Bitcoin and WIF in Euphoria phase: How to navigate the surge

A quick update today. As we mentioned previously, we really believe we've now moved into the beginning part of the bull market "euphoria phase". This can last anything from 3-9 months - We think it'll be north of 5-6 months at least.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

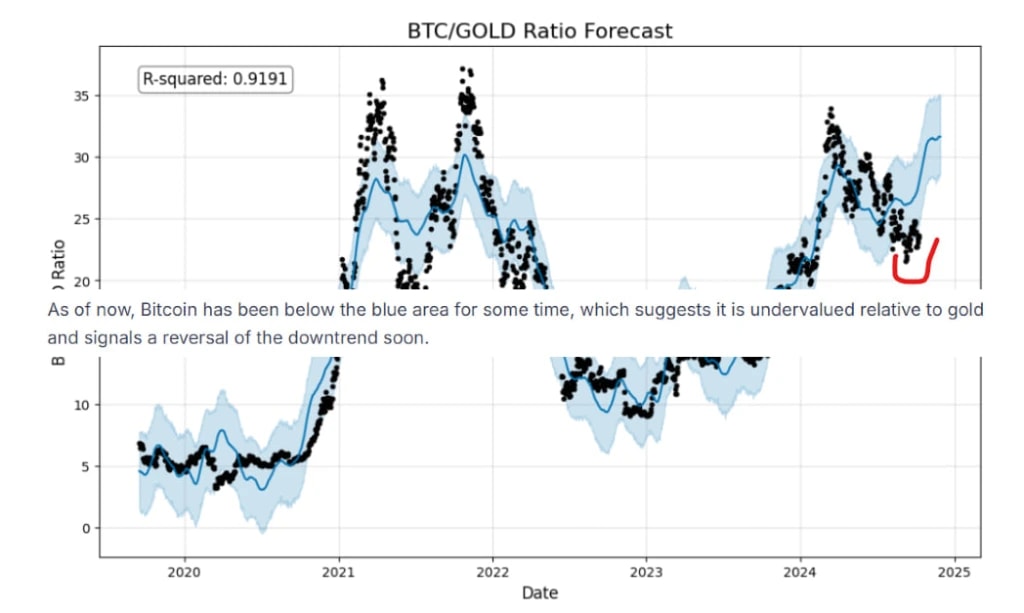

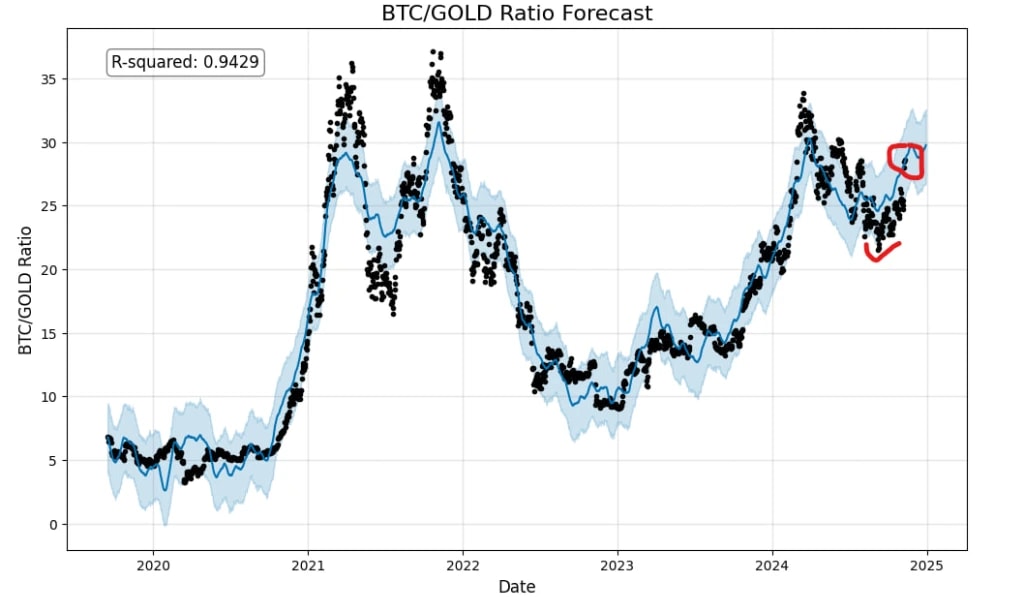

BTC has broken out cleanly and convincingly, as we anticipated. As you guys know, when Trump won, we called for a swift and sharp move higher and for $80k by the end of this week. And that's exactly what we've got. The arrows just don't miss. Further, as we forecasted in our machine learning report, BTC has reprised against GOLD. In the report, we said: "As of now, Bitcoin has been below the blue area for some time, which suggests it is undervalued relative to Gold and signals a reversal of the downtrend soon."

Further, as we forecasted in our machine learning report, BTC has reprised against GOLD. In the report, we said: "As of now, Bitcoin has been below the blue area for some time, which suggests it is undervalued relative to Gold and signals a reversal of the downtrend soon."  Fast forward to today, and our model worked out perfectly, positively reprising BTC against GOLD. Even though we expect the uptrend to continue, BTC is now fairly priced according to our model.

Fast forward to today, and our model worked out perfectly, positively reprising BTC against GOLD. Even though we expect the uptrend to continue, BTC is now fairly priced according to our model.

WIF

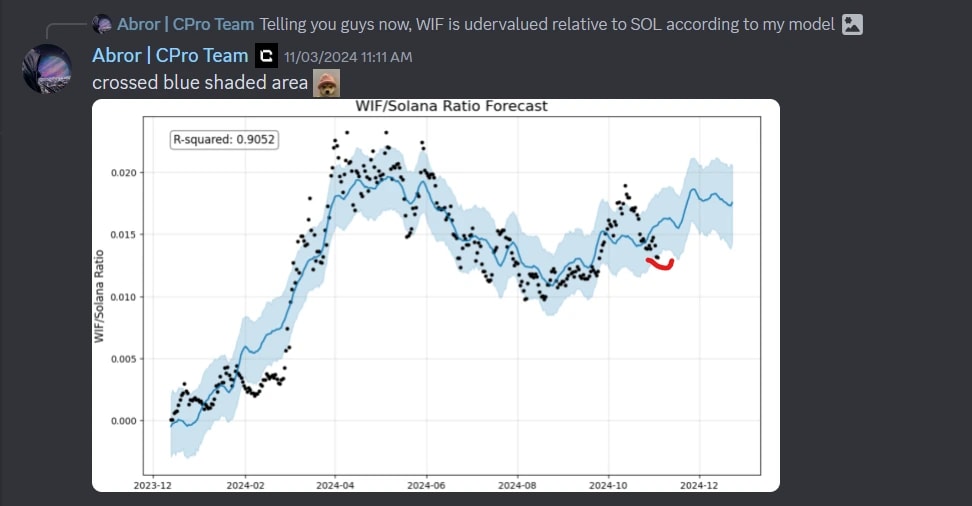

WIF is also starting up following the strong move from DOGE, which is 10 times the market cap of WIF. So, there is lots more room here for WIF. Once WIF makes its move, we think $3.05 to $3.40 in the pretty short-term (next week or two), and then we think POPCAT will play catch up once WIF slows down.Then, after POPCAT, the rest of the SOL eco-system memes will follow with more aggressive moves, although they'll grind up in the meantime. We have been calling for a reversal of WIF's downtrend against SOL for some time as well. The ratio has crossed the blue area, which signalled a buying opportunity.

Again, the ratio has reversed, and we expect WIF to outperform SOL. If the ratio drops below the blue area, that would again suggest WIF is undervalued relative to SOL.  We We have entered the euphoric stage of the cycle; honestly, SEND THEM ALL!!!!!

We We have entered the euphoric stage of the cycle; honestly, SEND THEM ALL!!!!!

LET'S GOOO!!!!!