Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Funding Rate is at 0.01%, indicating that there is a small bias amongst traders to be Long.

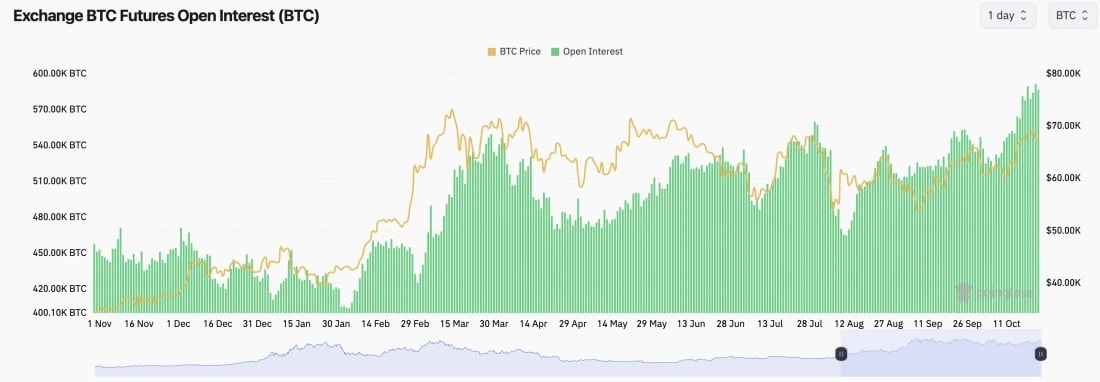

- Open Interest is at Daily highs, so this is something to be mindful of as we move forward.

- Overall, from a mechanics perspective, the market looks relatively ok here.

Technical analysis

- Late Sunday evening (never fully trust a late Sunday night pamp into the Weekly candle close), the price pushed beyond our $68,900 horizontal resistance but ultimately rejected from that level.

- The price has now pulled back very slightly, but the positive is that the RSI has pulled back from being overbought, is now at the 60 level, and is resting on top of the RSI Moving Average.

- To the upside, $68,900 remains the key level for the price to comfortably close above.

- To the downside, there is local support at $66,000 and more major horizontal support at $63,400.

- Next Support: $66,000

- Next Resistance: $68,900

- Direction: Bearish/Neutral

- Upside Target: $68,900

- Downside Target: $66,000

Cryptonary's take

BTC has moved higher than we thought it might do a week or two ago, as we expected the market to be relatively contained/subdued the closer we move to the US elections.However, the price has performed well, and Trump's odds of winning have improved in the betting market. Now, with approximately two weeks until the election, it's possible that price does pull back a tad here, potentially retesting $66,000.

If there are any major pull backs between now and the election, we would solely see them as buying opportunities.

For now, we remain in BTC Spot positions, of course, and we'd be buying anything between $63,400 and $66,000 (pre-election).