Market Direction

Disclaimer: This analysis is for informational purposes only and not financial advice.

TLDR:

- DOGE: Poised for bullish continuation above $0.261; watching $0.45 for momentum.

- LINK: Accumulation structure; targets set at $28.8 and $36.8 if range holds.

- XRP: Year-long re-accumulation; breakout above $3.3 could bring rapid highs.

- PENGU: Bull flag consolidation; break of $0.032 targets $0.038 and $0.05.

- AURA: $0.1 is pivotal; upside opens toward $0.15 and potentially ATH at $0.25.

- FARTCOIN: Needs to reclaim $0.678; range play could target $1.13 and $1.61.

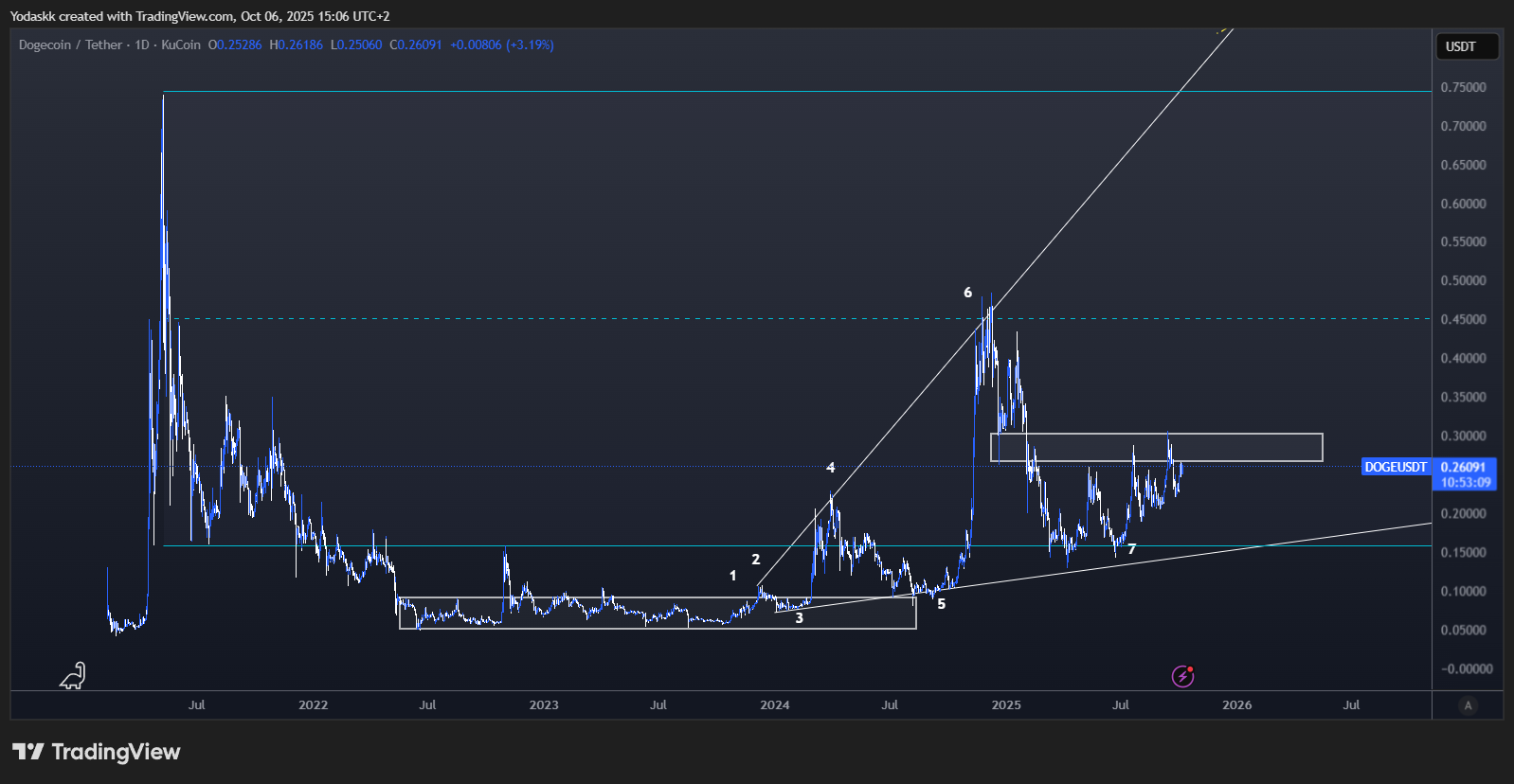

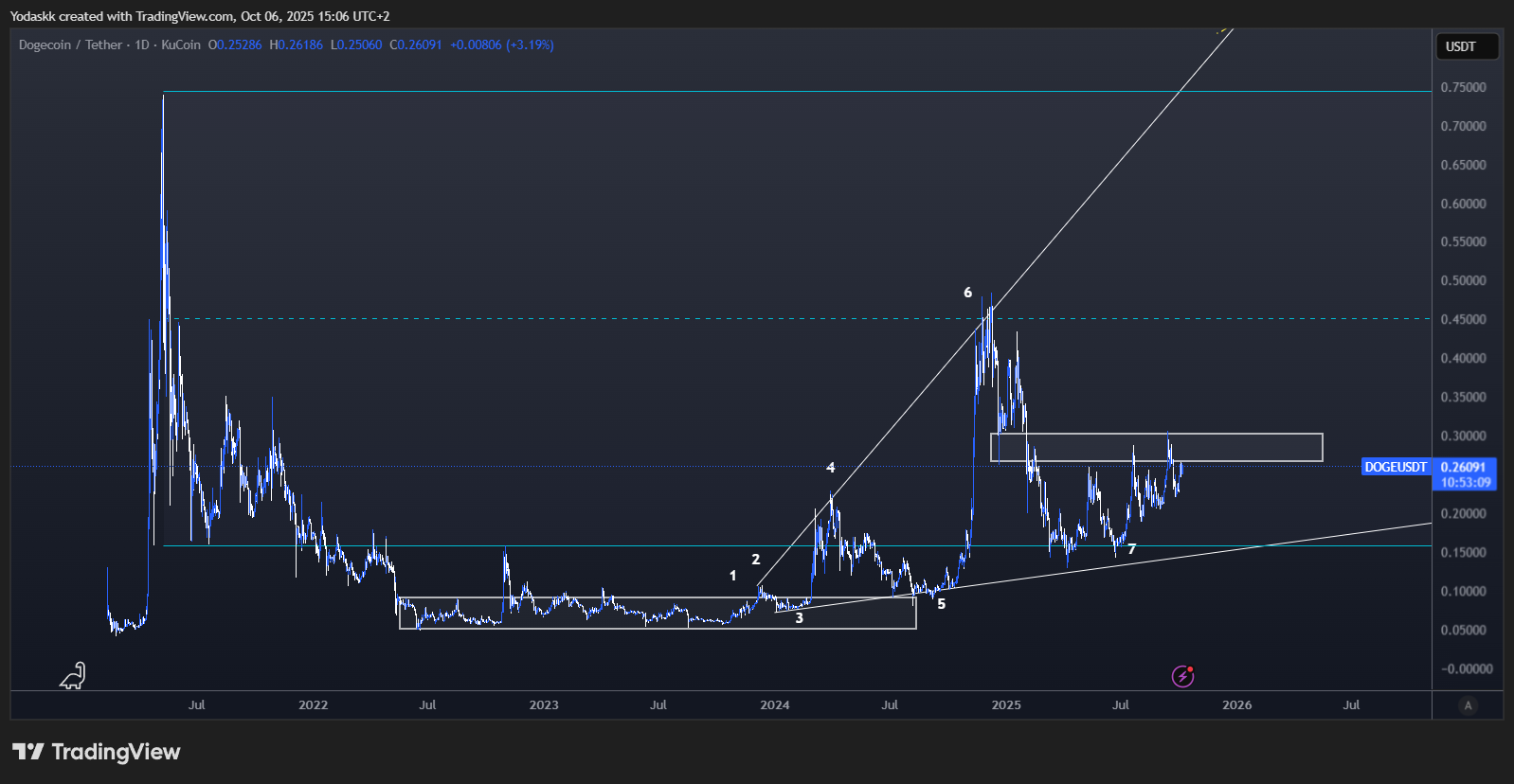

DOGE:

- Price structure favored by a Wyckoff accumulation range from May 2022 to Feb 2024.

- High timeframe Livermore Accumulation Cylinder suggests potential for explosive upside action.

- Currently ranges between $0.159 and $0.74; resistance just overhead at $0.261.

- Requires breakout above $0.261 to push toward key resistance at $0.45.

- A move above $0.45 likely to trigger a run toward previous ATH at $0.74.

Technical analysis

- Multiple higher lows and highs established since 2022 bottom.

- Livermore pattern in play; confirmation requires a firm close above $0.261.

- Failing $0.159 range support would threaten trend structure.

Cryptonary's take

DOGE remains coiled in a bullish long-term pattern. With a resistance test imminent, a breakout could trigger FOMO. Only a breakdown of the $0.159 range would negate the bullish thesis.- Next Support: $0.159

- Next Resistance: $0.261, then $0.45

- Direction: Bullish

- Upside Target: $0.45 / $0.74

- Downside Target: $0.159

LINK:

- Completed Wyckoff accumulation from May 2022 – Oct 2023.

- Higher low structure suggests Livermore Accumulation Cylinder and bullish potential.

- Currently within the $20.7–$37 range; targeting $28.8 mid-range and $36.8 range top next.

- Breakout above $36.8 eyes ATH at $53.

Technical analysis

- Solid recovery into main range; holding $20.7 is pivotal for bulls.

- Measured targets at $28.8 and $36.8.

- Downside risk below $20.7 reopens for deeper correction.

Cryptonary's take

LINK is showing trend strength coming out of a 2-year base. Above $28.8, expect accelerated returns. Only decisive failure of $20.7 flips the structure negative.- Next Support: $20.7

- Next Resistance: $28.8 / $36.8

- Direction: Bullish

- Upside Target: $36.8 / $53

- Downside Target: $20.7

XRP:

- 6 years of re-accumulation from 2018–2024, breakout in Nov 2024.

- Price is stalling near ATH for almost a year after breakout.

- Current range $2.73–$3.3 offers consolidation base ahead of next move.

- Breakout above $3.3 triggers new all-time-high momentum.

Technical analysis

- Year-long range is constructive for the next push higher.

- BTC strength would quickly propel XRP to the top of its $2.73–$3.3 range and new highs.

- Failure to hold $2.73 reopens range trade lower.

Cryptonary's take

XRP’s structure remains bullish. A $3.3+ break would trigger another impulsive all-time-high move. Watch for $2.73 support to hold if altcoins correct.- Next Support: $2.73

- Next Resistance: $3.3

- Direction: Bullish

- Upside Target: ATH, aggressive move higher

- Downside Target: $2.73

PENGU:

- Massive rally between April and July 2025, now consolidating.

- Range established between $0.0268 and $0.050; currently forming a 2-month bull flag.

- $0.032 horizontal resistance is key for upside continuation.

- Breakout targets $0.038 (mid-range) first, then $0.05 (range top).

Technical analysis

- Bull flag pattern favors a continuation move above $0.032.

- Range low $0.0268 must be defended for bull case.

- Measured move targets $0.038 and $0.05 in breakout scenario.

Cryptonary's take

PENGU’s recent retrace has cleaned out weak hands. Strength above $0.032 sets up a quick move to $0.038 and $0.05, though managing risk at $0.0268 is essential.- Next Support: $0.0268

- Next Resistance: $0.032 / $0.038

- Direction: Bullish

- Upside Target: $0.038 / $0.05

- Downside Target: $0.0268

AURA:

- $0.1 horizontal is the main pivot for trend direction.

- Recent move reclaimed $0.1 and broke above downtrend line.

- Holding $0.1 targets $0.15 next, then ATH near $0.25 if momentum continues.

Technical analysis

- $0.1 remains the battleground; sustained bid confirms bullish reversal.

- $0.15 is the breakout threshold for price discovery.

- Losing $0.1 flips structure back to neutral/bearish.

Cryptonary's take

AURA’s catalyst is now a retest and hold of $0.1. Bears must push price back below to regain control. Bulls eye $0.15 and $0.25 as key levels for the next move.- Next Support: $0.1

- Next Resistance: $0.15

- Direction: Bullish

- Upside Target: $0.15 / $0.25

- Downside Target: $0.1

FARTCOIN:

- Currently challenging resistance at $0.678.

- Reclaiming $0.678 puts the price back in the $0.678–$1.61 trade range.

- Classic range plays target $1.13 (mid) and $1.61 (top).

Technical analysis

- Watching for either rejection at $0.678 or reclaim to trigger range trade setup.

- Below $0.678 remains trendless, above $1.13 unlocks strong upside momentum.

Cryptonary's take

FARTCOIN is at an inflection point. Reclaiming and holding the main resistance creates an immediate range trade toward $1.13 and $1.61.- Next Support: $0.678

- Next Resistance: $1.13 / $1.61

- Direction: Neutral

- Upside Target: $1.13 / $1.61

- Downside Target: $0.678

Closing thoughts

BTC is coiling just below all-time highs, and once it breaks and holds above $125K, altcoins are likely to follow with force.

Many majors and low caps are coming out of multi-year accumulation ranges. The setups are there, now it’s a game of patience and positioning.

Any correction or leverage flush we get in the next weeks is another opportunity to position for what looks like a bullish Q4. It has historically delivered some of the strongest moves, and all signs point to this year being no different.

Cryptonary, OUT!