What if we told you there’s a way to earn high potential rewards without taking on large risk?

This opportunity lies in the world of Decentralised Finance (i.e. DeFi). For reference, DeFi is the newest and hottest sector in crypto. Simply put, it takes all financial institutions and services on-chain, makes them censorship-resistant and removes all middle men. This has created the most efficient financial system to date.

Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

This opportunity does not necessitate holding any sort of cryptocurrency and undergoing the risk of devaluation of that asset against fiat.

The only expense required by this opportunity is time, slippage and gas fees (for Ethereum-based projects). Depending on your portfolio size it may not be lucrative as fees have become rather expensive for a blockchain - this is due to the heightened demand to transact in the Ethereum ecosystem, but even $50-100 may do the trick.

Early DeFi Users Rewarded

Despite the parabolic growth, DeFi remains a nascent industry. A large portion of people are yet to interact with any DeFi protocol, this makes us: early users.

Another extremely attractive aspect about DeFi protocols is many of them release the product first and token second. This is the opposite of what ICOs have done: raise money by selling tokens, promise to deliver a product in the future and then fail at delivering.

Therefore, some protocols, when they release a token after delivering a full working product do a retroactive airdrop to early users. These tokens are governance tokens which gives holders voting power on where the platform heads next. As this is “decentralised” finance after all, it is an easy route to get the tokens in the hands of people whom have actually used the product.

The latest two examples are: Uniswap (UNI) and 1inch Exchange (1INCH).

Uniswap’s Retroactive Airdrop

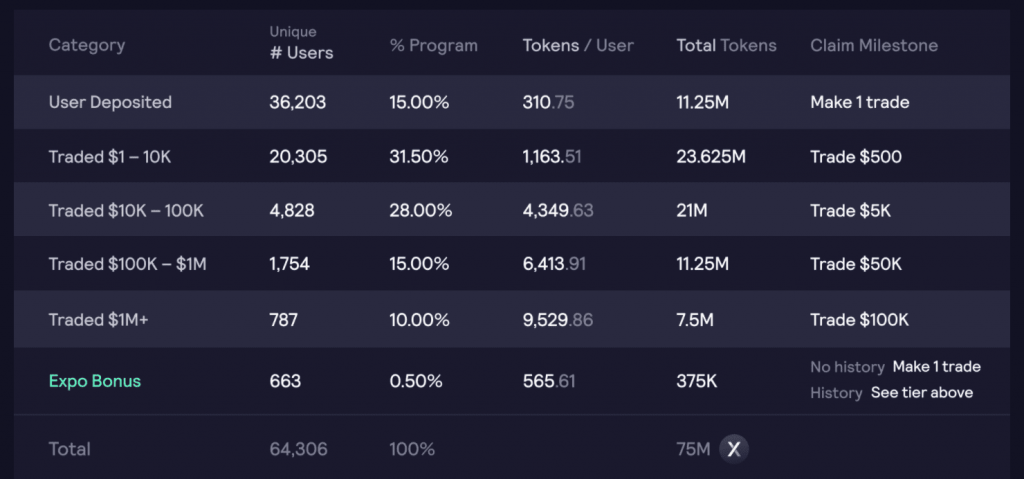

September 16 2020, Uniswap announced the launch of its UNI token. 15% of tokens were distributed amongst past users (150,000,000 UNI). Over 12,000 Ethereum addresses that tried to interact with Uniswap, even if it was a failed transaction, had the right to claim 400 UNI tokens. At the time of launch this was worth about $1,000.

Today, 400 UNI = $8,350+ (1 UNI = $20.9)

1inch Exchange’s Retroactive Airdrop

December 25th 2020, 1inch Exchange announced the launch of its 1INCH token. 6% were distributed amongst 50,000 addresses that have interacted with the protocol. There were conditions to the airdrop though:

- Placed at least one trade before September 15 OR

- At least four trades in total OR

- Trades for a total of at least $20

The Ethics of Airdrops

There are plenty of token-less protocols out there, probably in the 100s. However, going and trying to farm each and every airdrop out there is a big disservice to the industry, and ultimately yourself. You'll see that out of the projects mentioned below, you'll find ones fitting to sectors we are actually involved in and users of.Please do not try to farm airdrops from projects/protocols that mean nothing to you (i.e. that you'd probably never use). For the sake of DeFi, thank you.

Soo... Wen Airdrop Ser?

These airdrops to past users is one of the most efficient ways to get the governance tokens in the hands of actual users. Be careful out there, unless the information is vetted and confirmed by the official accounts of a project, it could be a scam!

dYdX ✅

The earliest DeFi derivatives platform that was launched in 2017, a severely undervalued platform. In the past 30 days alone, dYdX has seen $4.2 Million in revenue from fees paid to the platform by users. This most certainly is the sort of platform we’d like a piece of should they release a token.

By placing trades on dydx.exchange you may become eligible for a token airdrop should they do one in the future.

Update: 7-months Later

With the exception of US residents, anyone who traded on dYdX received a hefty airdrop which was of the tune of $10,000+.

MetaMask

You’re probably a MetaMask user, you know the third-party web extension that is an Ethereum wallet? Yes, that one.

For the longest time, MetaMask was only a wallet, quite convenient too. Recently they added a “Swap” function which would find the best rates across different DEXs and facilitate the trade all from within the wallet - an aggregator similar to 1inch Exchange.

The swap function has brought a total of $12M in revenue, with a daily average of $200,000.

Should they decentralise decision making and create a governance token, early users of this swap function would likely receive airdrops. (Once again it is not certain but it is worth it should it happen).

OpenSea

Currently OpenSea is effectively eBay for NFTs.No, OpenSea is yet to release a token but another protocol is airdropping tokens for existing OpenSea users - it is called The OpenDAO and the token ticker is $SOS. You can check elligibility to the airdrop here: https://www.theopendao.com/ If you decide to claim, check the price of SOS on CoinGecko because every 100,000,000 tokens are worth ~$650 so it may not be worthwhile to even spend gas fees on the claim if it is too small. The airdrop size is proportional to the number of transactions made by the address on OpenSea as well as the volume. We've not seen issues with token claims but always stay safe. The best way to do the claim, in the safest way possible, is to empty the wallet eligible from all tokens and just keeping a bit of ETH (~$50-$100) to make the claiming transaction. This way the worst case scenario is controlled and no theft can happen (it is controlled). Another airdropped token to OpenSea users was $LOOKS, which looks (pun intended) more promising that $SOS.

This is one of the biggest candidates with the most potential to become extremely lucrative if it occurs. We have seen other competing NFT marketplaces such as Superrare follow a token airdrop model to drive decentralisation, enhance their user engagement and try to increase their marketshare. OpenSea however dominates the NFT market on Ethereum with a marketshare of upwards of 80%. Thus they have no need to airdrop a token to their users, as they are happy operating with things the way they are now. Add in their lucrative fee structure as well as their dominant marketshare there is no incentive for OpenSea to ‘giveaway’ or share some of their profits via an airdrop.

Phantom Wallet

The MetaMask of Solana. The wallet has a "swap" function just like MetaMask which drives revenue for Phantom. At some point in time, they'll decide to decentralise governance (& maybe even revenue) which means token ser. Now, they don't necessarily need to use the airdrop route but in case they do, we are ready to receive haha.Additionally, with transaction fees on Solana being sub 1 cent there is no reason not to try out Phantom.

Solana Wormhole

Inspired by the recent Goodbridge airdrop on Avalanche, it is worth highlighting the Solana wormhole. Wormholes effectively look to facilitate moving assets across chains. I.e. you could move a Solana token or NFT to the ETH blockchain and vice versa. Cross chain interoperability is an important need for the solana ecosystem to drive wider adoption and use. Currently using the wormhole consists of fees on both the Solana and Ethereum side. With Solana fees being sub 1cent, the only significant fees are on the Ethereum side and it currently costs the standard amount of gas to move assets from the ETH to SOL blockchains. With the recent airdrop of the Goodbridging token which rewarded users who bridged to the Avalanche ecosystem from the ETH blockchain, it adds another incentive to interact with the latest in cross chain interoperability. An airdrop for the Solana wormhole is less likely to occur than for the projects outlined above, but still remains a distinct possibility. The Solana wormhole still remains a work in progress and the utility of assets which have been ported from one chain to another is still extremely limited.zkSync

zkSync is an L2 on Ethereum that is starting to gain traction. At the moment, it is token-less but a token is in their roadmap. With superior user-experience that we have tried, we'll probably end up being eligible for an airdrop should the team go with that route. We've used it by sending assets over to the L2 and interacted with ZigZag exchange on there.ZigZag Exchange

This is the prime exchange on zkSync, we'd recommend trying out the user experience and comparing it to that on the Ethereum L1 - they also have plans to release a token that may or may not be done via an airdrop.01 Exchange

A novel derivatives exchange that has launched Perpetual Futures on Solana and will soon ship a new product (only available on Opyn) called Power Perpetuals.

Minimising Gas Fees

Since the only expense on this opportunity is gas fees, it’s best to find ways to minimise them.

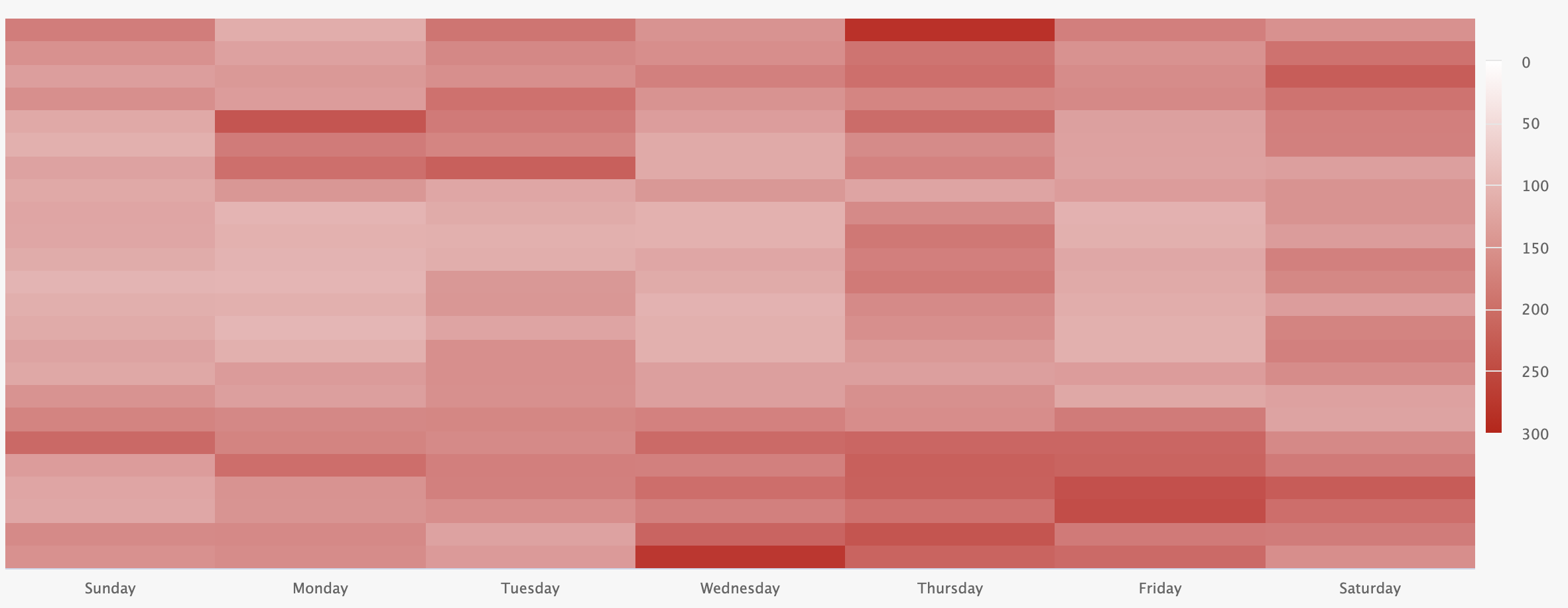

This website gives you an overview of which days and times are the least congested for the Ethereum network, meaning which days and times that have the lowest costs for gas fees: Ethereumprice.org/GAS

A final and important note to remember is that the above are simply educated guesses regarding what might occur with projects, potential tokens, and then distribution avenues. It involves a lot assumptions. You should never look to use a protocol specifically to increase your 'potential airdrop' allocation. Interact with the protocol to see if it offers something of value or use to your crypto activities, but do not look to increase your usage of it, specifically for a greater airdrop. To clarify with an example, do not look to buy/sell NFTs simply to increase you potential rewards. If NFTs are of interest then look to find a platform that caters to your requirements and also has airdrop potential. On the other hand if you are not interested in NFTs, but want to interact with the protocol make sure that you are comfortable with whatever interaction/allocation you have. Do not lose the forest for the trees.