Tutorial: Providing Liquidity on Uniswap

An important risk to consider when supplying liquidity is impermanent loss. This is a phenomenon whereby liquidity providers can end up with less value than what could have been realised by simply holding onto the staked assets (e.g. in a crypto wallet).

Overview

Uniswap is powered by liquidity pools. Briefly, a liquidity pool is made up of a crowdsourced pool of tokens locked in a smart contract. Users can supply funds to one of Uniswap’s pools and earn trading fees in return.It is essential to have a good understanding of impermanent loss prior to providing assets to a liquidity pool.

Before you continue with this tutorial, we highly recommend reading our pro article which provides a more detailed explanation and practical example of impermanent loss.

Providing liquidity

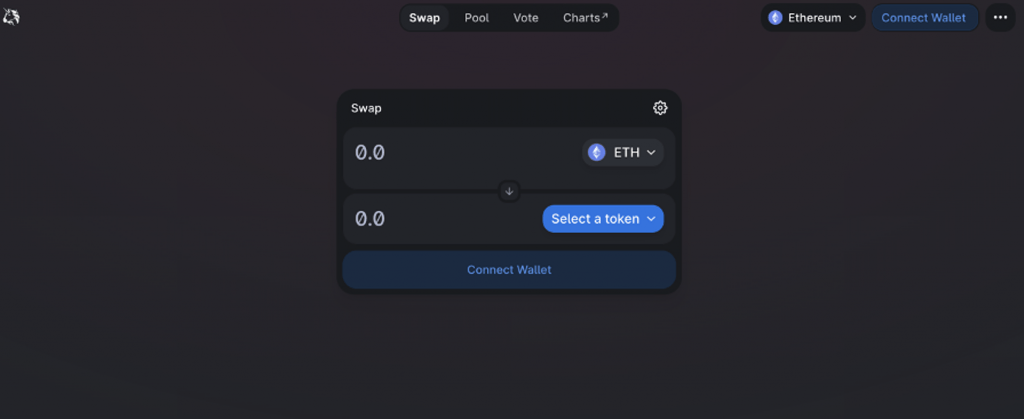

First, head to Uniswap’s website and click the ‘launch app’ button.

Next, you will need to connect your crypto wallet. If you are using a layer 2 network on Uniswap, you will need to transfer your tokens to this network, which we cover in our beginner’s Uniswap tutorial.

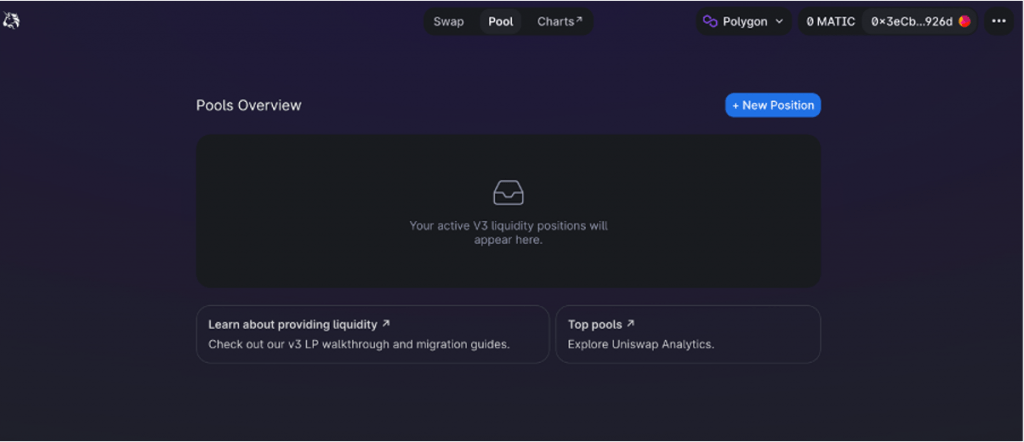

Once you have this done, select the ‘pool’ tab. For this example, we will be using the Polygon network.

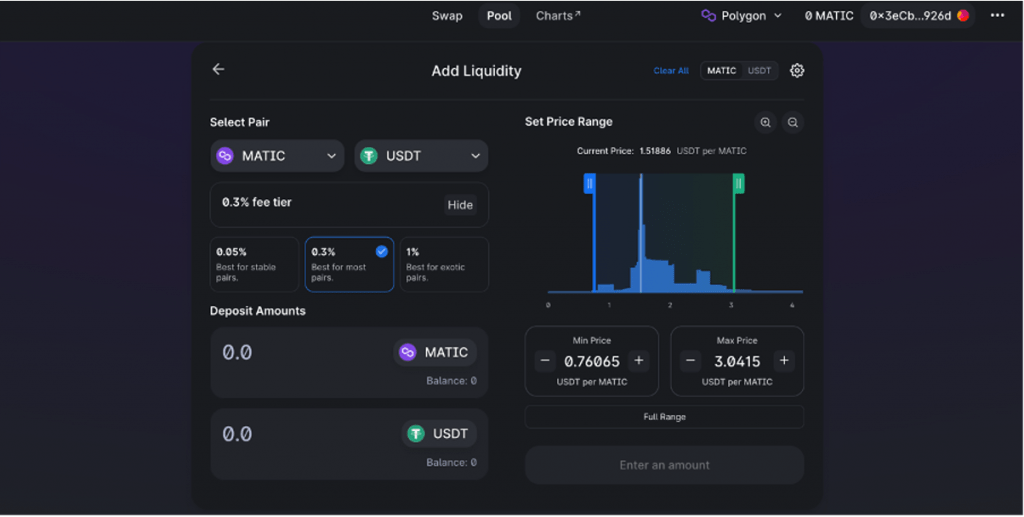

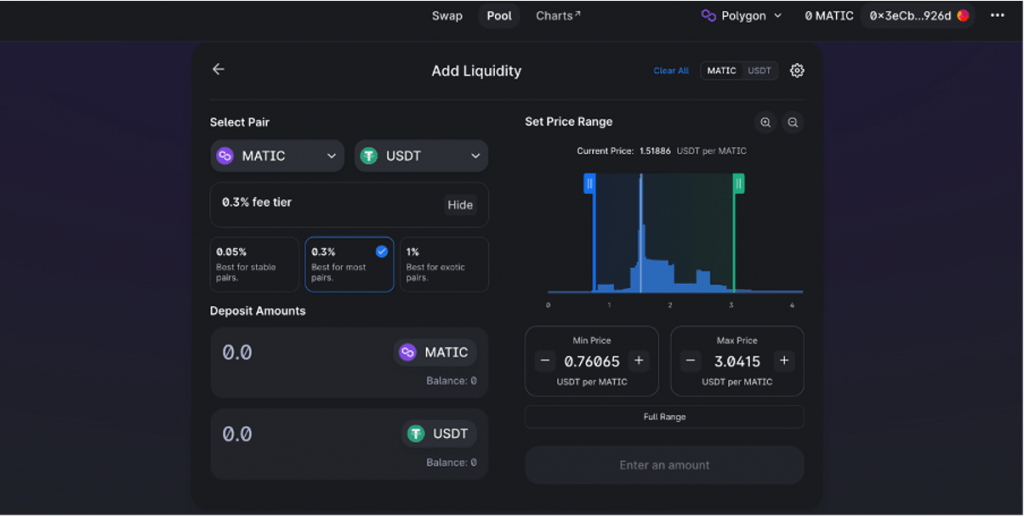

Click ‘new position’. On the following page, select the pair of tokens you want to provide.

Next, you will need to choose a trading fee tier. There are currently three tier options: 0.05%, 0.3% and 1%. The higher the tier you select, the more you’ll earn from providing liquidity.

As listed on the screen, the 1% tier is recommended for ‘exotic pairs’. These are pairs consisting of smaller coins/ tokens that generally don’t have a lot of liquidity, so buyers will expect to pay a bit more in trading fees for those coins. For token pairs traded at a highly correlated rate (e.g. stablecoins) or for pairs with large liquidity pools, Uniswap generally recommends the 0.05% fee tier. For the majority of trading pairs that fall somewhere between exotic pairs and very stable pairs, Uniswap recommends the 0.30% trading fee.

This fee tier system allows liquidity providers to be appropriately reimbursed for the varying levels of risks associated with holding particular types of assets. Uniswap will automatically select the fee tier it deems appropriate for your chosen pair, and we recommend sticking with that.

Liquidity providers are required to provide trading pairs in a set ratio. Therefore, when you enter the amount of one token you want to supply, the corresponding amount of the other token you will need to supply will be displayed.

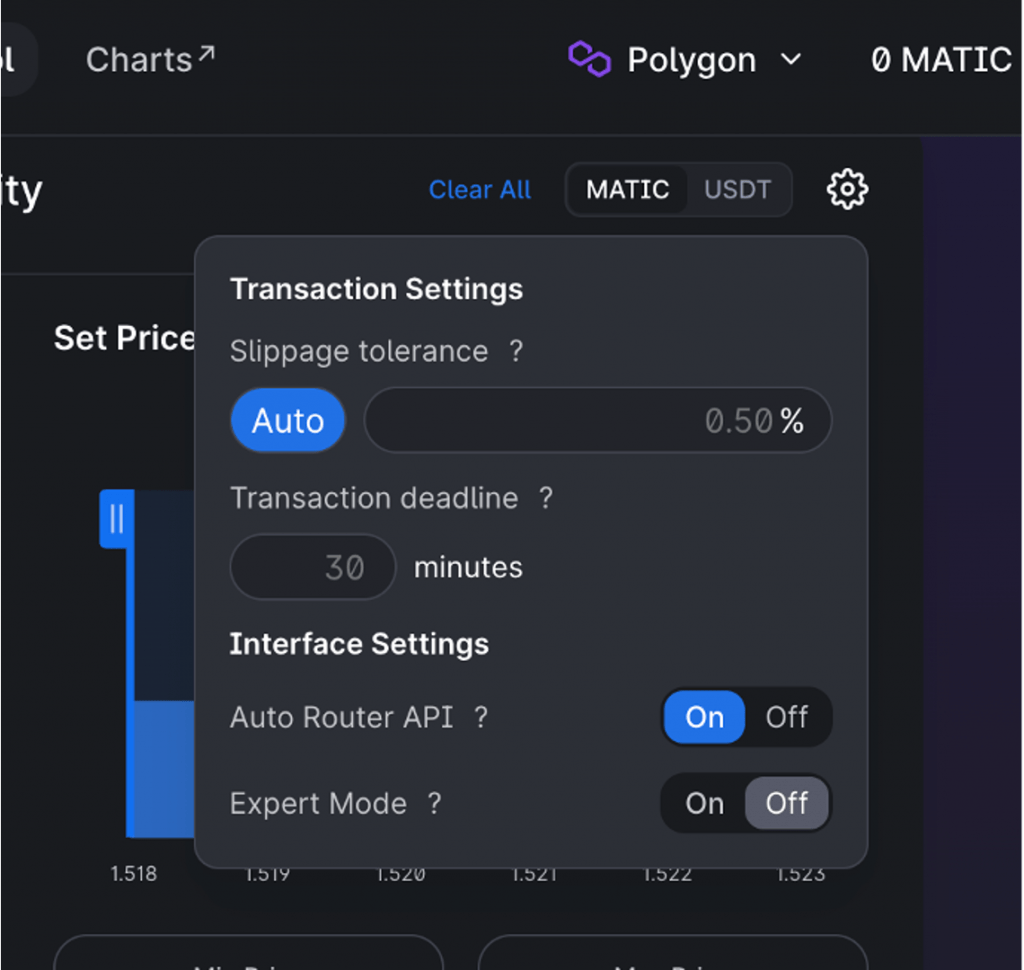

There is also a settings tab where you can adjust further aspects of the transaction.

Here you can set a specific slippage tolerance. Because we are using a decentralised exchange that is influenced by supply and demand, the price of the swap can vary slightly from the time you begin the transaction to the time it is processed. The slippage tolerance is used to represent the level of price fluctuation you are ok with. Uniswap will auto-generate a slippage tolerance rate for you, but you can also specify your own rate.

The 'auto-router' essentially routes your order through different applications and trading pairs to get you the best price. This is enabled by default, which we recommend leaving on.

There’s also the option to enable ‘expert mode’. If you turn this on, you won’t have to confirm transactions with your MetaMask wallet.

Back on the main screen, you will need to set the price range in which you supply your tokens.

By setting a price range, you’re concentrating your liquidity. In other words, if the price range of the two assets moves outside of this range, you stop earning trading fees and start accumulating one of the assets. The asset you accumulate will depend on how the price moves. Uniswap introduced this price range feature as a way of reducing the impact of impermanent losses.

The current price of the trading pair will be displayed in the price range section. You can easily edit the maximum and minimum price thresholds to a range you’re comfortable with. You can also come back and edit this over time.

Click ‘preview’ followed by ‘add’ to finalise the transaction.

When you provide liquidity, instead of getting liquidity provider tokens (as is the case on most exchanges), you’ll receive an NFT or Non-fungible token. This is because of the price range feature.

NFTs or non-fungible tokens are unique digital tokens that represent ownership of assets. ‘Fungible’ simply refers to an item that can be replaced by another identical item (e.g. one BTC can be traded for another one BTC). Each NFT has a unique digital signature, which makes it impossible for NFTs to be interchanged with one another, i.e. non-fungible.

Therefore, because each liquidity provider specifies their own unique price range, an NFT is used to represent their unique position in the pool.

Liquidity providers can use this NFT to withdraw their assets from the pool. Trading fees earned while providing liquidity are distributed to users when they withdraw.

Want to learn more about Ethereum Layer 2s? Then check out our podcast episode or have a read of our pro article.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms