Tether announced via social media that they have frozen the $1.7 million stolen as part of the Yearn Finance hack.

Popular decentralized finance (DeFi) project Yearn Finance has fallen victim to a flash loan attack.

Yearn.Finance confirmed on social media on Thursday that one of its pools of funds was breached, resulting in a loss of $11 million.

The exploit

Yearn. Finance said that the DAI v1 vault was exploited. And protocol managed to mitigate the attack.

A core developer with Yearn.Finance shared more details about the exploit, revealing that the attacker got away with $2.8 million even though the pool lost a total of $11 million.

After containing the attack, the protocol is now investigating the exploit and has suspended all deposits into V1 DAI, USDC, USDT, and TUSD as a safety measure.

Flash loan attack

The hacker got away with 513,000 DAI, $1.7 million in Tether (USDT), and the remaining $506K in CRV.

Stani Kulechov, the founder of DeFi liquidity protocol Aave, explained that the attacker completed the “complex exploit with over 160 nested transactions” across several DeFi platforms and paid $5K in gas fees for the breach.

A simplistic description of the breach shows that the attacker flash-loaned 116K ETH from dYdX and 99K Ether from Aave V2. The attacker proceeded to borrow 134 million USDC and 36 million DAI using Ether as collateral on Compound and then withdrew 165 million USDT from the 3crv Curve pool.

The entire process described above was repeated five times.

Furthermore, the attacker deposited 93 million DAI to yDAI vault and added 165 million USDT to the 3crv pool. The hacker withdrew 92 million DAI from the yDAI vault and 165 million USDT from the 3crv pool.

The attacker withdrew 39 million DAI and 134 million USDC instead of Tether. Then repaid Compound debts and flash loans.

YFI plunges

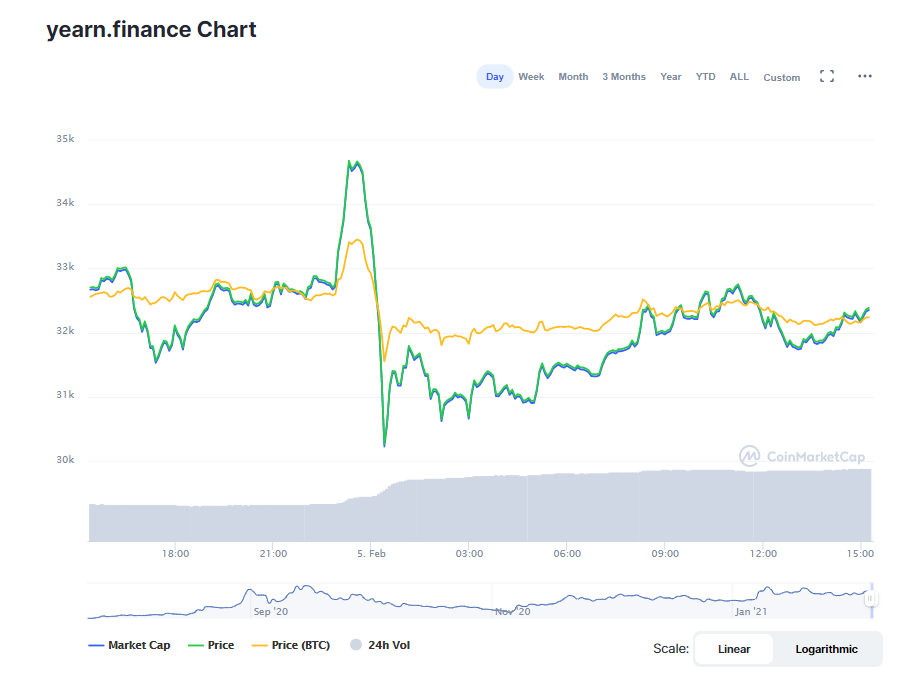

The hack seems to have affected Yearn Finance governance token as YFI plunged from $34,600 to a low of $30,256 with an hour.

[caption id="attachment_28408" align="alignnone" width="899"] YFI token tanks following flash loan attack. | Source: CoinMarketCap[/caption]

YFI token tanks following flash loan attack. | Source: CoinMarketCap[/caption]

However, the governance token is on a recovery path as it is trading above $32,300 at the time of writing.

According to DeFi Pulse, Yearn Finance’s total value locked has remained generally stable and dropped 3% in the last 24 hours to a current value of $490.4 million.

This story has been updated.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms