Bitcoin battles bond yields: Can BTC withstand rising rates?

There was a time when the crypto market used to move to the beat of its drum. Lately, traditional markets are calling more of the shots. Otherwise, how do we explain away the fact that bond yields are now stealing speculative interest from risk assets?

BTC has been bouncing between key levels, struggling to find momentum in either direction. Meanwhile, ETH can’t seem to sustain any upside as the bear hug gets tighter. But the stars might be aligning for possible trades on SOL and DOT – we just need a final push.

As macro trends impact traditional markets, crypto is on the receiving end of market sentiment.

What does this tell us about trading in times of uncertainty?

Let’s jump in.

TLDR

- BTC is trapped between key support and resistance as bond yields limit risk appetite.

- ETH is echoing broader indecision, with more downside likely soon.

- SOL is setting up for potential short trade if conditions align.

- DOT is poised for a long trade, but funding rates are not supportive enough yet.

- THOR is looking weak; it could retest support around $0.099.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

BTC | Bitcoin

Is Bitcoin becoming more governed by the Treasury market?The U.S. 10-Y bond is now pushing very close to a 5.00% yield (currently 4.96%). Investors can get a 5.00% yield “risk-free”; therefore, the appetite for risk assets is naturally decreasing.

The question we then ask is, does this reduction in risk appetite extend to Bitcoin and altcoins? If we expect a major reduction in the risk appetite for equities, then this will likely extend to crypto.

Let’s dive in to see where things currently stand for BTC.

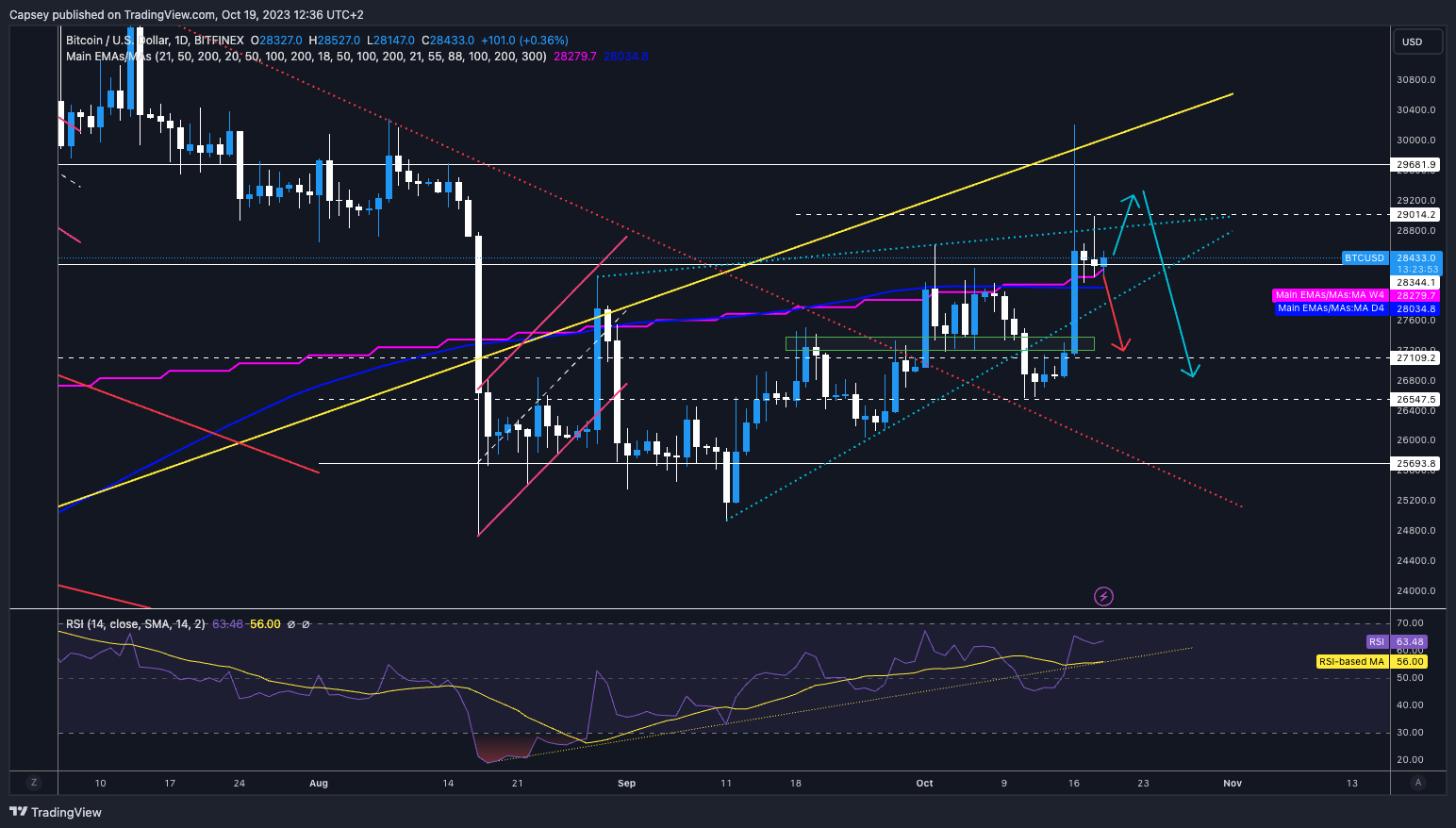

Technical analysis

Looking at the US 10-Y pushing up to 5.00%, we immediately come to BTC and see that it’s still holding above and battling at that horizontal resistance (potentially flipping to support) at $28,300, which we’d say is positive.Price is holding just above some of the key MA’s and EMA’s, so this is what we feel could be what helps BTC go slightly higher. However, volumes and open interest are relatively low, so it’s hard to see where the continuation of momentum comes from.

Even if price can increase to $29,000, we still see it as a strong resistance area.

RSI and funding rates

The RSI still has a bearish divergence (higher high in price and lower high on the oscillator), but is shy of overbought levels.Funding rates across the board (on most exchanges) are negative, so there are more shorts than longs. Open interest isn’t high, so this reduces the odds of a short squeeze.

Conclusion on trading BTC

We see BTC as being at an inflexion point here. Some positives could help fuel further upside. However, the overall move is beginning to look exhausted. When you then overlap this with Bond Yields soaring higher, you have to assume this will affect risk appetite negatively, and this should extend to BTC, which again should work to suppress further upside for BTC.Action

- We see BTC at an inflexion point here; therefore, we will wait for it to prove itself.

- BTC is currently battling at the $28,300 horizontal level; let’s let BTC make its move, and we’ll re-assess from there. BTC is at a very middle point here and could go either way.

- Ultimately, we expect a more significant downside, even if price can go slightly higher in the short term, although the case for a small further upside is weakening. Steering clear of BTC for now.

ETH | Ethereum

We think ETH reflects the genuine risk sentiment currently in the market. We can’t seem to sustain any meaningful upside, and if you take your eye off it for a few days, it seems naturally to fade lower.Technical analysis

ETH couldn’t seem to sustain any upside momentum and has drifted back down to the horizontal support of $1,550, where we now see the battle continue at this level. Rejecting the local resistance at $1,625 that converged with the underside of the local uptrend line is weak overall. We feel ETH will drop below these lows of $1,550 and discover new local lows. We may see some support around $1,480.The MA’s and EMA’s remain well above the current price – this is worth knowing but irrelevant. Note: BTC is above its key MA’s and EMA’s, ETH is 10% or so below its key MA’s and EMA’s - note the difference in overall strength.

RSI and funding rates

The RSI is at the RSI’s uptrend line and also at the same level as the RSI-based MA - at a value of 41. This is a very middle level and could bounce or fall from here. To say this is 50/50 here is an understatement. There are also no relevant divergences that could indicate that this goes one way or the other. So, regarding the RSI, there’s nothing to take from this.Regarding the funding rate for ETH, it’s just about positive but relatively mixed across the exchanges. Open interest isn’t too high either, so we have even positioning (longs vs. shorts) without much leverage (open interest). Again, this doesn’t indicate that the market is over-weighted in one direction or the other. We need to be aware of this, but it doesn’t indicate that price will likely move in one specific direction.

Conclusion on trading ETH

We are still not confident in ETH, which has performed worse than BTC. We feel the gradual direction for ETH in the coming weeks/months will be lower.Action

- We are steering clear of ETH, but if we can see the price break below the $1,550 level, we feel ETH will head comfortably into the $1,400, and that’s where we’ll be paying greater attention to it for some long-term DCA’ing opportunities.

- In terms of short-term opportunities, there’s nothing too appealing, and therefore, it’s not worth us getting involved here.

SOL | Solana

We’re tracking this closely for a potential trade. If our components for trade all align, we’ll be taking the trade.Technical analysis

After a few days more of price action, we can now see that we have formed a bull flag. Bull flags have a bias to break to the upside. This would likely see price move into the late $24s and possibly even see price get towards our red resistance box.

The area of interest for us is the red box.

We have drawn in some local uptrend lines that may become more relevant in the coming days/weeks, although it’s wise to draw them in and be aware of them ahead of time - they could provide some support for price if it were to come down again.

RSI and funding rates

“The RSI is key for setting up a trade here. We’re currently at 65 (just below overbought levels of 70), but we’re already putting in a bearish divergence - a higher high in price and a lower high on the oscillator. If this can maintain and also move into overbought territory, then this would entice us to short SOL if it reaches the red resistance box - layering short orders in that zone”.This was the update from the past few days, and it remains the same today. It’s one of the main keys to setting up a short trade. Can we get the move up higher, which maintains the bearish divergence but pushes the RSI closer to over-bought levels?

The funding rate has flipped again. It was very negative but then returned to more neutral levels, and today, it's back to being very negative again. This can set SOL up for a possible short-squeeze, which would drive price up another 3-5% to bring us to our red box area.

Conclusion on trading SOL

“We are still waiting for the conditions to fully align here, even though they already are somewhat aligned. There might be another move higher if BTC can retest higher, which is then the time for us to take the short for SOL, especially if price gets into the red box”.This was our update yesterday, and it remains the same today. Let the trades come to you. We wait for all the relevant conditions to align and then dive in. Right now, we’re close, but we’re just not there yet.

Action

- We remain patient but could pull the trigger on this trade soon.

DOT | Polkadot

DOT looks good here for a short-term trade opportunity, but we may have missed it.Technical analysis

On the technical analysis front, price lost the $3.90 horizontal support. Price then moved substantially lower, touched the green box area, bounced, formed a bear flag, and broke down again to retest the green box but fill more of the box. This is a very typical price structure.This will either put in a more meaningful bounce here or reject again and move meaningfully lower. DOT will likely need BTC to hold up for DOT to achieve that more sustainable bounce.

The indicators lie in the other metrics. Let’s dive in.

RSI and funding rates

The RSI looks perfect for a Long trade here. We have a higher low on the oscillator and a lower low in price. We’ve had four consecutive higher lows and lower lows - so there are multiple bullish divergences here. This is a perfect setup RSI-wise for a long IF we could get the price. Let’s look into this more.The letdown is the funding rate. It’s negative on Binance but positive on practically every other exchange. We’d want to see the funding rate be negative for us to take this long. i.e., too many shorts could be vulnerable to a short-squeeze, meaning we may want to take the other side and be longing into them. But unfortunately, the funding rate just isn’t negative enough overall to convince us to take this long trade.

Conclusion on trading DOT

Disappointing, as this could have provided us with another opportunity for a long. However, we note that BTC is feeling somewhat weak, and therefore, if we’re not confident in further upside from BTC, it’s unwise to be longing altcoins.Action

- We will continue watching this to see if the funding rate becomes more negative. We’ll also continue assessing BTC to see if it looks as if it’s gaining more positive momentum. If these factors align, then this may be the clearance we need to take the trade.

THOR | THORSwap

It looks weak, but THOR is potentially trying to build a base above support at $0.135.Technical Analysis

Following the massive move down, THOR formed a bear flag, which has a bias to break to the downside.

We then saw that happen with the horizontal support of $0.135 being tested multiple times. The volume is looking rather weak; therefore, it’s hard to see where the momentum will come from that will drive THOR higher in the near term.

RSI

The RSI is at 42, so it’s still in the middle territory, and there is room for further downside. The RSI-based MA is also just above the current RSI level, so you’d expect this to act as short-term resistance.Conclusion on trading THOR

We’d be cautious about THOR here. The $0.135 level is a critical support; if lost, price could move as low as $0.099 in the short/medium term. We believe the $0.135 level will be lost in the coming weeks/months.Action

- If you’re heavily exposed to THOR and believe in it for the long term, it may not be worth chopping in and out to improve your size.

- However, we believe THOR will be down and well below the $0.135 horizontal level in the coming weeks/months.

Cryptonary’s take

The winds of macroeconomics are blowing crypto all around. For now, uncertainty remains the name of the game.BTC is still finding its footing while ETH falters. SOL stirs, but we await the perfect storm. DOT needs a boost. And THOR looks the weakest currently.

In choppy seas like these, patience and prudence remain the best navigators. We'll continue watching for the next significant swells and trade accordingly.

As always, thanks for reading.

Cryptonary OUT!