2021 is the "Year of the Metal Ox" according to the Chinese Horoscope. Do you know what an Ox is also called?

A BULL.

2020 has been a phenomenal year for the Cryptocurrency market. Bitcoin turned into an institutional asset. Previously, there was a risk of being ridiculed for institutions if they owned any BTC, now the risk flipped on its head and became the risk of NOT owning BTC.Despite the Billions flooded into Bitcoin, this remains the tip of the iceberg compared to what is coming in 2021. The other factor is that "Bitcoin is the gateway, not the endgame" - institutions will park capital in specific Altcoins.

Our perspective for 2021 is split into two categories:

- Institutions

- New Sector

Institutions

This capital will keep rushing into our beloved market, so far there's about $2-3Billion publicly announced to have been dropped into BTC. Expect 5 times that number at least in 2021.

Institutional Investors will also begin announcing stakes in ETH as it witnesses another vertical accumulation, people will wake up to the fact that sub-$1,000 ETH is a gift. What makes ETH so valuable? Decentralised Finance. ETH is the DeFi mothership.

The managing director at Grayscale Investment stated:“Over the course of 2020 we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. There’s a growing conviction around Ethereum as an asset class."Ethereum - AN ASSET CLASS

New Sector: DeFi

Decentralised Finance (DeFi for short) is a capital blackhole, it has sucked close to $15 Billion into it in TVL (Total Value Locked) in 2020.Layer-2 scalability solutions will be adopted and ready for public use, gas fees will no longer stand in the way of smaller fish in the sea participating in this novel sector. Slowly (but surely) volumes will begin to increase on decentralised protocols, one which we are very bullish on will Synthetix with their upcoming perpetual futures.

The number of users in DeFi will grow but the newer people will prefer CeDeFi platforms such as "Celsius" for example as they have an easier to use UI.

The main volumes will come from more experienced players and liquidity will increase. Expecting the DeFi TVL (Total Value Locked) to reach $100 Billion at the very least.

One other platform will benefit from DeFi's growth and coexist with Ethereum: Polkadot.

Market Capitalisation

2021 will be the year when the cryptocurrency market cap breaks into the $1,000,000,000,000s range - (THIS WAS ALREADY ACHIEVED).

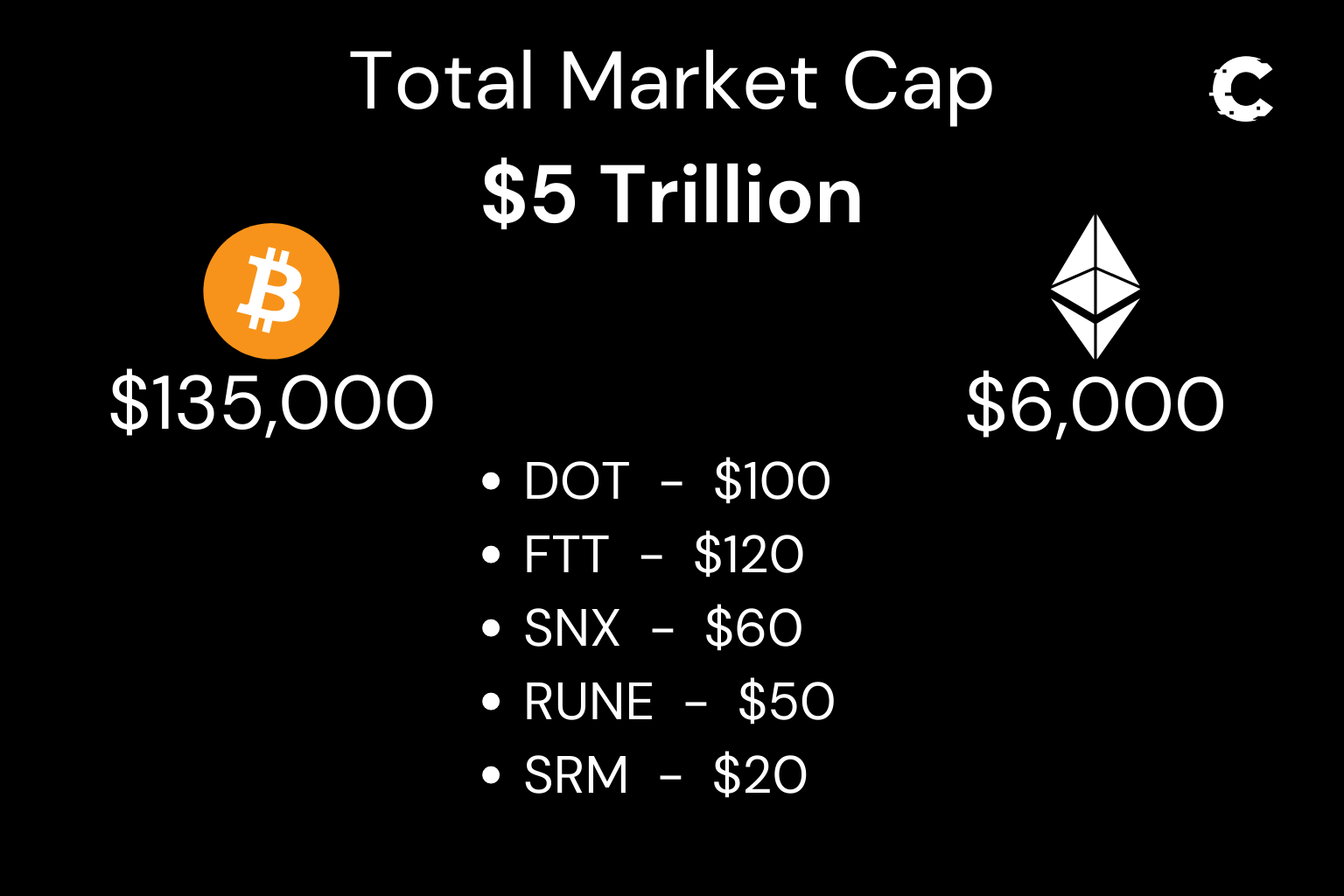

Our personal prediction is that the Total Market Cap would at least reach $5 Trillion (which will still be laughable compared to other asset classes - this is a conservative target).

- SNX $60 (our 20X target)

- RUNE: $50 ($90 in 2022)

- SRM: $20

- DOT: $100

Summary

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.