After facing rejecting at the $38k resistance level, the news of the Binance shakeup caused a slight sell pressure on BTC. However, we saw a decent bounce-back, with technicals now pointing to further recovery.

Yet, market mechanics across the open interest and funding rates have an interesting story to tell.

Let’s dive in.

TLDR

- Bitcoin rejected from the key $37k-38k resistance zone and pulled back sharply on the Binance news.

- Support held at $35.6k, and Bitcoin has bounced back positively.

- Technicals and mechanics suggest room for more upside.

- There’s the possibility of further pullbacks to around $34k before the next leg higher.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- The FOMC minutes revealed that the FOMC were uncertain about the economic outlook and the lagged effects of monetary tightening. Although they don’t expect an imminent recession, they did expect growth to be markedly slow in Q4 23.

- The dollar index continues to look for a relief bounce, which may suppress risk assets slightly.

- Today, we have Jobless Claims data. We don’t expect this to move the markets unless there is a meaningful increase in the number. The consensus is for 220k. Anything north of 250k would surprise the markets and potentially catalyse a sell-off.

BTC 12hr

Technical analysis

As expected, a rejection from the resistance zone of $37,700 to $38,000 led to a deeper pullback for Bitcoin. Of course, this coincided with the Binance news.- Bitcoin rejected from the key resistance zone between $37,700 and $38,000.

- This, along with the CZ and Binance news, saw Bitcoin’s price pullback, breaking the local uptrend line where price tested a more significant uptrend line and the horizontal support of $35,600. This area acted as support, and Bitcoin has since got a strong bounce. Yesterday, we called this area perfectly for a retest.

- Bitcoin is now running into a local resistance at $36,700. It’ll need to clear that area to then retest $37,200.

- Bitcoin is still in overbought territory on larger timeframes, with these timeframes still looking like they need a more meaningful reset.

- Overall, price remains range-bound between the key support ($35,600) and resistance ($38,000). A break of either would likely see a volatile move in that direction.

Market mechanics

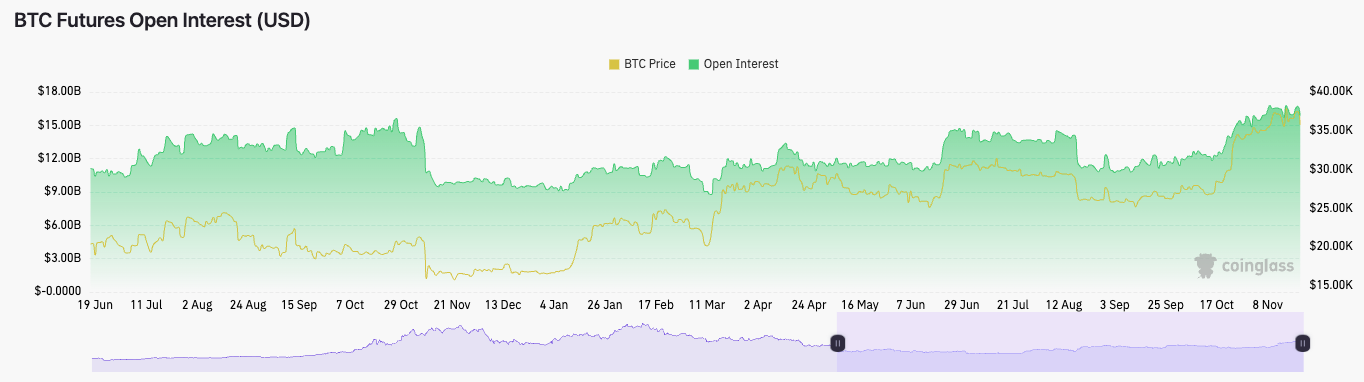

The mechanics suggest an interesting setup here.- The open interest has pulled back slightly, which is to be expected, considering there was some volatility yesterday. Open interest is now at $15.90B, pulling back from $16.72B.

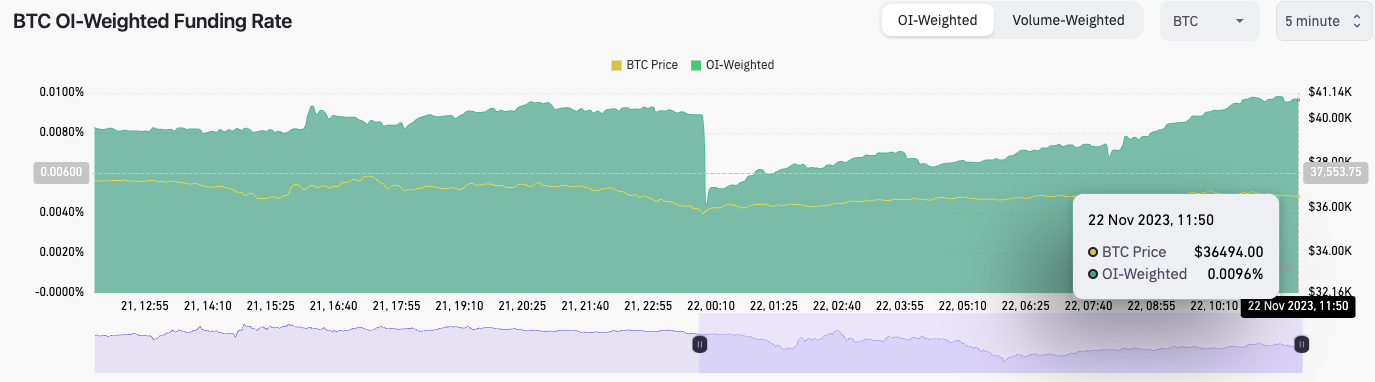

- The OI-weighted funding rate moved down significantly yesterday when Bitcoin’s price fell below $36,000 as shorts began to pile in. But Bitcoin bottomed at $36,600, and the OI-weighted funding rate has steadily increased.

- The funding rate is now close to 0.01%, indicating a bias to be long but that longs and shorts are relatively in balance.

- The long/short ratio is at 0.9425, which is likely due to many participants piling into shorts on the price move down yesterday. They’re somewhat offside, and some are being squeezed as we speak.

Cryptonary’s take

We got the breakdown yesterday that we were expecting for Bitcoin when we saw several 4-hour candles rejected from the resistance zone of $37,000 to $38,000.Now, the technicals and the mechanics suggest that Bitcoin can move higher, particularly considering how positive the bounce from the main horizontal support of $35,600 has been so far. But if we consider the number of rejections we’ve had at $38,000, we can see supply is stepping in there, and not enough buying pressure is coming in - you can see this in the order books.

We, therefore, feel Bitcoin could still have a further pullback to potentially the $34,000 horizontal support.

We’re not looking to trade currently, but we will be DCA buyers of Bitcoin sub $34,000, assuming the price gets there. These buys would be with a long-term view of 12-18 months.