ALT season sparks as BTC dominance fades

As BTC dominance falls and ALT season ignites, coins like XRP, SOL, and ETH take centre stage. The market watches Powell's Fed comments closely, with opportunities brewing across fresh plays like POPCAT and WIF. Let's explore the trends shaping the crypto cycle.

In this report:

- Data This Week & Increased Fed Speak and What This Means?

- The Scope of ALT Season.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data this week

The Equity market (S&P500) moved higher yesterday following a positive ISM Manufacturing print and a potentially more dovish-than-expected speech from FED member Waller. Waller said that he still leans towards a FED interest rate cut in December despite the slight recent uptick in core inflation.Alongside Waller, we have a plethora of FED speakers this week, with Chair Powell being late in booking a speech for Wednesday. The market is anticipating that Powell might be trying to get out early to guide the market that next year, there may be fewer interest rate cuts.

This is likely due to inflation having a slight uptick recently, whilst the FED also pre-empts Trump policies that may add to inflation. If this is Powell's messaging line, the market should still be fine digesting it, assuming growth remains positive and the labour market continues to hold up. We expect that both will hold up.

We have non-farm payrolls, and the unemployment rate out on Friday. The expectation is for a move down in the Unemployment Rate to 4.1% and for Non-Farms to come in at 194k.

These figures would be strong, and the market would likely react positively to them. This has also been supported today with a strong JOLT's Job Openings coming in at 7.74m, showing a reacceleration in Employers looking to hire.

Beyond this week, we have inflation data next Wednesday (11th) and then the FED Meeting on the 18th, during which we'll also get updated economic projections for next year.

The scope of ALT season

Firstly, we absolutely believe that ALT season has begun, and we can see that in the charts below, we have all of the movements that we have previously predicted and called for.- BTC Dominance has broken down.

- ETH/BTC looks as if it's bottomed on a zoomed-out timeframe.

- TOTAL3 (Crypto MCap minus BTC and ETH) has broken out.

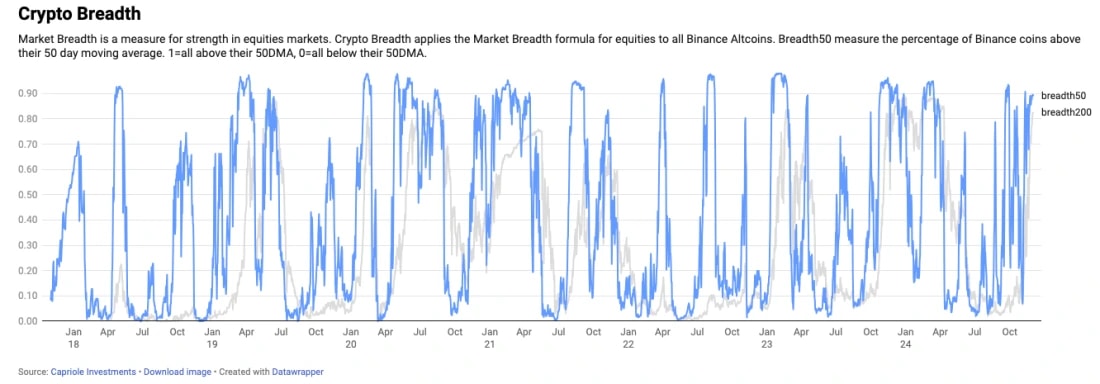

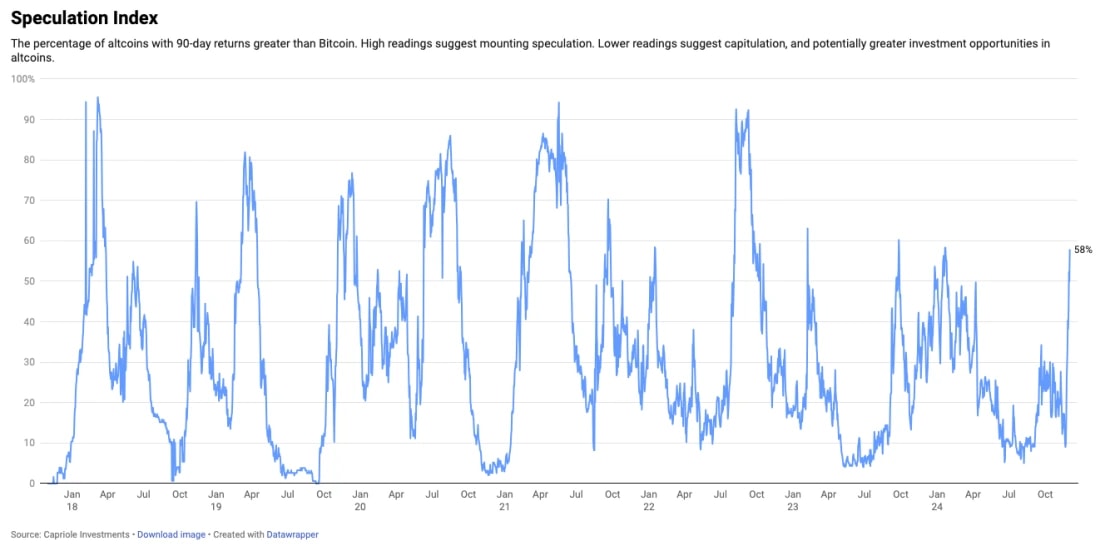

- Crypto Breadth and Speculation Index from Capriole are high values.

ETH/BTC bottomed?:

TOTAL3 broken out:

Crypto breadth from Capriole:

Crypto Breadth applies the Market Breadth formula for equities to all Binance ALT coins. Breadth measures the percentage of coins above their 50-day moving average.

Speculation index from Capriole:

The percentage of Altcoins with 90-day returns is greater than BTC. High readings suggest mounting speculation. Lower readings suggest capitulation.

There's no doubt that the above shows us that we're likely in the early innings of an ALT season. We have begun to see old-cycle coins move along with ETH. One of the more notable movers has been XRP, which has added more than $70b in MCap despite half of its supply still in the Ripple Treasury.

We're expecting the capital rotation to trickle down as the weeks and months go on. We believe we're at the ETH stage of this bull market and that there is more still to go.

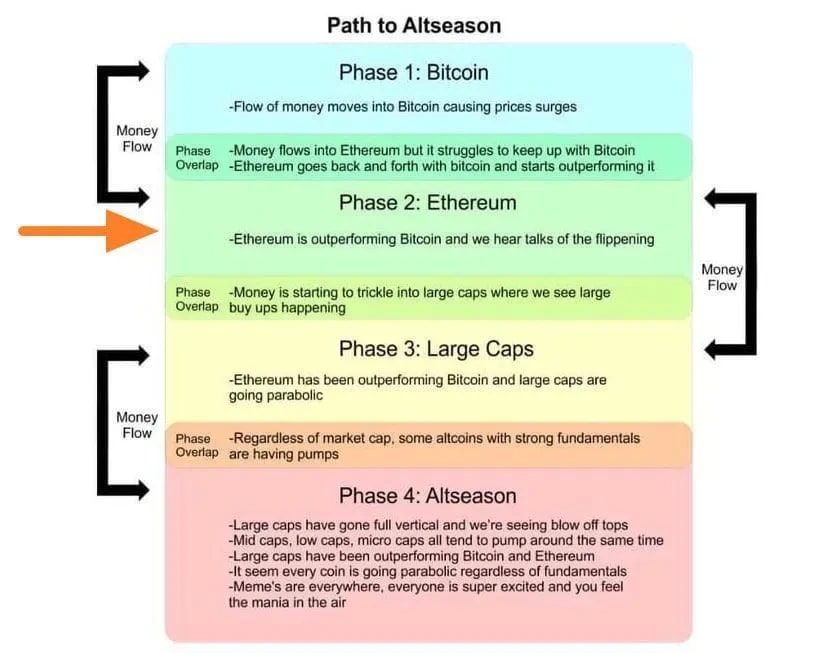

Path to Alt season: