They are not the first to jump on this trend and it seems like they won’t be the last. The two companies that pledged a portion of their treasuries into Bitcoin were Square Inc and Microstrategy Solutions; the latter went all-in and even raised debt to buy Bitcoin.

Bitcoin’s Progression

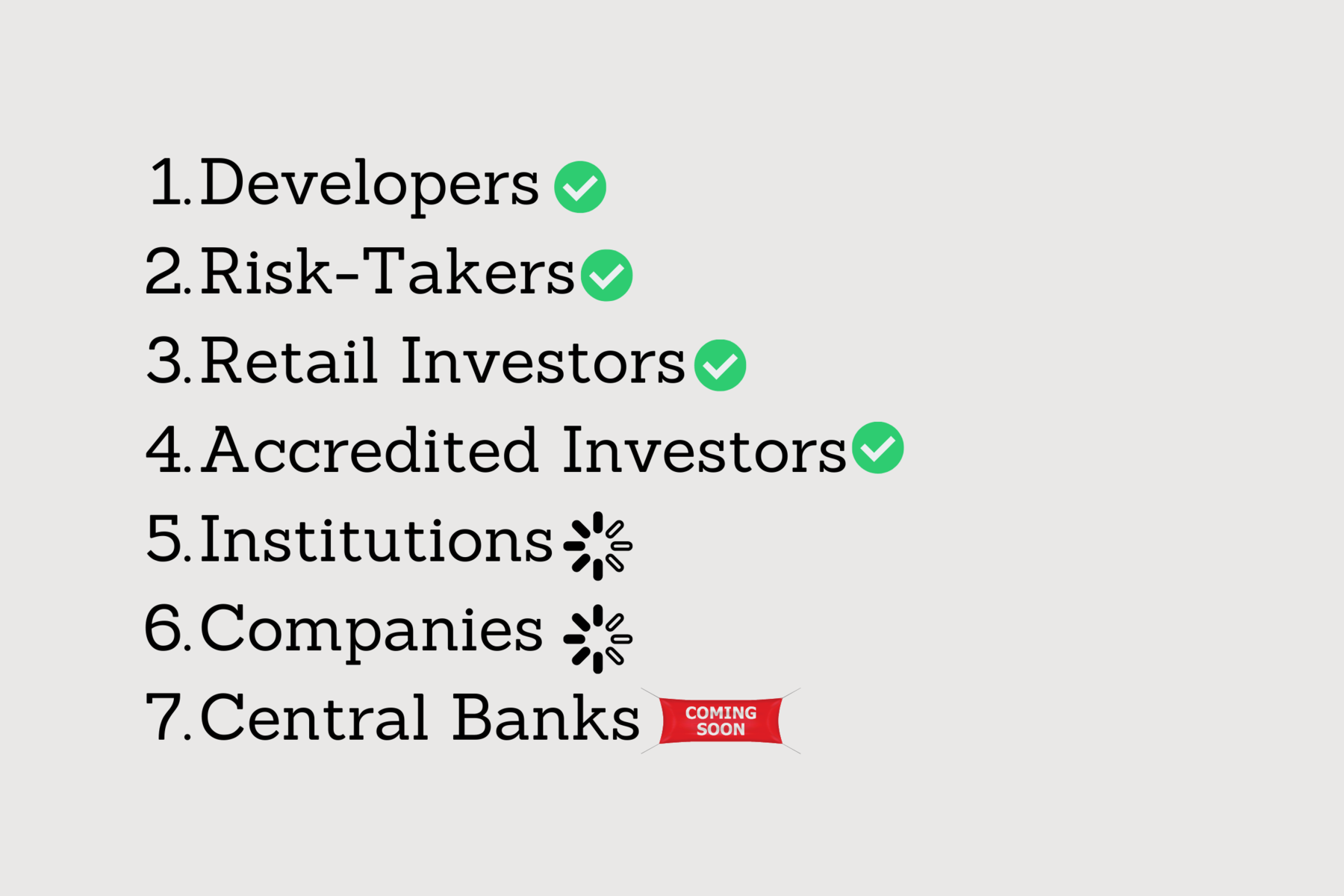

If we are to summarise Bitcoin’s progression in terms of investors, here is the list and we are getting to the bottom of it.

In 12 years, Bitcoin was able to overcome major obstacles and rise up the ranks of financial assets. From an enthusiasts’ magic internet money to a company treasury asset.

Risk of “NOT” owning Bitcoin

From 2009 and all the way until March 2020, Bitcoin was taken as a joke by Wall Street and traditional finance investors/institutions. It was called a scam numerous times. What most don’t see is that in Traditional Finance (TradFi), 90%+ of those involved in that industry are followers, they have no say. They simply follow the legendary investors’ footsteps such as Jim Simons, Paul Tudor Jones, Carl Icahn and Warren Buffet. For a portfolio manager (PM), adding a Bitcoin position and then losing money will represent the end of their career because they took on what seemed like a “stupid” risk since no legendary investor endorsed it yet.

After the March 2020 crash - Black Swan/Black Thursday - it all changed. Suddenly, Bitcoin became highly attractive to some institutional investors. The question is why?

Paul Tudor Jones (PTJ) expressed worries about the upcoming USD devaluation with the excess printing by the Federal Reserve. For that reason, he was looking at alternative assets. A censorship-resistant asset with a fixed supply schedule and no room for human discretionary decisions or corruption became highly interesting all of a sudden. PTJ invested into Bitcoin and the floodgates were open.

Other TradFi investors (the followers) were able to invest into Bitcoin and have someone reputable to point their finger at if things didn’t go as planned.

You will notice the same effect soon with other companies. This trend did not start with Microstrategy Solutions because it isn’t really considered a top company nor is Michael Saylor considered a leader. In fact, Microstrategy saw their stock run sideways after a massive drop following the Dot-Com bubble and Bitcoin was the only thing that revived it.

Tesla’s story is different: a leading company pledged a considerable portion of its treasury into Bitcoin.

The dollar devaluation will likely not stop with all the stimulus bills, a company’s balance sheet going down in purchasing power is no longer explicable after Tesla buying BTC. The risk for companies has also turned into a risk of “NOT” owning Bitcoin.

One of the major pros is self-custody. A company can own its own keys, no requirements nor any approval required from centralised entities for them to access their funds.

The Future

TradFi is slowly buying digital assets such as Bitcoin and Ether. As of now, that alone is sufficient for them.

However, once its all said and done, when all that was needed to be bought is bought, what happens?

These investors will look into a place to earn yield on their holdings. Where? Decentralised Finance (DeFi). That will represent the tipping point where DeFi swallows up TradFi and simply gets called “Fi”.