5X - The Journey

The Journey is a voyage Cryptonary is onboarding to capitalise on a specific sector's hype. The projected timeline of our investments in this space will range between 1 and 6 weeks.

The first investment is a token that will be launching over the next few days, a token we speculate we can achieve a 5X return on.

While reading through the report, you'll find that this is a rather conservative number as we've accounted for a large margin of error which includes bots front-running our entry.

Given the risky nature of hype-speculation, we've managed our risk by setting aside capital specifically for that purpose - capital we can fully afford to lose.

We'd like to stress the fact that this report does NOT constitute financial advice under any circumstance, we are simply sharing our research and approach to investments for educational purposes.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Introduction

We have already covered the fundamentals of Solana in a report earlier this month; however the Solana ecosystem is still in it’s infancy, and with all of the new DeFi applications that will be implemented and launched on there over the coming weeks/months, it would be useful to have a single place that allows you to keep track of, and manage, all Solana-based investments.Step Finance

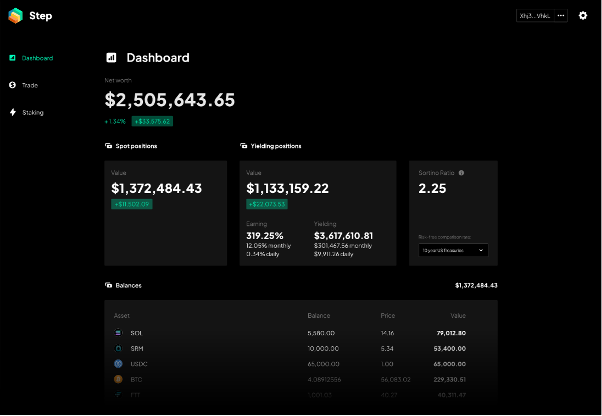

Step.Finance is the front page of SolanaStep is a one-stop shop portfolio visualisation, analysation, aggregation and execution utility that allows users of the Solana ecosystem to manage their portfolio through a single, easy to use platform. The purpose of Step is to improve your quality of life when interacting with Solana and its various dApps, and provides a summary of your performance across all of your investments. Giving credit where credit is due, their UI/UX is a great step forward for DeFi.

Not only that, Step plans to provide some more active features such as automated trading functions - Dollar Cost Averaging and EMAs/RSI crossover strategies, to name a couple of examples.

Let’s have a look at the functionality of Step, the tokenomics of the STEP token, and the planned future developments of the application before diving into our investment.

Step Functionality

There are a number of current and planned features and functions available on the Step platform:Dashboard

The STEP dashboard is a function that Solana participants can use to visualise their active positions, liquidity pools, farms and token balances - all in one place. It provides useful metrics and insights, as well as overall performance statistics of one’s portfolio. This comes in handy for highly active DeFi users as keeping track of positions across protocols can be a tedious.

Wallet Balances

Step allows you to keep track of your total value and change in value over time against a selection of base currencies (USD etc), with the option to consolidate multiple Solana addresses into a single dashboard view.Liquidity Providers (LPs)

All of Solana LP positions can be managed from a single dashboard that presents performance metrics such as LP vs HODL, fee revenue, impermanent loss, yield and overall/predicted APYs.

DEX Position Tracking & Analysis

Step will allow users to track their DEX balances, orders, positions and a multitude of other analytics relevant to your positions on the Solana DEXs. Due to the fact that all Solana DEXs currently use Serum as the base automated market maker (AMM), all positions and orders are registered on Serum allowing the data to be compiled and displayed by Step.

Interactive Functions

It is not just about the compilation and display of information – Step will allow direct interaction with various Solana based projects directly through the Step dashboard, saving users time and simplifying these interactions:

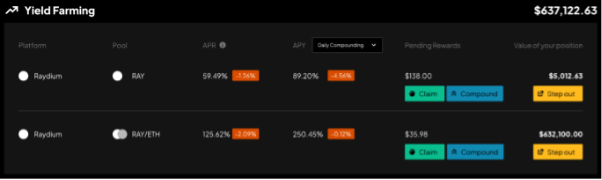

Yield Farming & Staking

Step will provide the user with Solana farming and staking opportunities in a single display, with one-click entry into any of the opportunities shown on the dashboard. Rewards can also be claimed just as easily, and single asset staking on Solana validator nodes will also be handled here.

Automated Investment Strategies

Step.Finance is a new project and was only founded in February 2021 for the Solana DeFi Hackathon, with the original purpose of providing a platform for automated trading strategies. We have touched on this earlier, however Step will have a full page dedicated to automated investment strategy and has plans to allow users to customise each strategy and set their own parameters to meet their individual needs.

Swap Aggregation

Liquidity can be fragmented amongst various pools and AMMs on Solana, and so Step works to provide users with swap aggregation so that they get the best possible instantaneous deals when swapping every single time, no matter the tokens swapped. This can be thought of similarly to Ethereum DEX aggregators like 1inch and Paraswap – they provide you the best pricing across different venues.

All of these functions combined in a single environment represent a powerful toolkit that will no doubt play an essential role in any Solana DeFi users day-to-day activities. Let’s take a look at the value proposition behind STEP.

STEP Token

The STEP token is the asset associated with Step.Finance. The plan is for the STEP token to accrue value over time as the user base grows and more features are added, increasing fee revenue and in turn attracting even more users and investors.Revenue

STEP’s value depends on the amount of users interacting with the interface, as well as amount of revenue generated from these interactions.

- Transaction fees are collected from swaps, yield farms, automated strategies etc. These fees are split 80% to STEP token stakers and 20% to the treasury. Step will also charge fees for their aggregation services.

- Finance will buy back STEP tokens using the fee revenue generated in order to distribute them as rewards to STEP stakers as well as liquidity providers.

- By incentivising users to lockup their tokens into various LP pools with a minimum lockup period, positive price pressure on STEP will be achieved by removing some tokens from circulation in the medium term.

Emission Period

Similar to other protocols and token launches, the STEP token emission period is designed to encourage sustainable growth whilst also providing scalability over a period of 2 years to ensure that the token retains fair value for early investors, whilst at the same time providing a feasible opportunity for new investors:

- The maximum STEP supply will be 1,000,000,000 tokens, to be emitted over a 2 year period. Every week, the amount emitted is reduced by 4%.

- Founders are allocated 20%, treasury 12.2%, and pre-sale investors 11.8%, with the rest (55%) going to the community and ecosystem as well as airdrops that will account for 1%.

- Community reward emissions are split between LPs and trade executors, with 60% of the rewards going to trade executors and 40% going to liquidity providers.

Staking of STEP tokens will be available through the Step.Finance interface:

- There will be single asset pool for staking STEP tokens. This pool won’t receive emissions, and instead revenue will come from fees and other income associated with usage of the project.

- Staking STEP will act as a sort of subscription enabling access to all of the functionality of Step.Finance, rather than a conventional paid plan subscription – a stake-for-access model.

- On top of the single-sided staking, holders of STEP will be able to provide liquidity into the STEP/USDC pool from launch.

STEP Token Launch

Now that we have covered the basics of Step.Finance and the mechanics behind the token, let’s go over the launch of the STEP token, the valuation and how we’ll personally be acquiring them.Initial Offering

STEP token will become available for purchase through a STEP/USDC pool on the 25th April at 00:00 HKT (Saturday 24th April, 17:00 GMT):The pool will be set at an initial liquidity of 200,000 USDC and 4,000,000 STEP tokens, implying a price of $0.05 per token.

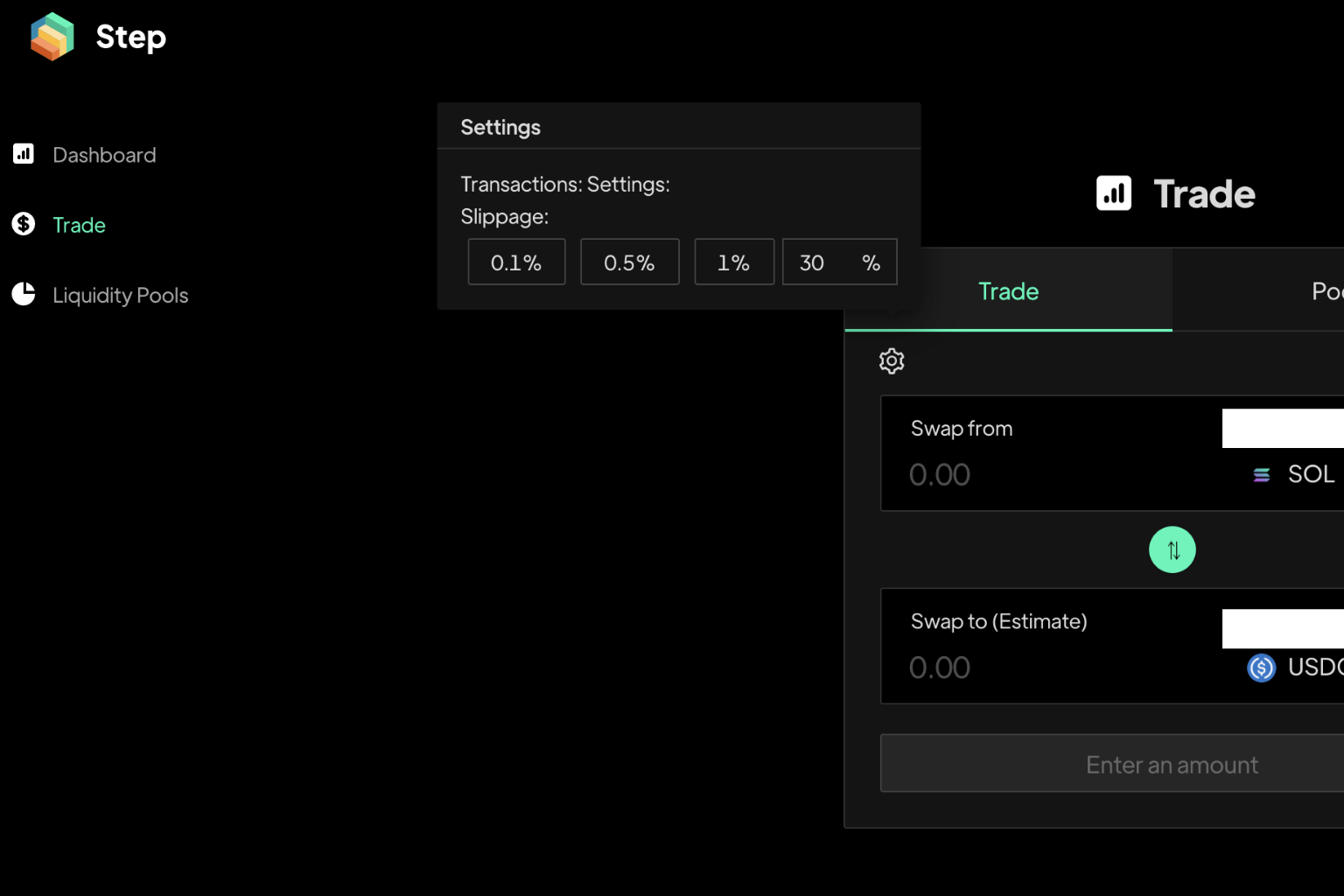

While price does launch at $0.05 per STEP, we think it is highly unlikely to be able to buy-in at that price. Bots will be front-running us and we think we’d realistically be able to buy in around $0.30-$0.40. For that reason, while market buying at the open we’re going to keep our slippage tolerance much higher than normal (30% instead of the usual 1%).

Token Valuation

We want to clarify once again that this not part of our long-term investments, it is part of a separate portfolio we’ve allocated funds to – an amount we are fully willing to lose.When it comes down to it, Step in its current form is more of a front-end analytics tool similar to TradingView and so it is nothing revolutionary or ground-breaking. Our interest in acquiring STEP is purely based on capitalising on the Solana hype, and so we are only allocating 10% of our Solana-portfolio.

We must stress this point; this is not like RUNE where the underlying functionality had never been implemented before, therefore STEP does not warrant a place in our main portfolio.

With that clarification out of the way, what do we think STEP will achieve as a price target?

In order to come up with a potential valuation for STEP, we can look at the potential market cap by analysing what we already know. Since the initial offering is 4,000,000 tokens at $200,000 value, this implies a price of $0.05 at launch. This leaves a lot of head room when you consider that Step.Finance has already raised $2 million in a round of funding earlier in April.

We would also expect the high demand post-launch to drive positive price pressure, along with the strength that SOL/Solana has shown over the last few weeks. While there will be weekly emissions, we find it likely that we see STEP enter the Top 1,000 by MCap – which implies a market cap of a mere $10 Million. With the initial 4,000,000 circulating supply it sets price at $2.50.

This appears reasonable to us when you consider the early interest from investors, and the on-going development of both Step and the hype surrounding the wider Solana ecosystem. This represents a ~5x opportunity, assuming a buy in price of 50 cents, which is on the conservative side in our opinion.

TLDR: $2.50 target, representing a market cap of $10,000,000 (top #1000 asset).

Exchange

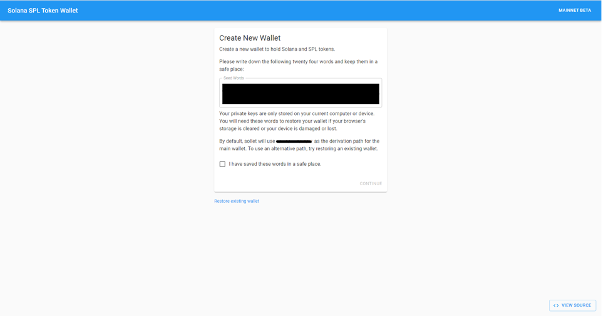

The STEP IDO will be held on test.step.finance and not a centralised exchange. Though we’re still using one to acquire SOL & USDC, that exchange being FTX for reasons explained below.There are a number of wallets for Solana, the best of which is Phantom but it is not yet available to the public. Therefore we’re going to be explaining how to use a Solana wallet which is available to all: Sollet.io

Sollet has a Google Chrome extension now and creating a new wallet is straightforward – it’s just the UI that is a bit buggy. The instructions are quite clear: save seed phrase, create a password and the wallet is created.

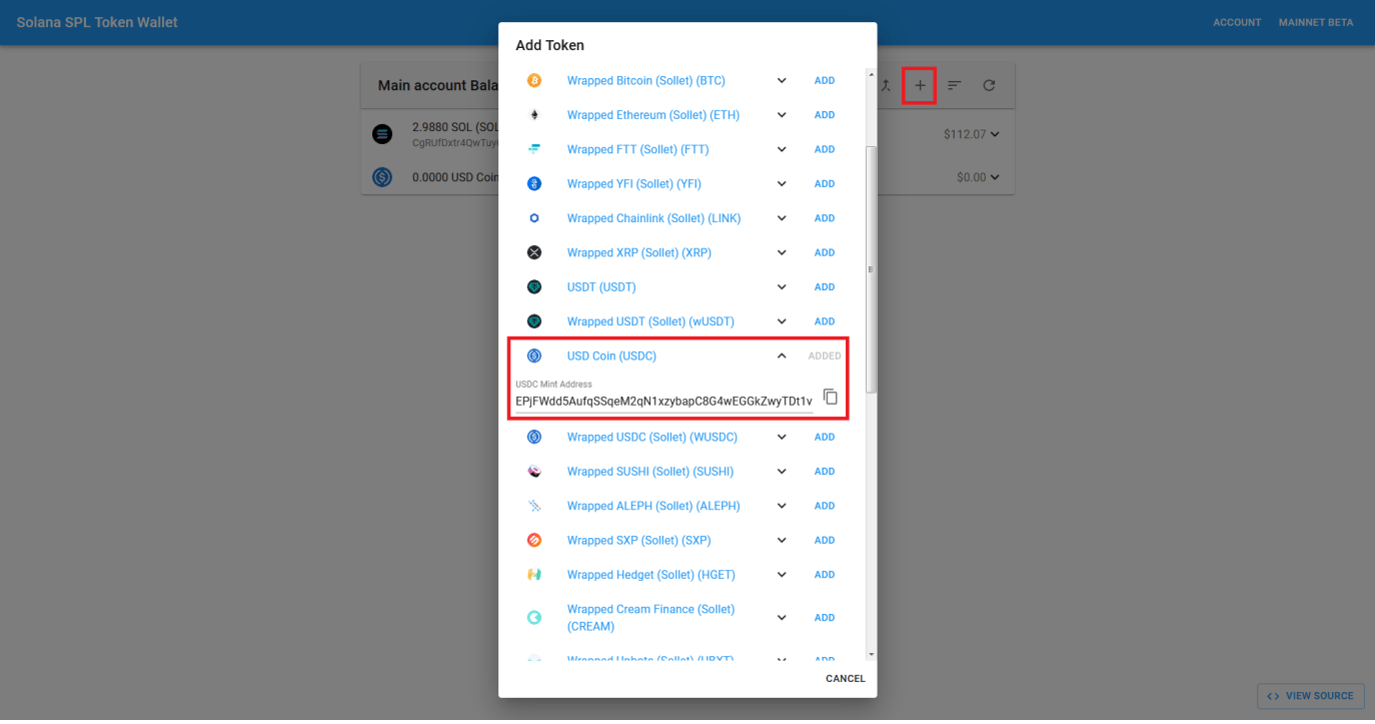

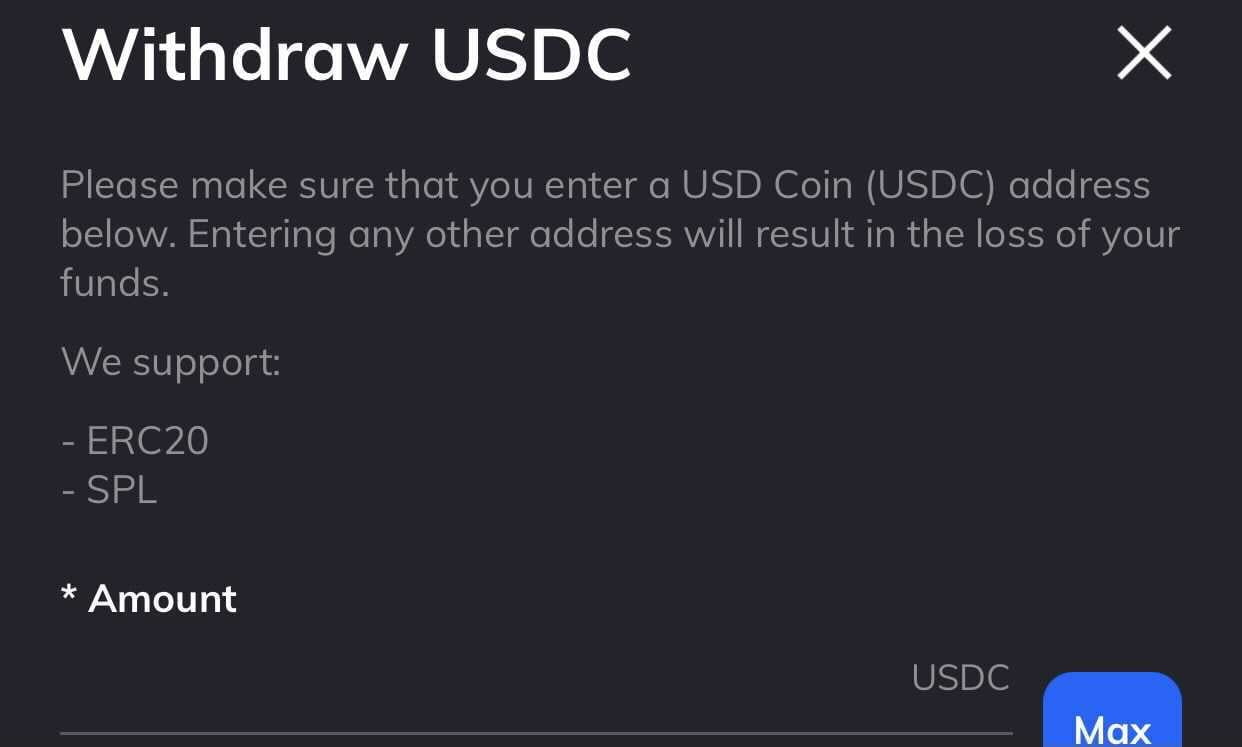

We need SOL to pay for network fees and USDC to buy into STEP. We first sent SOL to our Sollet wallet address, followed by USDC. The USDC we withdraw is not ERC-20, it’s SPL. As long as we add the proper address on FTX, they handle the USDC type.

STEP will be listed on test.Step.Finance. After connecting our wallet to the protocol, we’ll be increasing our slippage tolerance right from there.

Conclusion

We would like to re-iterate the fact that there are no guarantees in financial markets which is why risk management is always crucial. Given the hype-based investments we’re making at the moment, the capital risked is something we can fully afford to lose.With that said, Solana SZN is upon us 🚀