Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

- BTC's Open Interest remains very high, although denominated in coins, and BTC's OI has pulled back approximately 5% since OI peaked, just following the price's all-time high.

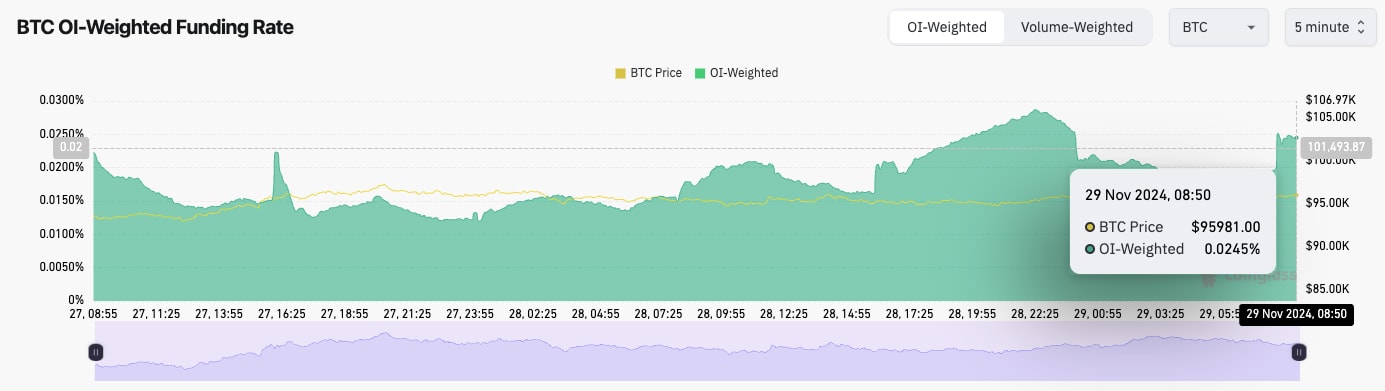

- Bitcoin's Funding Rate remains elevated. However, it is not at excessive levels that might suggest that a flush-out is imminent.

Technical analysis

- For the last few days, BTC has been range-bound between its all-time high of $99,500 and the prior resistance, now flipped new support at $91,500.

- This range-bound price action has helped the RSI pull back slightly from overbought territory. However, it's still close to overbought territory. Further consolidation would likely see the RSI continue to pull back.

- On the downside, the support for BTC is $91,500 and then $87,000. Whilst we don't rule out a break below $91,500 (but we think less likely), we expect $87,000 to be major support.

- On the upside, the all-time of $99,500 and the psychological level of $100k will act as the major resistance zone.

- Next Support: $91,500

- Next Resistance: $99,500

- Direction: Neutral

- Upside Target: $99,500

- Downside Target: $91,500

Cryptonary's take

As we expected, Bitcoin holds between $91,000 and $99,500 in this range. It is really positive to see that prices are consolidating at these higher levels following such a huge move after the US Election.We expect to see the price continue to be range-bound for possibly another week. We would see this as positive as it would continue to reset some of the indicators that were significantly overbought. It's important in larger uptrends to have periods of consolidation. This is what we believe we're getting now before the next leg higher.