Market Direction

This second rejection at a major upside barrier has opened the door for further downside, with Bitcoin struggling to maintain its local uptrend.

Turbulence likely lies ahead, as on-chain data shows leverage remains elevated while traders aggressively piled into shorts over the past 24 hours. Please proceed cautiously when leverage trading, as Bitcoin looks prone to increased volatility in the coming days.

TLDR

- Bitcoin price rejected again at resistance of $38k, now back under $36k

- Key support at $35.6k was held yesterday, but the uptrend is under threat if the support is broken.

- Leverage remains high, but funding rates and long/short ratio show traders piling into shorts.

- There's a chance for increased volatility ahead; we advise caution, especially when leverage trading.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- This week’s Fed-speak continues with the key notes being that the Fed recognises “real progress” on bringing inflation down, but the glide path down to the 2% mandated target is not easy.

- Yesterday, Initial and Continuing Jobless Claims came in above their prior readings and the consensus. The markets are watching these data points closely as a sharp move up will indicate a weakening in the labour market, which is the key to whether the US will fall into recession or not.

BTC 1D

Technical analysis

It was a scary/ugly day yesterday where price fully retraced the positive move higher the prior day. Below are the key technical points for $BTC today:- For the second time, price rejected perfectly into the $38,000 horizontal resistance we had outlined for several weeks.

- As price pulled back yesterday, the local horizontal support at $35,600 provided some support for Bitcoin to bounce from.

- Price is still in its local uptrend (the thin yellow line), which also converges with the horizontal support of $35,600. If this level is broken, we could see price breakdown and test the second local support at $34,000.

- The Daily RSI is now back well below overbought territory. We needed to see these indicators reset as Bitcoin was looking overheated.

Mechanics market

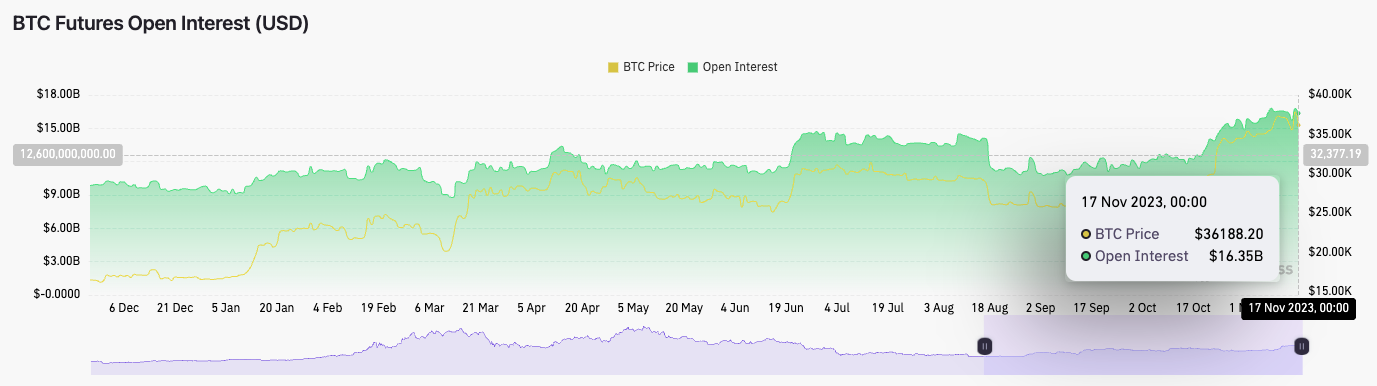

The mechanics are relatively mixed here, but volatility could be on the short-term horizon.- Open interest has dropped slightly, from $16.79B yesterday to $16.35B today. This is not a meaningful shift lower, suggesting that the futures market is still overheated.

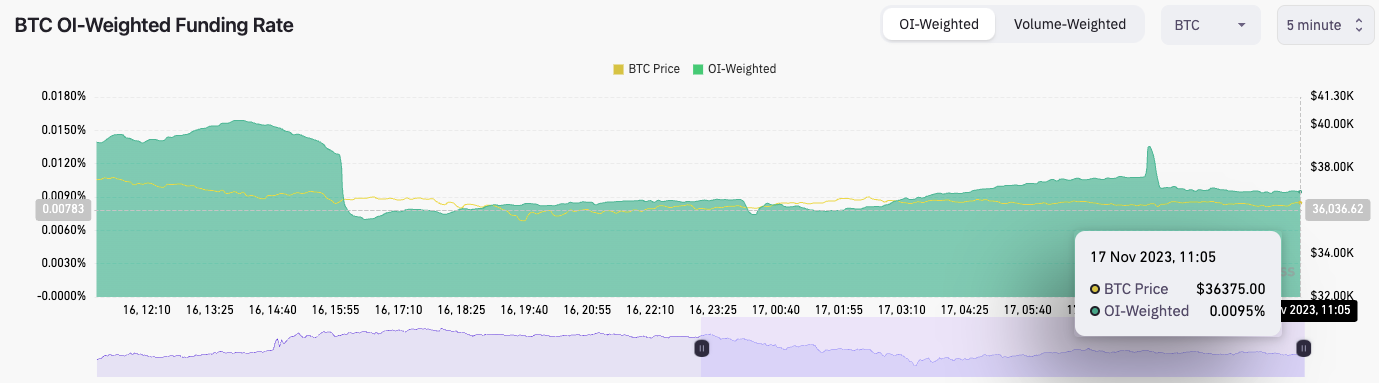

- The OI-weighted funding rate has moved meaningfully lower to 0.0095%. This suggests that longs and shorts are in a more even balance.

- The long/short ratio over the past 24 hours is at 0.9331. This means participants have had a strong bias to pile into shorts in the last 24 hours.

Cryptonary’s take

The technicals are mixed here for Bitcoin, but following a second rejection into the major level of $38,000, BTC could have more downside. The mechanics show that the leverage has remained high while funding rates have declined due to many participants piling into shorts yesterday. The market may shake out these late shorters (again), meaning price could head into the $37,000 before turning down again.We have called Bitcoin perfectly over the past few weeks. However, today, we feel Bitcoin is more difficult to call. We expect volatility, so we suggest caution when leverage trading.

We also remain interested in DCA’ing into Bitcoin sub $34,000 and aggressively DCA’ing sub $33,000.