Bitcoin at the crossroads: Which way will price action go next?

The Bitcoin bulls have been running wild over the past week, sending BTC surging above the $37,000 level. But storm clouds appear to be gathering as Bitcoin faces a critical technical test at the $38,000 resistance level.

Can Bitcoin power through and continue its parabolic ascent? Or will gravity finally take hold and send it plunging back down?

Having called Bitcoin’s direction perfectly over the past week, let’s take another look to see what we expect for price action in the coming days.

TLDR

- Bitcoin rejected again at the major $38K resistance level, raising doubts about an additional near-term upside.

- Technicals show signs of bearish divergence and overbought conditions across timeframes.

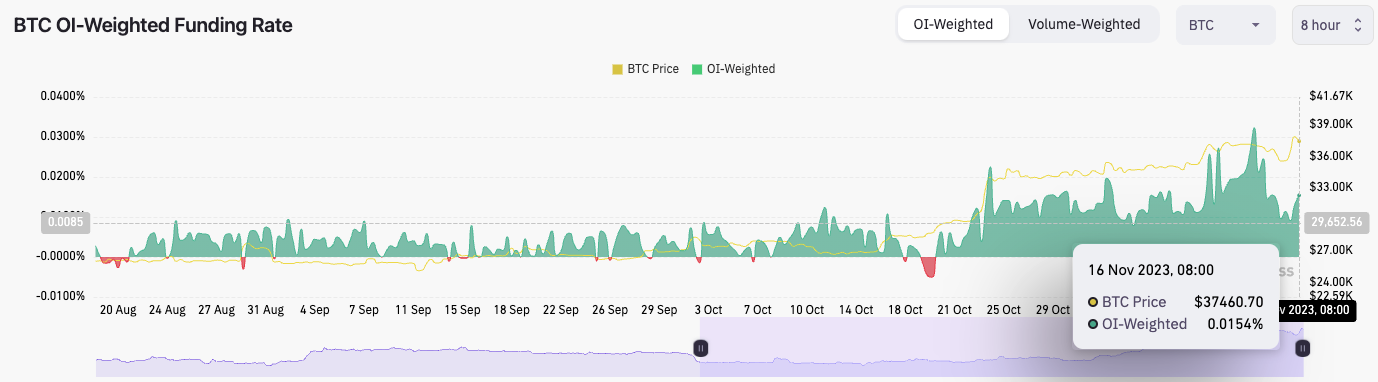

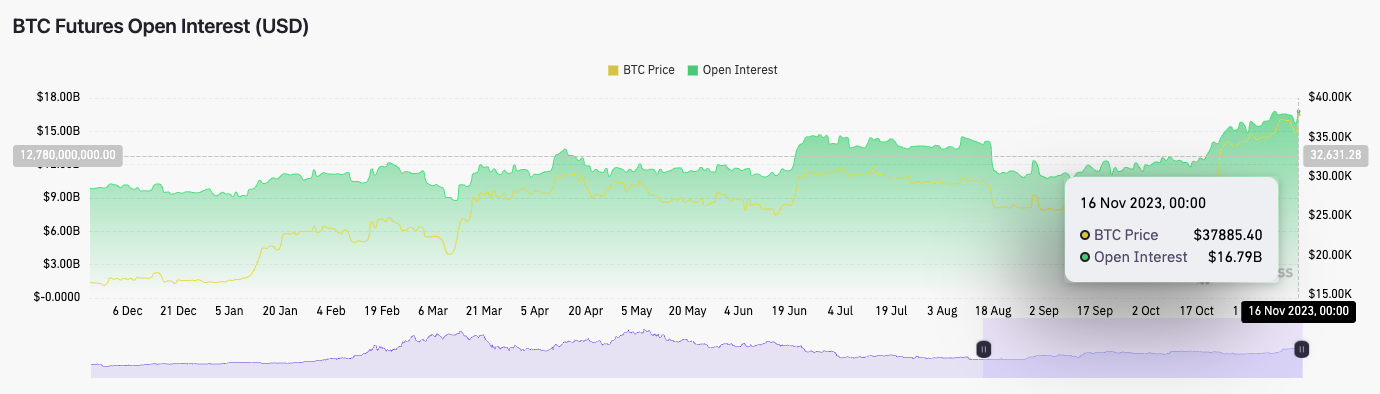

- Leverage is still elevated, which could exacerbate any sudden price swings.

- The uptrend remains intact, but BTC may be due for a pullback before continuing higher.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

On the macro front, we haven’t had a lot since the inflation data on Tuesday, which, of course, moved the markets dramatically higher. We have had a fair amount of Fed-speak, emphasising the “higher for longer” narrative while trying to walk back the market's pricing in rate cuts coming sooner than what was priced in just a week ago. This could lead to a short-term bounce in the DXY, which may suppress risk assets slightly. However, we don’t expect this to be massively impactful, just something to be aware of.Let’s now dive into the technicals for BTC.

Technical analysis

So far today, nasty price action. We previously outlined the $38,000 horizontal resistance as a major resistance that $BTC may struggle to overcome. We rejected at that level initially, and for now, we look to have rejected for a second time.If there is a more meaningful move down, $35,600 will need to act as support. If not, the move down could be more violent and push into $34,000. However, $BTC is still holding up here at $37,300.

The RSI is looking better than how it has looked recently. Now, it is out of the overbought territory on the daily timeframe. However, with yesterday’s close, we put in a bearish divergence, which is biased to lower prices. The 3D and the weekly timeframes are also very overbought and likely need a resetting, resulting from prices either consolidating for some time or due to prices pulling back. Bitcoin can still go higher here because of how bullish the overall momentum has been, but the technicals suggest some level of exhaustion here.

BTC 1D

Market mechanics

The mechanics aren’t too bad. There is still a lot of open interest (leverage in the system), with open interest at a high of $16.8B. The funding rate is positive, but not so positive that it indicates a massive long bias. The long/short ratio is at 1.02 over the last 24 hours, meaning more participants have leaned into longs rather than shorts.This market is still somewhat overheated, but it’s not overly positioned to one side. However, a flush-out in leverage would make the market somewhat healthier.

Cryptonary’s take

The technicals suggest there could be more downside for BTC. The mechanics are more tricky. The market is overheated, but not in any particular direction (between longs and shorts). Therefore if there is a significant movement in price this may drive a squeeze against that side.We’re cautious on BTC here, but we would buy up any major movement lower. If Bitcoin can pull back to $34,000, that’s where we’d be DCA buyers.