Bitcoin breakout as US election and economic data shape markets

We have a huge next 9-10 days ahead of us in terms of economic data, a FED Meeting, and the US Presidential Elections. Alongside this, BTC was on the cusp of breaking out of all-time highs. Let's dive into this update.

PS - the next Market Update (coming this Friday), we'll go through the Jobs data and the remainder of the Update will be an on-chain special.

Topics covered:

- Data This Week.

- Market Over-Pricing Trump?

- BTC & Index's.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data this week

This week is a heavier week on the Jobs data front. We had JOLT's Job Openings come out yesterday, which saw a downside surprise: 7.44m from the 7.86m prior month's reading. A downtrending JOLT would be slightly concerning in terms of a weakening labour market.However, ADP Employment Change came in today at 233k jobs added. 233k jobs added is strong, but we do have to wait for the official BLS statistics due out this Friday in the form of Non-Farm Payrolls. The consensus for Non Farm Payrolls (the number of Jobs added) on Friday is 115k, so substantially lower than what ADP has just reported.

On Friday, we also have the Unemployment Rate release, which is expected to come in at 4.2%, so there is a slight uptick from the prior figure of 4.1%.

Markets are pricing in the continuation of the labour market's strength, particularly as today's GDP came in at 2.8%, fuelled by strong consumer spending. The market will be watching this Friday's jobs data closely despite the attention mostly being focused on next week's US Presidential Elections.

Market over-pricing Trump?

In the last month, Trump's odds of winning the US elections in the betting markets have increased substantially to where he's now and still is, a clear favourite. In this time, we have seen the "Trump trade" assets perform well.Perhaps the clearest of these is in Trump's company's stock price - "Trump Media & Technology Group" - which is up 251% since September 24th, despite the stocks' price pulling back 23% in the last two trading sessions. This coincides with Trumps' odds of winning being at 46% 5 weeks ago, and now betting markets (Polymarket) has it at 66%.

DJT stock price 1D chart:

Polymarket odds of Trump Vs. Harris:

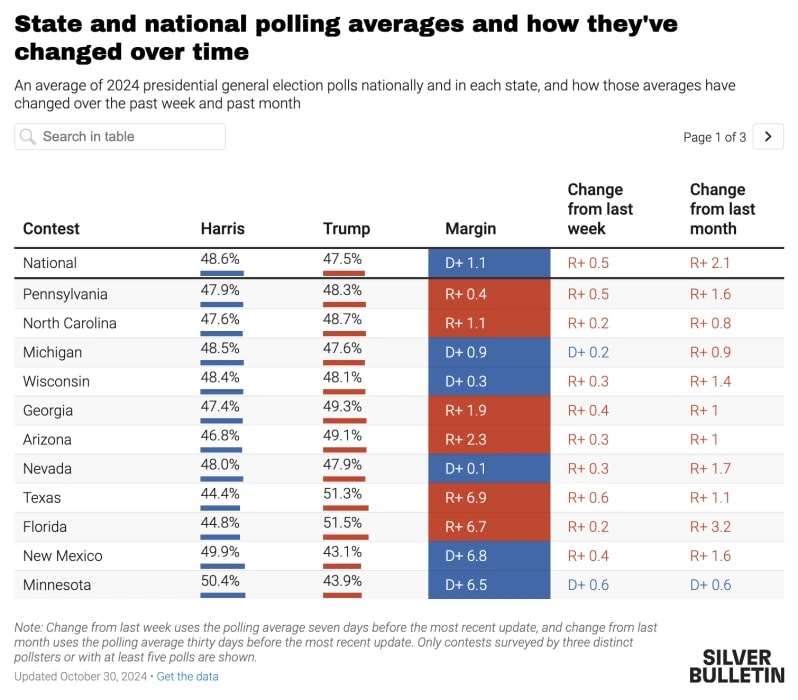

However, betting markets are diverging from the polls here. The polls still remain tight, despite the fact that many commentators say that the polls are somewhat irrelevant, as they're historically not good predictors.

In the below model (updated as of today), we can see that Nate Silver still has it as a very close race. However, Nate Silver does also have Trump gaining momentum over the last 7 and 30 days.

One note to add to this is that the voting so far has seen female turnout be at 54%, whilst male turnout is as low as 44%. I'm not exactly sure how they calculate this, but if this trend were to continue, it would favour Harris. It is possible that men just leave it to the last minute, though...

Nate Silver's polling averages and their changes:

It is possible that due to this now divergence between betting markets and the polls, that some profit taking is going on in "Trump trade" assets, hence we see $DJT down 23% in two days. However, BTC is potentially the anomaly here having broken out of it's range and pushing close to retesting prior price all-time highs.

BTC:

A really clean move. We needed and were looking for a convincing break above $68,900 with that level having been resistance a number of times. That clean break was exactly what we got, and on strong volumes as well - even more positive.In the short-term (next few days), it's possible BTC will pull back a tad. We're talking maybe $70k, nothing crazy. This would align with traders booking profits on the "Trump trade" assets we outlined above, as there is now that divergence between the betting markets and the polls.

BTC 1D:

TOTAL 3 (Crypto MCap excluding BTC and ETH)

The chart looks fantastic from a technical perspective. Price has broken out of a main downtrend line and is now butting into the horizontal resistance at 630b.We'd expect upon BTC's breakout that the TOTAL3 follows and breaks out of 630b and propels towards 704b relatively swiftly - great for ALTS and Meme's (although we know which we'd rather be positioned in).

$TOTAL 3 3D chart:

What does this depend on? What are we waiting for?

Cryptonary's take

As boring as it sounds, probably next weeks' Election. Over the last 5-6 days, I (Tom) have listened to some podcasts and read reports (my usual sort of homework and market research).But as I sat down today and deep-dived back into it, the overly resounding message I've read is that advisors continually say that their clients aren't looking to take on more meaningful risks or even put large new capital to work just a week before a 'coin-toss' election.

On top of this, the "Trump trade" assets now look as if they've, in the majority, priced in a Trump win. And, with the divergence between the betting markets/where "Trump trade" assets are trading and the polls, chasing "Trump trade" assets looks unattractive here.

Therefore, it's possible we see some risk over the coming days as traders book some profits on assets that have performed well over the last month. Traders will then likely look to redeploy that capital upon the conclusion of the election.

So, for now, the plan remains the same for us. We're not looking to take chips off the table here, and we're just looking to remain positioned. If there is a Harris win, that would likely provide the opportunity to put spare USDT to work.

But, on a Harris win, that USDT should be put to work further up the risk curve rather than in to riskier plays, as a Harris administration would favour BTC over ALTS and Meme's.