ADA, XRP, BNB, DOGE, and PEPE face critical tests as Bitcoin wavers

ADA bounced after the Crypto Reserve news, XRP trades in a range, BNB shows strength, while DOGE and PEPE face significant support tests. Let's examine key price levels and market mechanics ahead of Friday's Crypto Summit.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

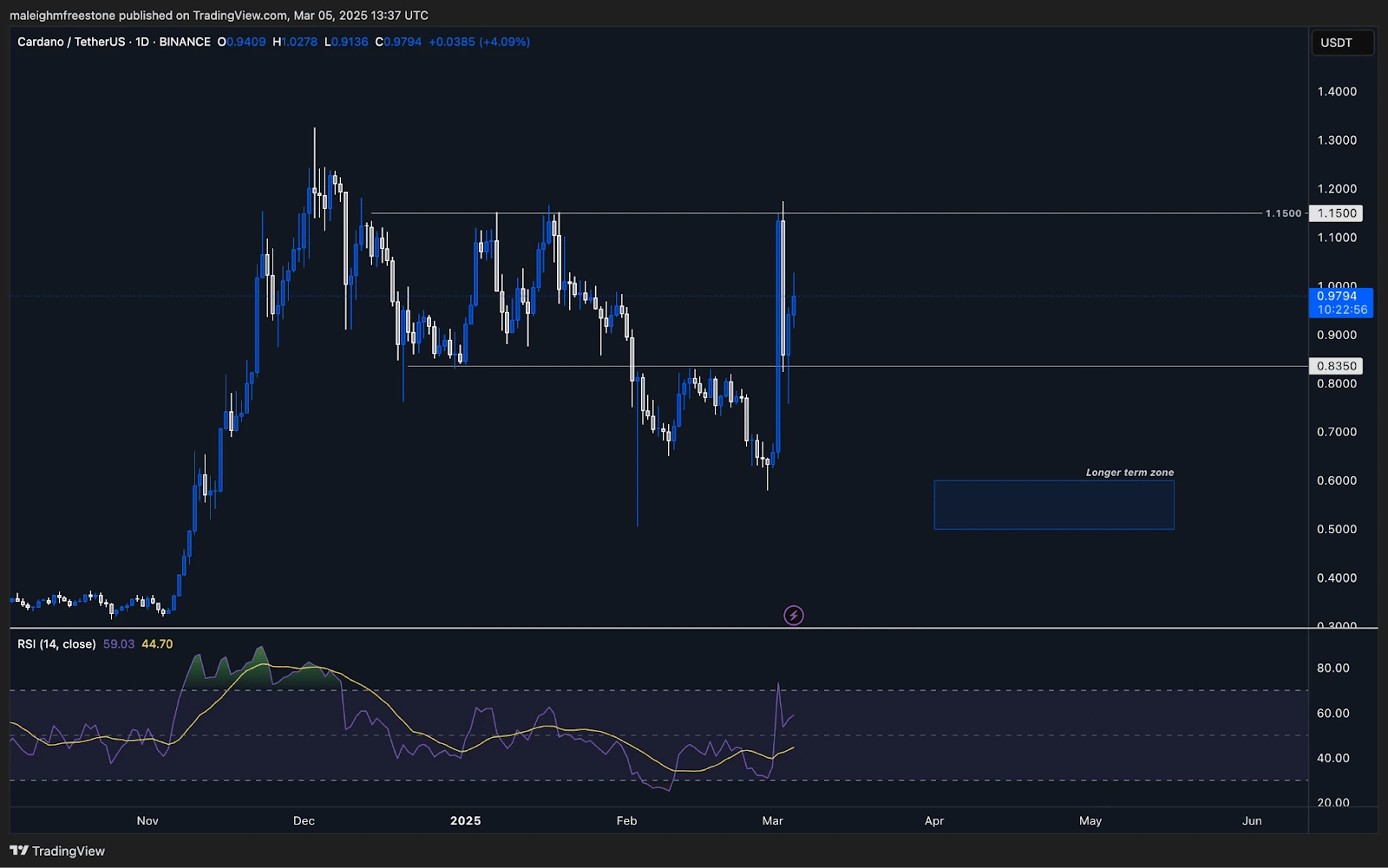

ADA:

Market context

ADA was one of the tokens that got aggressively bid off the back of the Crypto Reserve news, alongside XRP, SOL, ETH, and BTC. The move took ADA from $0.60 to $1.17, a 94% increase driven purely by speculative euphoria. However, the move was unsustainable, and the next day, ADA retraced nearly 30% down to key support at $0.835, which has been a significant level for the last few months.Technical analysis

- Key Support: $0.835 (a major level that held after the 30% retrace).

- Funding rate on March 4th was deeply negative, meaning it was dominated by Shorts.

- Open interest spiked from $522M to $1.21B by March 3rd, confirming heavy short positioning, sellers piled in and were squeezed resulting in that bounce we saw off the back of the pull black in open interest.

- Key Resistance: $1.15 (macro resistance and previous high from the Crypto Reserve pump).

- On the Crypto reserve news pump, we saw the RSI go north of 70 (overbought). The RSI has now reset to middle territory, but it is trading above its moving average (positive).

- Momentum: Price is currently magnetizing back toward $1.15, likely to face resistance.

- Next Support: $0.8350

- Next Resistance: $1.1500

- Direction: Bullish

- Upside Target: $1.1500

- Downside Target: $0.5000

Cryptonary's take

With the Crypto Summit on Friday, there could be a temporary buzz that bids ADA higher, similar to XRP. However, given the macro resistance in the market and the fact that the Crypto Reserve might be a "sell the news" event, the overall bias remains to the downside. The Crypto Reserve narrative lacks immediate legislative traction, and broader market forces are stronger than short-term speculation.If ADA trades back into $1.15, this would be an opportunity to stack short positions, as the move lacks real sustainability beyond speculation and with the way price is traded we can see price moving higher for ADA on the short term but this would just be to set up a roll over that we could take advantage of on the short side.

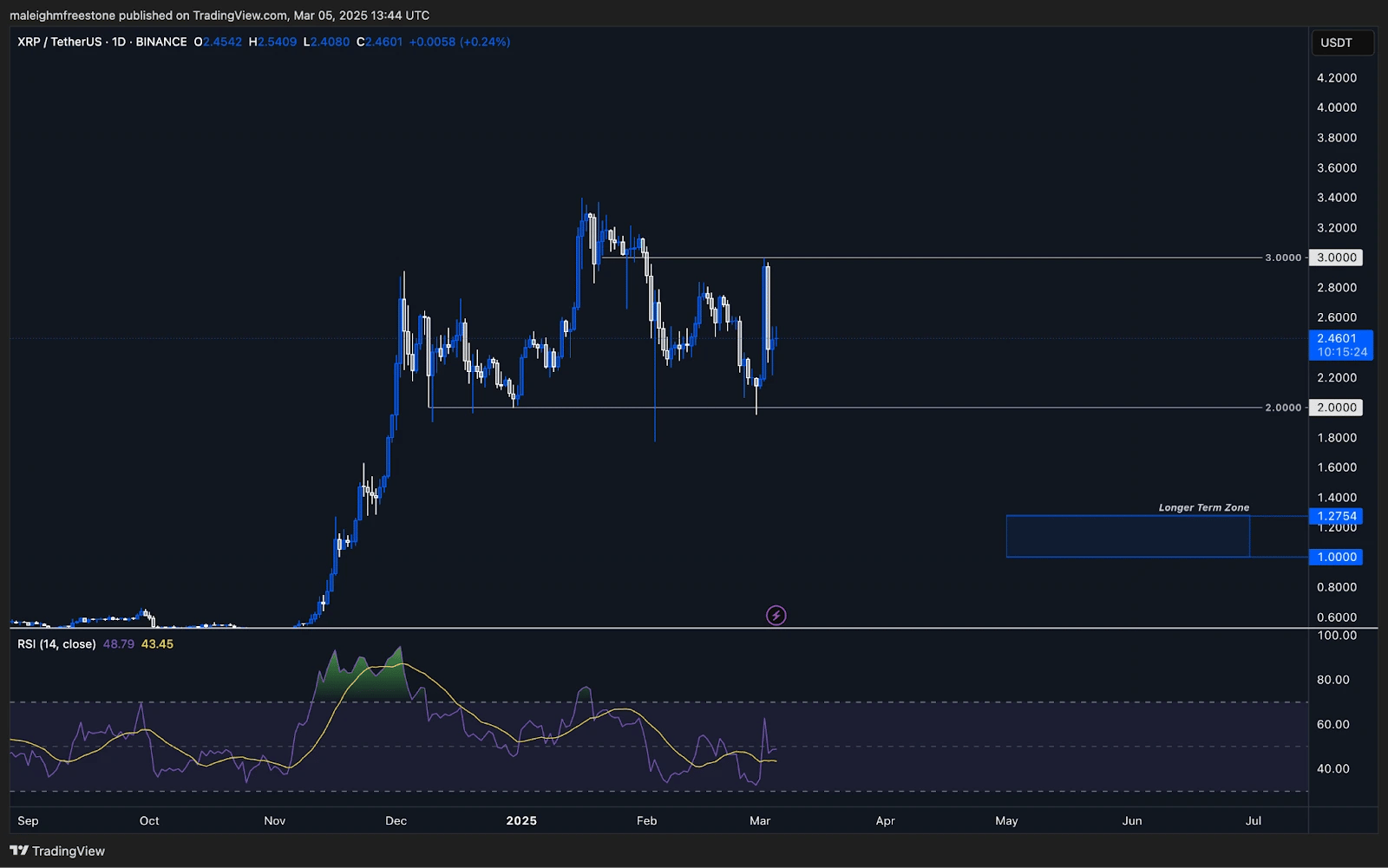

XRP:

Market context

Over the last week, XRP saw a 50% bounce from $2 to $3 before fully retracing, driven by the crypto reserve narrative. This aligns with the broader speculation around strategic reserves and global adoption, which has historically fueled aggressive bidding on XRP. However, indecision has crept in, reflected both in price action and market mechanics, with price now stalling around mid-range.Technical analysis

- XRP saw a 50% bounce from $2 to $3 before fully retracing, driven by the crypto reserve narrative.

- Open interest spiked from $2.92B to $4.45B on March 3rd, similar to December's post-election rally levels, but this time Funding is more neutral rather than long-biased, reflecting balanced positioning.

- Key Support: $2 is key support for XRP, propping the price up in a relatively bullish context. If and when this breaks, the next region we would target for projection would be the $1 region.

- Key Resistance: $3 is resistance, and we can anticipate it will struggle to break through given XRP's stretched overall move and the macro resistance the market is facing.

- RSI is relatively flat for XRP after the reset off the back of the volatile price action post Crypto Reserve news, but it is trading above its moving average.

- Momentum: Price is just chopping mid-range at $2.50, waiting for direction.

- Next Support: $2.0000

- Next Resistance: $3.0000

- Direction: Neutral

- Upside Target: $3.0000

- Downside Target: $2.0000

Cryptonary's take

XRP's market bias is flat, with buyers and sellers evenly matched, reflected in price action where a bullish candle was fully unpriced by a bearish one, signalling indecision. Despite broader bullish sentiment in crypto, macro resistance remains strong. With the Crypto Summit on Friday, XRP could see a euphoric bid if global adoption narratives resurface, potentially pushing the price into the $3 region.If that happens which we think is likely over the next week or so, experienced traders may look to stack shorts there, as no asset is likely to break major resistance purely on hype. XRP has held up well, but resistance is resistance—no reason to fight it, So this scenario would present a nice opportunity to stack shorts.

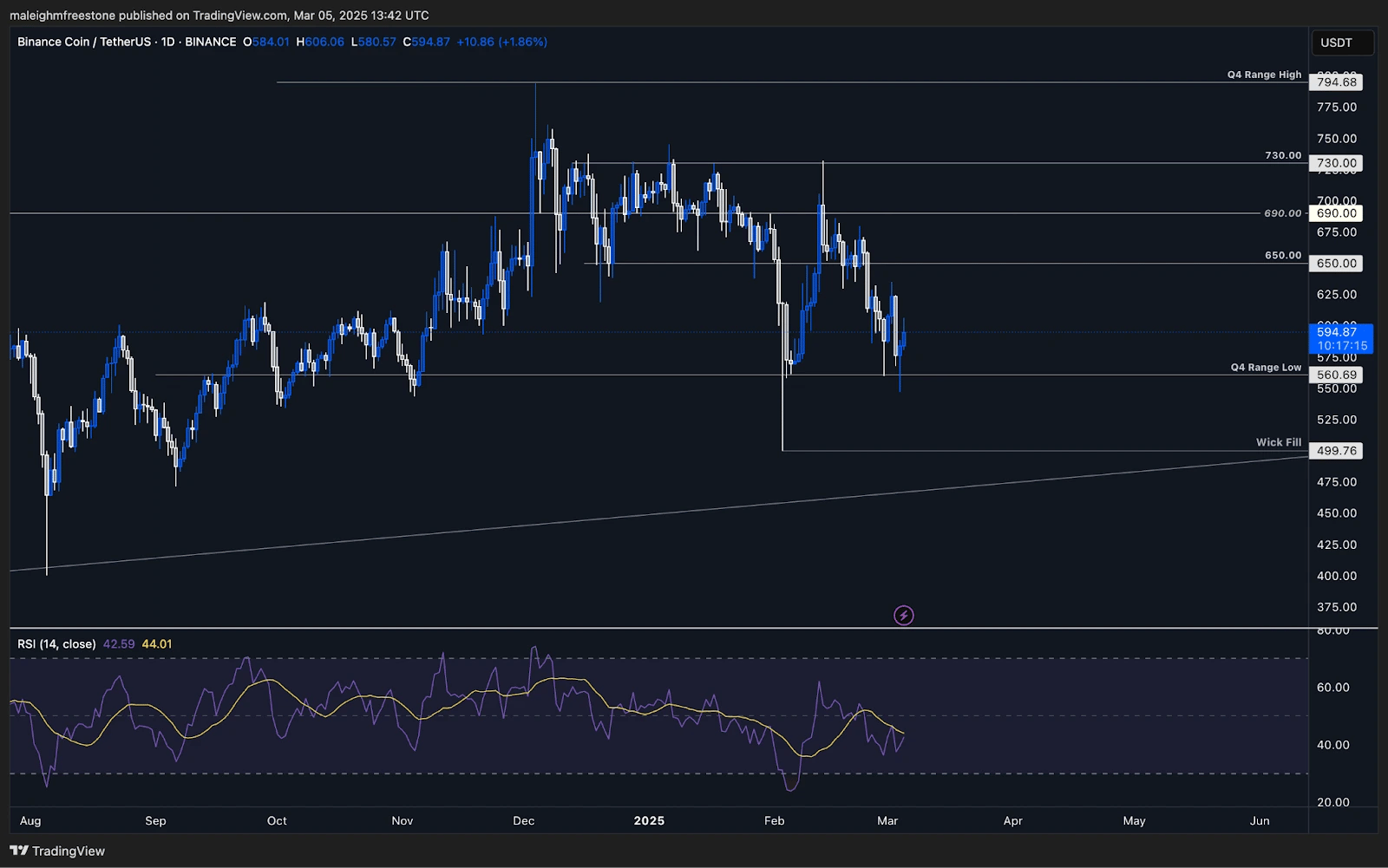

BNB:

Market context

BNB has been one of the stronger assets in the market over the past few weeks. CZ jumped on X and started engaging with the community, which led to fresh bidding, pushing the price from $650 to the $730 range. It hasn't pulled back again as deeply as the rest of the market which suggests if we get further downside market it may have room to go lower, there's still an untested wick down to $500 from February 3rd, which price could get magnetized toward if conditions continue to shift more and more bearish.Technical analysis

- $650 is near-term resistance, with the price struggling to push through.

- Short liquidations are stacked around $700, making it a key level to watch.

- RSI is in middle territory here, but it is below its moving average, which likely means the trend is still on the downside.

- It would be a stretch for the price to trade into $700, but if it does, that would be an attractive short entry.

- BNB has bounced off the Q4 range low, confirming buyers are still present, but macro resistance remains strong.

- Next Support: $560

- Next Resistance: $650

- Direction: Short-term bullish

- Upside Target: $650

- Downside Target: $500

Cryptonary's take

BNB has been stronger than a lot in the market, but there's a buildup of short liquidations of around $700, making it a key level to watch. If BNB trades into $690–$700, that's an area to start stacking shorts.It's a bit of a big ask to see prices push that high, but if we do get upside moves in the short term or over the next few weeks, that zone is where the best risk-reward setups are likely to form. If leverage starts ramping up again, $700 could be the area that catches late longs before any downside plays out. We can see price grinding steadily higher over the next week or so but expect some volatility around Friday.

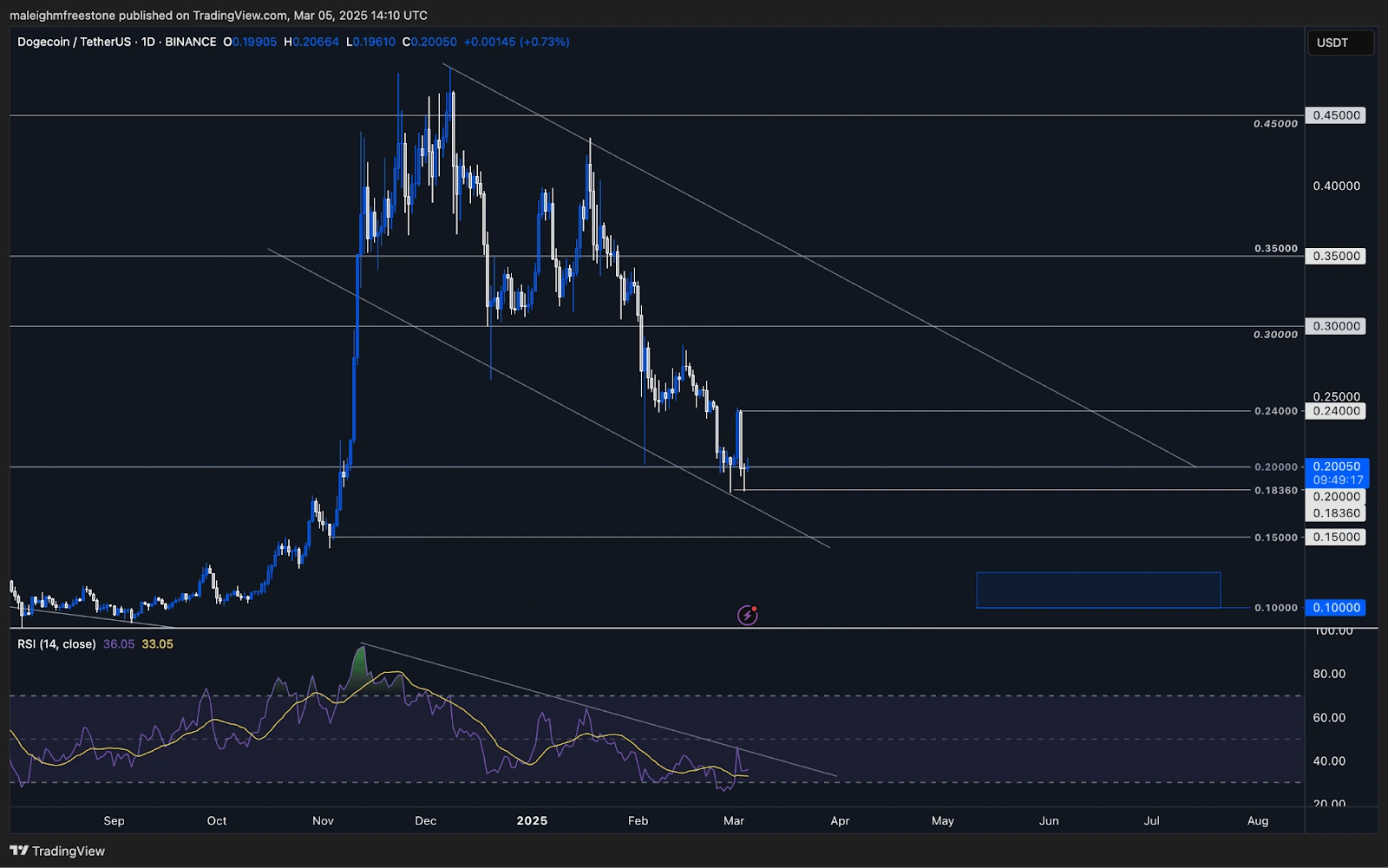

DOGE:

Technical analysis

- $0.191 is key support, and the price is currently holding above it.

- DOGE has held up well compared to the rest of the market but was also bid off the back of the Crypto Reserve news.

- The price moved up 20% before fully retracing that move. DOGE has a key support at $0.191, which has held strong so far in recent context.

- We have resistance at around $0.24 which was marked off the back of the crypto reserve pump.

- RSI on the daily is just above oversold territory which may mean we can see a short-term bounce, particularly as the RSI sits above its moving average. A clear bull reversal would be a breakout of the RSI's downtrend line.

- If a breakdown happens, $0.14 is the next major level where liquidity is positioned.

- DOGE has already pulled back significantly, but further downside isn't off the table, especially if market-wide de-risking continues.

- Next Support: $0.18360

- Next Resistance: $0.2400

- Direction: Neutral

- Upside Target: $0.2400

- Downside Target: $0.1000

Cryptonary's take

DOGE is in a different spot compared to most other assets, having already pulled back quite a bit. While $0.191 is holding for now, caution is needed, and this wouldn't be a level to bid. If market conditions worsen, $0.10 could come into play in the longer term and we have shorter-term support being $0.14, which price could roll over to after a little bounce to the upside. We'll monitor how this support holds up, but for now, the approach is to remain cautious.PEPE:

Technical analysis

- With traders de-risking further, momentum remains on the downside. PEPE has already retraced around 75% from its high, which is a significant pullback, which again like DOGE doesn't mean it can't go lower.

- PEPE has broken below the 0.000008 level, which was a key level as it marked the start of the breakout from the Trump election. This breakdown signals a shift in sentiment, if we were to break anywhere buyers previously saw this as an attractive area to bid, the market would now view this as a price where they would be happy to sell.

- 0.000004 is the next major support, the last significant in March 2024.

- 0.00001000 Is the next near-term key resistance where we would likely see exhaustion if the price traded to that level.

- Similar to Doge the RSI is nearer the oversold territory on the daily around 35 however, it's below its moving average line.

- PEPE has seen a deep retrace, but further downside remains on the table.

- Next Support: $0.00000630

- Next Resistance: $0.00000800

- Direction: Short-term bullish

- Upside Target: $0.00001000

- Downside Target: $0.00000550