With bears in retreat and bulls regaining control, Bitcoin now faces a critical test at the major resistance of $38,000.

A decisive break above this level could spark a surge back towards $40k and beyond. But with larger timeframe indicators pointing to overbought conditions, the path forward is far from certain. However, one thing is clear - with Bitcoin stabilising around current levels, volatility is building, and a major price swing could be just around the corner.

TLDR

- Bitcoin bounced from support at $35,600 over the weekend.

- Bulls are now targeting key resistance at $38,000.

- Larger timeframe indicators suggest a potential for pullback.

- Volatility is building as Bitcoin stabilises around current levels.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- The Dollar Index drops today on last week’s lower inflation, and the markets are now pricing for rate cuts sooner in 2024. This should be supportive of risk assets.

- Today, there is a 20Y U.S. Bond Auction. Markets will watch this and look for a positive auction that doesn’t tail.

- Regarding economic data this week, there is the FOMC Minutes on Tuesday, but we don’t expect it to bring much and move the markets. We’ll be paying attention to Wednesday’s Jobless Claims data to see if there is a further uptick in this data point. If so, this could move the markets, and likely not higher.

- On November 19th, the Argentinean Presidential elections saw right-wing libertarian Javier Milei win. Milei ran on the promise of removing Central Banks and Dollarising Argentina, which is currently suffering from huge inflation. For what it’s worth, Milei is a supporter of Bitcoin.

BTC 12hr

Technical analysis

There is a good bounce from local support, and now, it is not too far from the major resistance level. Could we be third-time lucky?Below are the key technical points for $BTC today:

- Last Thursday, $BTC came down to the local horizontal support of $35,600, bouncing from that local level while forming a local uptrend.

- The $38,000 point remains the key horizontal resistance for price to get above.

- The main uptrend remains intact, which should support continued bullish momentum.

- If the local support at $35,600 is broken, the next support would be $34,000.

- The RSI on the 12hr and 1D timeframes has reset and is now out of overbought territory. This would also support higher prices as there is room to go higher, as price isn’t as exhausted to the upside as previously.

- However, the 3D and weekly timeframes remain overbought and look like a resetting is needed. The 3D RSI will be of more significant concern if price closes this evening above $37,250, as this would put in a bearish divergence on the 3D - usually not positive for price.

Market mechanics

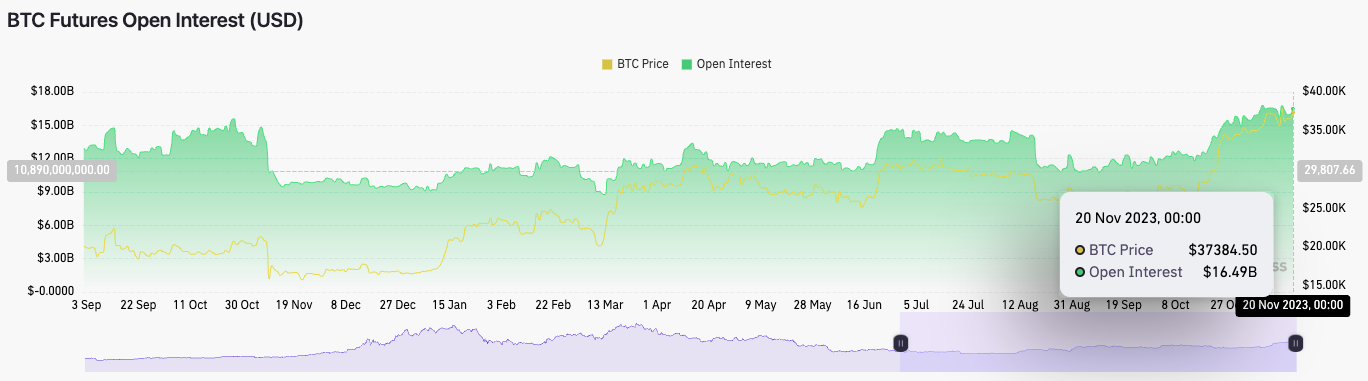

The mechanics are interesting here.- Over the weekend, the OI-weighted funding rate reset substantially back to sub 0.01% levels, indicating longs and shorts were in a much more even balance. However, the funding rate has begun increasing since late last night, indicating that longs are beginning to jump in.

- Open interest remains high at $16.49B.

- The long/short ratio is at 1.0513, having been at 0.99 midday yesterday. This indicates that over the last 24 hours, more participants have gone long than short, while the funding rate reflects this, having gone from 0.0080% to 0.0154%.

Cryptonary’s take

Bitcoin has an interesting setup here.Price has moved into the $37,000’s with the high open interest and the funding rate picking up over the past 12 hours with more participants ape’ing into longs. However, the mechanics’ setup isn’t overly frothy, so we shouldn’t be too concerned with the current positioning.

There is a liquidation level for shorts at $38,200, which price may hunt down. Ultimately, we will need strong spot buying to shove BTC above $38,000 and then push on meaningfully higher, while larger timeframe indicators suggest a pullback may be on the cards in the coming weeks. A pullback may take some time and will likely not be massive, maybe just into the $33,000 to $34,000 range.

While we recommend being exposed, we wouldn’t look to add exposure here, nor would we look to trim our exposure. We would, however, add to our BTC Spot bags at $34,000, and we would more aggressively DCA sub $33,000.