Bitcoin above $80k by month's end? The next 10 days hold the key

Today's market update provides insight into key macro concepts and why the data is pivotal. We consider this a really important market update going into the next ten days. Depending on the data, today's update could shape the next 1-6 months of price action.

In short, if we continue to see weakening data, this might bring Powell forward on rate cuts and we could see them as early as July or September. This would fully ignite risk assets (particularly if it were to be July), and we'd likely go significantly higher.

However, it all depends on the macro data. Crypto has some fantastically bullish catalysts at the moment. The space seems to me as if it's just waiting on that macro green light, and when it comes, it's probably lights out, and we see everything re-price much, much higher.

Let's dive in!

TLDR

- The next ten days are pivotal: Heavy macro data leading up to the June 12th Fed meeting could shape risk assets' performance for the next 1-6 months.

- Weakening data = bullish: Softening Manufacturing PMI, GDP estimates, and job openings suggest Fed rate cuts as early as September. A July announcement could potentially ignite a significant crypto rally.

- Labour market key: If Friday's jobs data is below 150k and unemployment tops 4%, risk assets could surge, which may prompt the Fed to consider rate-cutting sooner.

- Bitcoin poised for breakout: With bullish catalysts and awaiting macro green light, BTC could hit $80k by month's end if data supports early rate cuts.

- Portfolio strategy: Continue holding majors (BTC, ETH, SOL) and memes, but be ready to shift into altcoins if a dovish Fed ignites risk-on sentiment.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Moderating macro data supports Fed rate cuts

Firstly, it's important to lay out the data points that take us into next Wednesday's Fed Meeting (June 12th):- Monday 3rd: ISM Manufacturing PMI

- Tuesday 4th: JOLT's Job Openings

- Wednesday 5th; ISM Services PMI

- Friday 7th: Non-Farm Payrolls and Unemployment Rate

- Wednesday 12th: Inflation Data

Yesterday, the ISM Manufacturing PMI data missed expectations and came in below 50 (in contractionary territory) for the second straight month. This means that the Manufacturing sector is contracting rather than expanding, meaning further US growth is unlikely to be fuelled by the Manufacturing sector.

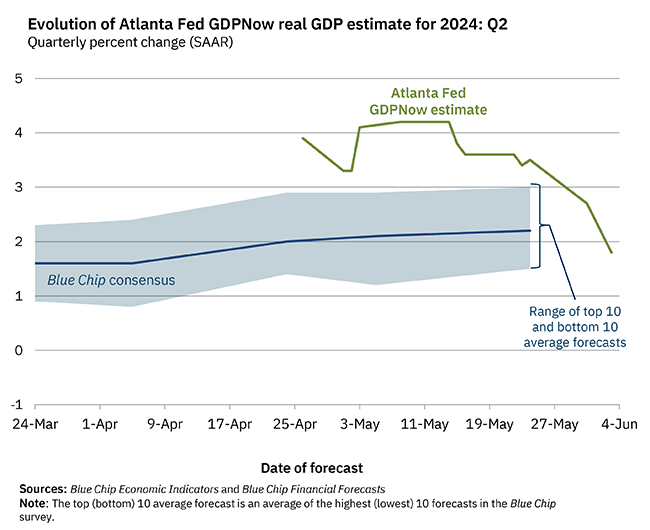

Within the report, the Prices Paid component saw a notable drop, which is, of course, positive in the Fed's eyes when they're in an inflation battle. Alongside this, the Atlanta Fed's Q2 GDP estimate has dropped considerably over the past few weeks. Two weeks ago, they estimated that Q2 GDP would be 4.1%, where as today, they're estimating that it'll be 1.8%. This aligns with our estimates that the economy isn't going into a recession, but it's moderating. This is positive for the "1-2 Fed interest rate cuts in 2024" narrative - growth slowing but not falling off a cliff while inflation trends lower.

The data above so far supports that.Evolution of Atlanta Fed GDP for Q2 2024

Tomorrow (Wednesday), we have the ISM Services PMI data, which, if it also comes out slightly weaker—similar to how ISM Manufacturing data came out yesterday—then again, this would support the narrative that the Fed can cut interest rates soon.

Alongside this, we have the Inflation Data out on Wednesday, the 12th (the day of the Fed Meeting, too, and they'll get the data well before the meeting). We also have Labour Market Data today (JOLTs Job Openings) and the 7th (Non-Farm Payrolls and the Unemployment Rate) on Friday.

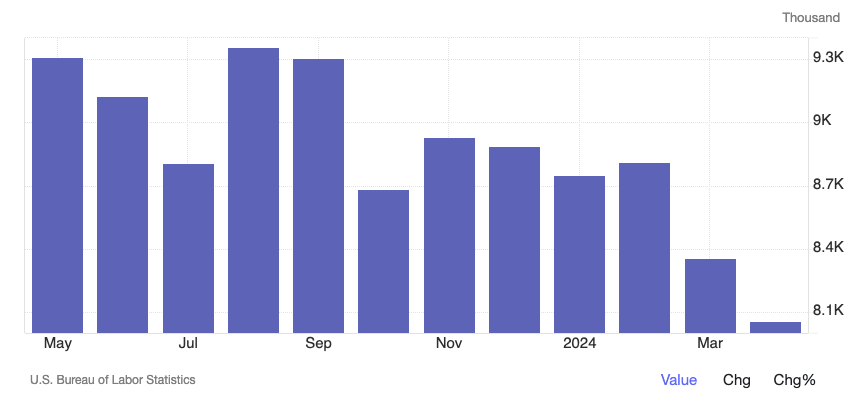

The JOLT's Job Openings came out just now at 8.059m, well below the 8.340m consensus and continuing the downtrend that we're seeing in this data point. A sustained decrease in Job Openings is usually a precursor to the Unemployment Rate rising more substantially.

An increasing Unemployment Rate would push the Fed to begin cutting interest rates. Hence, a softer 8.059 JOLTs print (weakening but not falling off a cliff) is a "goldilocks" number for markets. Risk assets have moved up on this news, with Bond Yields and the Dollar Index coming down—the market pricing in the potential for earlier-than-expected interest rate cuts than what had initially been priced in.

This Friday, the Labour Market Data will be important, and it can potentially move the market. The expectation is for between 150k and 190k jobs to be added and for the Unemployment Rate to come in at 3.9% (no change from last month).

Historically, this would be seen as relatively strong prints, and the market will likely remain flat if the prints come out at, say, 170k and 3.9%. However, suppose the prints come in at sub 150k and 4.0% or higher. In that case, risk assets may potentially move up considerably, as this data would potentially bring the Fed to the rate-cutting table in September, but maybe even as early as July.

JOLT's Job Openings

June Fed meeting

As we've stated above, the June Fed Meeting is on the 12th (next Wednesday), and we have inflation data out on the morning of it.If we do get slightly weaker Labour Market data - and based on the JOLT's data today, it looks as if we might - and then Inflation data next Wednesday isn't hot (more to the upside). We'll probably see a very dovish Fed that will likely maintain 2 to 3 interest rate cuts for 2024 in their Dot Plot.

We may also see Powell bring forward the first rate cut due to this potentially slightly weakening data. Powell may bring the first rate cut into September, which the markets would likely take as bullish. In July, if he makes the forward guidance that the Fed is considering cutting the interest rate in September, the forward guidance will likely spur a huge rally in risk assets (equities and crypto).

However, it must also be noted that if we get this slightly weakening labour market data and the inflation data is hotter, the Fed will begin to be in a stickier spot. They'll need to lower rates to support the economy and the labour market, but stickier inflation won't allow them to. This is probably the worst-case scenario. It's not what we're currently pricing in but we need to be aware of it.

Cryptonary's take

Macro data will very likely rule the market over the next ten days, and we're already seeing this.Today, we've had softer Manufacturing data and then softer JOLTs data. The softening data suggests that the Fed may need to bring forward rate cuts to support an economy that is beginning to soften.

This has seen the Dollar Index and Bond Yields come down. Based on this, risk assets should go higher. Weakening data means the Fed can begin to cut interest rates, but not so weak that the economy is falling into a recession—Goldilocks.

However, crypto has got a nice bid, but equities are struggling to get a substantial bid currently, but still a slight bid. If we do get the above scenario, I've (Tom) outlined softer data and then the Fed maintains 2 to 3 interest rate cuts in 2024, and if Powell is dovish and forward guides potentially earlier-than-expected rate cuts at the Press Conference on the 12th, then this would be the setup to see a real rally in risk assets (crypto).

This is why it is pivotal to monitor macro data closely and translate its implications for risk assets and, more importantly, our crypto bags.

$SPX 1D

$DYX 1D

US 2Y Bond Yield 1D

US 10Y Bond Yield

Portfolio positioning

For now, I (Tom) am maintaining the barbell portfolio of Majors (BTC, ETH and SOL) and memes (WIF and POPCAT).But if we do get the data softened and then a dovish Powell, that will ignite the risk-on rally, and I'd look to divest out of some of the BTC and ETH I have and move that into some altcoins.

Overall, crypto has several bullish catalysts on the mid-term horizon, and BTC really looks like it wants to rise higher soon.

$BTC 1D

We see that Bitcoin will likely break out in the coming month or two. If the data supports, and we get a dovish Powell and rate cuts brought forward, then Bitcoin can be at $80k by the end of the month.

There are lots still at play, and we need to see how the data comes in, but we could be set up for a really exciting next few weeks, which I didn't initially think we'd get until we got more of the summer months out the way and liquidity improved.

Let's see!!!