Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

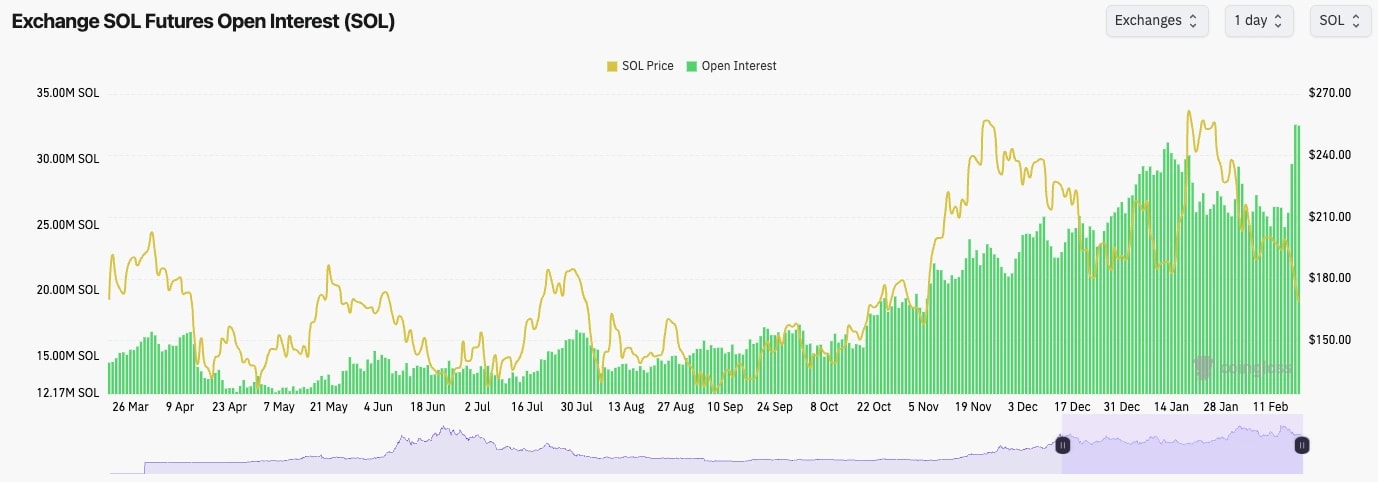

- SOL's Open Interest has gone from 24m SOL to now 32m SOL, as the price has gone from $200 down to $165.

- SOL's Funding Rate has fluctuated between negative and positive.

- Overall, this may need more reset, and this will likely be a time capitulation/reset rather than a price reset.

Technical analysis

- SOL broke out from its main downtrend line, but it couldn't reclaim the horizontal level of $203. The price was then rejected from there and the price immediately moved down to the next horizontal support at $165. This is a good example of how crucial key horizontal levels can be for price.

- The price is now at the next horizontal support of $162.

- Beneath the current support, we have $145 and $120 as the next two key levels to the downside.

- The RSI on the Daily and on smaller timeframes is now in oversold territory, whilst it's also well below its moving average.

- To the upside, $188 is likely to be the next local resistance.

- Next Support: $162

- Next Resistance: $188

- Direction: Neutral

- Upside Target: $188 (maybe $203)

- Downside Target: $145