Psychology of Crypto Investing

Psychology is such a broad subject. The individuality of the human mind is hard to quantify, and no two people will have the same thoughts on any topic. Throughout our entire lives, we have been subjected to a vast number of experiences and moments that have shaped our view of the world.

However, there are some recurring themes in human behaviour that are common to all financial markets. Creating and maintaining an edge against this behaviour is essential if the investor is to see a return. Generally, for an individual to realise a gain on a trade, someone else must lose.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Market Mentality

Although it has certainly matured a lot over the last 4-5 years, the crypto market is still in its infancy with relatively low liquidity when compared to other markets such as stocks or FOREX. Additionally, crypto has a sizeable retail element that is emotionally driven. These characteristics combine to create a highly volatile and unpredictable environment for both investors and traders. Sentiment can flip like a switch, and it is ultimately sentiment that drives the market – in both directions.There is a certain level of herd mentality when it comes to the sentiment in any asset class. We are all guilty of just buying an asset because everyone else appears to be without doing any research or diligence on the investment. Can this be profitable? Of course, but only if an exit is made before the irrational buying stops. Crypto is especially prone to herd behaviour, and some projects have an almost cult-like following. It is the herd mentality that leads to bubbles and the subsequent collapse of those bubbles.

This quote from C. S. Lewis is something that all investors and traders should always have in the back of their minds. In terms of financial markets, this can be the case for either bull markets or bear markets. The point is that often the sentiment can become an echo chamber with everyone feeding each other data that fits their own bias, refusing to take in information that goes against that bias. There is no better place to see this in action than Crypto Twitter. Obviously, there will be moments where the crowd will be correct in their collective assessment. However, it should always be part of the thought process to consider the current climate and whether outside influence, emotional attachment to assets in a portfolio, or unrealised profit/loss is affecting an individual’s decision making.

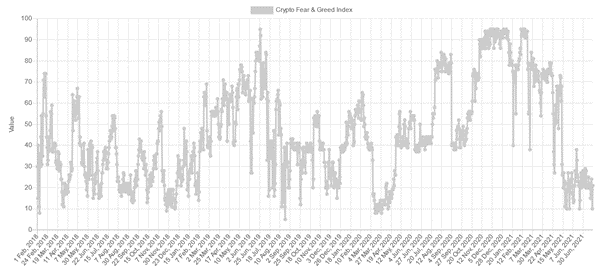

A lot of inexperienced investors will be riding on the back of hype, whether it be Elon Musk shilling DOGE or Bitcoin being on the news after making a new all-time high. This is a less than optimal time to invest, as these new entrants into the market are looking for value where other earlier investors have already found it. Unless someone is lucky enough to have invested in Bitcoin way back in the day, the only way to get a good entry is to buy when no one else is buying. Whether that is in a bear market, or a correction, buying fear has historically always been a profitable play. This is why the fear and greed index is so important for us and is the reason we post an update on it regularly.

No one can time the exact market top or bottom. In order to realise opportunity, it is often beneficial to buy when the majority are selling out of fear and sell when the majority are buying out of greed. Allow other people to become your exit liquidity, rather than becoming exit liquidity yourself. For someone to sell, there must be someone to buy on the other end of the trade. This sounds simple, but the fear and greed index is not some sort of cheat code. We have seen the index running at extreme greed, or fear, for weeks at a time - other factors must come into the decision-making process.

What is an edge?

It is imperative to establish an edge over the herd. An edge is simply an investment idea or strategy that will allow us to outperform the market in some way. For us, the definition of outperforming the market is exceeding the returns that simply buying and holding Bitcoin could offer. We have a long-term bullish bias on crypto in general. However, we believe our edge is investing in DeFi assets

Even a slight edge utilised consistently over a long period can produce a higher than average return over a few years. Of course, it is impossible to know if an edge is effective without trial and error and paying tuition to the market to figure out what works and what does not. To be honest, just surviving the market is half the battle. Time, effort and, most importantly, motivation to succeed is vital – nothing will ever be handed out on a silver plate.

It would be unreasonable to pick an individual off the street, take them into a hospital and ask them to perform heart surgery. Surgeons go through years of education and practical learning before they are let anywhere near a patient.

Therefore, why would it be any more reasonable to pick the same individual off the street and ask him to outperform any financial index, let alone one of the newest and most volatile in existence? People look for the easiest route to solve their problems – and there is nothing wrong with that. But if everyone is doing the same thing, it is essential to do more than the herd, be better, look for opportunity where no one else can see it if we are to have any chance of maintaining an edge over the competitors. Everyone in the market wants to make money; it is on us to want it more and actually do something that sets us apart.

The Emotional Aspect

Nobody likes seeing red days, weeks, months on end and watching their portfolio drop in value, even more so if it is a substantial portion of the individuals net worth. Conversely, everyone loves seeing green days and their portfolio growing on paper. Big losses, as well as big gains, create the kind of emotional response that leads to buying the top and selling the bottom. Making investment decisions based on thorough research and creating a theory that is based on as much information as possible is paramount to weathering storms – this is called conviction.

Being shaken out of a crypto investment because of short term volatility simply means that the investor does not understand the game. On the other hand, taking profits when an investment theory plays out is equally as important. Even taking partial profits on the way up can do wonders for the confidence of an investor – clicking the sell button when an investment is in the green feels infinitely better than clicking the sell button in the red.

If a profit is a substantial portion of an individual’s net worth, then it can sometimes be beneficial to secure profits, take a step back, and figure out what the next move is. It can be easy to get caught up in the hype and FOMO (Fear of Missing Out) - some of the returns seen in the market since March 2020 is in the thousands of percent. If the goal is long-term over a few years, great! But the investor should be prepared to see the occasional 50/60/70% drawdown.