Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

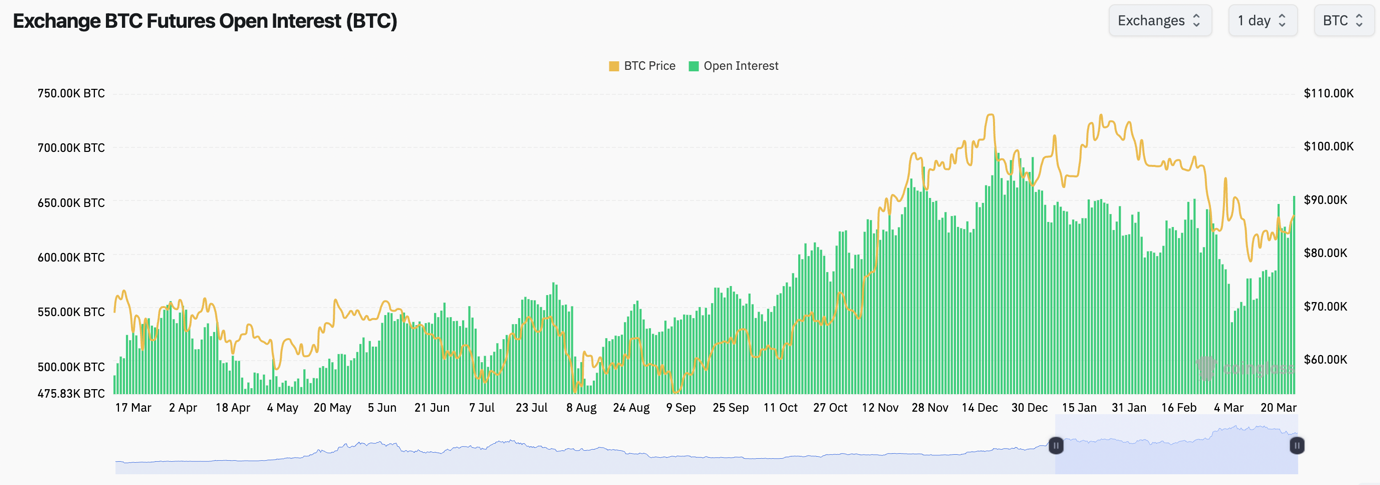

Market metrics:- BTC's Open Interest is up substantially over the last 3-4 days, indicating that this move up has been somewhat driven by leverage.

- BTC's Funding Rate has stayed relatively tight around the 0.00% level, and it has been fluctuating between slightly positive and slightly negative. This just indicates that traders are flip-flopping between Longs and Shorts without much conviction which is normal during choppy market periods.

Bitcoin Open Interest has increased significantly, indicating a leverage-driven movement

Bitcoin Open Interest has increased significantly, indicating a leverage-driven movement

Technical analysis

- After putting in two back-to-back bullish divergences, BTC has begun moving higher along with the stock indices as we expected it would.

- We have the local horizontal resistance at $87,000 (up from $86,300, $87,000 seems like the more clear level). We'll now be seeing if BTC can break out above it.

- The main horizontal resistance is at $91,700. We don't expect that level to be breached in the short term.

- To the downside, the local support is in the $82k's, with the major horizontal support at $78,700.

- BTC is potentially breaking out of it's RSI downtrend, which is positive. However, the price will put in a hidden bearish divergence (lower high in price, higher high on the oscillator).

Bitcoin technical analysis showing projected movement into the $88-89K region BTC 1D Timeframe - Key Levels:

Bitcoin technical analysis showing projected movement into the $88-89K region BTC 1D Timeframe - Key Levels:

- Next Support: $85,200

- Next Resistance: $91,700

- Direction: Neutral/Bullish

- Upside Target: $90,000

- Downside Target: $82,000