Tutorial: Yearn.Finance

Yearn.finance, according to its documentation, is a collection of DeFi products that provides features such as yield generation and lending aggregation.

In simpler terms, yearn.finance makes it easy to earn interest on a wide array of assets. It works on multiple blockchains and takes no time at all to start using.

This tutorial will walk you through the steps of connecting to yearn.finance, depositing into its core product, Vaults, depositing into its experimental product, Labs, and changing settings such as slippage tolerance.

Tutorial

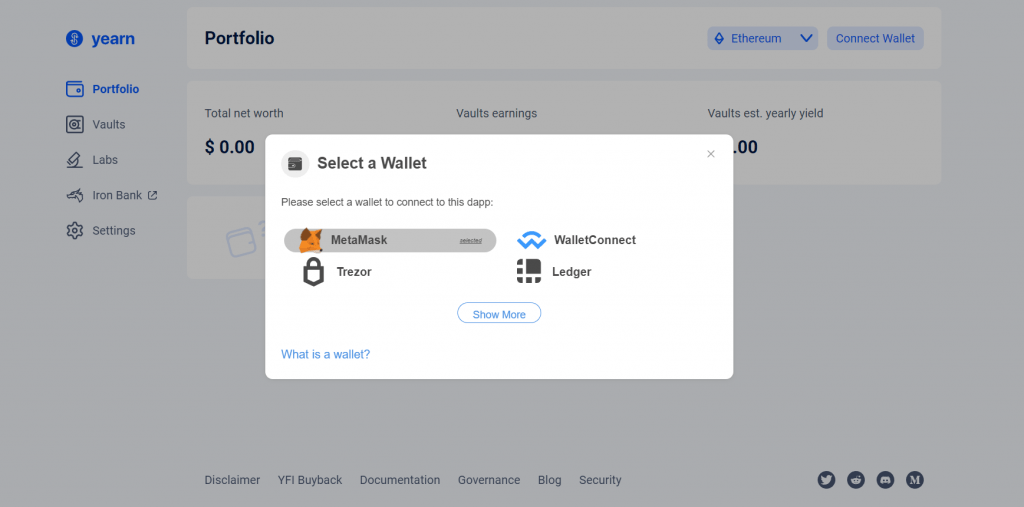

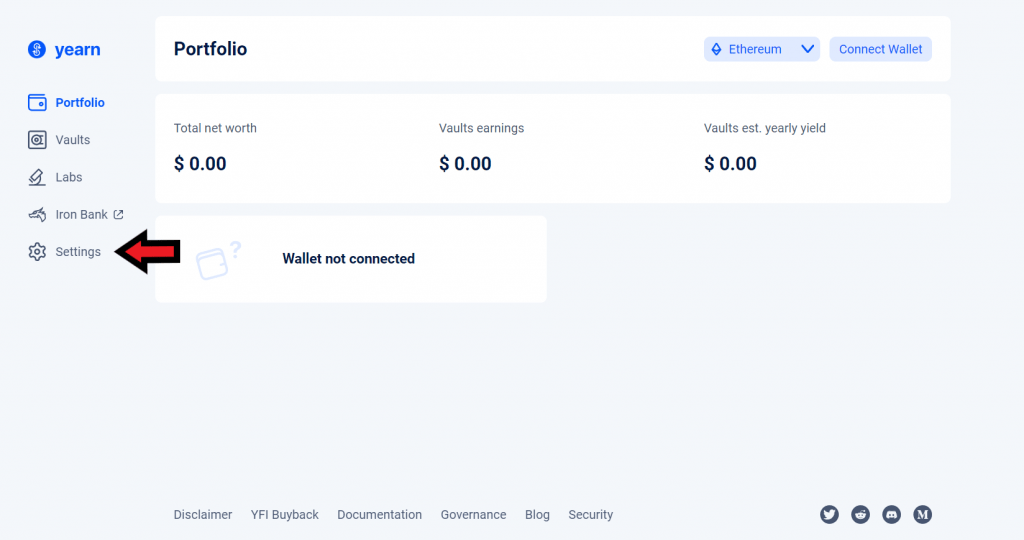

Connecting your wallet to yearn.finance is the first step after arriving at its website. Start the process from the ‘Portfolio’ home page by clicking on the ‘Connect Wallet’ button in the upper right corner.

For this tutorial, we’ll select MetaMask as our wallet.

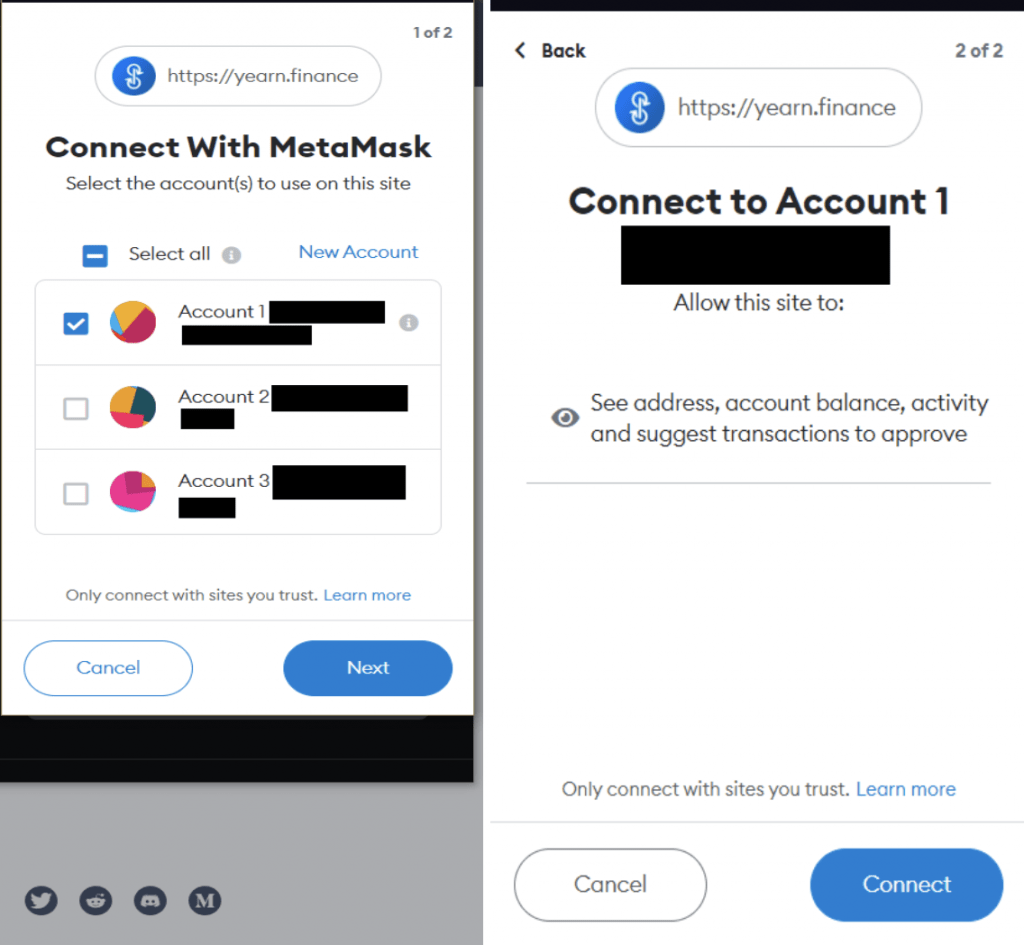

Select the account you wish to use with yearn.finance and complete the connection process.

Select the account you wish to use with yearn.finance and complete the connection process.

You should now be connected to yearn.finance and see a snippet of your wallet’s address where the ‘Connect Wallet’ button used to be.

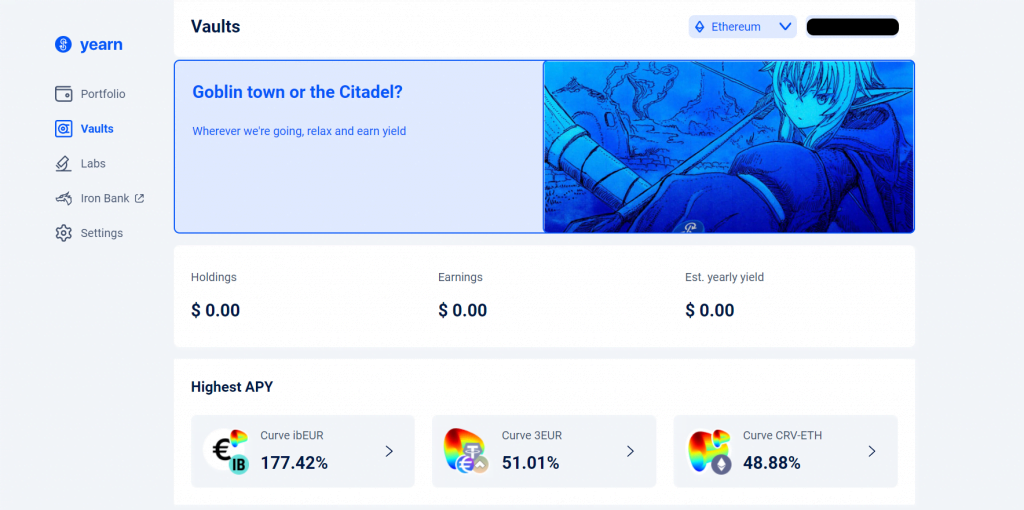

Depositing into a Vault

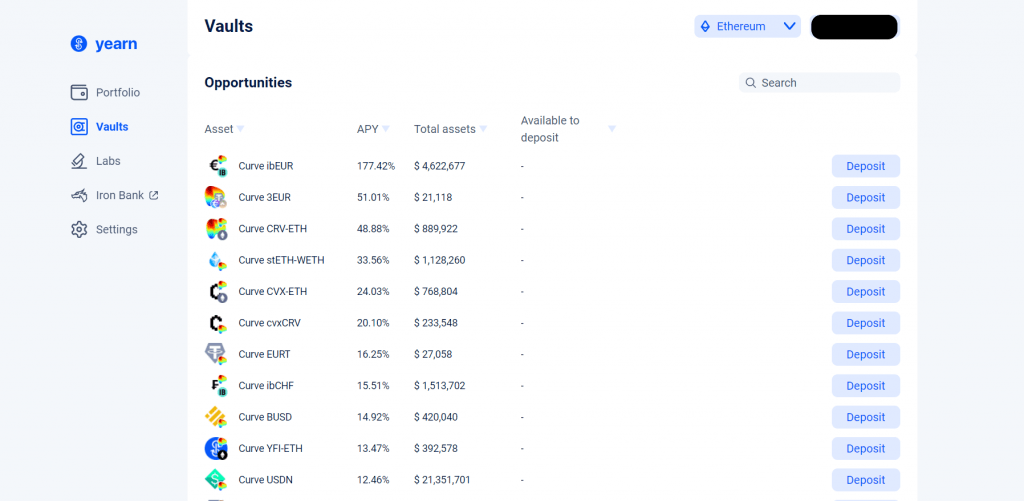

Before providing liquidity of any kind, you must understand the risk of impermanent loss. You can read Cryptonary’s guide to impermanent loss here.Navigate to Vaults by clicking ‘Vaults’ on the left sidebar. Once on the Vaults page, you’ll see your current holdings, earnings, and estimated yearly yield. You’ll also see the positions with the highest APY and a full list of opportunities you can deposit into and earn yield.

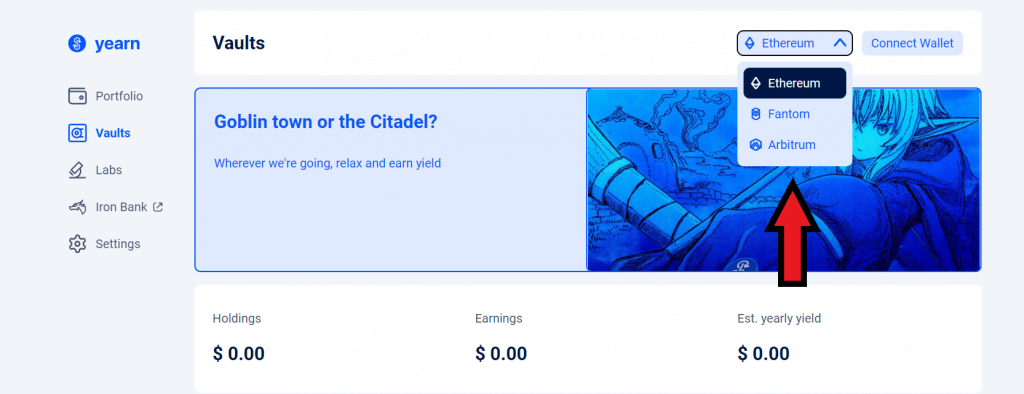

Now is a good time to note that yearn.finance is a multi-chain dApp. In addition to Ethereum, it also supports Fantom and Arbitum. Each chain has a different list of opportunities. You can switch between networks by clicking on the dropdown labelled ‘Ethereum’ and selecting your network of choice.

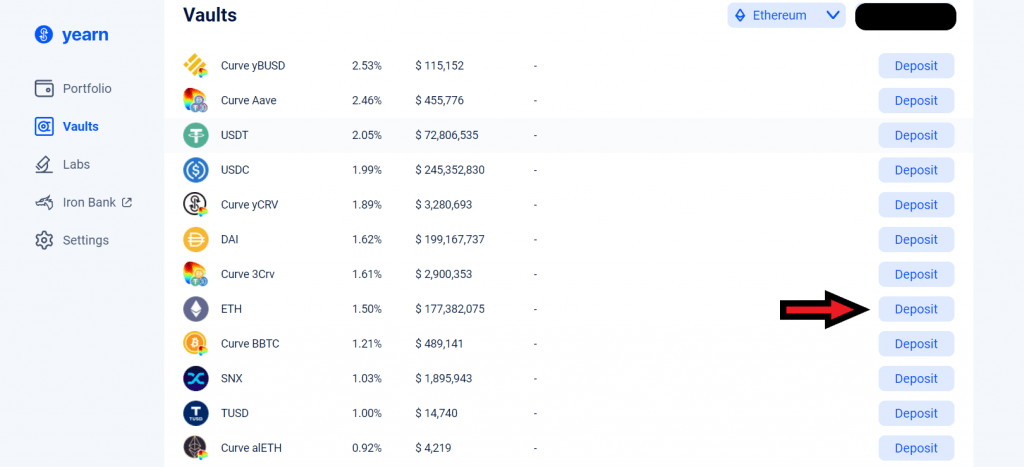

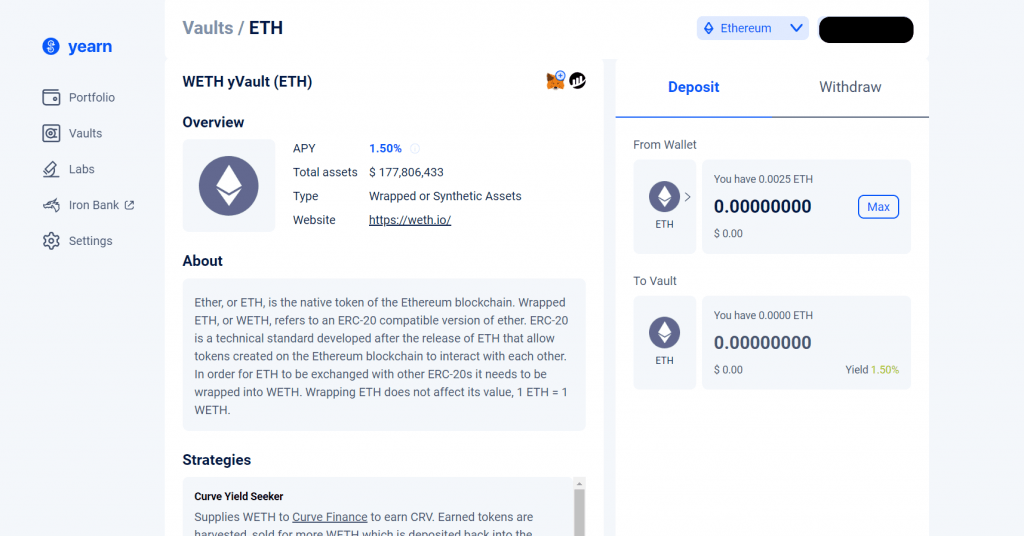

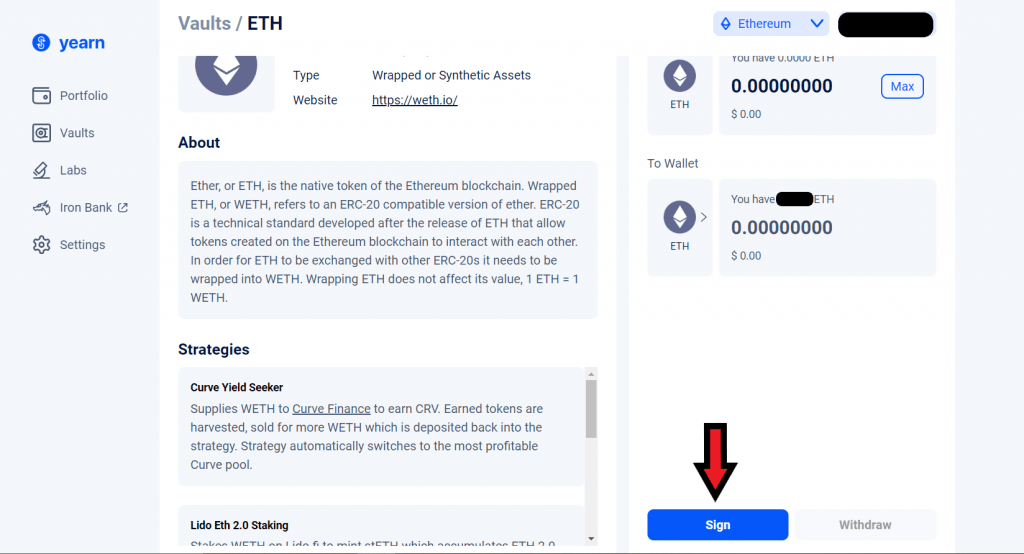

After connecting your wallet, select the opportunity that interests you by clicking on the name. You’ll be taken to a new page that shows an overview of the Vault, an about section and the investing strategies employed by that Vault. To make things simple for this example, I’ve selected the ETH Vault.

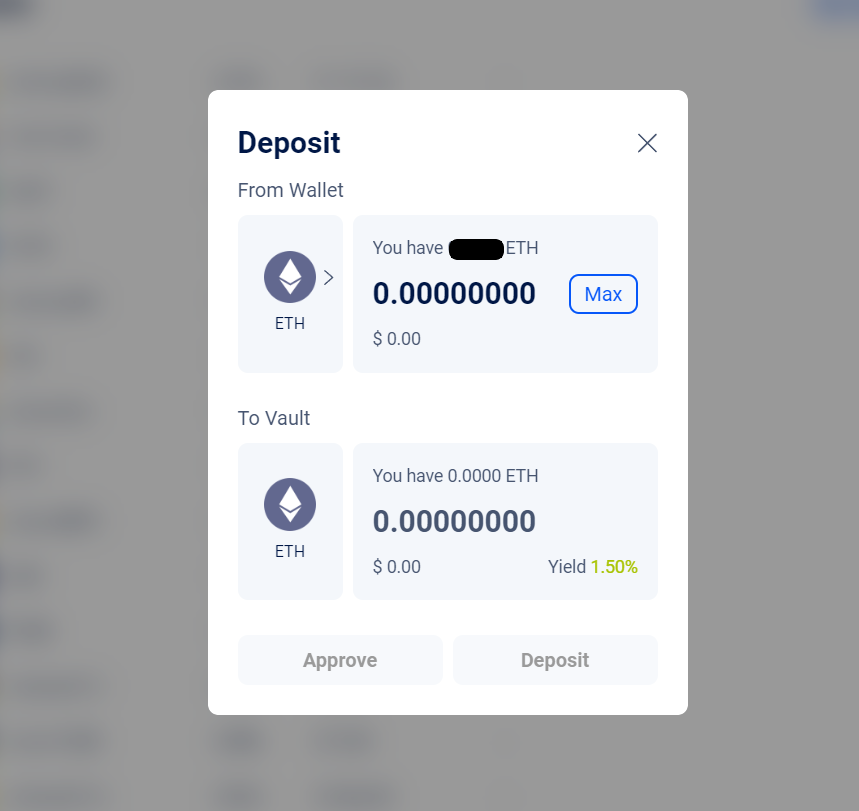

Note: Yearn.finance features a ‘zap’ mechanic that allows you to deposit into a Vault even if you don’t have the correct token; it handles the conversions for you. If using yearn.finance to deposit a token you haven’t used before, you may have to approve the token first by clicking ‘Approve.’ This will incur an additional gas fee. Learn more about ‘zapping’ here.

Provided you have enough ETH to pay gas fees, confirm the transaction by clicking ‘Confirm’ in MetaMask.

Note: Transactions on Ethereum can take some time to process due to network congestion. Read our section on speeding up a transaction or cancelling a pending transaction in our MetaMask Advanced tutorial if you face any issues.

After the transaction is successful, you should be able to see your new balance on the Vault’s information page and at the top of the ‘Opportunities’ list on the main Vault page.

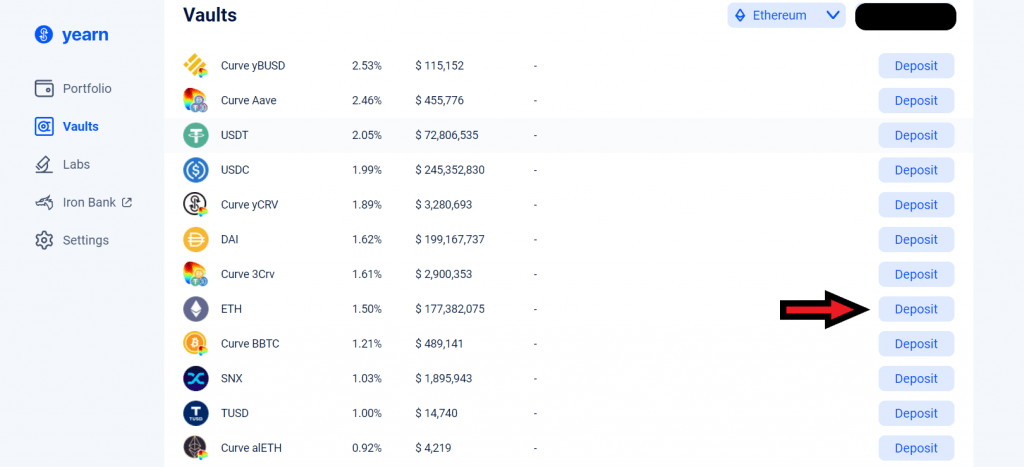

Note: Depositing can also be conducted right from the main Vault page by clicking ‘Deposit’ on the Vault you wish to use.

Withdrawing from a Vault

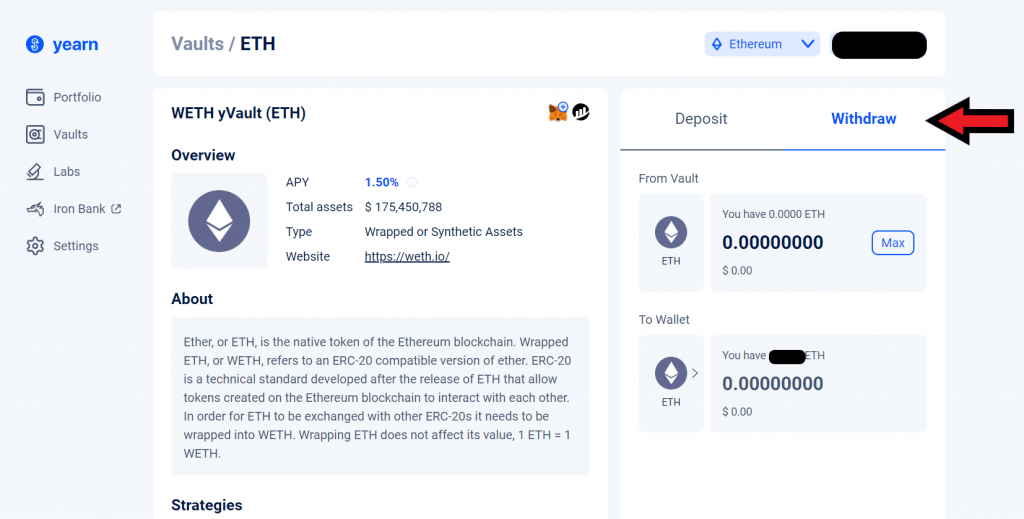

You can withdraw your tokens much in the same way you deposited them. From the Vault’s information page, navigate to the ‘Withdraw’ tab.

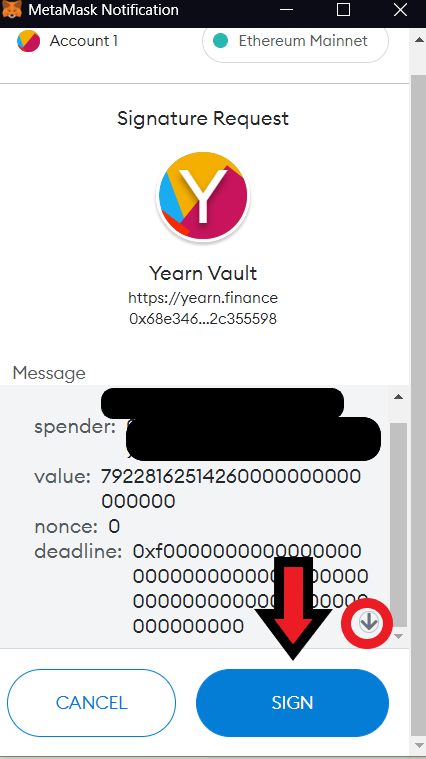

To withdraw, you must first sign the transaction by clicking ‘Sign,’ which will open your MetaMask extension.

Click ‘Sign’ again in MetaMask. You may have to click the small arrow encircled in red to allow this button to be clicked.

Now, enter the amount you’d like to withdraw from the Vault to your wallet, click ‘Withdraw,’ and confirm the transaction just as you did when depositing. You can click ‘MAX’ if you’d like to withdraw the entire balance.

After a successful transaction, your tokens will appear in your wallet again.

Note: Withdrawing can also be conducted right from the main Vault page by clicking ‘Withdraw’ on the Vault from which you want to remove funds.

Depositing and Withdrawing from Labs

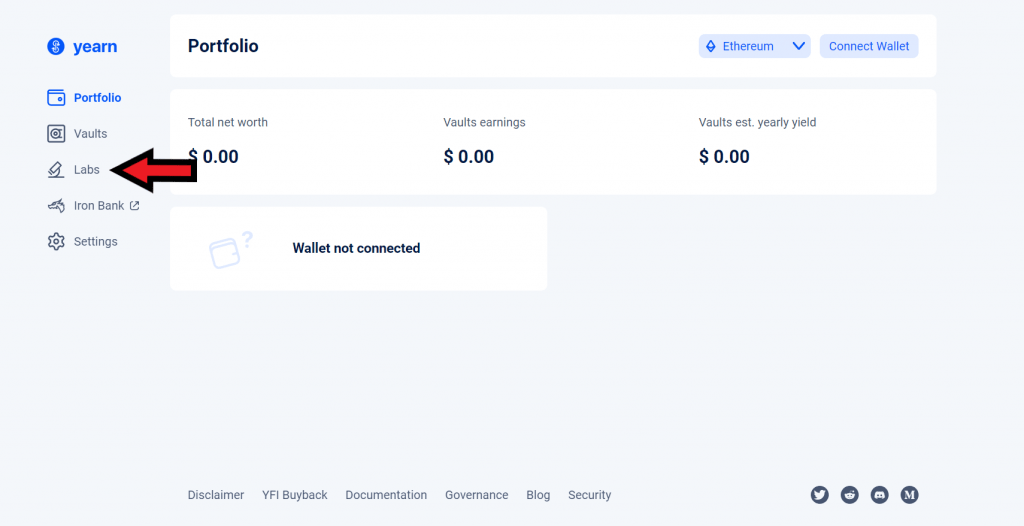

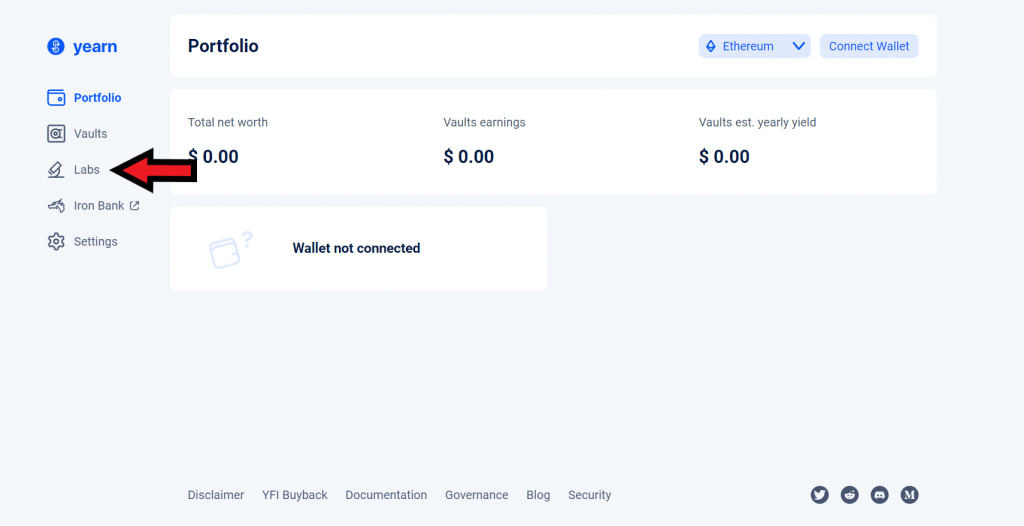

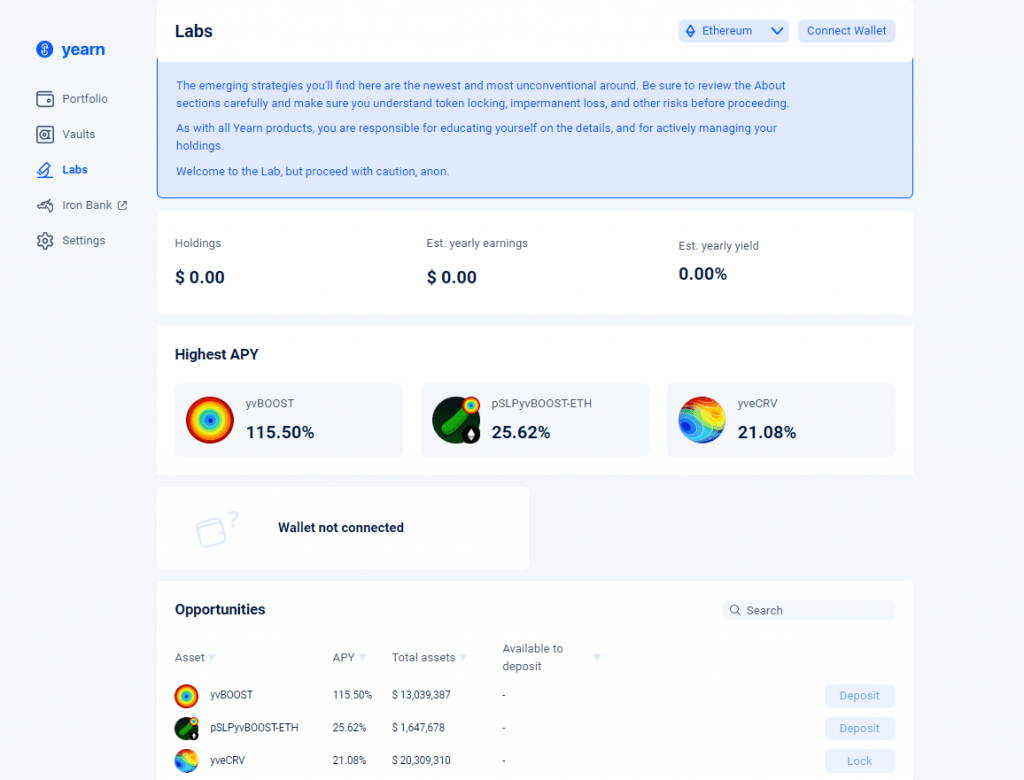

Labs are a feature that is only available to Ethereum users as of the writing of this tutorial. It can be accessed by clicking ‘Labs’ on the left sidebar under ‘Vaults.’

These yield earning opportunities are riskier than Vaults according to the disclaimer provided by yearn.finance, so exercise caution when using these and make sure to read about token locking, impermanent loss, and other risks before jumping in.

These yield earning opportunities are riskier than Vaults according to the disclaimer provided by yearn.finance, so exercise caution when using these and make sure to read about token locking, impermanent loss, and other risks before jumping in.

Depositing and withdrawing from Labs follows a procedure similar to that of Vaults, so refer to the steps above when utilizing this feature.

Iron Bank

You may have noticed the ‘Iron Bank’ link in the left sidebar under ‘Labs.’ This feature is separate from yearn.finance and may be covered in a future tutorial.Changing Settings

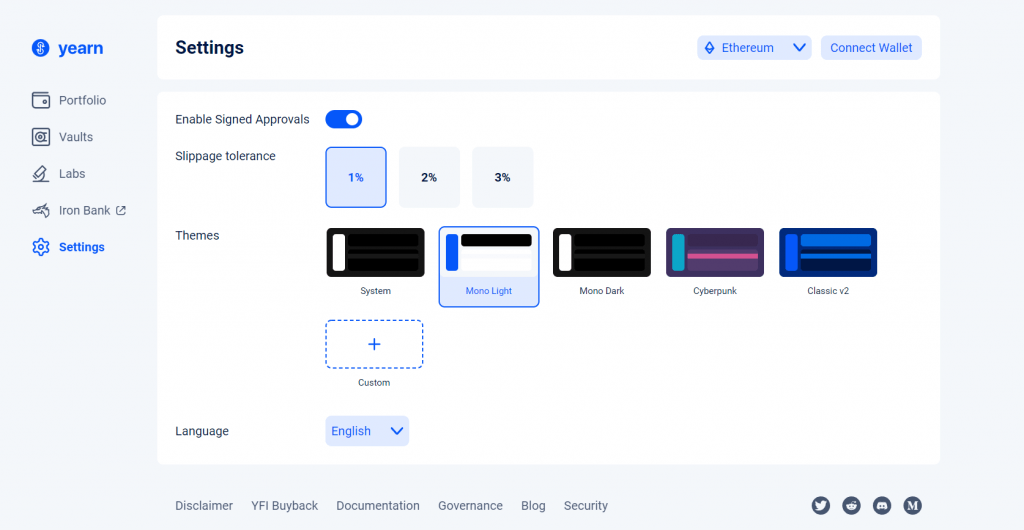

It’s possible to change a few settings within yearn.finance to suit your tastes. Navigate to the settings page by clicking ‘Settings’ in the left sidebar under ‘Iron Bank.’

There are four settings you can change in yearn.finance: enable signed approvals, slippage tolerance, themes, and language. It’s best to leave signed approvals on for security reasons.

Slippage tolerance is important when attempting to deposit tokens that have higher volatility and low liquidity. Keep this at 1% to avoid major changes in the expected value of your transactions.

There are four premade themes to choose from in yearn.finance. You can also set the site theme to default to your system settings or create a custom theme.

Lastly, yearn.finance allows you to switch between English and Spanish via the language dropdown menu.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

If you found this tutorial useful, make sure to comment and share! Also, let us know what tutorials you’d like to see next!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms