Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

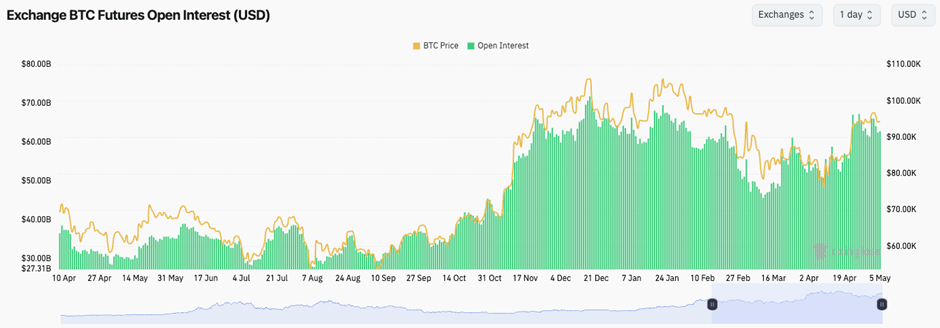

- On the price move up to $97,000, the negative Funding reset to neutral (a Short-squeeze), but the Open Interest remains relatively high in USD terms. This suggests that the build-up in Shorts has mostly been squeezed, but with OI still high, there's more room for this to potentially develop.

Technical analysis

- BTC has seemingly rejected through the $97,500 level, with price now below, but battling at the mid-level of the range at $95,700.

- If the price falls below the local low of $93,400, it will likely reach $90,000. This is a major psychological support that we're watching, and if lost, then $86,00 is on the cards.

- If price can recover $95,700, then it's possible we see a move higher to the major resistance level at $98,900. If this were to happen, we'd expect that to be a local top, and likely an area where we'd strongly consider a more sizeable Short.

- The RSI did briefly pop into overbought territory, but since it has pulled back, and it's now beneath its moving average. It's possible we see a move higher in price that then potentially puts in a bearish divergence (higher high in price and lower high on the oscillator) in overbought territory, and price can then pull back from there.

- Next Support: $91,700

- Next Resistance: $98,900

- Direction: Bearish

- Upside Target: $98,900

- Downside Target: $86,000

Cryptonary's take

We move into a pivotal week with a FED Meeting on Wednesday 7th, where we expect Powell to be somewhat hawkish and keep his optionality open. This might lead to a pullback in risk assets as rate cut bets are potentially pushed out to July, maybe even September.We're expecting BTC to have either put in a local top, or for a local top to be very close here. We're not looking to add to Spot bags at the current price, and we're expecting a pullback over the coming 2-6 weeks to take the price back to at least $86,000.