U.S. companies borrowed $2.5 trillion from the bond markets last year. The funding is very important for the survival of some of the businesses. Others have already gone under.

There are solid hopes that life might return, albeit in limited form, to the pre-pandemic era as coronavirus vaccines are distributed to the people. The aviation industry could bounce back as more passengers begin to travel again.

And while the situation plays itself out, the biggest question that remains is “how do companies allocate the vast amounts of cash sitting in their balance sheets.”

Bitcoin: Microstrategy’s capital allocation strategy

Converting part of a company’s treasury into bitcoin a few years ago was improbable. And only company chiefs ready to put their jobs on the line thought of doing it. The trend has changed as more companies, and now even cities, are thinking of investing in bitcoin.In August last year, Michael Saylor, the CEO of the business intelligence software firm Microstrategy made a big and bold bet when used nearly $500 million in company funds to buy the highly-volatile bitcoin.

Less than three years earlier, bitcoin made an incredible run to peak at nearly $20,000 in December 2017. Then the bubble burst and the digital currency spent the following year reversing its gains, and the next on a recovery path.

But for Saylor and his publicly-traded company, this was just the beginning of an aggressive bitcoin buying spree that culminated in the firm spending at least $1.1 billion in purchasing the digital asset.

Microstrategy now owns 71,079 bitcoins, and their value has more than doubled.

What the numbers say

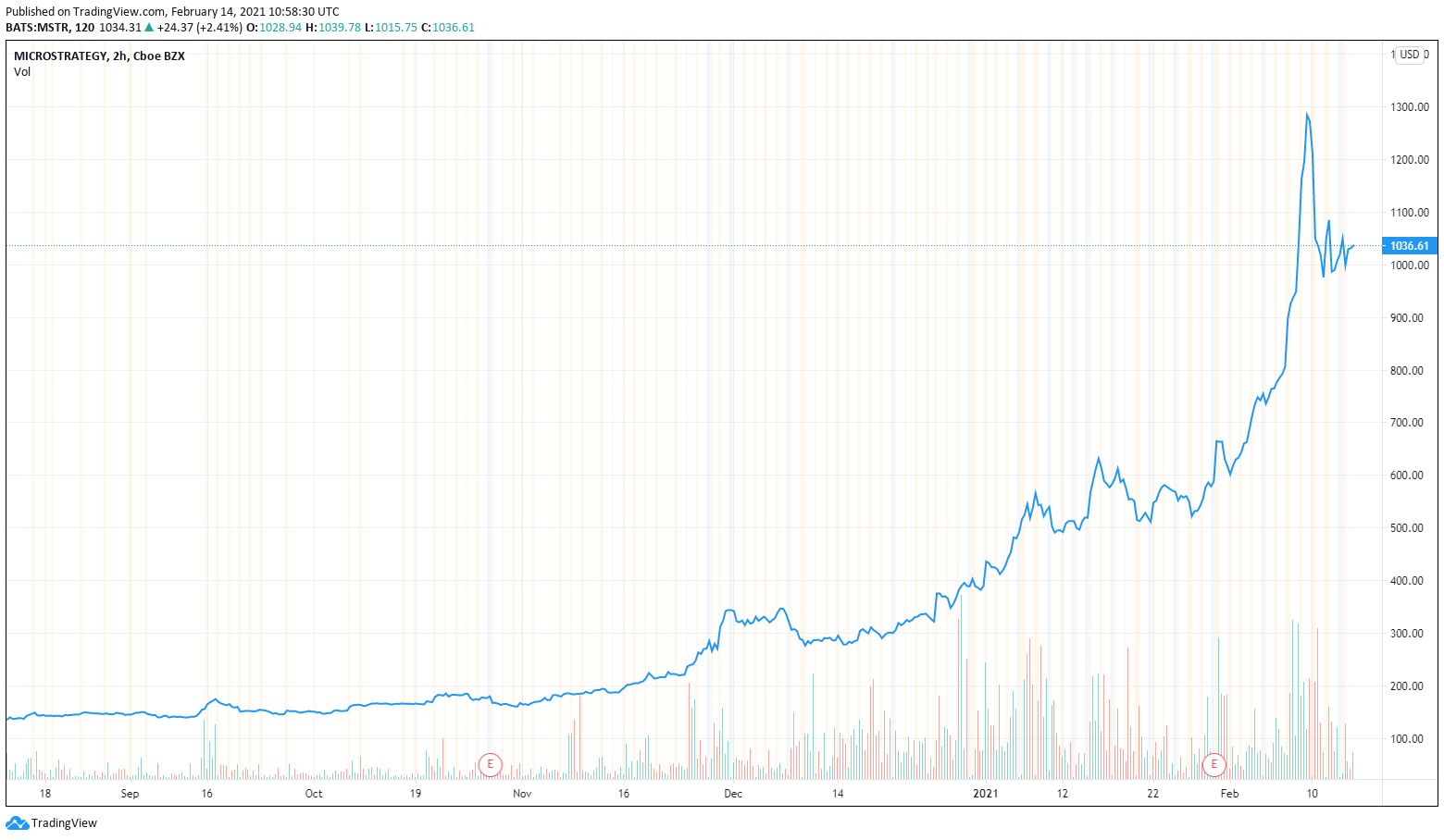

Apart from the bitcoin paper profits, Microstrategy’s investors could be the real winners in the bitcoin bet.The buying spree, described as a “capital allocation strategy” might have contributed to the company’s share price surge of nearly ten-fold since the bitcoin acquisition began.

On Aug. 14, a few days after investing in bitcoin for the first time, Microstrategy’s shares, traded on Nasdaq, were going for $146.63. The share price reached a peak of $1,272+ on Feb. 9 before pulling back to $1,036, TradingView data shows.

[caption id="attachment_30088" align="alignnone" width="1560"] Microstrategy grows nearly 10-fold since August when the company first purchased Bitcoins. |Source: TradingView[/caption]

Microstrategy grows nearly 10-fold since August when the company first purchased Bitcoins. |Source: TradingView[/caption]

Tesla, an innovative electric car maker led by its maverick CEO Elon Musk, treaded in Microstrategy’s terrain when it bought bitcoins worth $1.5 billion.

The firm’s war chest - 43,053 bitcoins - has grown to over $2.1 billion. And this is within a space of one month since the company made an investment in the digital asset.

This equates to paper profits of more than $600 million.

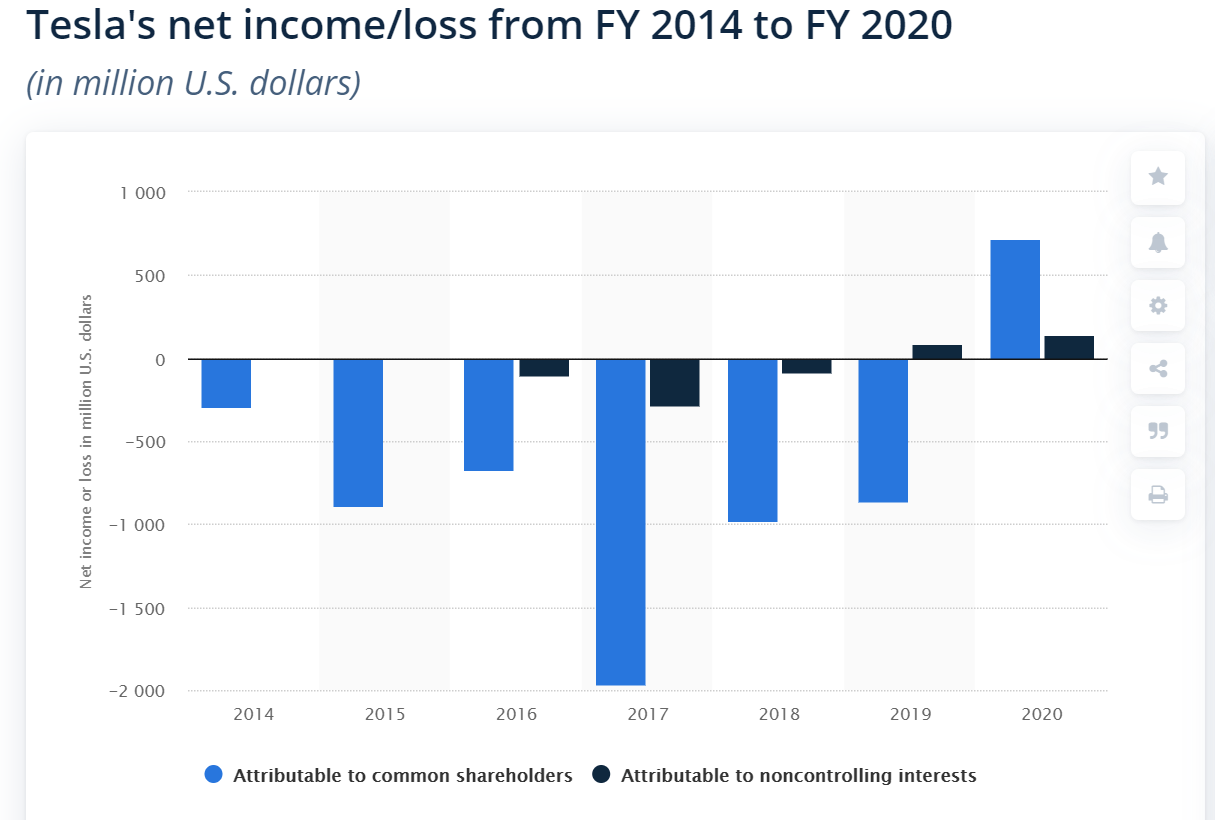

This is by far no easy feat, at least given Tesla’s financial history. Despite a runaway surge in share price last year, Tesla made an annual profit of over $700 million in 2020, the first time that the company was in the green.

[caption id="attachment_30089" align="alignnone" width="1215"] Tesla turned a net profit of over $700 million in 2020, the first time it has been profitable. |Source: Statista.com[/caption]

Tesla turned a net profit of over $700 million in 2020, the first time it has been profitable. |Source: Statista.com[/caption]

For Tesla, buying bitcoin is a way of diversifying and maximizing return on cash.

Microstrategy inspired companies such as Sqaure Inc. and Tesla among others to invest in bitcoins.

This is a story familiar to many, but its ramifications could be far-reaching, and eventually, the pay-off of the company’s bet could push other companies in a similar direction.

But not all financial executives have the same risk appetite as the eccentric Taylor, Musk, or Jack Dorsey who invested $50 million of Square’s treasury into bitcoin.

Grayscale’s Bitcoin Trust

Corporations that want exposure to bitcoin in the form of a security and without going through the hustles of buying and safekeeping BTC can do so using investment vehicles such as the Grayscale Bitcoin Trust (GBTC). GBTC share price has risen over the years.[caption id="attachment_30090" align="alignnone" width="1381"] Grayscale Bitcoin Trust's all-time performance. | Source: TradingView[/caption]

Grayscale Bitcoin Trust's all-time performance. | Source: TradingView[/caption]

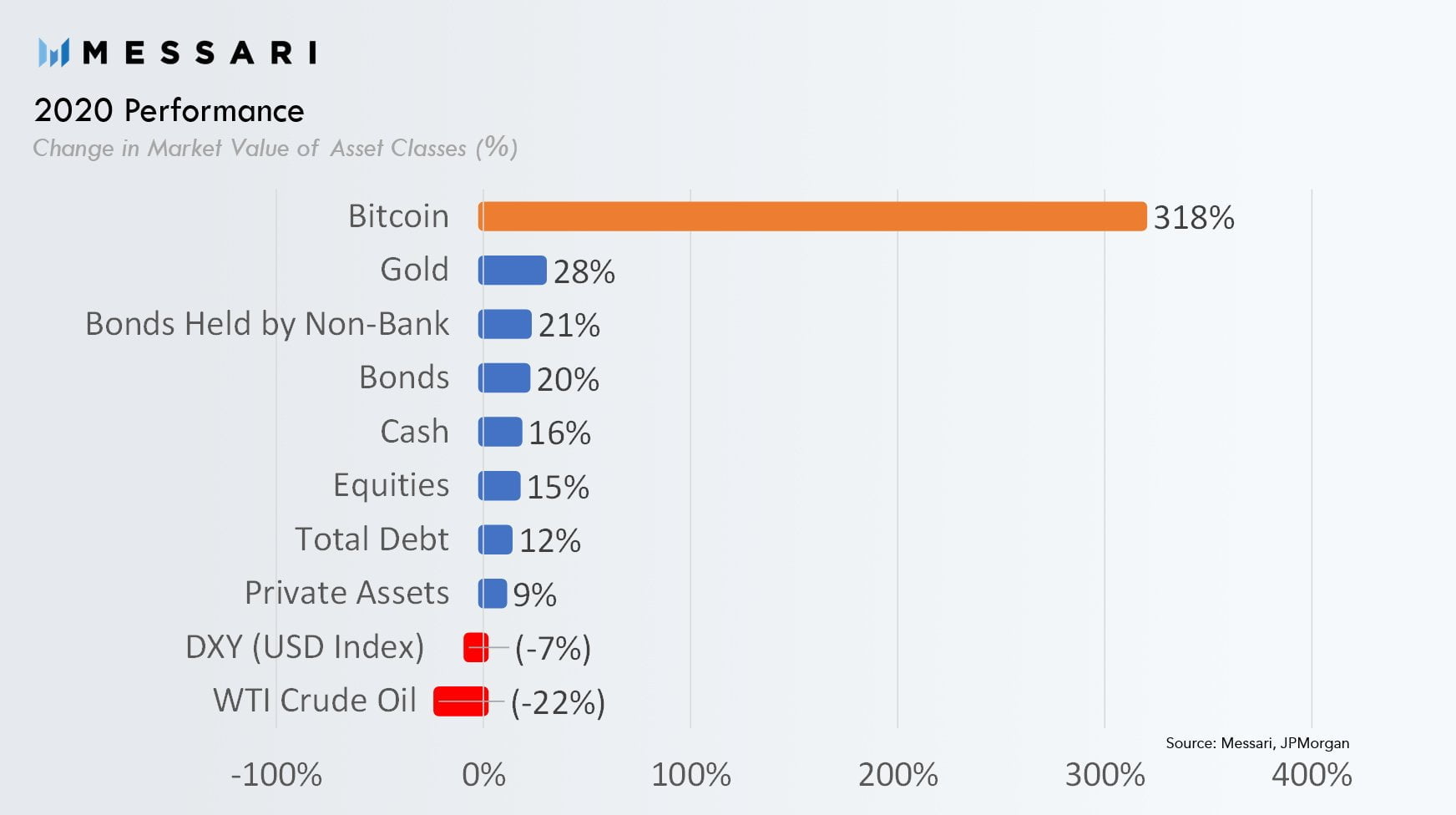

Bitcoin was outperformed by other cryptocurrencies in 2020. Despite this, it has gained a lot of attention from institutional investors.

It was the best-performing institutional asset of 2020 after surging more than 300% in the year. Gold, the traditional safe-haven asset, was up 28% in the same period.

[caption id="attachment_30091" align="alignnone" width="1744"] Bitcoin was the best performing institutional asset of 2020. | Source: Messari[/caption]

Bitcoin was the best performing institutional asset of 2020. | Source: Messari[/caption]

Some companies would still prefer to bet on traditional financial instruments instead of bitcoin because of the risk associated with the digital asset. Other corporations might take note of bitcoin’s institutional-fuelled bull run and think that it's 2017 all over again.

Taking the traditional route

Companies can do what they have always been doing in allocating their treasury. They could alter this a bit because of the high scale of borrowing in 2020.Giving it back

Giving back seems reasonable as some of the companies borrowed excessively. It would go a long way in reducing debt and undoing the ‘borrowing spree’ of last year.Investing in the business

The cost of borrowing is very low at the moment and could discourage companies from reducing their debt. Instead, they can opt to invest the cash into the business.Acquisitions

Companies can either buy back their stock or go for bold moves such as acquisitions. Analysts expect banks to splash $10 billion on stock repurchases this quarter.Hold the cash

Some strategists believe that due to an uncertain economic outlook, companies might prefer to hold the surplus cash and use it whenever the need arises.The economy could be rattled further as the world is still not yet out of the woods yet. The pandemic is still on.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms