Short liquidations have hit $38k, with today’s move being driven by Perps, but there is some Spot interest. We likely need more volume to breach $38,000.

Alts are also hitting key resistances.

TLDR

- Bitcoin is facing major resistance at $38K after pushing upwards.

- Bulls struggling to break through bears looking to force rejection.

- Huge sell walls from $38K to $40K could block further upside.

- Market sentiment expects a clean break to $40K if $38K is breached, but the supply above makes sharp rejection possible.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

- US markets are back open today after Thanksgiving yesterday, but they will close early.

- There isn’t any key economic data out today. The markets will await GDP data next Wednesday.

- The Indices (the S&P and Nasdaq) are both due to open higher today.

BTC 4hr

Technical analysis

- Bitcoin has moved back into the resistance zone of $37,700 to $38,000 and is holding within the zone but seems to be struggling.

- Price is still beneath the local uptrend line and finds the underside of the line as resistance.

- If Bitcoin can break $38,000 comfortably, then that’ll open the door to $40,000. However, the order books have a large supply, between $38,000 and $40,000.

- The RSI on the 3D and Weekly timeframes remain in overbought territory. But the RSI on all other timeframes has been healthily reset - there is room for further upside.

Market mechanics

- The Open Interest on Bitcoin is now at a high of $16.83b. This amount of Open Interest in USD hasn’t been seen since the summer of 2022.

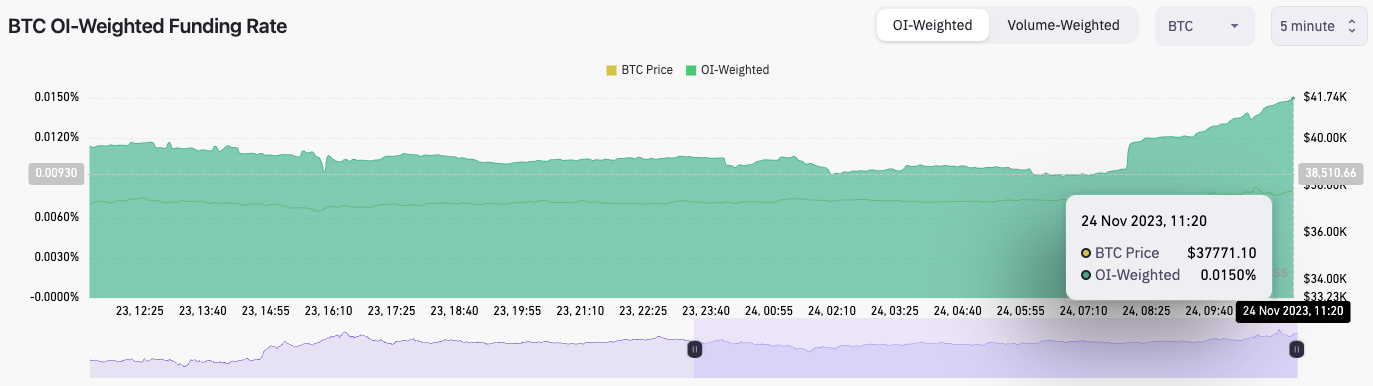

- The OI-Weighted Funding Rate was relatively flat yesterday at 0.01%, but it has now ramped up to close to 0.015%. This indicates that Longs have piled in as price has pushed into the $37,700 level this morning.

Cryptonary’s take

Bitcoin has moved back into the $37,700 to $38,000 horizontal resistance zone, but the higher move has been more dominantly driven by futures rather than Spot volume. There is some interest from Spot, but we likely need greater volumes than what we’re currently seeing for price to break above $38,000.Currently, the mechanics are showing that Longs are ape’ing in here. This isn’t unhealthy, but if it continues and Spot doesn’t follow, then we likely reject.

We have also mentioned the sentiment. Participants expect that if price breaks above $38,000, then there will be a clean move higher to $40k/$42k. However, there is a lot of supply between $38,000 and $40,000, which could be too much for Spot to drive through. This may lead to a more meaningful rejection.

Ultimately, this is difficult to call here, as Bitcoin has been the past 48 hours. We remain on the side and focused on DCA’ing into lower levels if Bitcoin presents them at a later date. The area of interest is $34,000. We will reassess if there is a break higher to $40,000.