Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

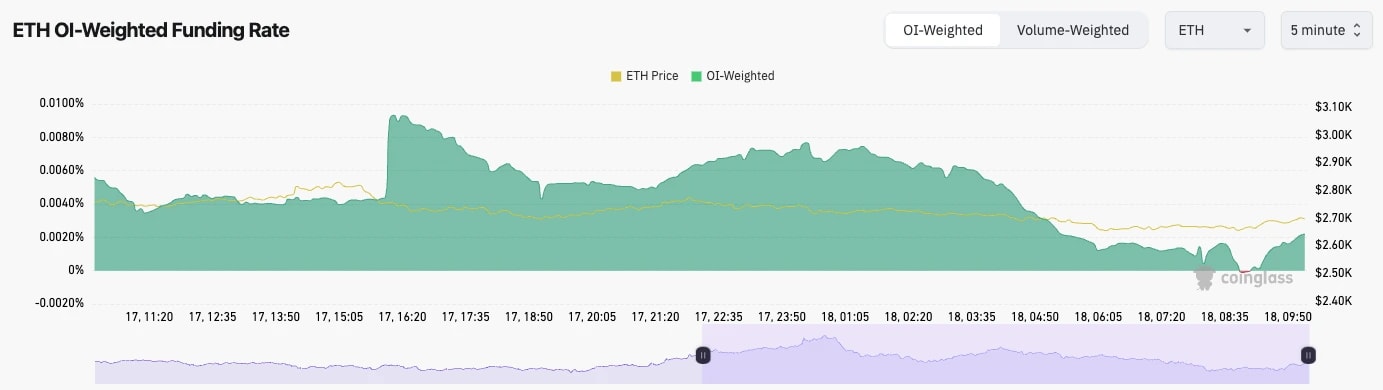

- ETH's Open Interest pulled back substantially on the price puke out in early February. Open Interest then bottomed off and has started rising again.

- ETH's Funding Rate isn't negative, but it is only just positive. This suggests that a fair portion of the open interest that has been recently added is in Shorts.

Technical analysis

- ETH has been range-bound at the new lows between $2,500 and $2,900.

- The horizontal resistance is at $2,875. We would need to see this level flipped and reclaimed in order to flip bullish again. However, just beyond this level, $3,050 is also a large resistance. So ETH has two big resistances within just a 10% move higher for price.

- Currently, there is local support at $2,700, but the main horizontal support is at $2,420.

- The RSI is the most positive aspect of ETH. It's broken out of its downtrend line, and it's also now nicely above its moving average.

- Next Support: $2,500

- Next Resistance: $2,875

- Direction: Neutral/Bearish

- Upside Target: $2,875

- Downside Target: $2,420

Cryptonary's take

It's hard to get bullish on ETH here. We're now just generally used to lacking performance, and then when you look at the chart, ETH is below two heavy horizontal resistances; $2,875 and $3,050.For now, we'd just remain patient with ETH, and whilst we still don't see the macro as majorly supportive, this would suggest to us that ETH can revisit the $2,420 area as a minimum in the coming weeks/months.