Market Direction

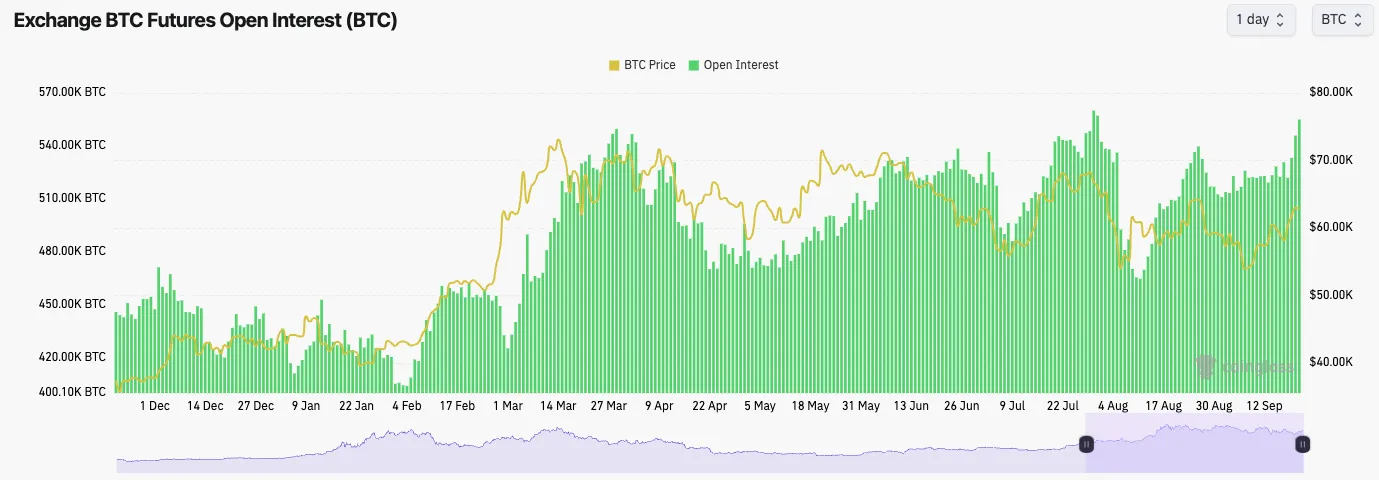

- Bitcoin's funding rate has mostly been positive but fluctuated, and the open interest rate has increased more noticeably.

- A rising OI, especially considering that it's mostly Longs, might mean the price is vulnerable to a small flush out to the downside, shaking out these late Longs.

- We wouldn't expect the flush out to be severe, potentially just a 2-3% price move lower before a rebound.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Note: Note the larger-than-usual increase in OI (far right-hand side of the chart) in the last few days as the price has moved higher.

Technical analysis

- In the last Market Direction we released, we mentioned BTC pulling back from $60k, retesting $58k, and then pushing on to retest $63,400, which is exactly what's happened.

- Price is now testing the horizontal resistance at $63,400 but struggling to maintain above it.

- In the short term, $63,400 may act as enough of a resistance that the price rejects from that area.

- We would be looking at a slight pullback and retest of $60,200 to $61,800 as an area of support.

- If price does lose $60k, we'd expect $56k to $58k to act as support again.

- What we do like is that BTC is still in it's local uptrend whilst it has also broken out of the local red downtrend line.

- The RSI isn't yet close to being overbought so there is still the potential for more upside to be had here.

Cryptonary's take

In the short-term (next 2-4 days), we expect the price to pull back very slightly from $63,000 and potentially retest the Yellow box area (between $60,200 and $61,700). But, beyond that, we think there can still be another positive week or two before we move closer to the build-up of the election, where markets might get more jittery throughout October, and the level of risk-on might be more subdued during that period. Over the next 10-14 days, we're expecting the price to remain relatively range-bound between $60k and $64k, but it is more tricky to call here beyond a very shorter-term pullback, which we think is likely. Let's see what we get beyond that.What is Bitcoin: Bitcoin (BTC) is the pioneering cryptocurrency introduced by the enigmatic Satoshi Nakamoto in 2008. It operates on a revolutionary decentralized ledger known as the blockchain and is widely regarded as digital gold due to its finite supply and secure, transparent nature. As the first and most recognized cryptocurrency, Bitcoin remains a cornerstone of the digital asset world.

Bitcoin's all-time high (ATH) is $75,757.

How to Buy:

- Via Centralized Exchange (CEX):

- Choose a CEX like Binance, Coinbase, or Kraken.

- Create and verify your account.

- Deposit fiat or other cryptocurrencies.

- Navigate to the BTC trading section and complete your purchase.