend position to use it as collateral for borrowing, which is covered in the following section.

Note: not all assets can be used as collateral. Click here for more info.

To withdraw, click on your position followed by the withdraw tab in the following pop-up. Next, simply enter the amount you want to withdraw and confirm the transaction in your wallet.

Borrowing

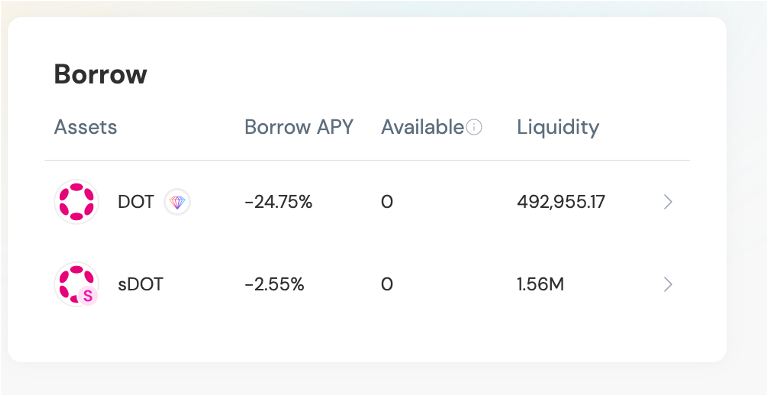

Once you have provided collateral (as shown above), you will be able to borrow on Parallel. Currently, the only assets available to borrow are DOT and sDOT.

You’ll see DOT has a diamond icon beside it, which signifies that it is a ‘liquidation free loan.’ Basically this means that because of a relatively fixed exchange rate between DOT and certain tokens that can be used as collateral (marked by a diamond icon), DOT loans can be issued with virtually no risk of your position being liquidated. More info on this here.

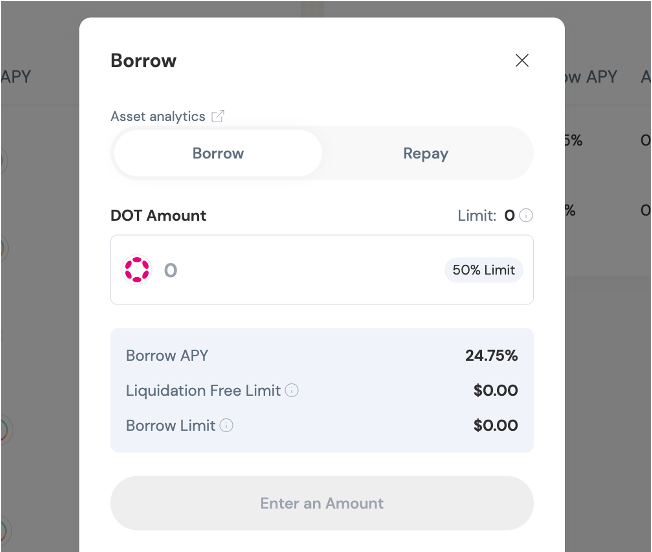

Same as with lending, when you click on the asset you want to borrow, a pop-up screen will appear, and you can click on ‘asset analytics’ at the top of this screen to view more details.

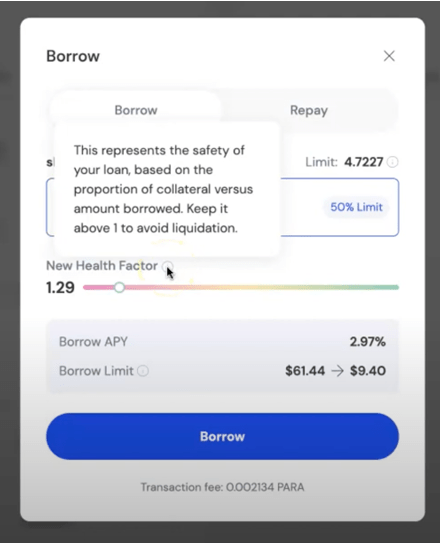

Next, enter the amount you want to borrow.

The ‘limit’/borrow limit’ figures represent the maximum amount of the asset you can borrow (this value is dependent on the available liquidity and your collateral amount).

The Health factor represents the price ratio between your collateralized and borrowed asset and is therefore an indicator of the safety of your loan. If this value reaches 1, your loan will automatically be liquidated to repay your debt, and any leftover collateral will be returned to you. It’s your responsibility to ensure that the health factor remains above 1. Make sure you are comfortable with this ratio and never invest more than you are willing to lose.

The borrow APY rate represents the interest you can expect to pay for your loan.

For liquidation free loans, you’ll also have a ‘liquidation free limit’, which is the maximum amount that you can borrow without any risk of being liquidated.

Once you click ‘borrow,’ you’ll be prompted to sign the transaction in your wallet. You should now be able to see a ‘my borrow positions’ section on the Money Market page.

Note that the interest on your loan that accrues over time will have a negative effect on the health factor, but repaying some of your loan is a way of increasing it. To do this, click on your position followed by the repay tab in the following pop-up. Next, enter the amount you want to repay and confirm the transaction in your wallet.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Comment and share if you found this tutorial useful! Also let us know what tutorials you’d like to see next.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms