Granted, the movement is not quite northbound.

Yet, this doesn’t change our main trajectory!

Opportunities will always be there for the taking, so we have our eyes on a few assets we’re betting on if the market starts rising again.

Let’s dive into the secrets in the charts.

TLDR 📃

- Bitcoin heads for support at $28,750. Our priority? Staying above this level, otherwise, it’s going to get bloody in the crypto streets🩸

- Bitcoin’s dominance continues to fall, and altcoins will be heavily affected if its price loses support.

- We’re betting on Bitcoin bouncing from $28,750, and we have our eyes on an asset to capitalise on if that happens.

- A break of $32,000 will be the event that makes us risk-on to the fullest. In the meantime, some risks should keep you from making dangerous plays.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total market cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go.

Altcoins market cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Cryptonary's Portfolio

BTC | Bitcoin

BTC is aiming for support.

After a few weeks of indecision, Bitcoin seems to have decided, and it is now heading for support at $28,750.

Our priority? Seeing Bitcoin hold this level at all costs!

The entire market depends on BTC holding $28,750 as support, which means things can get bloody if our expectations are unmet. However, we remain bullish until we see a weekly closure under that level.

In the meantime, we’re putting our money where our mouth is in the July edition of Skin in the Game.

Bitcoin’s dominance

We expect more downside on the Bitcoin Dominance chart, but what does that mean for the market?

Think of it this way - Bitcoin’s dominance falling is actually a good thing; it means its market share drops and moves into altcoins instead.

However, Bitcoin’s dominance falling while its price is also falling means that it will get bloody pretty fast for altcoins – and that’s the risk we got on the table right now.

If you will risk-on, it should be in a favourable environment. However, a situation in which Bitcoin is still fighting to maintain support at $28,750 doesn’t look all that favourable.

But should Bitcoin break out above $32,000 in the next few days — we are going in with all we’ve got.

More on that in a bit.

ETH | Ethereum

DYDX | dYdX

ARB | Arbitrum

Cryptonary's Watchlist 🔎

DOT | Polkadot

RUNE | THORChain

SOL | Solana

MINA | Mina Protocol

Astar | ASTR

THOR | THORSwap

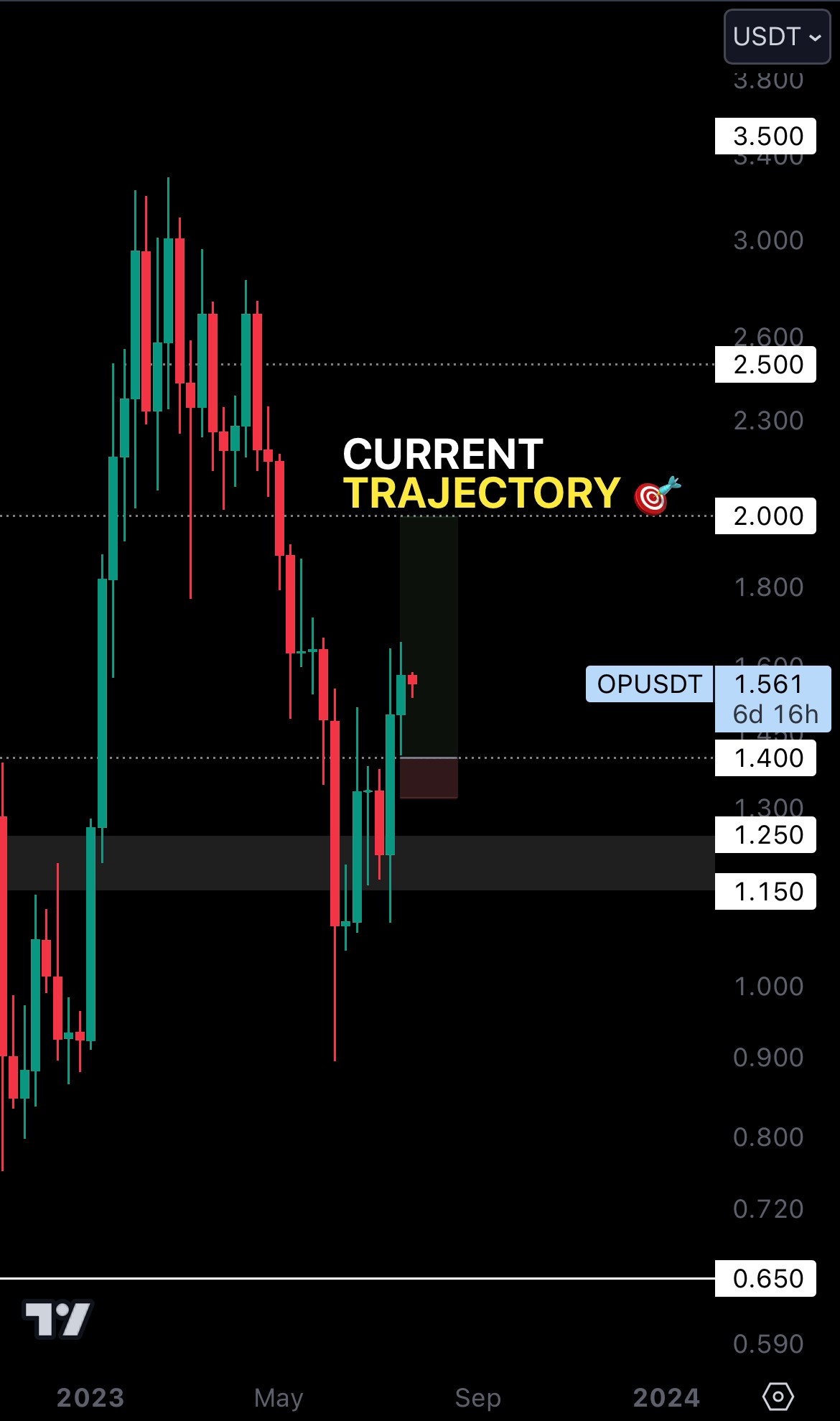

OP | Optimism

LDO | Lido DAO

Remember LDO? Its time is almost here 👀

We’ve been monitoring LDO’s price as it trades inside this triangle. We have our eyes on it is simple - it is close to breaking out/down.

Since our expectations are bullish for BTC (at least until we lose support), we’re looking at LDO from an opportunistic perspective with a target of $3.10.

The only invalidation for this scenario occurs if LDO closes a weekly candle under $1.85, the bottom side of its current support region.

Cryptonary’s take 🧠

The market is very close to a significant decision.

- We bottom out and start a new rally!

- We lose support and head into oblivion!

Unfortunately, only time will answer this question, but we’re leaning into the bullish side of things. 🐂

At Cryptonary, all hands are on deck to find you the biggest opportunities for profit, and we will be keeping you updated with everything that grabs our attention.

Now, it’s time to let the clock tick - we’ll be listening.

Action points 🎯

- What out for $32,000 – that’s the one event that will make us throw almost everything in the market. Until this breakout happens, we’d be trading in an uncertain market.

- Hopping on opportunities is always a good option but don’t place extreme bets until the breakout is confirmed.

- Got more questions? Hit us up on Discord in the “✍️・traders-pit” channel!

As always, thanks for reading.🙏

Cryptonary out!