Bearish sentiment dominates BTC, ETH, SOL, and HYPE

As uncertainty looms, Bitcoin and Ethereum are showing mixed signals while Solana and HYPE deal with tough support zones. Let’s explore the current price action and what the near-term outlook looks like for these assets.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC:

- BTC's Open Interest has pulled back a tad whilst Funding remains close to 0.00%, indicating that there isn't huge appetite amongst traders to be placing heavy leverage bets.

Technical analysis

- Price rejected into the $87k to $88k region (our Short Box), and price has pulled back to $82k, which we have identified as a local support.

- $81,500 to $82,000 is the local support zone, and the price has bounced slightly from there over the last 24 hours.

- There is now a very local resistance at $84,500, with $87,200 as a more meaningful resistance. Beyond that, the key level is $91,700. But, we don't expect this level to be even tested anytime soon.

- Below $81,500 to $82,000 (the local support), the major support is likely the zone between $76,000 and $78,000.

- Interestingly, the RSI broke out of its downtrend, it pulled back to retest the downtrend as support, and it's now bouncing. However, it does remain below its moving average.

- Next Support: $81,500

- Next Resistance: $87,200

- Direction: Bearish

- Upside Target: $85,500

- Downside Target: $78,000

Cryptonary's take

Bitcoin is in a tighter range between $81,500 and $87,200, however, the levels on either side are also open. These would be $78,000 and $88,500. We don't, however, expect any major upside in the short-term, and in fact, we are quite confident that this price range will break, and the break will be to the downside.The market is on edge going into Trump's reciprocal tariff announcement tomorrow, and even if that comes in lighter than expected (we don't think it will), then any rally off the back of it we expect to be short-lived.

Ultimately, in the short or medium term, we do expect the price to break down and eventually retest that $76,000 to $78,000 level. We'll exercise patience in the meantime.

ETH:

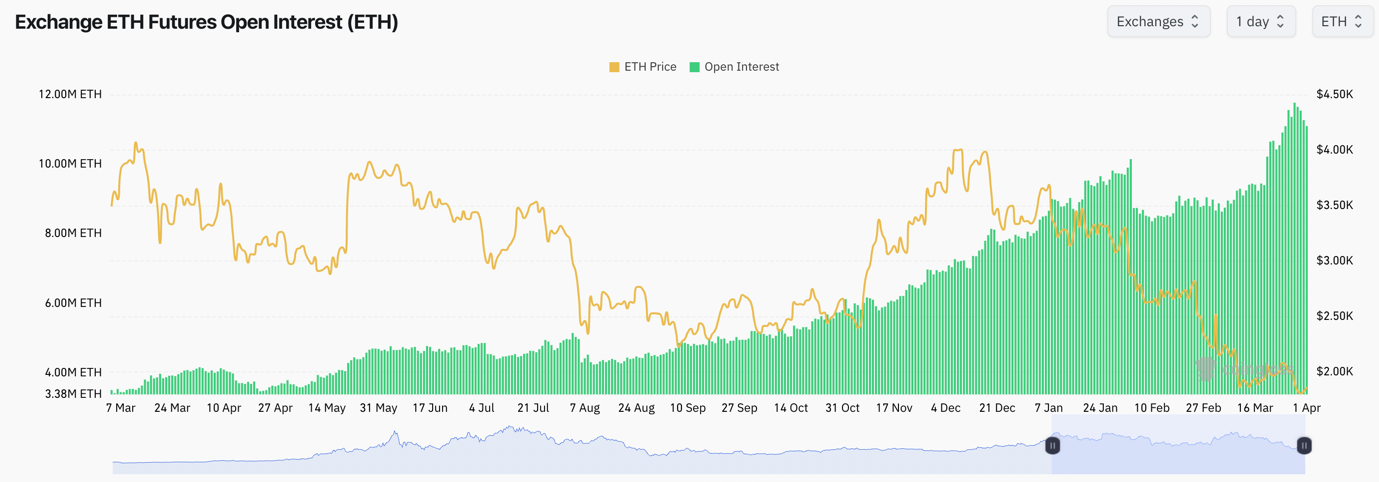

- ETH's Open Interest remains close to all-time highs (by number of coins), whilst the Funding Rate remains slightly positive. Again, there isn't much signal in this currently other than the fact that the carry trade is still being had, whilst there isn't a huge appetite amongst leverage traders to be taking sizeable trades.

Technical analysis

- ETH rejected at $2,100 and price pulled back to the horizontal support of $1,745, as we expected it might.

- Price is now trying to bounce from this $1,745 horizontal support level. The RSI has also put in back-to-back bullish divergences (lower lows in price, with higher lows on the oscillator). This could help fuel a move higher.

- If the $1,745 horizontal support is broken to the downside, then the next major horizontal support is at $1,530. If $1,745 is broken, then expect $1,530 swiftly, although we do think $1,745 can hold in the short-term.

- To the upside, the horizontal resistances are $2,100 and $,2160, with the most significant at $2,420, although, to be frank, we don't expect this to be retested anytime soon.

- Next Support: $1,745

- Next Resistance: $2,100

- Direction: Neutral

- Upside Target: $2,100

- Downside Target: $1,530

Cryptonary's take

Despite the general picture for risk assets not being very positive currently, ETH is squeezing into a local downtrend line, having put in two back-to-back bullish divergences. If there is a general breakout in the market, then ETH does look like one of the plays that could get a good breakout.The issue with ETH recently has been its underperformance. So, even though this chart might look good for a breakout (if we're wrong on the macro and the market can break out) then ETH might rally but still underperform.

Whilst the structure looks constructive, we're not looking to chase strength in the current macro backdrop. We'd be more interested in Shorts if the price runs into key resistances, say at $2,420, but we don't expect this level to be retested anytime soon. For this reason, we just steer clear of ETH for now. The play recently was BTC into the Short box zone.

SOL:

- SOL's Open Interest (by the number of coins) remains really high, but the Open Interest in USD isn't close to its highs. This therefore just tells us that OI is high by a number of coins because the price of SOL has halved in the last few months.

- Funding Rates like ETH and BTC are close to 0.00% but are very slightly positive. There is little signal here from a leverage perspective, to be honest.

Technical analysis

- SOL rejected off the local horizontal resistance at $148, having put in the hidden bearish divergence (lower high in price, higher high on the oscillator).

- Price has since pulled back to the horizontal support of $120 and retested that area as support, as we expected it would do.

- Price is now attempting to bounce, but the RSI is moving into the underside of it's moving average. It's possible this is a local stalling area for SOL's price here in the short-term.

- Price is essentially in this tighter zone between the $120 horizontal support and the $148 horizontal resistance. Beyond that, $98 is the major support and $162 is the major horizontal resistance.

- Next Support: $120

- Next Resistance: $148

- Direction: Neutral/Bearish

- Upside Target: $148

- Downside Target: $98

Cryptonary's take

In the short term, we expect the price to remain range-bound between the levels we've identified ($120 to $148); however, in the short/medium term, we do expect the price to break down and test $98. At that point ($98), that's where we'd be strongly considering buys.For now, though, our bearish bias remains as we expect a continuation of the fiscal unwind and the uncertainty surrounding the new Trump administration.

If you're a range trader, you can play the range. If not, remain patient, and we'll look to play the wider range ($98 support of $162 horizontal resistance).

HYPE:

- Price rejected off the horizontal resistance of $17, and price has pulled right back to the main horizontal support of $12.00.

- Price is beneath the local horizontal mid level (between the range) at $14.50, and therefore in the bearish part of the range.

- Price is in a downtrend and it's now squeezing into its main downtrend line. This might help set up the price for a potential breakout if we see Trump's tariffs potentially come in softer.

- The RSI has moved out of oversold territory, but it's now run up into the underside of its moving average, so this might be a rejection level for HYPE.

- Next Support: $12.00

- Next Resistance: $14.50

- Direction: Neutral

- Upside Target: $14.50

- Downside Target: $10.00

Cryptonary's take

Ultimately, we can keep this relatively simple. Due to the bearish macro setup and the lack of new liquidity/stimulus, we expect risk assets to continue to pull back further.Therefore, we do see HYPE breaking below $12.00 in the short or medium term. Where's stopping point/local bottom will be is hard to say, but we can take it in stages. The first stage of this is that we're expecting a breakdown of $12.00, and we see it as very possible that we see single-digit HYPE in the short/medium term.

We may then look to buy HYPE below $12.00, but we'd likely let the price find a price bottom first, and we expect this to be in the single digits.