Battle of Majors (4): BTC vs ETH vs SOL

It’s been a month since our last deep dive, and in that time, the total market cap has danced between key zones, building momentum for what could be a seismic move. Bitcoin and Ethereum are both facing their own make-or-break moments while Solana continues to tighten its grip on market share. The bull flags are flying high, and the question is no longer if we’ll see a breakout but when.

General market overview

The stage is set, and the market is holding its breath. After weeks of volatility, dips, and recoveries, the crypto market is now primed for a defining moment. We’ve watched the market test critical levels, flirt with breakouts, and consolidate into tight structures. But now, we stand on the edge of something much bigger.In this edition, we shift our focus to Ethereum—a giant in waiting—and examine how its performance could set the tone for the next few months. We’re also introducing a new angle—fundamental research comparing Solana and Ethereum—to give deeper insight into how these two giants are positioning themselves in this cycle. With the entire market coiling up, this could be the moment that defines the rest of 2024. Let’s dive into the details and see what’s in store for the majors.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Total market cap

The market’s been dancing on the edge. The last few weeks have seen a sharp dip, followed by a swift recovery, bringing us right back to where we were in late September. Back then, we were watching closely as the total market cap was breaking out of the 2.24 trillion range, but a pullback to the 2 trillion zone reset the stage. What’s important is how the market took that pullback—forming a solid double bottom at the grey box support on the daily timeframe, showing us that the bulls aren’t done yet.- Resistance: The market is now facing rejection at 2.29 trillion, right at the top of the bull flag that’s been forming for an incredible 7 months (or 215 days, for those counting). This level is crucial. A clean break above 2.29 trillion could trigger a full-blown rally.

- Support: On the downside, the 2.12 trillion zone holds strong, providing a solid base for any further consolidation.

- Potential scenario: If the total market cap breaks above and holds 2.29 trillion, we could be in for a market-wide explosion of bullish momentum. But if the price falters, the 2.12 trillion support is there to catch the fall and give us time to build a stronger base.

Conclusion

We’re at a tipping point—if the market can push through $2.29 trillion and hold, get ready for fireworks. The consolidation is nearing an end, and when it breaks, it’s going to be massive.

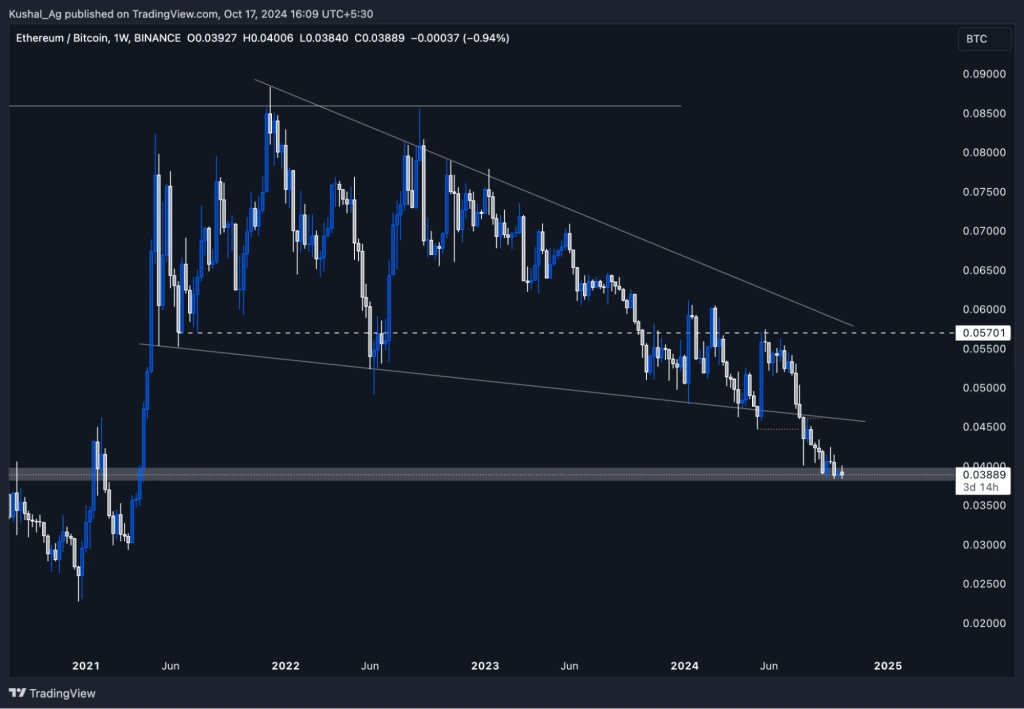

ETH/BTC

Ethereum is sitting at a crossroads. For the past six weeks, the ETH/BTC pair has clung to the 0.04 support level, refusing to break down despite multiple tests. This is more than just consolidation—this is Ethereum holding the line, preparing for what could be a defining reversal against Bitcoin.- Support: The 0.04 grey zone is rock solid, and even if the price wicks down to 0.035, this area is shaping up to be Ethereum’s bottom against Bitcoin.

- Resistance: To really get things moving, ETH/BTC needs to reclaim the 0.045 level. This is where we start seeing Ethereum taking back some control from Bitcoin.

- Potential Scenario: The longer Ethereum holds this support, the stronger the eventual move. Once it breaks 0.045, expect capital to flow heavily into ETH, giving it the momentum to start outperforming Bitcoin in the coming months.

Conclusion

Ethereum has been quietly holding its ground, and the pressure is building. With key support intact, the next leg up could see Ethereum lead the charge in this bull run.

SOL/BTC

Solana continues to surprise. While other assets have been stuck in indecision, SOL/BTC has been consolidating in a very tight range, signalling a potential breakout on the horizon. The price is stuck between 0.0023 and 0.0024, with the 200 EMA right in the middle at 0.0023. This isn’t just consolidation—it’s Solana building strength for its next move.- Support: The 0.0023 level, along with the 200 EMA, is acting as a crucial support zone. It’s been tested, held, and is ready for a push.

- Resistance: A break above 0.0024 is what we’re watching for. If SOL/BTC can clear this level, the next target is 0.0026—a move that could spark serious momentum.

- Potential scenario: Solana’s price action is tight, but tight consolidation usually precedes big moves. If SOL/BTC breaks above 0.0024, we’re likely to see a strong rally in the weeks ahead.

Conclusion

SOL/BTC is coiling up for something big. A break above 0.0024 could be the catalyst for Solana’s next leg up, signalling that it’s ready to lead the market once again.

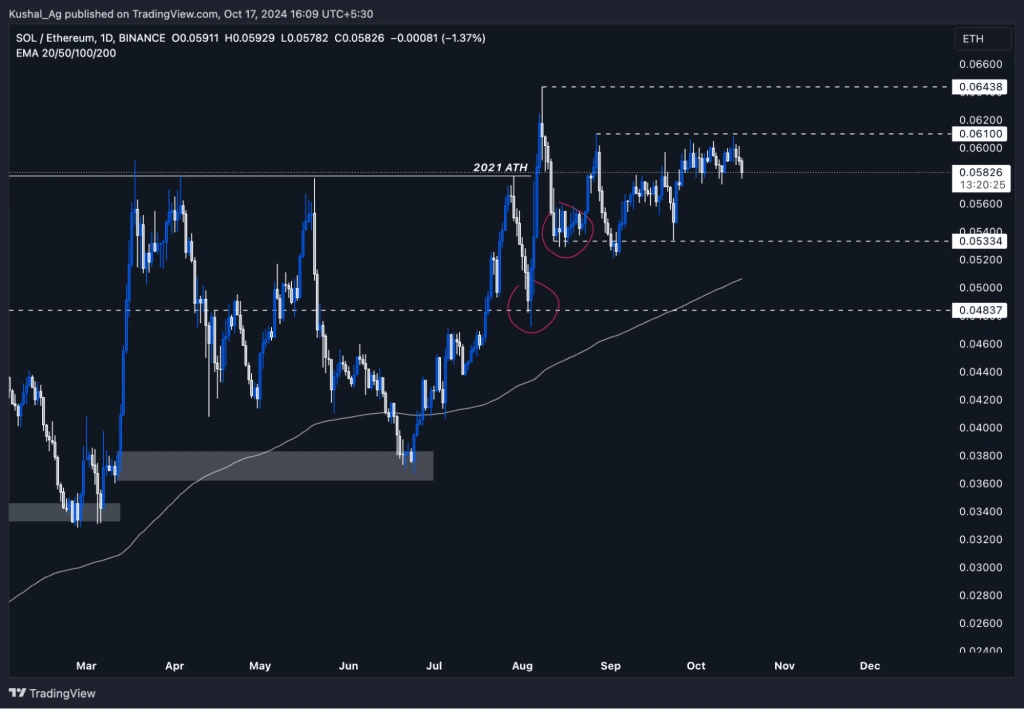

SOL/ETH

Solana versus Ethereum is shaping up to be a battle of titans. SOL/ETH has been consolidating just under the 0.061 resistance level, preparing for what looks like its next major move. While Solana has held strong against Bitcoin, it’s also quietly positioning itself to challenge Ethereum.- Support: The 0.0533 level remains a key support, with the 200 EMA around 0.05 acting as a solid backup if we see any deeper pullbacks.

- Resistance: Solana is knocking on the door of the 0.061 resistance. If it breaks above this level, the next target is the 0.064 all-time high (ATH), which could be the launchpad for another major rally.

- Potential scenario: If SOL/ETH manages to push through the 0.061 resistance, we could see Solana outperform Ethereum in the short term, moving towards 0.064 ATH and possibly higher.

Conclusion

SOL/ETH is on the verge of breaking key resistance levels. If Solana manages to push through 0.061, it could be poised to outperform Ethereum, setting the stage for a major rally in the coming months.

Apart from technical analysis, let’s look at fundamentals a little bit for a better picture.

Inflation rate of SOL vs ETH

- Ethereum (ETH): Post-EIP-1559, Ethereum's inflation has been dynamic due to its burn mechanism. As of October 2024, Ethereum’s inflation rate has stood at approximately -0.054% since the merger, with a significant supply reduction of 136K ETH over the last two years. Ethereum's deflationary mechanism, especially during high transaction periods, creates a supply scarcity that positions it as "ultrasound money," a narrative strengthened by the network's growing staked supply.

- Solana (SOL): In contrast, Solana has a much higher inflation rate. Its current inflation rate is 5.1%, which will gradually taper by 15% annually until it reaches a terminal rate of 1.5% in 2031. Further, Solana’s burn mechanism, while active, has had a more limited effect compared to Ethereum. Only 1.1M SOL has been burned YTD, offsetting about 6% of the gross issuance. This fixed schedule makes Solana more inflationary in the short term but predictable for long-term investors.

Unlock vs. Pectra upgrade

- Solana's upcoming unlocks: One of the significant unlock events is expected in March 2025, which will release 7.5M SOL (worth $1.1B) into the market. Such unlocks typically can lead to sell pressure.

- Ethereum’s Pectra upgrade: At the same time, Ethereum’s next upgrade is scheduled for early 2025. The Pectra upgrade aims to enhance Ethereum’s staking system, increasing validator staking limits from 32 ETH to 2,048 ETH. The upgrade will also improve gas efficiency, rollup scalability, and smart contract functionality, positioning Ethereum as a more scalable and secure platform. These enhancements are key for Ethereum’s future dominance, especially in the growing institutional adoption of its Layer 2 solutions.

Layer 2s thesis: Ethereum vs Solana

- Ethereum’s Layer 2 Ecosystem: Ethereum’s success with Layer 2s is evident, with major institutions like Coinbase and Sony integrating their operations. Ethereum’s rollups dramatically reduce gas fees and improve scalability, drawing more projects and users into its ecosystem. This institutional growth further reinforces Ethereum’s leadership in decentralised applications (dApps), and the upcoming Pectra upgrade will only bolster this position.

- Solana’s Scaling Strategy: Solana focuses on base-layer scaling, notably with its Firedancer initiative, which could enable the network to process over 1 million TPS per core. Unlike Ethereum’s reliance on Layer 2s, Solana’s core network is optimised for speed and low-cost transactions, giving it an edge in high-frequency trading and gaming sectors.

BTC dominance (BTC.D)

Bitcoin’s dominance is hitting the ceiling. BTC dominance has been slowly grinding upwards and recently hit 58.8%, just below the critical 60% level. This dominance spike has been a steady climb, but we’re nearing the point where the trend could reverse, unleashing the altcoin market.- Resistance: The 60% level is a major resistance for BTC dominance. The rising wedge formation that’s been in place for over two years is approaching its peak.

- Potential scenario: A push towards 60% is likely, but once dominance hits this ceiling, we expect a breakdown. This will be the signal for money to flow out of Bitcoin and into altcoins, sparking an altcoin rally.

- Market dynamics: Bitcoin is soaking up capital for now, but this could be its final push before the market rotates back to altcoins. The longer BTC dominance hovers near this level, the stronger the eventual breakdown will be.

Conclusion

BTC dominance is peaking, and once it hits 60%, we expect a significant shift in market dynamics. This could be the trigger for alt season, with altcoins finally getting their moment in the spotlight.

SOL dominance (SOL.D)

Solana is quietly capturing more market share. SOL dominance has been steadily climbing, consolidating just above the 200 EMA at 3.03%. Price is currently at 3.18%, and all signs point to Solana continuing to grow its market share as we head deeper into the bull cycle.- Support: The 200 EMA around 3% has been acting as a solid base, keeping Solana’s dominance in a bullish structure.

- Resistance: Solana is eyeing the 3.66% resistance, and a break above this level could lead to a significant increase in dominance, possibly reaching 4% in the coming months.

- Potential scenario: With Solana consolidating just above its support, it’s only a matter of time before we see another breakout. Once SOL dominance breaks through 3.66%, expect a major push towards 4%, solidifying Solana’s role as a market leader.

Conclusion

Solana’s dominance is quietly but steadily growing. With strong support in place, the next breakout could see Solana capture even more market share, potentially reaching 4% in the near future.

Cryptonary’s take

The market is coiling up, and the tension is palpable. Both Bitcoin and the Total Market Cap are testing critical levels, and it’s becoming clear that the next big move is around the corner. Bitcoin dominance is nearing its peak, but the real story lies in the altcoins—especially Ethereum and Solana.While we expect Solana to outperform Ethereum during this cycle due to its fast-growing ecosystem and aggressive market positioning, Ethereum is still a crucial long-term player. ETH remains undervalued at current prices, offering a discounted entry point for investors looking for solid returns over multiple cycles. With increasing institutional adoption and a dominant presence in decentralised finance (DeFi), Ethereum is here for the long run, making it an excellent bet for those thinking beyond this cycle.

This is the moment when the bulls need to step up. A breakout in the Total Market Cap above 2.29 trillion could be the signal for the next explosive rally, and when that happens, Ethereum and Solana will be front and centre. Position yourself accordingly: Solana is set to lead this cycle, but don’t sleep on Ethereum’s long-term value.

Get ready. The market is poised for something big, and when the dust settles, the majors will have paved the way for what could be the most exciting leg of this bull run yet.