Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- Bitcoin's Open Interest has generally downtrended since mid-December, however, it has risen 6% from the lows in late January.

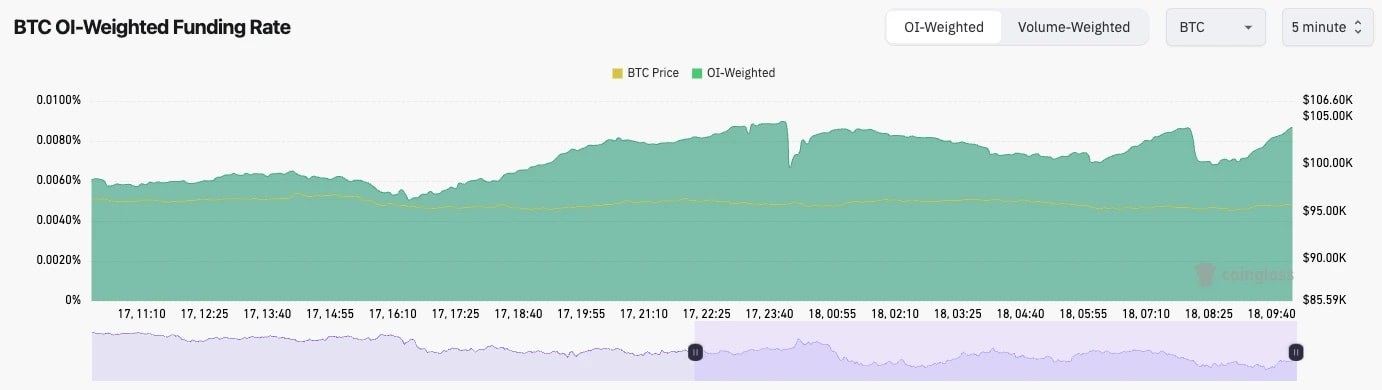

- The Funding Rate has remained positive and fluctuated between 0.004% and 0.01%. This suggests some indecision amongst traders, but still with a slight bias towards Longs.

- Overall, this is a more healthy leverage environment.

Technical analysis

- BTC has remained in a really tight range between its local support of $95,600 and its local resistance of $98,900.

- Beyond $98,900, the $100k level should act as a tricky psychological level, whilst the main horizontal resistance is at $106,900.

- To the downside, we expect $91,700 to act as key support as this also closely matches the short-term holder cost basis price ($92k).

- Sub $91,700, and the key levels are $87,100 and $80,300.

- The RSI is in relatively middle territory, so it has a downside if the price wants to go lower. The RSI is also beneath its moving average and finding that to be resistance currently.

- Next Support: $95,600

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $91,700