We’re still taking a safer approach as we enter a new quarter. We’re not going all-in, we’re not jumping blindly - and neither should you.

So Cryptonary, what about Q3?

We'd say we are optimistic for Q3 and for a good reason. In hindsight, most of the year was bullish for the majors (as in Bitcoin and Ethereum) but not so much for the rest of the market. That’s probably a good sign to keep your attention on the big movers this year.

Plus, there’s something interesting about Bitcoin’s monthly timeframe, which we’re sure you’d want to know all about.

Let’s dive in!

TLDR 📃

- Something happened on Bitcoin’s monthly timeframe that requires your attention. SPOILER: It’s bullish 🐂

- Ethereum is on its way to $2,000. This level will likely be tested in July.

- Despite Bitcoin being the outperformer, altcoins will still rise. Find out what our next targets are for each of our picks.

- Q3 has a very real chance of being another bullish quarter.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

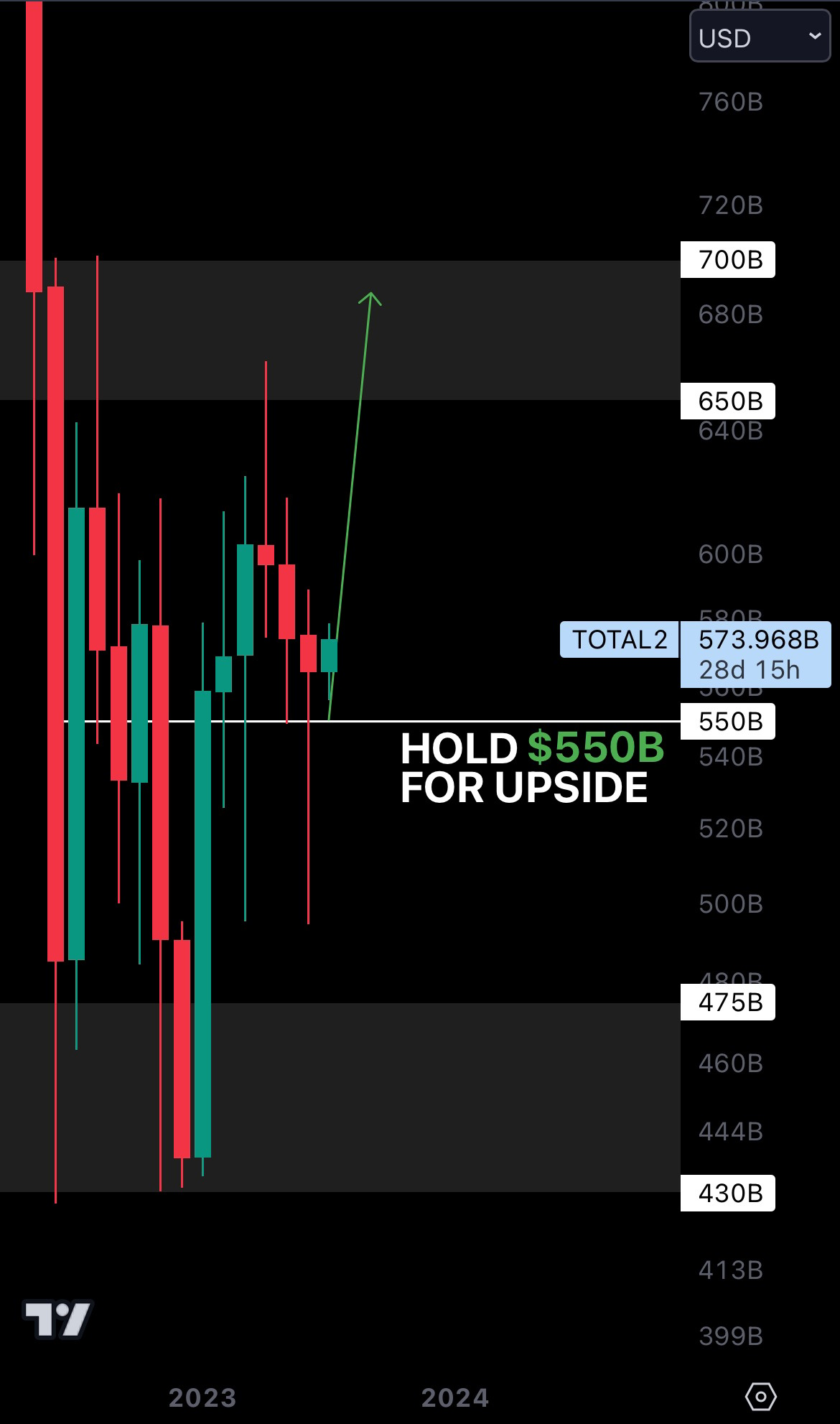

Total market cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go.

Altcoins market cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Cryptonary's portfolio

ETH | Ethereum

DYDX | dYdX

HEGIC | Hegic

SPA | Sperax

Cryptonary's watchlist 🔎

DOT | Polkadot

RUNE | THORChain

SOL | Solana

MINA | Mina Protocol

Astar | ASTR

THOR | THORSwap

OP | Optimism

LDO | Lido DAO

BTC | Bitcoin

Things are about to get interesting for Bitcoin…

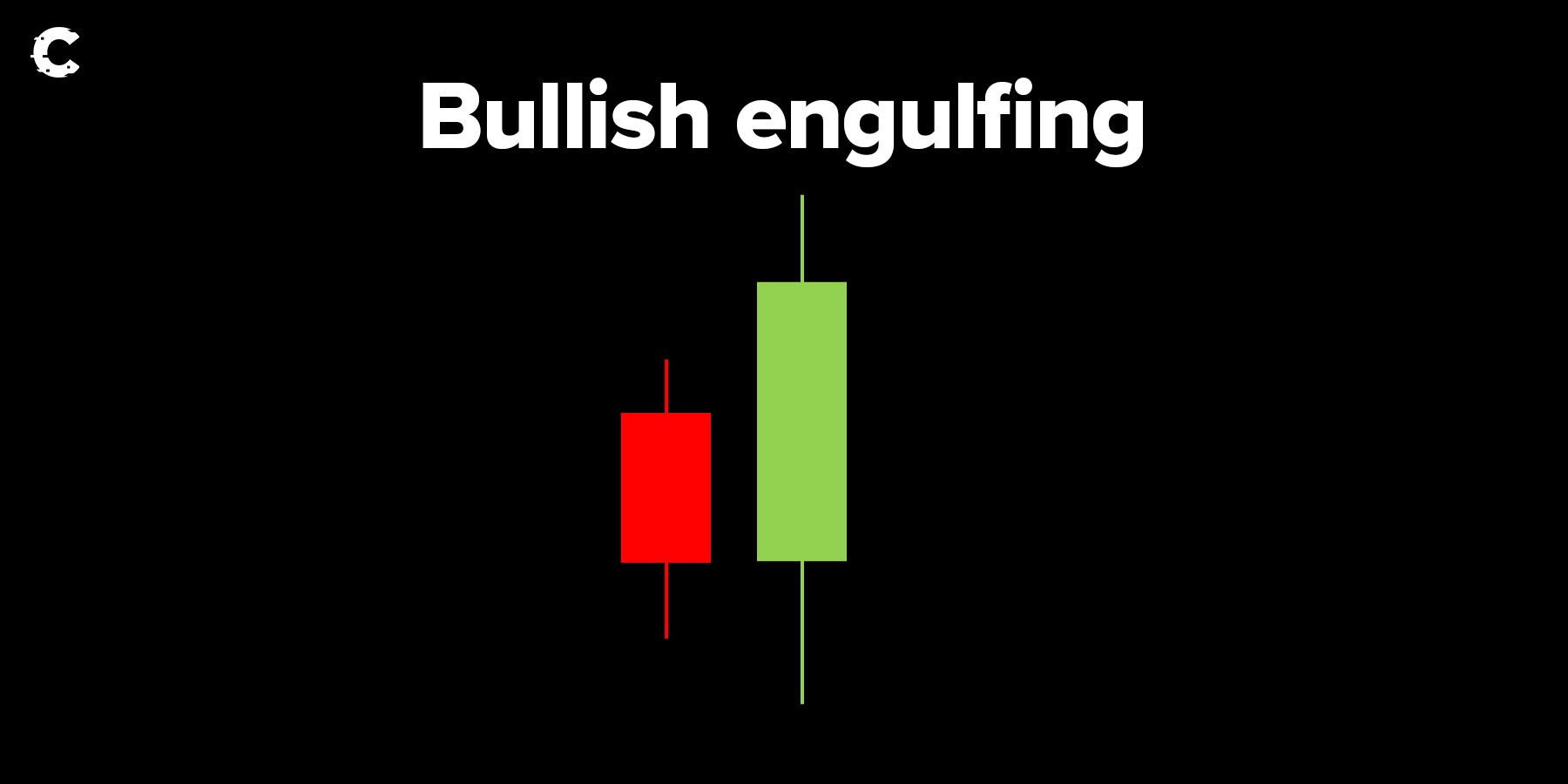

This is the all-mighty monthly timeframe. See last month’s candle?

That’s a bullish engulfing. Before we get into the details, here’s a clearer representation of how a bullish engulfing candle looks like:

We believe a bullish engulfing candle is one of the most bullish technical signals you can find. Why? Because it clearly shows us who is in demand. There’s a catch, though - the higher the timeframe, the more strength there is to a bullish engulfing.

Note that this is on the monthly timeframe, so we could say that’s hella powerful.

A bullish signal like this could easily hint at a bullish July. However, there’s one slight obstacle in our way, and that’s $32,000. For Bitcoin to go higher, $32,000 needs to be flipped into support on the weekly timeframe.

We’d say there’s a solid chance of that happening, at least from a technical standpoint.

Cryptonary’s take 🧠

Bitcoin’s bullish engulfing has caught our attention and had us feeling optimistic. Add its recent performance into the mix, and the third quarter will likely be bullish for crypto.

Of course, there can be sudden surprises along the way. Some of them might even shake things up a bit. But hey, don’t forget the most important thing here…

We’re still in a bear market. It’s not the right time to get lost in daydreams about your next vacation paid with crypto profits.

It’s the time to accumulate, be patient and try to save as much of your capital, so at some point, you can go on that vacation and enjoy the reward.

It’s all about the long game, nothing more.

Action points 🎯

- Try not to increase your exposure too much until $32,00 happens

- Bitcoin’s dominance is starting to go down, and more money will flow into altcoins, yet, we think Bitcoin will outperform in Q3.

- Stay up to date with our investments in our latest Skin in the Game.

- Got more questions? Hit us up on Discord in the “📉・technical-analysis” channel.

As always, thanks for reading! 🙏

Cryptonary out.