Bitcoin is about to do this... | March 9th

The market has reached a decision-making point. In this week’s report, we dive into the charts to understand what is going on and what we believe may happen in the short-term. We remain bullish until circumstances change. As soon as market structures for both indexes, Bitcoin and Ether turn bearish, so do we, but that’s only for the short term. Our bullish expectations for the future haven’t changed.

TLDR

- The Total Market Cap is at support ($950B). Holding this level is crucial for the market to remain bullish.

- The Altcoins Market could lose $550B as support this week. If this happens, altcoins will drop rapidly.

- Bitcoin is at support ($21,450). Holding this level is necessary. Otherwise, we’ll be heading toward its 2017 all-time high of $19,866.

- XRP is on the verge of breaking out from a symmetrical triangle. A potential opportunity is on the cards.

- SOL is at risk of losing $19 as support on the weekly timeframe. A weekly closure under $19 would confirm a move to $15.

- Surprisingly, SHIB made it into this week’s report. A symmetrical triangle is forming as we speak.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

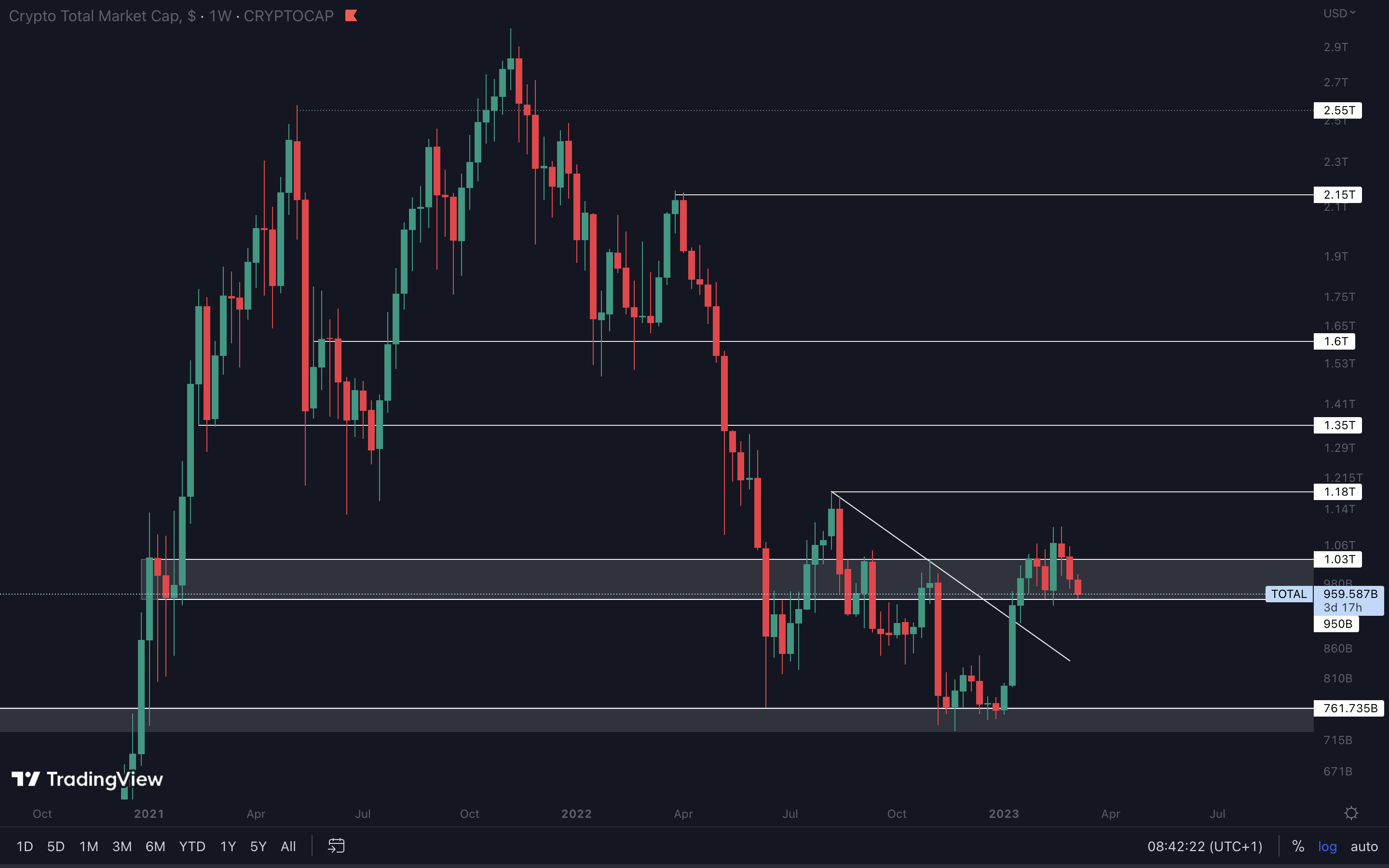

Total Market Cap (Weekly)

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap is at support. This is a decisive point for the short term because a loss of $950B would result in Bitcoin breaking its weekly market structure and invalidate any further upside.

The Total Market Cap is at support. This is a decisive point for the short term because a loss of $950B would result in Bitcoin breaking its weekly market structure and invalidate any further upside.

Watching this week’s closures for the indexes will be our main priority, and we’ll update you with all the technical changes as they happen.

Our take? Holding $950B as support keeps the market healthy and ready for upside to $1.18T and $1.35T, respectively. If this level is lost, we recommend changing your strategy to reduce your exposure and save your capital.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The secondary index is tackling $550B. This has been a major level for the altcoins market in the past ~9 months, and holding it as support is crucial to keep upside on the cards.

The secondary index is tackling $550B. This has been a major level for the altcoins market in the past ~9 months, and holding it as support is crucial to keep upside on the cards.

You might’ve noticed that altcoins have been bleeding much more than usual recently. Imagine that but three times as aggressive - that’s what will happen if the Altcoins Market Cap index closes a weekly candle under $550B.

For now, the only thing we can do is wait and see how this week closes. If we close under $550B, it may be a good idea to reduce your short-term positions to prevent losses and preserve capital for lower entries.

BTC | Bitcoin (Weekly)

We’ve reached a decision-making point on the BTC chart. It’s close to reaching $21,450, which must be held to keep upside on the cards.

A weekly loss of $21,450 would invalidate BTC’s bullish market structure and result in a potential test of its 2017 all-time high of $19,866. If Bitcoin gets there, it’s likely that most altcoins will have already dropped by 10% - 20% at that point. This would give us even more opportunities to tackle.

On the positive side, holding $21,450 as support would keep the trend healthy. After that, we could see a move back to $25,150, potentially even higher in the coming weeks.

It’s a dice roll at this time, so waiting for the outcome is our only play.

We’ve reached a decision-making point on the BTC chart. It’s close to reaching $21,450, which must be held to keep upside on the cards.

A weekly loss of $21,450 would invalidate BTC’s bullish market structure and result in a potential test of its 2017 all-time high of $19,866. If Bitcoin gets there, it’s likely that most altcoins will have already dropped by 10% - 20% at that point. This would give us even more opportunities to tackle.

On the positive side, holding $21,450 as support would keep the trend healthy. After that, we could see a move back to $25,150, potentially even higher in the coming weeks.

It’s a dice roll at this time, so waiting for the outcome is our only play.

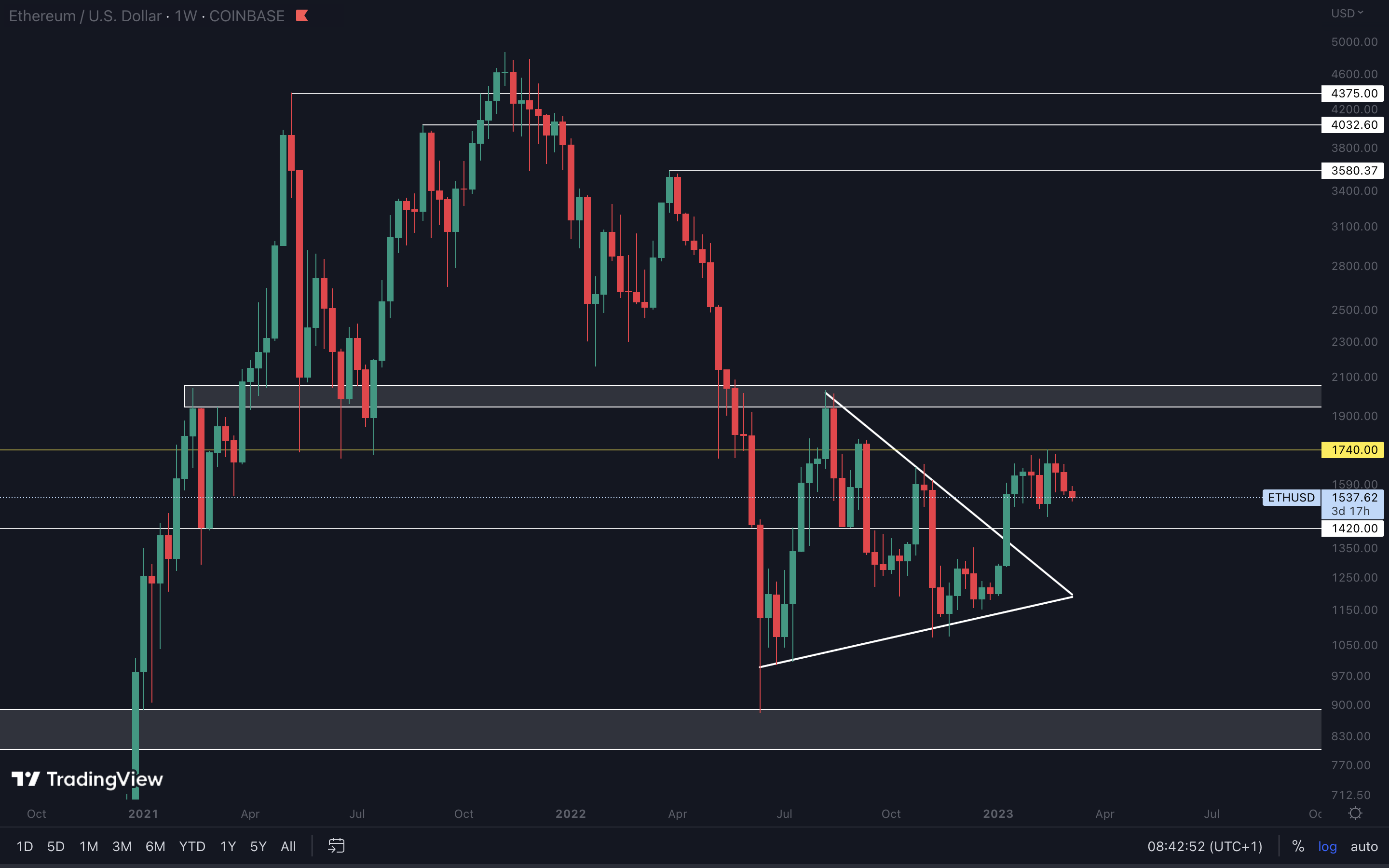

ETH | Ethereum (Weekly)

Ether is in a tougher spot than Bitcoin because there aren’t any levels near its current price. In short, Ether is basically free-falling or rising depending on Bitcoin’s price action.

Ether is in a tougher spot than Bitcoin because there aren’t any levels near its current price. In short, Ether is basically free-falling or rising depending on Bitcoin’s price action.

For that reason, we believe focusing on the indexes and the Bitcoin chart gives us a better look at the market right now.

If Bitcoin loses $21,450 as support, Ether will likely head back to its 2017 all-time high too, which sits at $1420.

BNB | Binance (Weekly)

Although BNB is at support ($283), this level lacks strength because there haven’t been many previous tests. If Bitcoin loses $21,450, we may see BNB drop faster than The Flash on a slow day toward $260, and destroy $283 in the process.

Although BNB is at support ($283), this level lacks strength because there haven’t been many previous tests. If Bitcoin loses $21,450, we may see BNB drop faster than The Flash on a slow day toward $260, and destroy $283 in the process.

For that reason, we wouldn’t recommend buying… yet. A rising BTC would result in BNB holding $283 as support and heading back to $300 and above. That’s when you’d want to buy, not now.

XRP | XRP (Weekly)

We have to give it to XRP here, it’s the only token from the Top 10 (by market capitalisation) to outperform this week.

By the looks of it, XRP is forming a bullish engulfing candle into resistance. This is a step toward a potential breakout from this symmetrical triangle.

There’s still some development left to happen here, but you might want to be prepared in case it does break out. Keep in mind that volumes have to increase upon breakout, otherwise upside may be short-lived, especially with how Bitcoin is performing right now.

We’ll be tracking this chart on a daily basis in our TA here, so keep an eye on that.

We have to give it to XRP here, it’s the only token from the Top 10 (by market capitalisation) to outperform this week.

By the looks of it, XRP is forming a bullish engulfing candle into resistance. This is a step toward a potential breakout from this symmetrical triangle.

There’s still some development left to happen here, but you might want to be prepared in case it does break out. Keep in mind that volumes have to increase upon breakout, otherwise upside may be short-lived, especially with how Bitcoin is performing right now.

We’ll be tracking this chart on a daily basis in our TA here, so keep an eye on that.

ADA | Cardano (Weekly)

Sellers remain in control, and there are no signs of this changing anytime soon. For the time being, ADA remains bearish, and we’re going to see it head to $0.24 in the coming weeks unless Bitcoin holds $21,450 as support and starts rising back to $25,150.

Sellers remain in control, and there are no signs of this changing anytime soon. For the time being, ADA remains bearish, and we’re going to see it head to $0.24 in the coming weeks unless Bitcoin holds $21,450 as support and starts rising back to $25,150.

DOGE | Dogecoin (Daily)

There hasn’t been any progress for DOGE’s falling wedge. Despite it having no use-case, DOGE lives to surprise us all.

There hasn’t been any progress for DOGE’s falling wedge. Despite it having no use-case, DOGE lives to surprise us all.

We’ll be tracking the falling wedge and any potential breaks throughout March and Q2 until something of interest happens.

MATIC | Polygon (Weekly)

As long as MATIC stays inside the $1.30 - $0.75 range, we may see it consolidate for multiple weeks until Bitcoin picks itself up again and continues the rally.

As long as MATIC stays inside the $1.30 - $0.75 range, we may see it consolidate for multiple weeks until Bitcoin picks itself up again and continues the rally.

For MATIC to rise significantly, we’ll have to wait for a weekly closure above $1.30.

SOL | Solana (Weekly)

SOL is on the verge of losing $19 as support. Although it closed under $19 yesterday, we’re more interested in a weekly closure under or above this level, given its increased strength.

SOL is on the verge of losing $19 as support. Although it closed under $19 yesterday, we’re more interested in a weekly closure under or above this level, given its increased strength.

As you might’ve heard: the higher the timeframe, the more strength. This is applicable for breakouts, breakdowns, reclaims, and any other technical events. The main concern here is that SOL marked a weekly lower low, breaking the bullish market structure in the process. However, SOL holding $19 as support could prevent it from going down - that’s if Bitcoin plays along.

A weekly closure under $19 would confirm $15 as our next target for SOL.

DOT | Polkadot (Weekly)

If you’ve been following our daily TA, you might’ve known that DOT was heading to $5.50 after closing last week’s candle under $6. This level has now been reached.

If you’ve been following our daily TA, you might’ve known that DOT was heading to $5.50 after closing last week’s candle under $6. This level has now been reached.

What comes next is left in the mighty hands of Bitcoin. With DOT reaching support and Bitcoin just above its support, we may see some buying pressure for both assets.

Of course, DOT could go lower if Bitcoin fails to hold $21,450 as support. So, it would be wise to use a loss of that level as invalidation for DOT’s upside if you’re thinking of entering any trades.

SHIB | Shiba Inu (Weekly)

We aren’t the only ones wondering what’s up with dog coins forming patterns lately, right?

We aren’t the only ones wondering what’s up with dog coins forming patterns lately, right?

Just a few weeks back, SHIB marked a lower high on the weekly timeframe, which we highlighted using the yellow trend line. We now have two tests of both trend lines to confirm this is a symmetrical triangle formation.

Given that the market isn’t on its best terms and SHIB is not a fundamentally-sound asset, we’ll likely see it test the channel as support in the coming weeks. We wouldn’t recommend trading SHIB during the pattern’s formation, but rather waiting for it to break out.

For a proper confirmation of the above, volumes will have to increase upon breakout.

Cryptonary's take

The market is in a tough spot. This week’s closures are crucial for the short term because our bullish targets could be invalidated if Bitcoin fails to hold support.

Here are a few action steps for you:

- Keep a close eye on the indexes and Bitcoin this week. Their weekly closures will help us understand where the market is headed in the next few weeks.

- In case the market takes on the bearish scenario (Bitcoin losing $21,450 as support), reducing short-term positions and taking profits to preserve capital for lower entries are all good ideas.