The downside to the attention flow is that some narratives can become so hyped up that they become bid to their highs, and then the market struggles to find the demand to sustain higher levels. This is why we like to optimise for solid assets with strong utility that other market participants will naturally back.

Today, we present two assets that have extremely strong fundamentals. But beyond the fundamentals, we can strongly argue that they are undervalued based on their price action.

The first project is the beating heart of the Base ecosystem, and the second is a battle-tested blockchain with a strong developer community.

Sounds exciting?

Let's dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. We also advise setting a risk tolerance level in terms of capital allocation while trading. The industry standard is no more than 2% of your portfolio at any given time. This means if you are in an open position already, it's advised not to take on more trades, which will lead you to be overexposed. Allow current trades to be settled; there will be more opportunities around the corner.

AERO

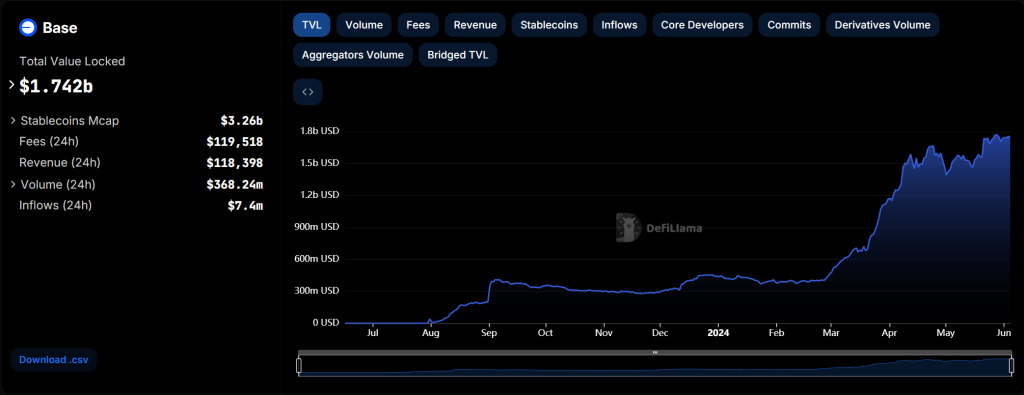

Aerodrome Finance is the leading decentralised exchange on Base, and it shows in the numbers.The charts below show how Aerodrome's TVL has tracked Base's TVL since the beginning of the year.

Base's TVL has grown from around $440 million to over $1.74 billion, and it's extremely interesting to see what AERO has contributed to that.

If you are bullish on the ETH ecosystem, especially with ETH ETFs and other developments, AERO makes a strong case to be an up-and-coming player in this arena.

Technical analysis

The technicals display a very strong chart in a healthy pullback with the recent swing low and demand around the key psychological number of $1 and the big-picture Fibonacci of 61.8%. We have seen significant intraday bounces at this level, and the price is looking to retrace over the coming days.

Play for traders

- Scenario 1: Consider placing a limit order on the LOI (Level of Interest) of around $0.9500.

Risk and reward

If you are going to apply leverage, we would always advise using a stop loss to protect capital and stay calculated with our risk-to-reward strategy. The technicals would render this particular setup invalid based on the conviction at the price seen below until further structure is printed.- Stop loss - $0.8182

Take profit

The conviction overall is actually in the long run for Aerodrome to set a new swing high.Spot players can buy loosely and hold for the long run, but the near-term take profit is $1.5000 to achieve a nicely justified risk-to-reward return for leveraged players.

- TP 1: $1.5000

- TP 2: $2.3780

NEO

NEO has been trading sideways for most of Q4 2023 and Q1 2024.However, late Q1 saw a surge in demand, propelling the coin from $14 to $24 at the start of Q2, indicating significant interest and bullish momentum.

NEO is one of the most feature-complete blockchain platforms for building decentralised applications. It allows developers to digitise and automate asset management through smart contracts and offers powerful native infrastructures such as decentralised storage, oracles, and domain name services.

With its token unlock complete, no further dilution is expected, strengthening its value proposition.

NEO's historical cycle shows a consolidation period of around 800 days before each major bullish phase. C

Currently, NEO is nearing the end of another 800-day consolidation period, suggesting a substantial bullish run could be imminent.

Technical analysis

The technicals display a strong chart with a healthy pullback from its recent rally.

NEO moved from $14 to $24 in early Q2, flipping the previous major resistance at $14 into solid support.

This area has seen significant demand, as evidenced by the base structure that NEO has been forming above it throughout May.

NEO is in a retracement phase post its surge to $24, with the $13 area marked as a crucial support zone. This level offers an excellent opportunity for accumulation, with a minimum potential upside of 50% if it sustains above $14.

In the event of a broader market sell-off, the $13 support zone remains a critical area to watch. Further downside support is found around the $10 region if this level fails.

Play for traders

- Scenario 1: Enter a position at the current market price of $14.8.

- Scenario 2: Wait for price to retrace to the $13 region

Risk to reward

Scenario 1 and 2 have the same stop loss.We believe this conviction would be invalidated if we began to trade beneath the LOI and the next key level below:

Stop Loss: $11.0

Take profit

Keep 10% of positions open for further upside beyond TP2, capitalising on the anticipated bullish cycle.- TP1: $18.5

- TP2: $23