Big Market Update: What's Next?

Markets just wrapped a huge week: the Fed cut rates, Big Tech earnings rolled in, and Trump and Xi struck a temporary truce. But Powell’s hawkish tone left traders uneasy. Let’s break down what happened and how it sets up the next few weeks.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Big Tech Earnings: Mag7 mostly beat expectations; Nasdaq strength remains concentrated in Big Tech. Meta fell 11% on higher AI capex guidance.

- Trump-Xi Truce: 1-year trade pause eases tariffs and tensions — short-term positive for markets.

- Fed & Shutdown: Fed cut 25bps, but Powell’s hawkish tone lowered December cut odds (65%). Weak labour data is still expected to drive cuts later.

- BTC Market: Long-term holders selling, ETF outflows ($959m), and key resistance at $112k–$113k limit upside near term.

- Cryptonary’s Take: Expect BTC to retest $98k–$104k before rebounding toward $125k–$135k by year-end. The December rate cut is a key catalyst.

Topics covered:

- Big Tech Earnings and Trump-Xi Meeting.

- The Fed and the Government Shutdown.

- Limited BTC Spot Bid.

- Cryptonary's Take.

Big Tech Earnings and Trump-Xi Meeting:

On Wednesday, we saw Meta, Google and Microsoft all report their Earnings, where revenues surpassed expectations. However, only Google's stock price increased, with Meta taking the more notable hit, down 11%, after they guided towards increased capital expenditure for AI build-out, which threatens future margins.Yesterday (Thursday 30th), we had more Mag7 companies report, Apple and Amazon. Both reported positively, beating on key metrics, and their share prices moved higher, although Apple had a more tempered reaction due to concerns over China sales.

Overall, Mag7 companies reported positively in this Earnings season, and this has reflected in the index, the Nasdaq. But, we do note that the performance is becoming more and more concentrated in the Nasdaq (by the Big Tech companies), and whilst this isn't an outright concern for now, it's something we're watching.

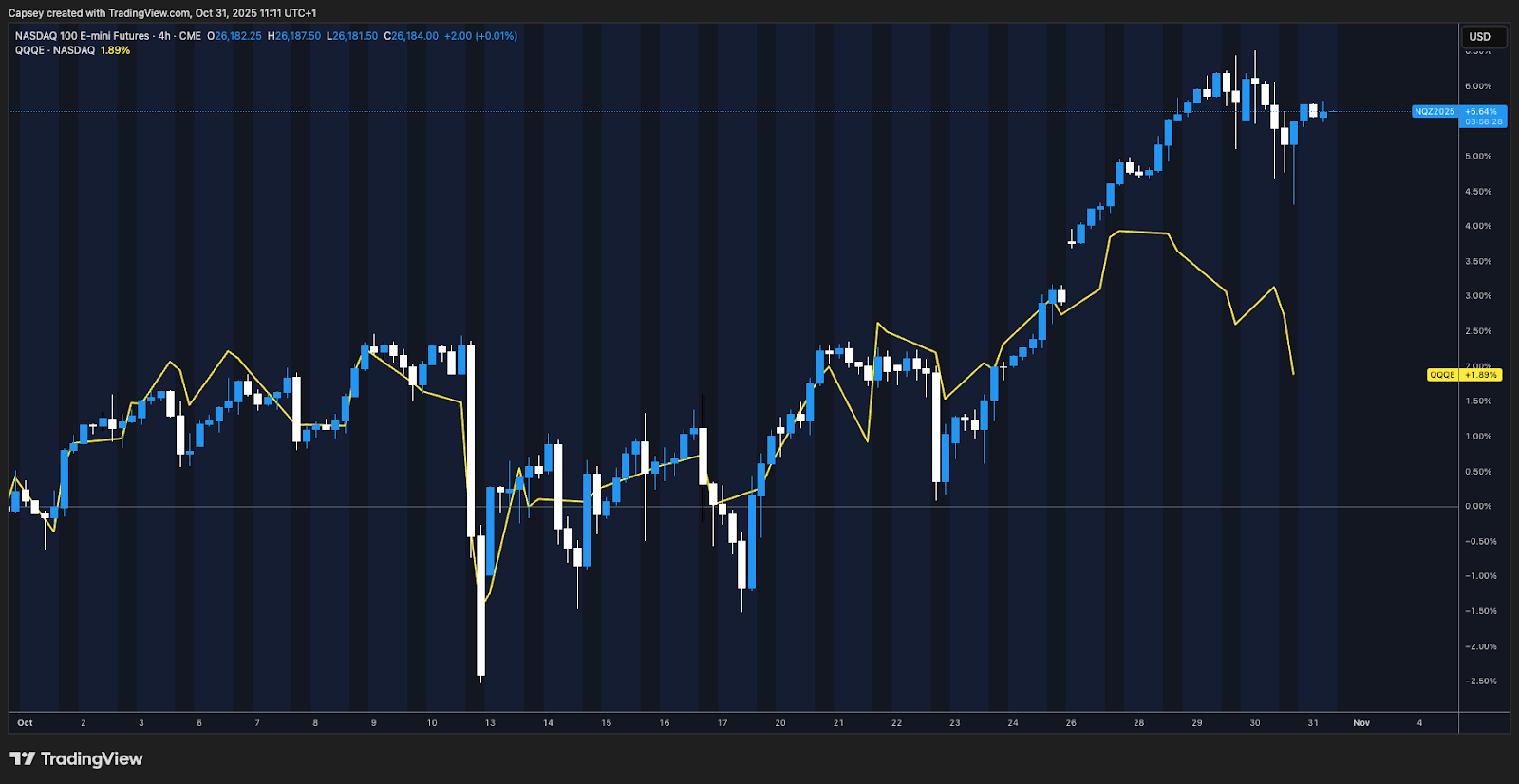

The following chart shows the Nasdaq performance since the start of October, compared to its equal-weight counterpart (yellow line). The Nasdaq is up 5.66%, and the equal-weight is up 1.89%. This really shows how concentrated the Nasdaq is in just a few names: the Mag 7 companies, which make up slightly north of 60% of the Nasdaq.

Nasdaq overlayed with QQQE (equal-weighted Nasdaq) - 4hr Timeframe:

Trump-Xi Meeting:

On Thursday, President Trump and President Xi Jinping met in South Korea for the first time since 2019. They agreed to a 1-year trade truce where the Chinese deferred their planned export controls on rare earths, and the US dropped their 100% tariffs placed on Chinese goods, whilst committing the Chinese to increased purchases of US soybeans and energy. Alongside this, Trump and the US dropped the fentanyl tariff to 10%, down from 20%. The effective US tariff rate on China is now 47%, with the Chinese tariff rate on the US at 84%.Trump touted this as "an amazing meeting with President Xi Jinping"; however, it isn't a full-blown trade deal, but rather a 1-year truce that is to be renegotiated in a year's time.

The trade tensions that were a headwind for the market should now be behind us for the foreseeable future.

The Fed and the Government Shutdown:

We covered this extensively yesterday, so we'll give a brief breakdown before diving into how it sets us up for the upcoming weeks.

Wednesday 29th Fed Meeting, Key Points:

- The Fed cut by 25bps.

- Announced the end of QT by December 1st.

- Powell pushed back on a December cut, despite it being heavily priced by markets.

Powell’s hawkish stance likely reflects either (1) hedging to preserve optionality should economic data support a pause, or (2) political pressure tactics to accelerate government reopening. However, this appears inconsistent with current labour market conditions.

Even though the odds of a December cut have fallen from 94% down to 64.8% today, it's our view that the Fed will still cut rates at the December 10th Meeting due to weakness in the labour market data. Prediction markets have the shutdown lasting 40-44 days, so a reopening in mid-November. That would give ample time for economic data to be released in time for the December 10th Fed Meeting.

A December rate cut would be a meaningful tailwind for risk assets. However, the pessimism in the market is likely to last a couple more weeks, at least until we get the economic data and then Fed speak that leans towards a December cut.

Limited BTC Spot Bid:

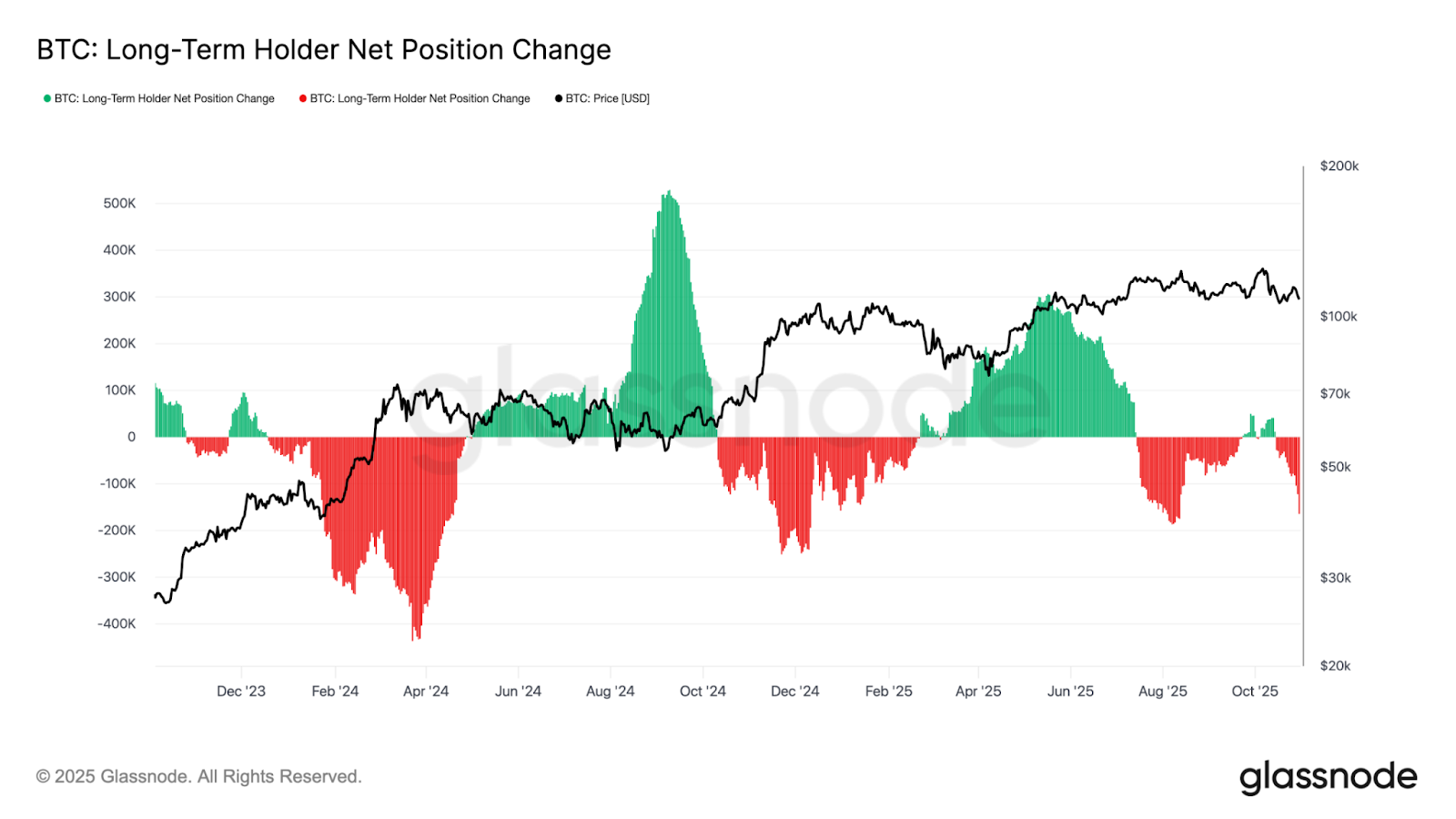

In recent months, we've seen substantial selling from Long-Term BTC Holders. This has dampened price action at the range highs ($120k-$125k), and prevented BTC from meaningfully breaking out of the range, excluding deviations above.

BTC Long-Term Holder Net Position Change:

Historically, when Long-Term Holders have sold, and sold in large quantities, this has marked a local top in price. We'd be looking for this metric that has currently spiked meaningfully into the red, to turn around and into the green, meaning Long-Term Holders are buying BTC again.

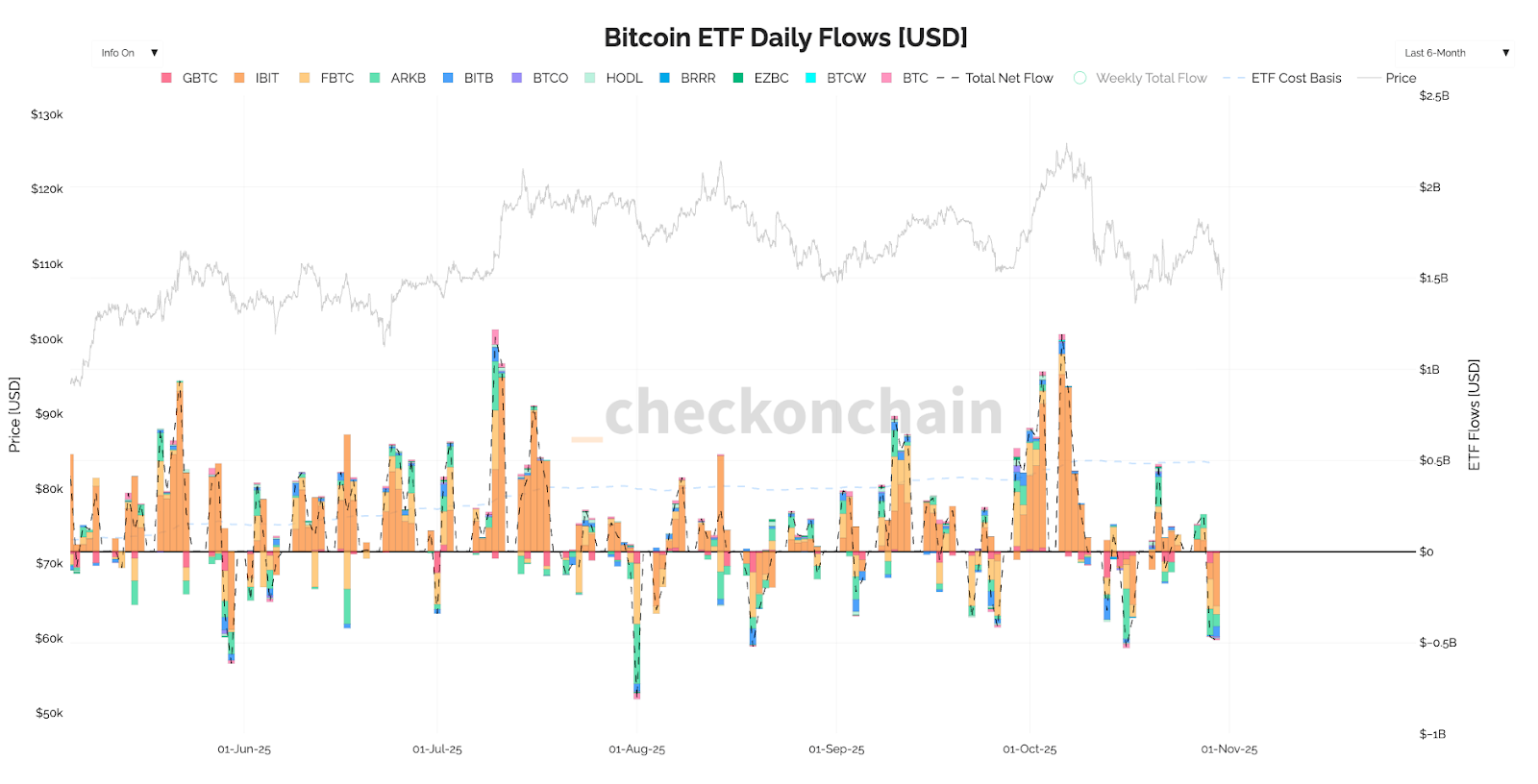

Alongside this, we've seen poor ETF flows, with the last two days seeing $959m of net outflows.

BTC ETF Daily Flows (in USD):

Until these flows/metrics improve, it's hard to be super bullish on BTC in the immediate term, particularly when price is still below key on-chain cost levels such as the Short-Term Holder Cost Basis (at $113,000), and the major technical resistance of $112,000.

If you then pair this with a market that is not sure whether the Fed is going to cut interest rates in December, it leaves the market with a tricky next few weeks to navigate.

Cryptonary's Take:

Powell's announcement that an interest rate cut in December isn't a "foregone conclusion" has muted risk appetite in the market, despite China and the US coming to a 1-year trade truce. Our expectation is that the Fed will cut rates in December, and the catalyst for this will be weaker labour market data, although we're still a few weeks away from getting that data.This likely opens the door for a continuation in the short-term (next 1-2 weeks) - the stock indexes (S&P and Nasdaq) grind higher, whilst BTC chops and remains range-bound between $100k and $116k.

But beyond the next few weeks, we expect there to be bullish catalysts that can see BTC breakout to the upside:

- a December rate cut.

- further rate cuts in 2026.

- Big Beautiful Bill stimulus in January 2026.

- The Fed is likely to add assets to its balance sheet in 2026. Not QE, but liquidity positive (we'll cover this in greater detail in future weeks).

It's a bold call, but our macro, on-chain, and technical analysis data support this outlook. An invalidation would be a Daily close for BTC above the $116k-$117k zone.

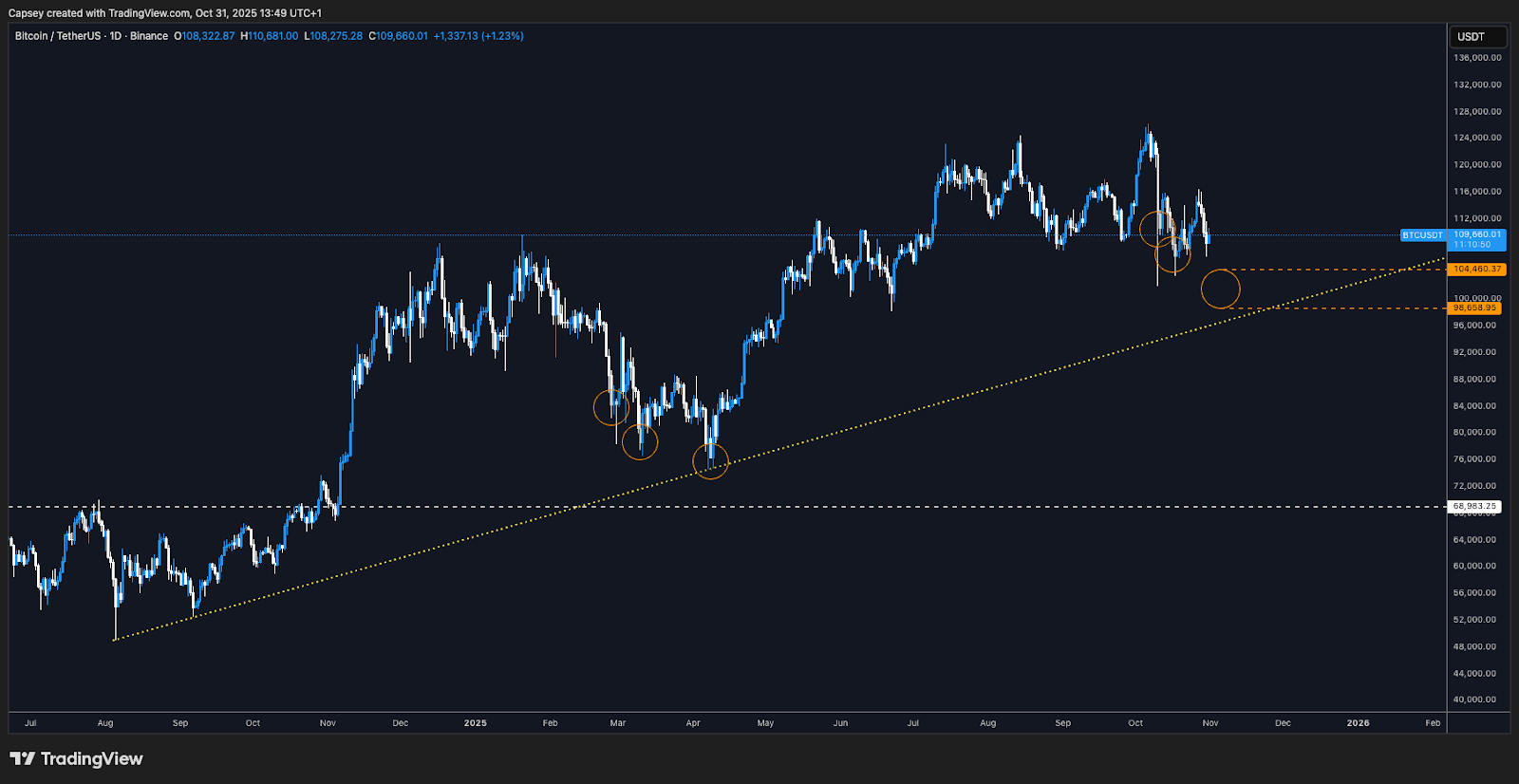

$98k-$104k for BTC should be bid if it's retested.

BTC 1D Timeframe - Orange Buy Zone:

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms