As many of you saw in last night's livetream, even in a somewhat range-bound market, there are still plenty of opportunities for trading.

Last night, we tried a slightly new style with the AMA by presenting a presentation in its first half. You can catch up on the recording if you missed yesterday's stream. Also, plan to attend the next one.

In today's Market Update, we'll cover the economic data, examine how the bond market suggests rate cuts are coming, and conclude with an outlook on Bitcoin's price action in the short term.

Key questions

- What does the latest Core PCE data reveal about the Fed's next moves, and how might this impact market dynamics?

- Is the bond market signalling something crucial about upcoming interest rate changes? Dive into the yield trends and auction results.

- Why are Bitcoin miners currently net sellers, and how long might this trend continue post-Halving?

- What intriguing pattern is Bitcoin's price action potentially forming, and where are the key levels to watch?

- Could a surprising bullish divergence be on the horizon for Bitcoin? Discover the potential setup that savvy traders are eyeing.

- How are economic indicators and crypto markets interplaying in this range-bound environment, and what opportunities might emerge?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Today's economic data and Bitcoin correction

Today, we had Core PCE (the Fed's preferred inflation data point) data out. The expectation was that the Core PCE MoM data came in at 0.1%. However, this was also lower than the last month's reading at 0.3%, which is positive.It also meant the YoY figure came in at 2.6%. This is in and around the Fed's 2.0% inflation target, and inflation has come down drastically in the last 18 months. The new number now raises the question of whether the Fed needs to be as restrictive in its policy by keeping the Interest Rate at 5.5%.

This PCE data, which came out today, suggests that disinflation is continuing and that the Fed should begin to moderate policy, i.e., begin to bring the Interest Rate down to reduce the current gap between the Interest Rate and the rate of inflation.

Several members have sent me charts over the previous months showing that markets puke as Interest Rate cuts happen. Recent data shows this is true—but that's because Interest Rates are being cut to re-stimulate an economy that's falling hard into a recession.

That isn't currently the case for this economy and market. The chart below shows that cutting Interest Rates to normalise/moderate policy is positive for returns, at least beyond the first 30 days.

Bond market suggests rate cuts are coming

The Bond market is also suggesting that rate cuts should be coming. We can see this with US Bonds finally getting more of a sustained bid, meaning the Yields are coming down, i.e., Bonds are being bid.Alongside this, we've seen much more positive US Bond Auctions recently, with demand being met for the Bonds rather than the auctions tailing, which is what we were seeing before. Bonds pricing this in (increased likelihood for upcoming Interest Rate cuts is positive for risk assets).

A tailing bond auction occurs when buyers who bought the bonds wanted them at a slightly lower price than what they were being offered, which was less attractive to the buyer.

US 2Y Bond Yield

US 10Y Bond Yield

Bitcoin miners capitulating, holding down price

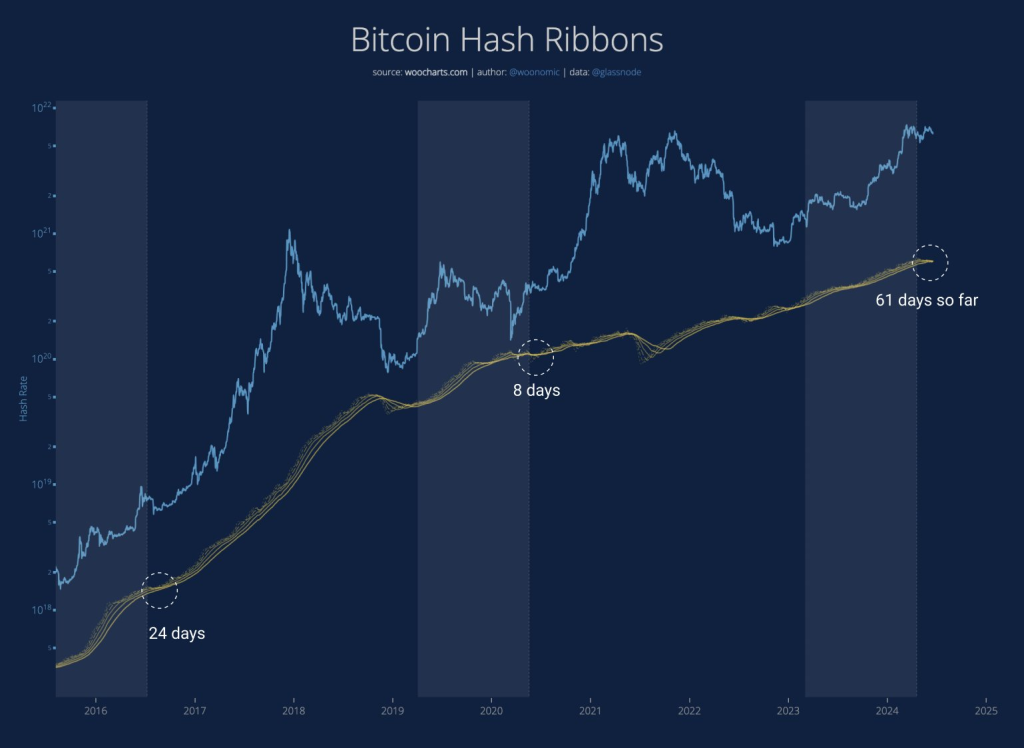

Bitcoin miners will most likely be very positive about the space as a whole; however, at the moment, they're a net seller of Bitcoin. This is because the rewards paid out (since the Halving) are half of what they were. This means that Bitcoin miners have to sell their Bitcoin to cover their costs until the price of Bitcoin increases and the Miners' margins improve.The sale is typical after a Bitcoin Halving event, but Miner Capitulation is taking longer than usual to finish this time. One reason for this is likely more activity/revenue from Ordinal Inscriptions.

Bitcoin Hash Ribbons

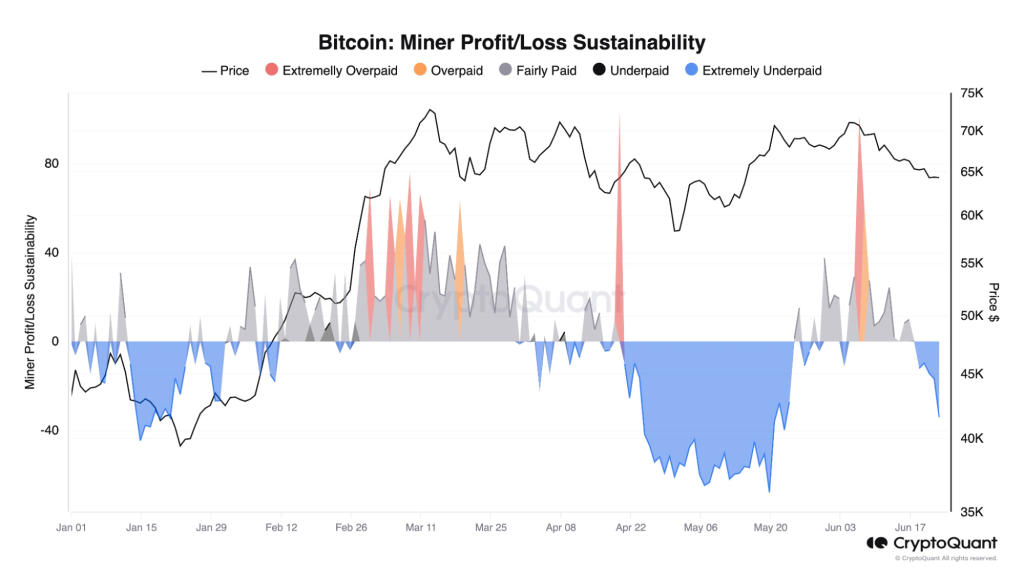

As the chart below shows, miners are currently very underpaid, with Bitcoin at around $60k.

Bitcoin Miner Profit/Loss Sustainability:

Bitcoin price action plan

In our last Market Direction, we stated that Bitcoin is potentially forming a bear flag, and with more days of price action, that is increasingly looking the case. We note that the $58k—$59k area is an area of support, and Bitcoin is currently very close to oversold territory.If there is a breakdown, price will likely create a lower low, but it may put in a bullish divergence (a higher low on the oscillator) in oversold territory. If this were to play out, this would be an attractive Long trade to take.

A move down to $58k—$59k forms the bullish divergence in oversold territory, and Long BTC could potentially return to $63k. Let's see.

We have marked out on the chart below with a brush showing the potential direction of BTC's price. Again, it's just an idea, but it has been playing out so far.

BTC